wdstock/iStock Editorial via Getty Images

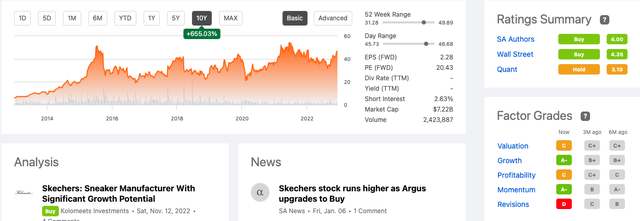

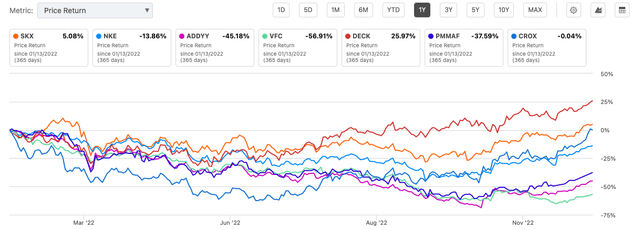

90s footwear manufacturer Skechers U.S.A., Inc. (NYSE:SKX) followed in the footsteps of larger, more established peers to grow its firm quickly through advertising and celebrity endorsements. SKX has been a worthy stock to hold on to in the short and long run, growing organically and backed up by solid fundamentals. The stock has rewarded investors over the last six months with returns of 25.97%, over the previous year by 5.08%, over the last five years by 19.11% and over the previous ten years by an overwhelming 655.03%.

Ten-year stock trend (Seeking Alpha)

Recently Argus analysts have upgraded the stock to a Buy rating with a price target of $50 due to its rapid growth potential in emerging markets. The company has strong top and bottom line performance, increasing margins through its direct-to-customer strategy and a pipeline of new stores and facilities to be opened in the coming year, tapping into the fast-paced growth potential in the APAC market with competitively priced products that are well-liked by consumers. Investors may want to take a bullish stance on this company, and it continues to establish itself as a worthy competitor in the fierce footwear industry.

Overview

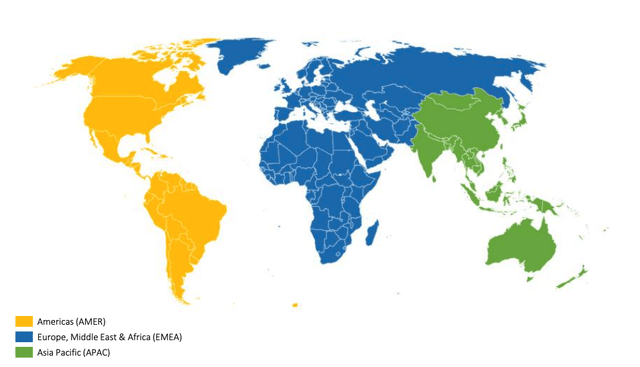

SKX is a California-based footwear company founded in 1992 and IPOed in 1999 at $11 per share. It has grown organically, with only one acquisition, Fitwall, a fitness chain, in 2015, which has yet to have a mentionable business impact. Since 2022 the company has redefined its reportable business segments into wholesale and direct-to-consumer segments, which are operated in three regions, as shown on the map. Its manufacturing facilities are located in China and Vietnam, primarily through independent contractors.

Geographic regions (Investor Presentation 2022)

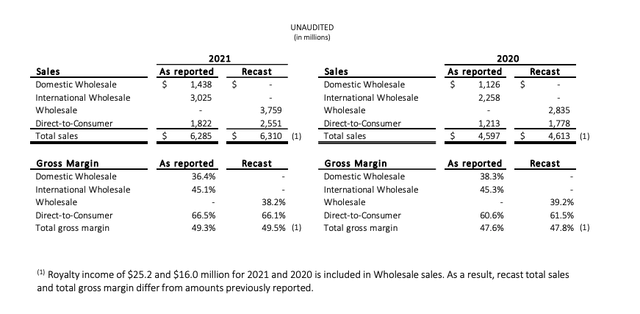

The wholesale sector makes up 59.57% of total sales, with a gross profit margin of 38.2% in FY2021, focusing on sales through its vast network of partners ranging from department stores, e-retailers, franchisees, and various small and large distributors across the globe. Direct-to-consumer making up 40.42% of total sales, with a gross profit margin of 66.1%, entails 1,360 company-owned retail stores, digital and mobile commerce platforms, and international marketplaces such as Tmall.

