Investors would not be to blame for detesting the international sleeve of their portfolios over the past decade. Coming out of the global financial crisis in 2009, the U.S. equity market has easily eclipsed foreign developed markets. The Morningstar US Market Index outperformed Morningstar Developed Markets ex-US Index by 6 percentage points annualized between January 2009 and July 2023. These past 14 years of underperformance were hard to stomach, and researchers have debated the cause of foreign markets’ stagnant returns. Most agree that multiple factors contributed, like a stronger U.S. dollar and the growth of U.S. technology companies. In addition, U.S. firms were more profitable and increased their earnings at a faster clip.

Predicting the trajectory of foreign equities can be challenging, and the market tends to price in the prevailing outlook. However, investors have some control over whether they want currency exposure to influence performance. In this article, I will take a closer look at the impact of exchange-rate fluctuations on the relative underperformance of foreign developed markets and whether hedging currency risk is worthwhile for investors.

The Impact of Exchange-Rate Fluctuations

Foreign exchange-rate fluctuations affect the performance of foreign stocks. U.S.-based investors who buy shares of foreign stocks typically do so in the stock’s local currency. Those returns are then translated back into U.S. dollars based on the relative exchange rate. The movement of exchange rates can either benefit or hurt U.S. investors who hold foreign stocks. If the value of the local currency appreciates versus the U.S. dollar, U.S. investors will see higher returns and vice versa.

