One of the hottest investment trends on Wall Street is AI stocks. Many investors recognize the long-term value potential of artificial intelligence, especially after OpenAI chatbot ChatGPT took the world by storm.

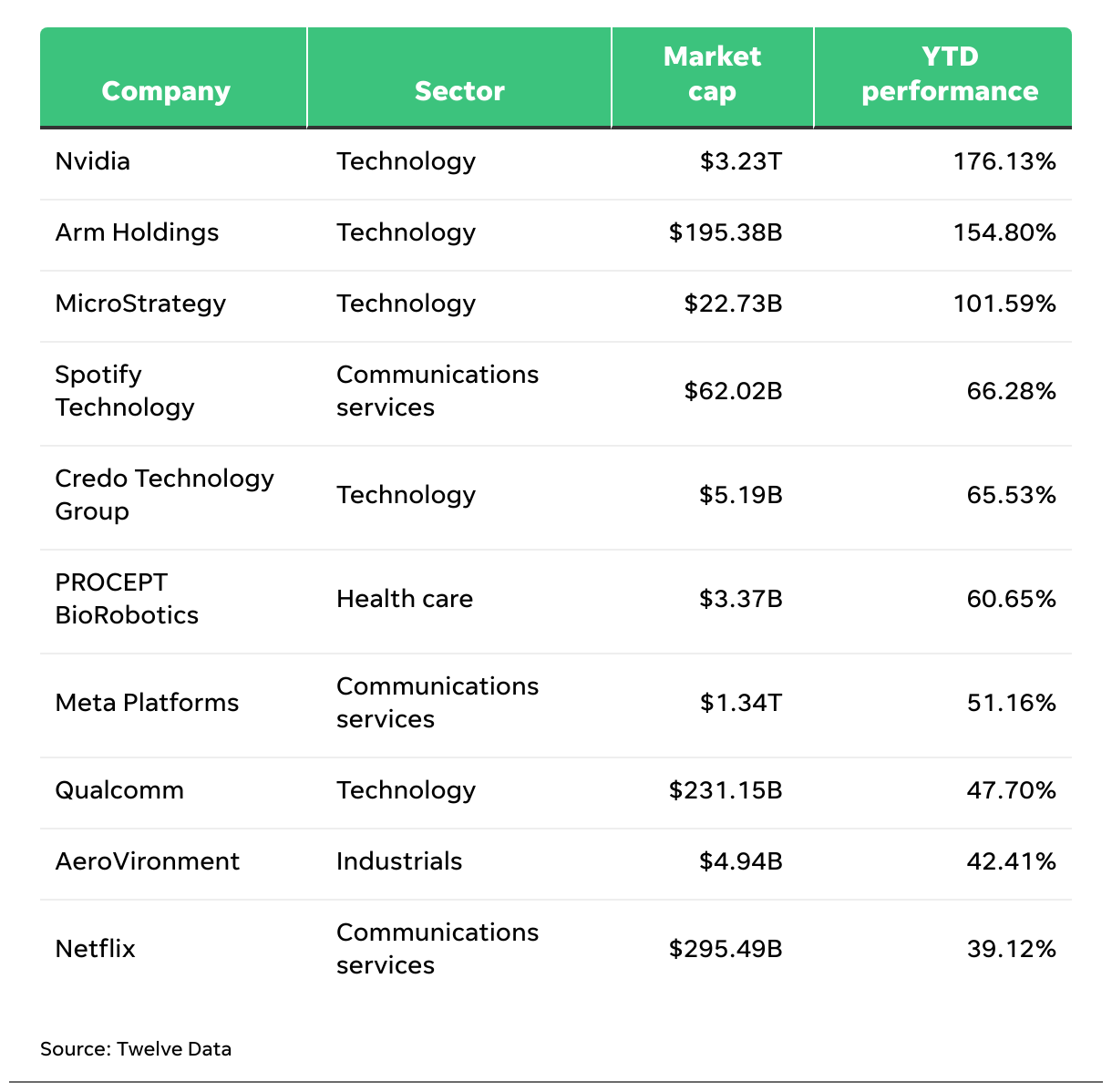

Here are the 10 best-performing AI stocks of 2024 based on several factors: highest year-to-date returns among AI stocks, included in a major AI exchange-traded fund portfolio, covered by at least one Wall Street analyst, and a market capitalization of $2 billion or higher.