Recast of Segments to Wholesale and Direct-to-Consumer (Investor Presentation 2022)

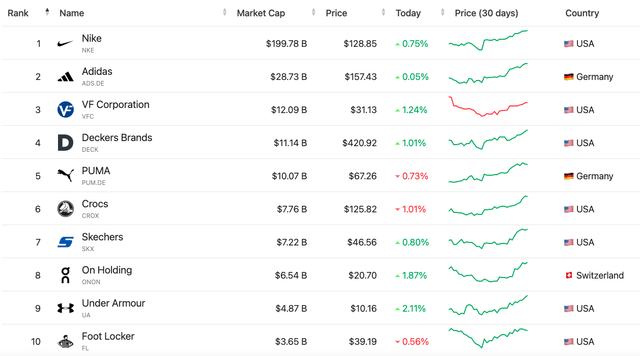

SKX is the seventh largest footwear company by market cap at $7.22 billion. The industry is highly competitive, with the top three companies holding an 8% market share. The footwear market continues to grow with an annual CAGR of 3.38% and is expected to reach $445.00 billion in 2023.

Footwear companies ranking (Companies Market Cap)

SKX’s competitive advantage lies in its competitively priced products, large physical store footprint, constant domestic and international growth, and geographic diversification, present in over 180 countries with a serious boost from its APAC market and growing more profitable direct-to-consumer initiatives. It has been investing in technologies leading to effortless and attractive customer buying experiences. Across various studies, SKX is considered a high-quality product at an affordable price.

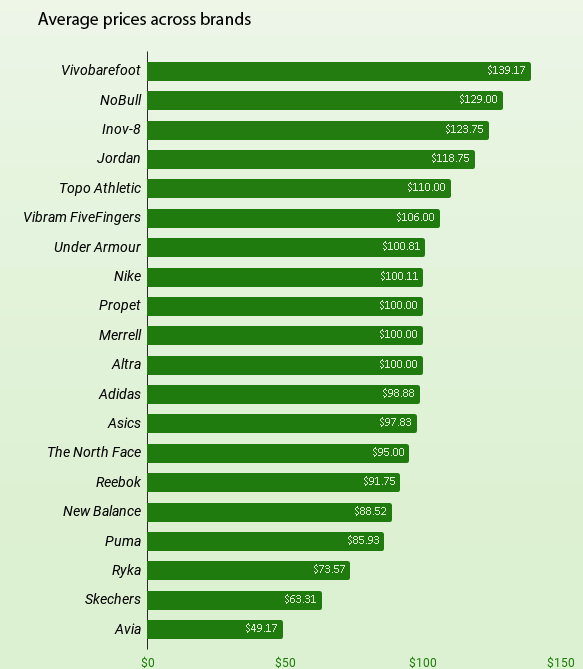

Average workout shoe price 2021 (RunRepeat)

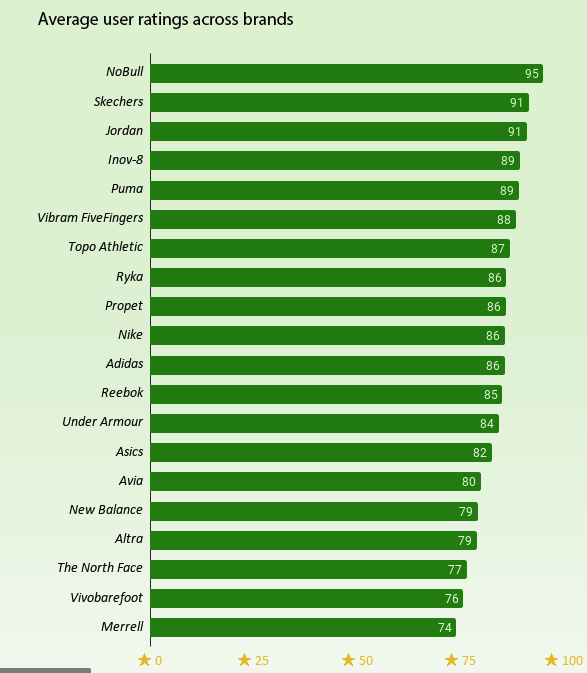

In a study looking at workout shoes, Skechers is considered good quality at 91 out of 100.

Average user rating (RunRepeat)

SKX has a celebrity ambassador program to grow its Gen Z market in the APAC region. It has most recently signed an agreement with Cha Eun-Woo, a K-Pop star, with an Instagram following of 32.2 million.

Financials And Valuation

The company has been improving its top and bottom-line performances for the last few years. We can see an upward trend in revenue with a TTM of $7.221 billion and a gross profit of $3.413 billion TTM. Direct sales and growth in the APAC markets have contributed significantly to this increase over the years.

