The US trade deficit widened to a 6-month high and by the most in 8 years.

That means that we way more goods while our declined.

We don’t like to use one economic stat as the end-all-be-all, but this strengthens our stagflation outlook.

The recent strength is also a factor.

The west coast port labor potential strike could hurt imports and exports in the coming months.

Meanwhile, the chart shows us another interesting trend.

One that we have dubbed the “sleeper trade” for 2023 and beyond.

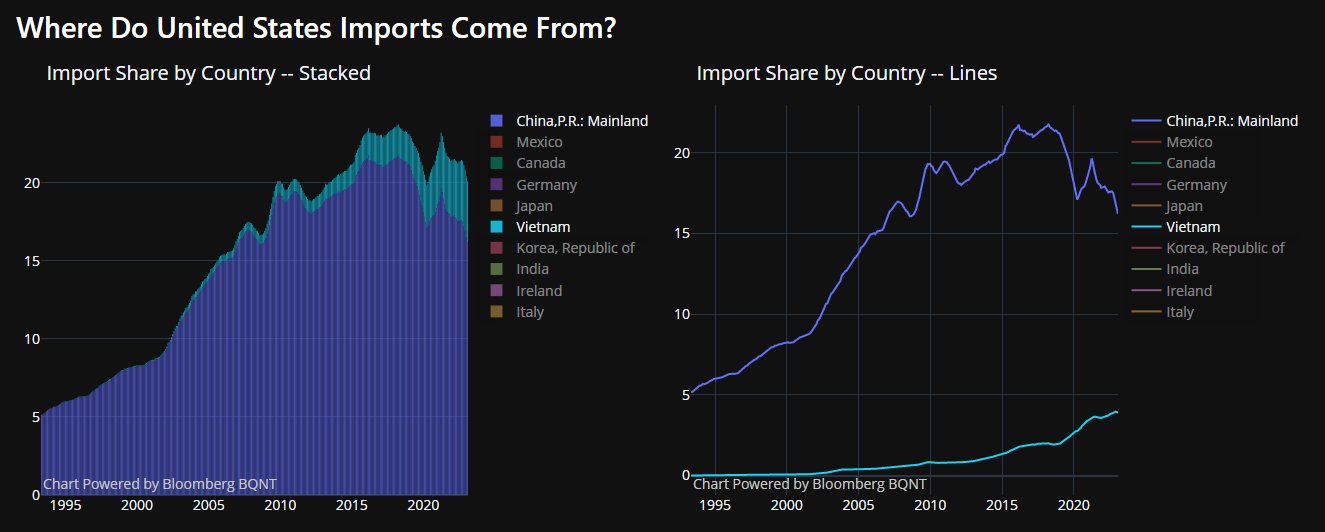

Since we in the US have rising imports, these charts illustrate where we (and other countries) are going for cheap labor and goods.

And it is not just China.

Note the declining dependence on China and the rising dependence on Vietnam for imports.

This is a weekly chart using the VanEck Vietnam ETF (NYSE:) for Vietnam.

VNM extends beyond firms domiciled in Vietnam to include non-local companies generating at least 50% of revenues in Vietnam. In doing so, VNM adds exposure to different sectors via companies in other regions.

It’s a broad take on the Vietnamese market for those seeking a pure-play fund.

Finance is the top sector in the ETF basket at 51.95%, followed by Consumer Non-Durables at 16.62%.

The blue line is the 23-week moving average. Should that clear and confirm by the end of this week, that is a phase change to recuperation.

The last time VNM traded at these levels was the week of January 23, when the high was 13.17.

Should the price hold the phase change and take out the 2023 highs, we will consider that a more bullish sign.

Our Real Motion Indictor tells us that momentum has cleared its 50-week moving average. Price and momentum are moving in tandem.

Nothing pleases us more than when fundamentals and technicals line up.

ETF Summary

- (SPY) August 2022 high 431.73-and of course 420 now key

- Russell 2000 (IWM) 180-now must hold while still miles from its 23-month MA 193

- Dow (DIA) 23-month MA 337 pivotal and closed right there

- Nasdaq (QQQ) Big correction as Canada hikes rates-also somewhat saturated index. 350 pivotal with the close below

- Regional banks (KRE) 45.50 significant resistance

- Semiconductors (SMH) 142.50 the 10-DMA if breaks still looking at 138-140

- Transportation (IYT) 233.50 is significant resistance

- Biotechnology (IBB) 121-135 trading range

- Retail (XRT) 60 now support and 63 resistance