The meaning of an ‘optimal’ clean energy investment is changing as prices rise, analysts report

Historic clean energy investments propelled by Biden administration climate initiatives are shifting energy economics in ways that have developers, investors and analysts recalculating clean energy’s value.

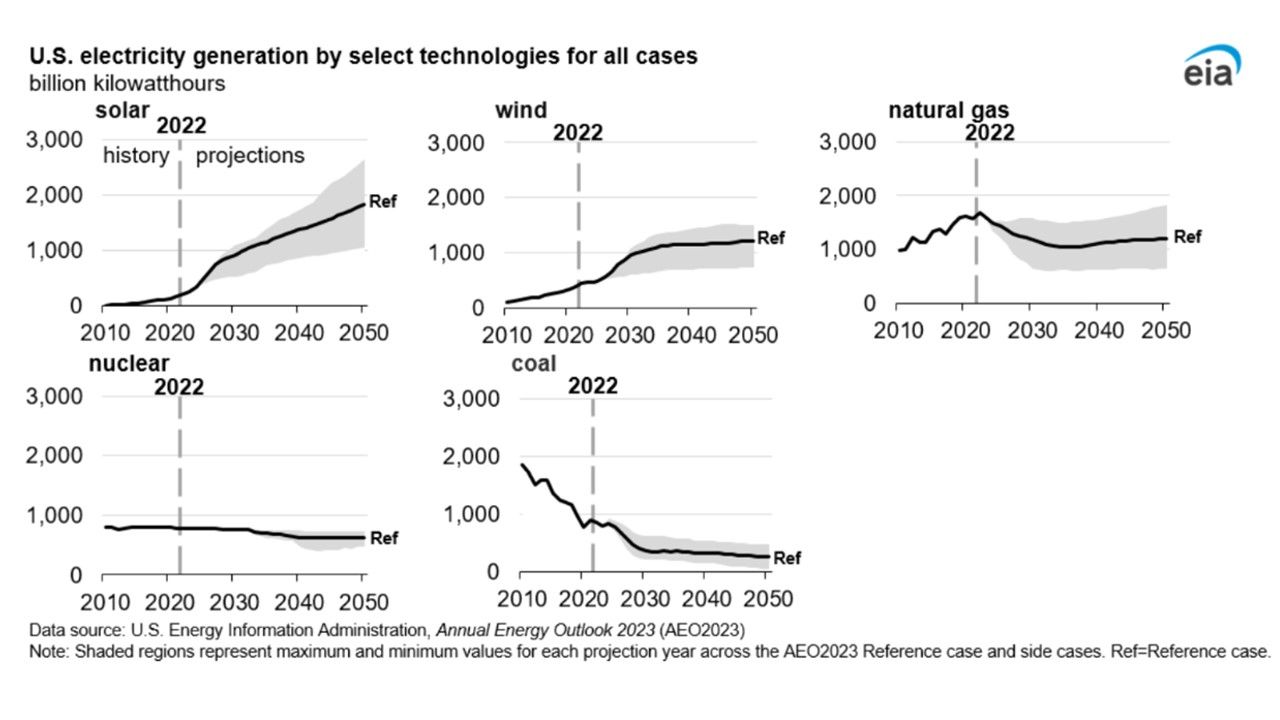

By 2050, Biden initiatives could grow U.S. wind capacity 235% and solar capacity 1,019%, with proportional battery storage growth, according to the Energy Information Administration’s Advanced Energy Outlook 2023, published in March. Already accelerating growth has driven up renewable energy prices and left builders and buyers scrambling to find the lowest cost investments, analysts reported.

New utility-scale solar, paired solar and storage, utility-scale onshore wind, and paired wind and storage, even without subsidies, clearly have the lowest levelized costs of energy, or LCOEs, of the full range of utility-scale generation options, according to the April 2023 Lazard LCOE report.

But “the least-cost solution is no longer just the lowest LCOE, it is an evaluation of how renewables fit into a power system,” Wood Mackenzie Vice Chair, Energy Transition and Power & Renewables, Christopher Seiple told Utility Dive. Comprehensive procurement requires evaluating the “proposed project’s specific location and output profile, its interconnection costs, and the system’s transmission and reliability needs,” he added.