Annual Revenue Growth (Seeking Alpha)

If we zoom into the margins, we can see that gross profit margins have increased from 46.08% for FY 2016 to 49.51% for FY 2021. This year we see a decrease in the margins TTM due to strong headwinds which have increased costs.

Annual gross profit as a % of revenue (Seeking Alpha)

If we take a look at the full financial year net income and compare it to the cash flow, we have a better insight into where the cash is being spent. For FY21, the company had a negative free cash flow of $98 million.

Linking net income to cash flow (trefis.com)

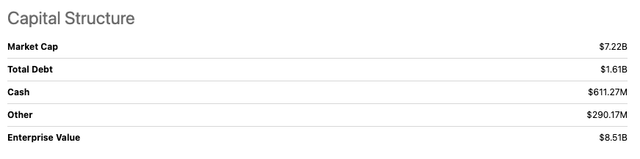

Below we can see the capital structure, with much of the enterprise value of total debt of $1.61 billion. Total assets have been consistently growing, and the company has relatively safe liquidity with a current ratio of 2.27 and a quick ratio of 1.08, which we would like to see a little higher but is sufficient to cover short-term liabilities.

Capital Structure (Seeking Alpha)

If we look at SKX compared to its larger peers, we can see that over the last year, it has been one of the better-performing stocks, with a favourable price return of 5.08% compared to most of its peers, delivering negative returns. The industry has been impacted by headwinds of inflation and a drop in consumer discretionary purchases as customers become more cautious of their purchases.

One year Price Return Comparison (Seeking Alpha)

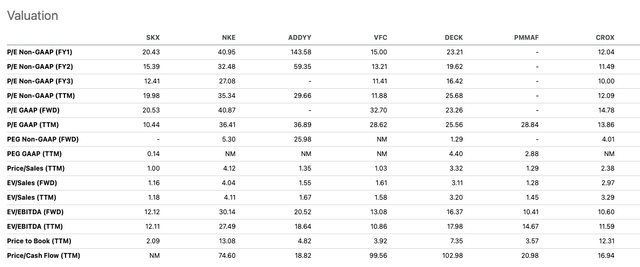

If we look at its valuation compared to the top footwear firms by market share, the company has a very attractive price-to-sales ratio of 1.00. However, its price-to-earnings ratio is more than VFC and CROX at 19.98. Although CROX looks attractive across several valuation metrics, investors should be cautious of its high debt-to-equity ratio of 459.14%.

Relative valuation (Seeking Alpha)

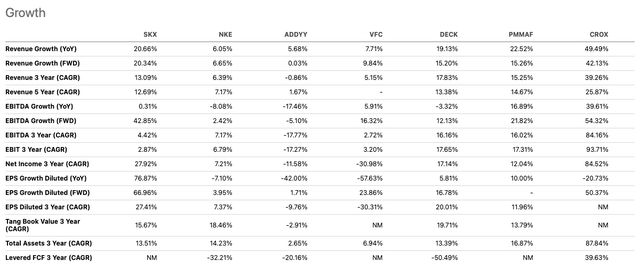

Furthermore, we can see that compared to the largest peers in the field, SKX is growing at an attractive rate with a forward EBITDA growth rate of 42.85%.

Growth comparison (Seeking Alpha)

Risks

SKX is a consumer discretionary stock facing the current headwinds of cost inflation, supply chain problems and labour shortage which have and will continue to impact the costs of the business. It is a company with a global footprint which will always bring the risk of geopolitical factors affecting the business performance. Its primary product lines are located in China and Vietnam. US-China trade has been tense for many years with restrictions and compliance issues that are changing and developing. Increased regulations and rules could impact the potential growth of the business, with a limited diversification of its factory locations. Furthermore, the highly competitive market often results in infringement settlements. Most recently, SKX is suing Hermes (RMS: EN Paris) for an infringement on patent rights. These cases can lead to increased costs and time spent outside the core business.

Final thoughts

SKX has a growing brand and an expanding infrastructure, allowing it to scale up internationally, with an emphasis on the APAC market. The company has performed well against headwinds and is structuring its business according to growth possibilities through developing its Direct-to-customer segment on and offline, benefiting from its competitively priced products that are well perceived by the market and investing in advertising through ambassador programs with notable celebrities in the APAC region to reach a broader audience. The stock price is lower than many of its larger peers, while the company is growing faster. Investors may want to take a bullish stance on this company.