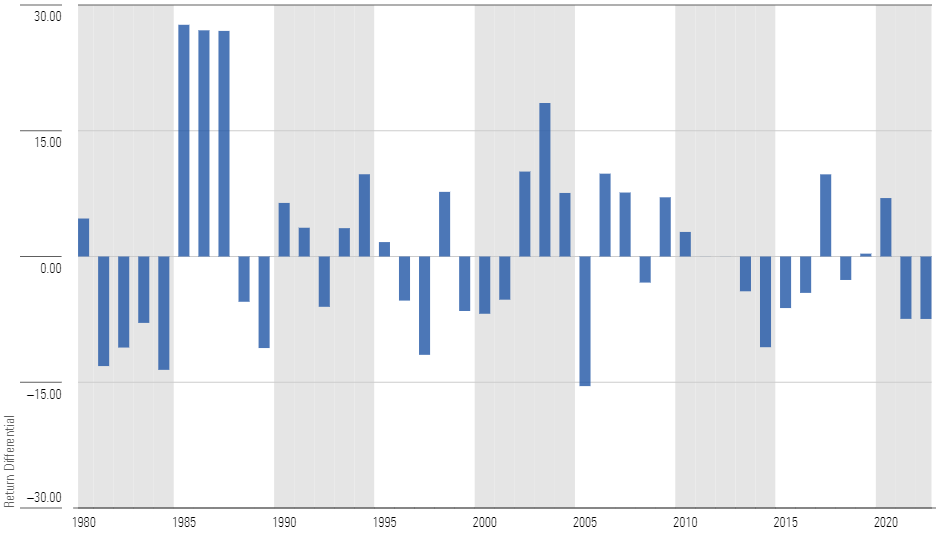

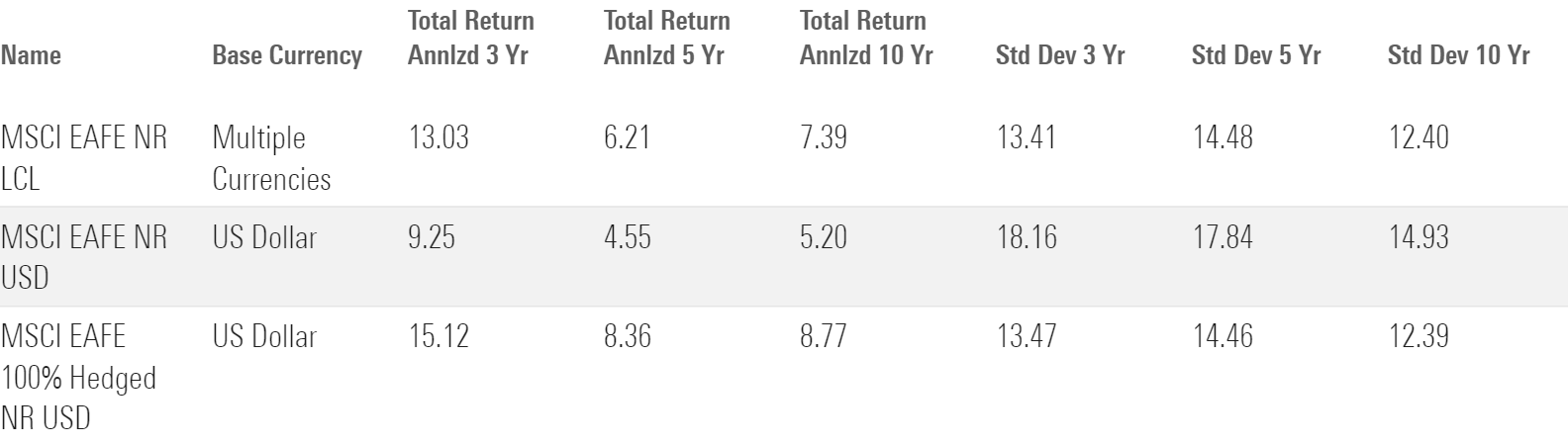

To determine the impact of foreign-exchange rates on a basket of foreign stocks, we subtract the total return of foreign stocks denominated in U.S. dollars from those denominated in their local currencies. Over a short period, fluctuations in exchange rates can significantly affect the performance of foreign stocks. For example, over the three years through July 2023, the local-currency-denominated MSCI EAFE index lost 3.8 percentage points to its U.S.-dollar-denominated counterpart because of exchange-rate fluctuations. Further, exchange rates tend to experience large swings from year to year. Between 1980 and 2022, the largest yearly return differential between the MSCI EAFE Index’s U.S.-dollar and local-currency returns was 27 percentage points; this was in 1985, when the U.S. dollar depreciated following the Plaza Accord (an agreement to devalue the dollar against a cohort of foreign currencies). These swings can be brutal for investors with shorter horizons and can persist for several years.

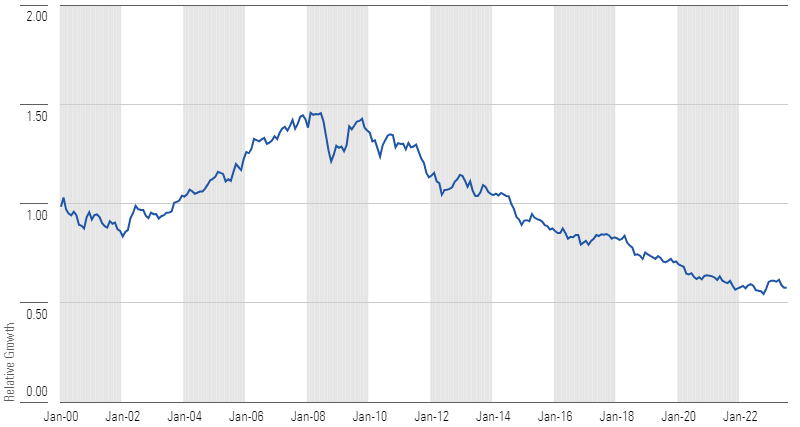

However, the impact of currency fluctuations over extended periods of time tends to be minimal. From 1980 through July 2023, the local-currency MSCI EAFE index trailed the U.S.-dollar-denominated version by only 35 basis points annualized, indicating that exchange-rate fluctuations tend to wash out over the long run.

Factors other than exchange rates play a larger role in explaining the relative performance of foreign stocks. The MSCI EAFE index trailed the MSCI USA index by 6.45 percentage points annualized between January 2009 and July 2023. Of that difference, only 1.31 percentage points were attributable to exchange-rate fluctuations.

The volatility of exchange rates can be hard to stomach for some investors. Some choose to hedge currency risk to damp volatility. The following section explores the basics of hedging foreign currency and its implications for investors.

Should You Consider Currency Hedging?