The following AI stocks are ordered based on year-to-date performance.

Experienced stock analysts select our best stock selections based on screening for several must-have metrics. These metrics often include but are not limited to forward price-to-earnings, risk, earning stability and Wall Street “buy” consensus. Among all of our stock selections, the average return beats the S&P 500. But investors should note that before purchasing any stocks, it’s important to do plenty of research and ensure their selections align with their financial goals and risk tolerance. You can read more about our methodology below.

- 5,000+ companies screened.

- 3 levels of fact-checking.

- 3-step editorial review.

Nvidia (NVDA)

Sector: Technology

Market cap: $3.23 trillion

5-day performance: 11.77%

YTD performance: 176.13%

Open price: $135.98

P/E: 76.83

Why it made our list

Nvidia is a semiconductor company. It develops and markets graphics and mobile processors for personal computers, workstations, smartphones and tablets. The company’s high-end AI chips help provide the processing power AI software needs to perform optimally.

Cloud vendors and consumer internet companies are buying Nvidia graphics processing units hand over fist as they integrate AI technology into their businesses. These GPUs are used to train and deploy generative AI applications, such as ChatGPT.

Nvidia is generating impressive growth numbers in its automotive division. The company’s chips will likely play a large role in the global autonomous vehicle market.

Pros and cons

Pros:

- Highly exposed to several massive long-term growth trends.

- NVDA’s self-driving platform is an early leader in the AV market.

- The complexity of high-end GPU research and development creates a barrier to entry.

Cons:

- Highly exposed to the maturing PC market.

- The AV market is in its early innings and highly competitive.

- NVDA has a relatively high price-to-sales ratio, creating significant valuation risk.

Arm Holdings (ARM)

Sector: Technology

Market cap: $195.38 billion

5-day performance: 15.31%

YTD performance: 154.80%

Open price: $187.28

P/E: 621.53

Why it made our list

Arm Holdings is a semiconductor and software company and a leading supplier of microprocessor technology. Most mobile devices, including 99% of premium smartphones, use Arm processor technology. In 2020, Apple introduced custom Arm-based chips for its products to replace the Intel chips it previously used.

Arm architecture is attractive for mobile devices because it offers high performance and energy efficiency. This also allows generative AI to run on Arm-powered smartphones, PCs and data centers. According to ARM, companies can save upward to 15% of their power usage.

Pros and cons

Pros:

- Arm architecture is used in most mobile devices, including Samsung and Apple smartphones.

- The licensing model generates significant revenue for the company.

- Room to grow in sectors like data centers and automotive.

Cons:

- Faces competition from companies like Intel and AMD.

- Arm’s success largely relies on the adoption and continued use of its technology.

- RISC-V, an open-source alternative to Arm, is emerging as another potential competitor.

MicroStrategy (MSTR)

Sector: Technology

Market cap: $22.73 billion

5-day performance: 7.55%

YTD performance: 101.59%

Open price: $1,396.00

P/E: 48.54

Why it made our list

MicroStrategy designs and sells enterprise analytics and mobility software. The company is investing in enhancing the AI capabilities of its MicroStrategy ONE analytics platform.

In 2023, the company expanded a multiyear partnership with Microsoft to integrate MicroStrategy’s advanced analytics capabilities into Azure OpenAI Service. This will help businesses maximize their data.

MSTR has experienced two powerful tailwinds in the past two years: AI and cryptocurrency. The company holds 190,000 bitcoins on its balance sheet, making it the largest corporate bitcoin investor.