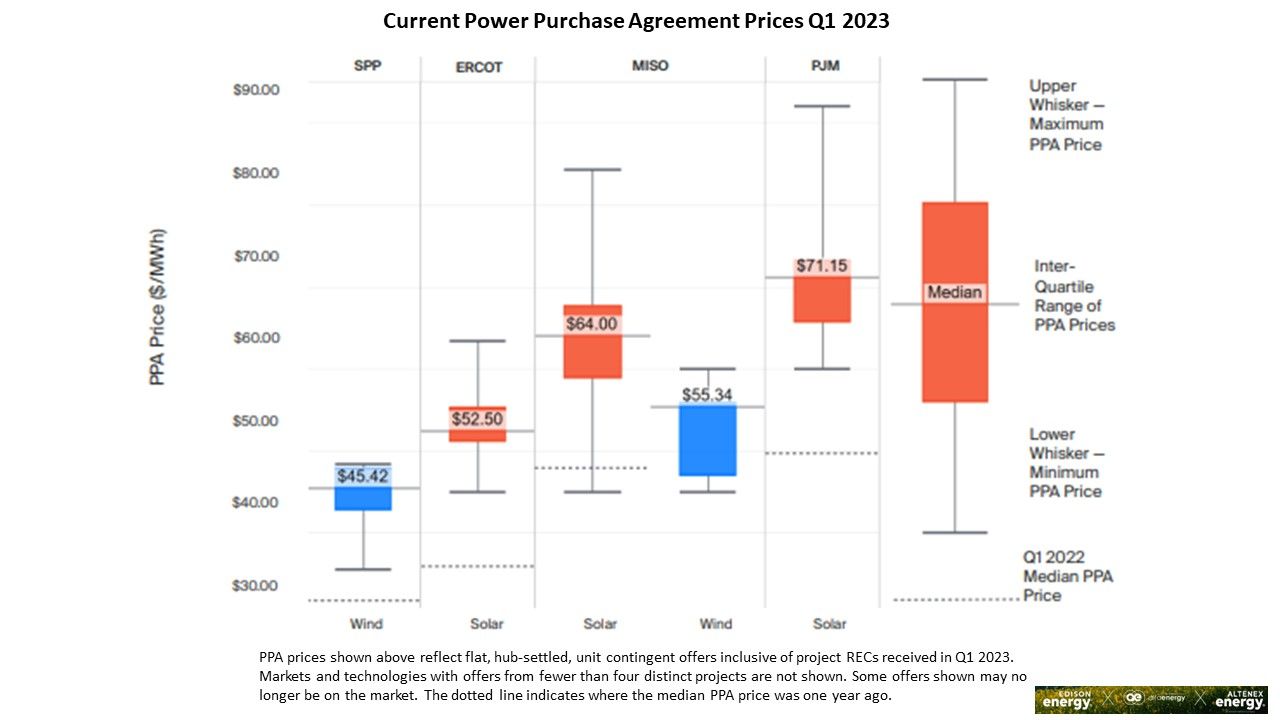

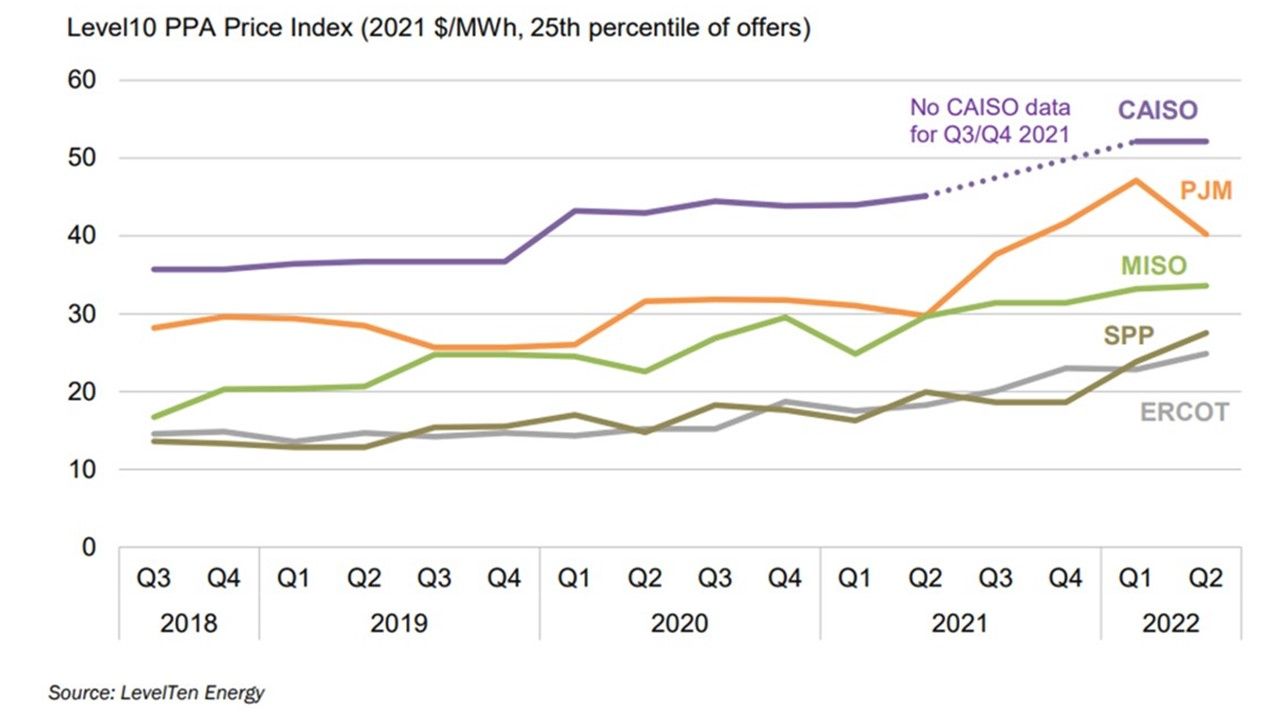

Comprehensive project evaluation is especially necessary and complicated now with renewable energy contract prices spiking since late 2022 in response to a range of policy and economic drivers, market watchers including LevelTen Energy and Edison Energy agreed.

“There is no easy way to identify the lowest [renewable energy] project prices because the project and macroeconomic factors compound” as value is forecast, Edison Energy Managing Director, Renewables Advisory, Joey Lange said. “Even where renewables were recently the most economically viable, market congestion and price suppression are making them harder and more expensive to build,” he added.

IRA-driven demand, interconnection backlogs, interest rate turmoil and supply chain constraints are driving spikes in new renewable project prices, analysts and stakeholders said. But the magnitude and duration of those factors are uncertain, making a more sophisticated project analysis necessary and offering a new appreciation of how the suboptimal renewable energy project choice can deliver the optimal value in cost-effectiveness and locational benefits, they said.

The big picture

