(Bloomberg) — The Bank of England is likely to leave interest rates at a 15-year high on Thursday, with concerns that inflation is persisting balancing signs the economy may be tipping into a protracted slump.

Economists and investors expect the UK central bank’s nine-member Monetary Policy Committee to maintain the key rate at 5.25% for a third consecutive meeting when the decision is announced at 12 p.m. in London.

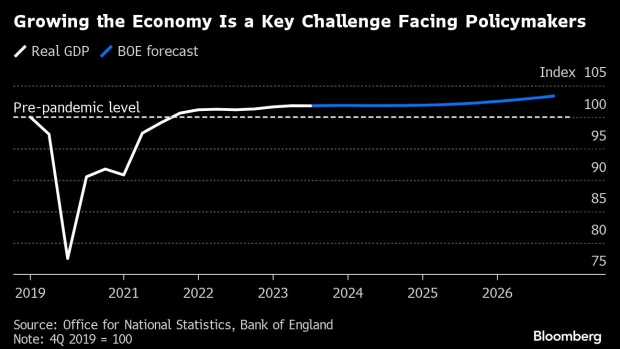

While Governor Andrew Bailey has warned the UK is facing its worst growth outlook in his career, inflation is more than double the BOE’s 2% target and worker pay is rising rapidly. That’s added to the risk of a wage-price spiral.

It’s a bleak backdrop for Prime Minister Rishi Sunak’s Conservative government, which is likely call a general election next year.

With no relief from high borrowing costs in store for this month, investors are focused on signs of when the BOE thinks inflationary pressures might subside enough to open the way for reductions. They’ve priced in the first move in the middle of next year and a full percentage point cut by December. That’s double the amount penciled in just after November’s decision — despite BOE warnings that they’ll have to bear down on inflation for an extended period.

For markets, the BOE meeting is likely to be something of a “non-event” barring any surprises, according to Bank of America strategists. The US Federal Reserve last night left rates on hold, giving the clearest sign since March 2021 that its hiking cycle is finished.

Sterling’s moves against the euro today are more likely to be affected by language from the European Central Bank, which is releasing its own monetary policy decision at 1:15 p.m. London time followed by a press conference half an hour later. Traders watching the eurozone are also betting on rate cuts halfway through next year, and with inflation just 0.4 percentage points above target, they look far more in reach than in the UK.

As far as the BOE meeting goes, here are the key elements to watch:

Vote Split

Economists expect three MPC members to vote for a further quarter-point rate hike. Those hawks would include Catherine Mann, Jonathan Haskel and Megan Greene, each of whom has voiced concern about pay growth driving up inflation.

That would repeat the split from November’s meeting. Another hawk emerging on Thursday could tamp down bets on rate cuts next year.

Bailey and his colleagues have turned more hawkish in recent weeks as investors ramped up bets on lower rates. Those wagers have effectively reduced the cost of borrowing by more than half a percentage point since the last meeting in November.

Forward Guidance

The BOE’s current guidance indicates a risk that rates may have to be raised again, a sharp contrast to market positioning for a cut.

Bank of America thinks the BOE will keep the current guidance unchanged to prevent markets from unraveling the monetary tightening delivered so far. As a result, the BOE will likely be “among the last to normalize policy,” trailing the US Federal Reserve and the European Central Bank, said BofA’s UK economist Rob Wood.

BOE Guidance in November

“The MPC’s latest projections indicated that monetary policy was likely to need to be restrictive for an extended period of time. Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.”

— Bank of England minutes from Nov. 2, paragraph 22

It’s possible the BOE may push back on market pricing, shedding light on what “sufficiently long” means. Markets have now priced in a percentage point of rate cuts over the course of the next year.

That’s a sharp contrast to Chief Economist Huw Pill’s assertion that rates may follow a “Table Mountain” profile, a reference to the flat-topped landmark outside Cape Town he used to contrast with a “Matterhorn” policy where rates rise sharply then fall quickly.

Inflation

UK consumer prices are rising 4.6% from a year ago, 0.2 points below the BOE’s forecast but still more than double the target. Bailey has warned that figure might tick up again before subsiding.

Minutes of the meeting may update the outlook, but full forecasts won’t come until February. The MPC may also comment on wages, which have been rising by more than 7% for months — much stronger than is compatible with 2% inflation.

While the UK economy is weakening — and shrank in October for the first time in months — Britain still has the highest inflation in the Group of Seven nations. Policy-makers say reducing those pressures is their first priority — even if the economy tips into recession.

What Bloomberg Economics Says

“The sharper-than-expected slowdown in inflation in the October CPI release gives the Bank of England all the cover it needs to remain on hold at its December meeting. At the same time, we expect the central bank to double down on its message that policy is likely to remain restrictive for an extended period of time — services inflation is too high, and there are tentative signs the economy may have regathered some momentum in the fourth quarter. There is still a long way to go on the road to 2% inflation.”

—Dan Hanson & Ana Andrade, Bloomberg Economics. Click for the PREVIEW.

“Wage inflation is still too high for comfort,” said Imogen Bachra, head of non-dollar rates strategy at Natwest Markets, though the fall in weekly earnings growth in Tuesday’s data was steeper than expected.

Budget

Chancellor Jeremy Hunt’s Autumn Statement will provide a £21 billion stimulus to the UK economy in the run-up to the next election. It will boost the economy by an average of just under 0.3% between the fiscal years ending March 2025 and 2029, according to the Office for Budget Responsibility.

The BOE may make some assessment of what that action will mean for monetary policy, leaving a fuller analysis for its quarterly forecasting round in February.

One of Hunt’s key measures was to cut National Insurance contributions. Some economists see this adding to inflation, softening the blow of a debt burden headed for a post-war high.

Quantitative Tightening

The BOE plans to sell off £100 billion of assets under the second year of its quantitative tightening program, a reversal of the stimulus it had in place for more than a decade of bond purchases. It’s possible that program is tweaked at this meeting.

Sales in the year through October are split across three “buckets” of maturities — 3-7 years, 7-20 years and 20-year-plus. There’s been an even split across those buckets since active sales started.

Some economists are pressing for a focus on selling more short-dated gilts. That would reduce upward pressure on yields at the long end of the curve and cut the losses on QT sales that the Treasury must pay.

Bank of America and Deutsche Bank have argued for the change but aren’t hopeful. They note remarks from Deputy Governor Dave Ramsden and other MPC officials happy with the current mix and relaxed about losses for taxpayers.

–With assistance from Harumi Ichikura, Andrew Atkinson and Greg Ritchie.

©2023 Bloomberg L.P.