Pros and cons

Pros:

- A major partnership with AI technology and enterprise software leader Microsoft.

- MSTR’s surging price has allowed the company to raise cash via equity offerings.

- A leading Big Tech stock.

Cons:

- High exposure to the volatile cryptocurrency market.

- Crypto stock reputation could undermine awareness of the enterprise analytics business.

- Bitcoin profits have masked negative revenue growth and losses from operations.

Spotify Technology (SPOT)

Sector: Communications services

Market cap: $62.02 billion

5-day performance: -0.83%

YTD performance: 66.28%

Open price: $312.69

P/E: N/A

Why it made our list

Spotify is one of the world’s largest music streaming platforms. It operates subscription and ad-supported models. The company has also expanded into podcasts and other forms of audio content.

SPOT has launched several AI-based features. These include a DJ that curates playlists based on users’ preferences and software that translates podcasts into different languages.

As AI technology improves, Spotify can tap into users’ wants and maximize engagement.

Pros and cons

Pros:

- Opportunities to negotiate better terms with record labels.

- Services and tools targeted at artists may facilitate independent distribution.

- Expansion of offerings diversifies the business and attracts a larger audience.

Cons:

- Competition with Big Tech companies’ music businesses.

- Variable content acquisition costs limit gross margin expansion opportunities.

- Royalty contracts with record labels limit financial visibility and create uncertainty.

Credo Technology Group (CRDO)

Sector: Technology

Market cap: $5.19 billion

5-day performance: 0.48%

YTD performance: 65.53%

Open price: $31.50

P/E: N/A

Why it made our list

Credo Technology delivers high-speed connectivity solutions, essential for data centers and AI applications. CRDO has a fairly strong market position within the tech sector.

While CRDO’s stock was a high flyer in 2024, its book value suggests that it is a little overvalued — leaving little room for error. That said, revenue remains strong for the AI company. CRDO reported revenue of $60.8 million in the fourth quarter, marking an 89.4% year-over-year increase.

Pros and cons

Pros:

- Solid quarterly performances.

- Revenues have been aligned with Wall Street analyst expectations.

- Analysts give CRDO stock an optimistic outlook.

Cons:

- P/E is significantly high.

- The price-to-book is higher than the industry average.

- Stock price volatility.

PROCEPT BioRobotics (PRCT)

Sector: Health care

Market cap: $3.37 billion

5-day performance: 4.87%

YTD performance: 60.65%

Open price: $66.35

P/E: N/A

Why it made our list

PROCEPT BioRobotics is a surgical robotics company developing minimally invasive urologic surgery solutions. Its Aquabeam Robotic System uses Aquablation therapy to treat benign prostatic hyperplasia. Aquablation therapy combines several technologies, including automated robotics, to remove prostate tissue.

In a 2023 SEC Form 10-Q, the company mentions integrating AI into its Aquablation therapy. It plans to use treatment data to integrate AI and machine learning. PRCT is also developing an AI team focused on technical design and development.

Pros and cons

Pros:

- The market for robotic surgical systems is expected to more than double by 2033.

- The Aquabeam system has seen positive results in clinical trials compared to other BPH therapies.

- Procept looks to expand globally and has already completed its first therapy procedures in Japan.

Cons:

- Robotics is a competitive field; other companies could take market share.

- Changes in insurance reimbursement rates could affect its potential to turn a profit.

- The company’s success largely hinges on its Aquabeam technology.

Sector: Communications services

Market cap: $1.34 trillion

5-day performance: 4.88%

YTD performance: 51.16%

Open price: $531.07

P/E: 30.49

Why it made our list

Meta Platforms owns and operates some of the world’s largest social media and messaging platforms. These include Facebook, Messenger, Instagram and WhatsApp. As of December 2023, Meta had over 3 billion daily active people across its platforms. Facebook alone has more than 2 billion daily active users.

