© Reuters.

By Scott Kanowsky

Investing.com — The number of Americans filing for unemployment benefits declined unexpectedly last week, while another report showed that producer prices accelerated in January.

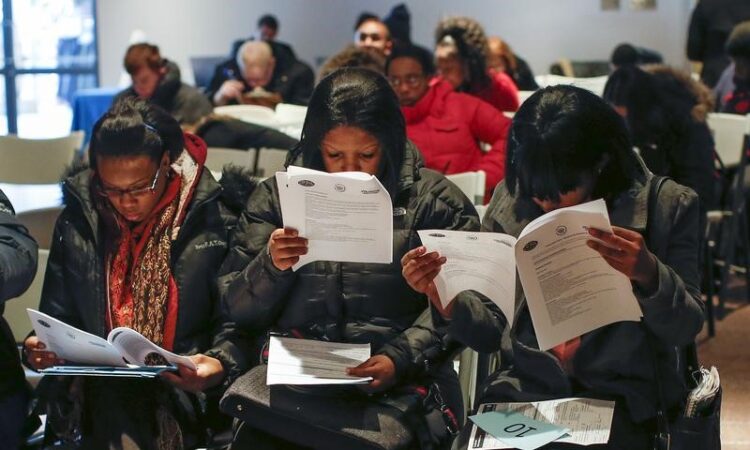

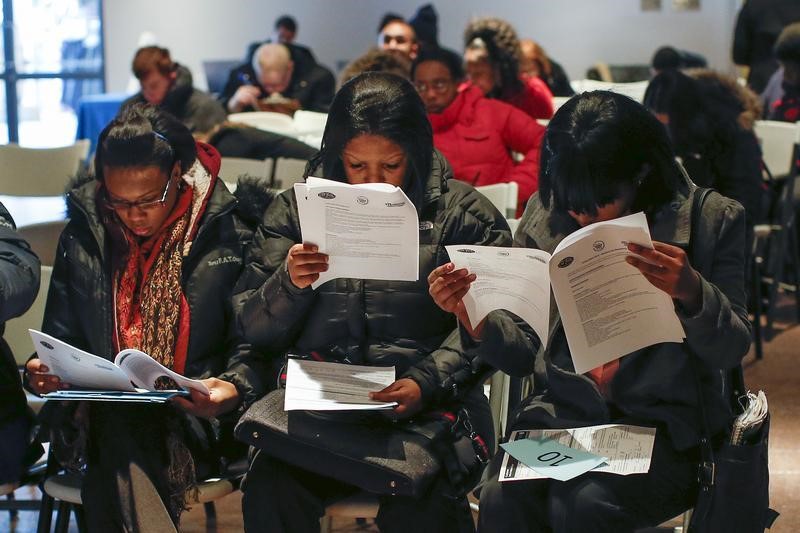

Initial dipped to 194,000 people in the week ending on February 11, according to Labor Department data on Thursday, inching lower from a downwardly revised figure of 195,000 in the prior week. Economists had predicted that the reading would climb to 200,000.

The , which aims to account for volatility in the weekly count, moved up by 500 to 189,500. Meanwhile, also edged a touch higher to 1.696 million, up from 1.680 million in the prior week and topping estimates.

“This is your weekly reminder that the US labor market remains secularly tight,” said Bob Elliott, chief executive officer at Unlimited Funds in a tweet. “Continuing and initial claims moving sideways at low levels. Employment probably not booming as much as payrolls suggest, but this labor market is strong.”

Cooling the red-hot job market has been a central objective for the Federal Reserve. The U.S. central bank has raised its target range for interest from near-zero to between 4.5% to 4.75% in less than a year, with policymakers partly hoping that these hikes will loosen the labor market, quell demand and ultimately help bring down elevated inflation.

But there are still plenty of vacancies on offer for the newly out of work. rose above 11 million in December, while the latest labor market report was far stronger than economists had first anticipated.

In a separate release on Thursday, the Labor Department data showed that monthly increased by 0.7% in January, rebounding from a 0.2% decline in the previous month and above projections for growth of 0.4%.

Following the unveiling of the PPI data, major U.S. index futures slipped into the red as investors fretted that the data may persuade the Fed to continue pursuing its hawkish monetary policy for a longer period of time.

Further data this week showed that while annual in the world’s largest economy slowed slightly to 6.4% last month, price growth remains far higher than the Fed’s 2% target. Inflation also accelerated on a , suggesting that the pace of slowing may be losing some steam.

expanded by more than predicted to begin the year as well, thanks in part to the robust U.S. employment situation. Persistently elevated inflation gave additional fuel to the data in nominal terms.