Image source: Getty Images

Any UK share that can hike its dividend for 32 years in a row demands my attention. A high yield is all very well, but one that rises every year can be even better.

It indicates that the company is on a steady course, with the board confident enough to keep paying shareholders more. Yet it doesn’t necessarily mean that all is well.

Chemicals manufacturer Croda International (LSE: CRDA) is a true Dividend Aristocrat. Yet investors have gone off it lately, and with good reason.

FTSE 100 income hero

The Croda share price has had a nightmare. It’s crashed 30.78% over the last year. Over three years, it’s down 48.25%.

Croda had a good pandemic with panicky customers stockpiling chemicals and vaccine makers relying on its lipids. The aftermath has been brutal as lipid sales plunged and customers embarked on a “prolonged destocking”.

Full-year 2023 pro-forma sales, published in February, fell 11% as customers reduced inventory levels across multiple markets. Adjusted profit before tax crashed 33% to £308.8m. The share price duly followed.

Happily, the dividend didn’t. The board maintained its three-decade record of dividend progression but only just, hiking the full-year payout a measly 1p. That lifted it from 108p per share to 109p, a rise of just 0.93%.

Croda’s shares don’t look like they’re about to make a stellar comeback in 2024, judging by Q1 results. Group sales fell 10% to £409m, albeit versus a strong Q1 2023 comparator. Full-year profits before tax remain on course to be between £260m and £300m. Last year they rocked in at £236.3m, so there’s progress there.

Chief executive Steve Foots said the Consumer Care division made an encouraging start to the year, particularly in North America, but Life Sciences face a challenging market, particularly in Crop Protection.

Low yield, low growth

The dividend should be solid with free cash flow rising 5% to £165.5m last year, but I suspect investors are in line for another marginal hike. The trailing yield of 2.68% is forecast to edge up to 2.75% in 2024 and 2.8% in 2025. That’s pretty sluggish.

Net debt jumped to £537.6m in 2023 following the recent Solus Biotech acquisition but is forecast to fall to £503m in 2024 and £478m in 2025. Given that Croda is a £5.68bn company, I’m not worried by that.

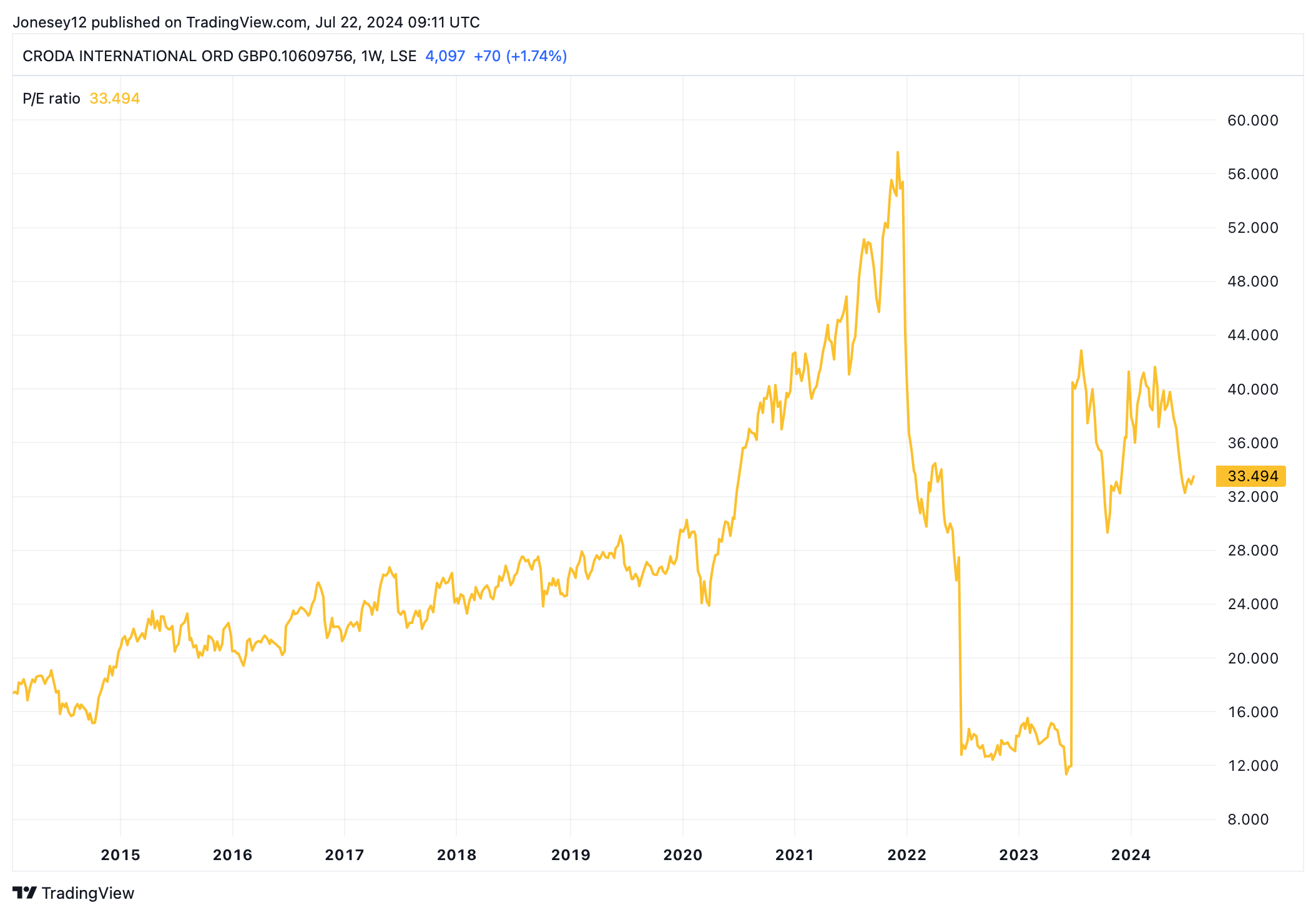

Normally when a stock has crashed, I expect its price-to-earnings ratio to follow. Sadly, that’s not the case here, because earnings have fallen sharply too, from £2.089bn in 2022 to £1.654bn in 2024. Today’s P/E has jumped to 33.49 times as a result. Let’s see what the chart shows.

Chart by TradingView

Croda’s shares are expensive, rather than the bargain I hoped to find. As the pandemic effect fades, the company should start to grow from today’s lower base. If the economy picks up, demand for its products could accelerate. Croda could make a good long-term buy-and-hold, but I’m not excited enough to purchase it at today’s price. I can see far better FTSE 100 dividend-paying bargains out there.