Meta invests heavily in several AI initiatives as part of its long-term technology roadmap. For example, it’s building an AI model to power its entire video ecosystem. The company also invests billions of dollars in Nvidia GPUs to develop its AI systems.

Pros and cons

Pros:

- An unmatched global social media user base provides unique value to advertisers.

- Ad revenue per user is trending higher.

- AI technology integration will help increase user engagement and ad targeting.

Cons:

- Social media is a competitive business, particularly among younger users.

- Exposure to regulatory risks that could limit or restrict user data collection and utilization.

- Metaverse investments are costly and may not pay off in the long term.

Qualcomm (QCOM)

Sector: Technology

Market cap: $231.15 billion

5-day performance: 3.62%

YTD performance: 47.70%

Open price: $210.02

P/E: 27.62

Why it made our list

Qualcomm is a technology company that offers processors, modems, and RF systems. It is best known for its Snapdragon processors, which are found in smartphones.

Snapdragon processors have also been created for laptops. These processors are built for AI to help Qualcomm take its piece of the AI cake. Qualcomm’s Snapdragon Computer Platforms have on-device AI, reducing delays and improving performance. These processors perform exceptionally well and could shake up the laptop market.

Pros and cons

Pros:

- Qualcomm is an industry leader in producing products that power 5G wireless devices.

- A commitment to research and development helps ensure Qualcomm will continue to develop cutting-edge products.

- Introducing powerful laptop processors could help the company compete in a new market.

Cons:

- Despite Qualcomm’s strong position, it faces competition from MediaTek and Samsung.

- The company has been the focus of antitrust lawsuits over alleged monopolistic practices.

- Despite promising results for laptop processors, it faces competition from established players like AMD and Intel.

AeroVironment (AVAV)

Sector: Industrials

Market cap: $4.94 billion

5-day performance: 4.32%

YTD performance: 42.41%

Open price: $178.26

P/E: 80.48

Why it made our list

AeroVironment designs and produces unmanned aircraft systems and provides electric transportation solutions. In addition to the AI trade, the drone company will likely benefit from improving investor sentiment toward the defense industry. This comes as the war drags on in Ukraine, conflicts in the Middle East ramp up and geopolitical tension between the U.S. and China escalates.

AVAV acquired Tomahawk Robotics and its flagship AI-enabled control system, Kinesis, in 2023. The company will likely continue to integrate AI technology into its unmanned systems. This will make them even more adaptive and effective on the battlefield.

Pros and cons

Pros:

- Escalating geopolitical conflicts will likely increase global defense budgets.

- Government contracts typically generate stable, predictable cash flows.

- The company generates high revenue growth for the aerospace and defense industry.

Cons:

- A price-to-sales ratio higher than the industry peer average.

- Growth in the MacCready Works segment has lagged.

- Execution risks associated with Tomahawk Robotics integration.

Netflix (NFLX)

Sector: Communications services

Market cap: $295.49 billion

5-day performance: -0.78%

YTD performance: 39.12%

Open price: $672.20

P/E: 47.62

Why it made our list

Netflix is an American media company that operates one of the largest global streaming video platforms. It acquires the rights to the content and produces original content. The company offers several subscription plans, including standard with ads and premium.

NFLX’s sophisticated algorithms are among its most valuable assets. They generate personal recommendations, optimize content delivery and enhance user experience. The company’s advanced AI algorithms analyze vast troves of data to predict what content a user will enjoy. Netflix uses AI technology to identify trends and insights from its customer base and determine content creation strategies.

Pros and cons

Pros:

- An extensive library of original content is exclusively available on Netflix.

- Highly profitable business contrasts with other streaming services generating net losses.

- Ad-supported subscription tiers create opportunities for revenue growth.

Cons:

- Creating original content can lead to fluctuations in engagement and subscriber counts.

- Other streaming services have made the market increasingly competitive.

- Must rely largely on subscription price hikes to drive domestic growth.

