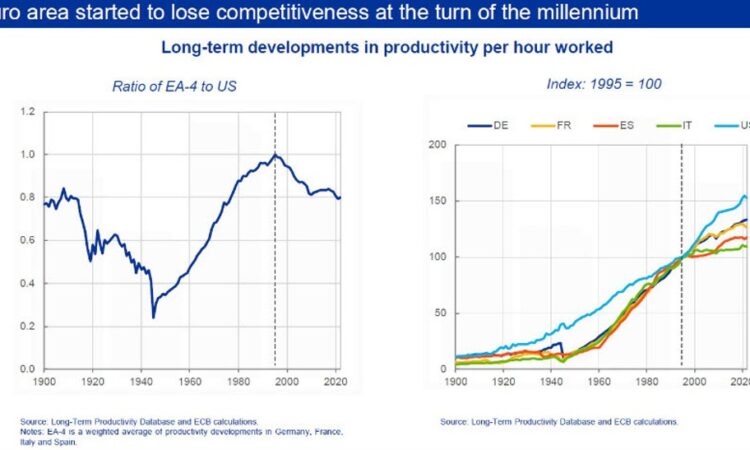

The euro hit a 20-year low in 2022 and the recovery since has been modest at best. If you look at equity market performance, it’s even more stark with the S&P 500 doubling the performance of the STOXX 600 from the financial crisis lows.

Here’s the problem, as highlighted by ECB Governing Council member Isabel Schnabel today:

Europe vs US productivity

She highlights a handful of causes and solutions:

- The US has invested far more heavily in IT

- High European barriers to entry protect the rents of incumbents, reduce technology diffusion and constrain the entry of younger firms

- The lack of venture capital

- Firms are smaller in the eurozone, and small firms invest less in IT

- “we need regulation that more strongly embraces and encourages competition”

- The single market allows firms to compete but integration remains disappointing, especially in market services. Financial markets also remain segmented, contributing to capital misallocation

- we need more public investment at national and European levels

Schnabel says that it’s urgent to fix the problem, in part due to energy and demographic challenges in Europe, and I’d argue it’s the only way to spark a long-term turn in the euro.

Schnabel:

“Turning from laggard to leader requires a virtuous circle between investment and productivity growth. Governments need to strengthen competition, reduce bureaucracy and foster integration, channelling capital and labour towards their most productive uses.”