Teva Pharmaceutical Industries Adds US$389m To Market Cap, But Investors Still Down 47% From Five Years Ago

It is a pleasure to report that the Teva Pharmaceutical Industries Limited (NYSE:TEVA) is up 35% in the last quarter. But that doesn’t change the fact that the returns over the last five years have been less than pleasing. After all, the share price is down 47% in that time, significantly under-performing the market.

The recent uptick of 3.2% could be a positive sign of things to come, so let’s take a look at historical fundamentals.

Check out our latest analysis for Teva Pharmaceutical Industries

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Teva Pharmaceutical Industries became profitable within the last five years. On the other hand, it reported a trailing twelve months loss, suggesting it isn’t reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 7.6% per year is viewed as evidence that Teva Pharmaceutical Industries is shrinking. This has probably encouraged some shareholders to sell down the stock.

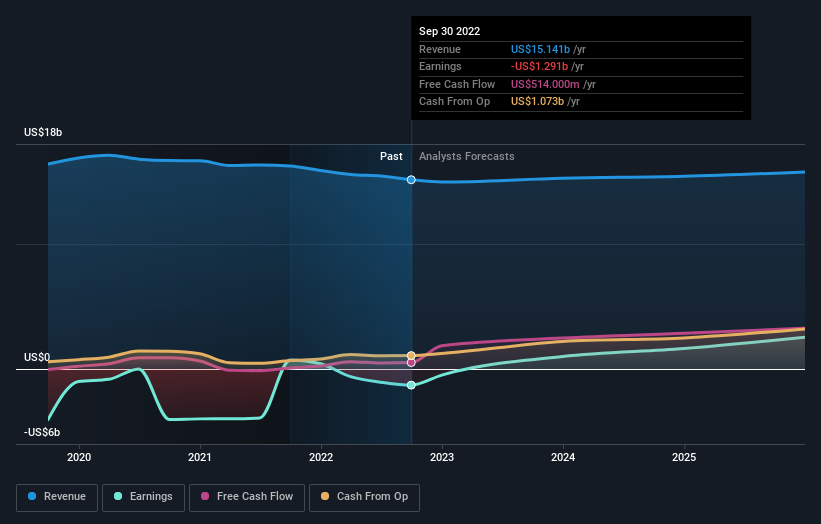

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Teva Pharmaceutical Industries is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

It’s nice to see that Teva Pharmaceutical Industries shareholders have received a total shareholder return of 23% over the last year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. You could get a better understanding of Teva Pharmaceutical Industries’ growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

What are the risks and opportunities for Teva Pharmaceutical Industries?

Teva Pharmaceutical Industries Limited, a pharmaceutical company, develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, and internationally.

Rewards

-

Trading at 64.9% below our estimate of its fair value

-

Earnings are forecast to grow 43.36% per year

Risks

No risks detected for TEVA from our risks checks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.