Compare the best AI companies

Methodology

The best AI stocks included above all trade on a major U.S. stock exchange and meet the following criteria:

- Covered by at least one Wall Street analyst. Stocks covered by a certified equity analyst have been assessed by a professional trained in reviewing business performance, stock market valuations and financial statements. They also tend to have higher trading volume, media coverage and investor awareness.

- A market capitalization of at least $2 billion. Some companies on this list are midcaps around that value with plenty of room to grow. Others are dominant forces with valuations of well over $10 billion. These large-cap stocks are generally considered safer investments, as they’re more established and less volatile.

- iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) or Global X Robotics and Artificial Intelligence ETF (BOTZ) holding. IRBO and BOTZ are two of the most popular ETFs focused on artificial intelligence. The funds invest only in stocks with businesses positioned to benefit from innovation and long-term growth in robotics and AI.

- Highest year-to-date returns among AI stocks. The stocks included in this list are the best-performing U.S.-listed stocks from among the IRBO and BOTZ fund holdings. Each stock included has outperformed its AI technology peer group.

Why other stocks didn’t make the cut

This list includes only top-performing AI stocks. It doesn’t necessarily include AI stocks that will make the best long-term investments.

For instance, Microsoft (MSFT) and Apple (AAPL) have performed well in terms of their stock prices this year. But they aren’t the top gainers. This list is a directory of the best-performing AI stocks.

Exciting technology tends to inspire enthusiasm among investors. The popularity of ChatGPT and other AI services has triggered extreme rallies in the stocks listed here. If a stock’s price doubles in weeks or months, you should look closely at the company’s business fundamentals. Consider whether the underlying metrics justify the big move. Generally, it’s best to avoid stocks with sky-high P/E ratios, P/S ratios or price-to-free-cash flow ratios.

Final verdict

The hype surrounding AI technology has raised awareness of AI stocks and generated significant returns for the AI stocks in this list. But DataTrek Research co-founder Jessica Rabe said additional upside for these stocks hinges on their ability to improve their current offerings and turn their AI technologies into profitable, sustainable businesses.

“So far, Big Tech has collectively benefited most from the buzz around genAI. We think this trend will continue given their ability to leverage their global scale and large competitive moats when utilizing this disruptive technology,” Rabe said.

How to invest in AI

There are several ways to invest in AI, including purchasing stocks and ETFs. Stocks such as Nvidia, Meta and Alphabet are among the best AI stocks for performance. These companies either work directly on AI technologies or implement AI into their existing services.

Buying AI stocks is one of the easiest ways to invest in AI. But it’s not the only way. You can also purchase AI-focused ETFs like BOTZ, ARK Autonomous Technology & Robotics (ARKQ) and Robo Global Robotics & Automation (ROBO). These funds help diversify your portfolio while exposing you to several AI stocks.

You give up some control over your investments. There are typically fees, too. Carefully weigh the pros and cons of each approach before investing.

How to buy AI stocks

Buying AI stocks can be as simple as placing an order with a stockbroker. Search for your desired stock by its name or ticker. Then, place an order for the desired amount.

If you don’t already have an account, you can open one with an online broker. Before opening an account, consider factors such as fees, research tools and user-friendliness. Many brokers have research tools that help you identify potentially attractive buys. Examine each stock’s financial reports, news reports, industry trends and potential growth.

Frequently asked questions (FAQ)

Yes, AI technology is likely a safe long-term investment overall. But many individual AI stocks will be big winners and big losers along the way.

The best approach to investing in AI technology is to build a diversified basket of high-quality AI stocks.

While most high-growth companies do not pay dividends, a handful of AI-related stocks do. Semiconductor stocks Texas Instruments (TXN), Qualcomm (QCOM) and Microchip Technology (MCHP) are AI-related stocks that offer dividend yields.

Many AI stocks may be overvalued based on fundamental valuation metrics like P/E and P/S ratios. The market has historically rewarded higher-growth stocks with premium valuations. But proceed cautiously when buying AI stocks with valuation metrics significantly higher than overall market or sector averages.