A foreign investment’s currency risk can be hedged using forward contracts. These contracts establish a fixed exchange rate at a future date, eliminating the uncertainty around exchange-rate movements. By doing so, currency-hedged funds can effectively manage currency risk and reduce its increment of volatility in investment portfolios. While hedging risk does not generate higher expected returns for investors, it can lessen a portfolio’s volatility.

Hedging cuts both ways for investors as exchange rates go up and down relative to the U.S. dollar. When the dollar is weak, currency hedging can be more effective in reducing risk but at the expense of returns, as foreign assets become more expensive in dollar terms. For example, the MSCI EAFE index outperformed its hedged version by 2.2 percentage points annualized between January 2000 and December 2007 as the foreign currencies appreciated.

But when the dollar is strong, currency hedging results in higher returns because it limits the effects of depreciating foreign assets relative to the dollar. For example, the MSCI EAFE index underperformed its hedged version by 5.9 percentage points annualized over the past three years through July 2023, as the dollar steadily strengthened over that period.

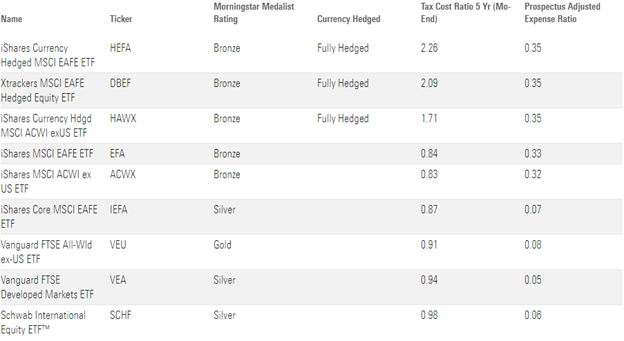

Currency hedging is not free. Currency-hedged funds incur higher costs and charge investors higher fees (in most cases) than unhedged alternatives. The exhibit below showcases the fees of hedged and unhedged exchange-traded funds investing in foreign developed markets. IShares Currency Hedged MSCI ACWI exUS ETF HAWX charges 0.35%, while its unhedged version, iShares MSCI ACWI ex US ETF ACWX, charges 0.32%. Both are relatively more expensive than ETFs with comparable exposure to foreign stocks like iShares Core MSCI EAFE ETF IEFA and Vanguard FTSE Developed Markets ETF VEA, which charge 0.07% and 0.05%, respectively.

Another consideration for investors is that currency-hedged strategies tend to be less tax-efficient than unhedged counterparts. Currency-hedged strategies must roll their forward contracts monthly. Profitable contracts can lead to capital gains distributions. For example, iShares Currency Hedged MSCI EAFE ETF HEFA and iShares MSCI EAFE ETF EFA track the same index, but HEFA hedges currency risk. The hedged version has made capital gains distributions in six out of 10 years since inception, while its unhedged counterpart has made none. As a result, the hedged version has an annualized five-year tax-cost ratio (which measures how an ETF’s returns are reduced by the taxes that investors pay on distributions) of 2.26%, compared with 0.84% for the unhedged version.

Investors need to examine various factors before deciding whether to hedge or not, such as their risk tolerance, investment horizon, and the currency exposure in their portfolio. Long-term investors willing to accept more-volatile returns benefit from the lower cost and tax bill of unhedged strategies, while investors with shorter horizons and lower risk tolerance may prefer the hedged ones. Overall, currency hedging can be an effective way to manage currency risk, but it is not intended to generate excess returns.

Choosing a Path When Investing Abroad

The underperformance of foreign developed markets since the global financial crisis can be partly attributed to currency fluctuations. Over shorter periods, exchange-rate swings can have a significant impact on the performance of foreign stocks, but it should wash out over an extended period. Other factors play a larger role in explaining the disparity in performance between U.S. and foreign developed equities.

Hedging may make sense for risk-averse investors. But it comes with real costs and no expectation of excess returns. Investors should consider their own situation before deciding whether to hedge or not. Ultimately, hedging can cut both ways, and investors should carefully weigh the costs and benefits of currency hedging before making a decision. The pitfalls of performance-chasing can rear its ugly head with currency hedging—investors would be wise to stick with their decision over the long run, whatever they choose.