The average power purchase agreement, or PPA, price in North America rose 6.6% during Q1 2023, with solar project PPAs up 8.5% and wind project prices up 4.9%, LevelTen reported in April. And that price increase might actually have been as high as “almost 11%,” when measured across “almost every market and technology,” according to the Edison Energy Q1 2023 Global Renewables Market Update Report.

Final Q2 data has not been released but the trend of higher PPA prices, though moderating slightly for solar, has continued in 2023’s second quarter, with uncertainties subject to multiple market dynamics as the key price drivers rise, both LevelTen and Edison Energy said. Though some details of the 2022 Inflation Reduction Act are being clarified, the uncertainties due to slow federal guidance remain frustrating to developers and investors, Edison Energy added.

The IRA extends solar’s investment tax credit to standalone storage and its 30% deduction of project costs may be significantly increased by adders for qualifying projects, analysts reported. In addition, the IRA extends wind’s production tax credit to solar projects that choose it, with similar adders that could bring the deduction to as much as $23/MWh, they added.

The unsubsidized LCOE for new utility-scale solar is as low as $24/MWh and the LCOE for broadly calculated new paired solar and-storage projects can be as low as $46/MWh, Lazard reported. The lowest unsubsidized and broadly calculated utility-scale onshore wind LCOE is $24/MWh and the lowest broadly calculated paired wind and storage LCOE is $42/MWh, it found.