It has started again, and it’s not quite clear yet whether investors should react to claims that a sharp economic downturn is on its way, or put faith in the adage coined by Professor Paul Samuelson over 40 years ago about how “the stock market has predicted nine out of the last five recessions”.

With UK equities out of favour globally, small-cap fund managers say their sector in particular has gone through such a de-rating in the last two years that stocks already discount what risks there are on a longer-term view.

I find it hard to accept that if economic conditions worsen, we will not see profit warnings which even stocks trading on low valuation multiples will find hard to avoid.

This week started with economists at KPMG predicting UK growth will slow sharply – as high interest rates, continued uncertainty and low productivity weigh on the economy. They reckon on just 0.4% growth in the second half of this year after 4.1% overall in 2022, then just 0.3% in 2024.

I recall from the late 1980s, a firm consensus of economists asserted the UK would enjoy a soft landing as interest rates rose to tackle inflation caused by tax cuts during the “Lawson boom”.

A technical recession resulted from autumn 1990 to autumn 1991 which cast a long shadow. A contrast back then was interest rates rising from 8% in summer 1988 to nearly 15% in summer 1989 – a far cry from possibly stabilising at 5.25% now.

My base-case scenario has been for a delayed impact on economic activity after the Bank of England belatedly addressed inflation with small, stepped rate rises from December 2021. Yes, stock markets began to price in the expectation of central banks tightening monetary policy, with stocks falling from around September 2021, but we are yet to see the full effects on consumers and businesses.

Is a UK general election an additional risk factor?

KPMG further cautions that next year’s general election will compromise investment decisions in months ahead, although I tend to think political parties nowadays mostly follow “centrist” social democratic policies.

They will more likely compete on pledges to improve infrastructure such as school buildings, which bodes well for Kier Group (LSE:KIE), which I rated “buy” last July at 90p, given its key client is HM Government and it is the UK’s largest schools contractor. The stock has risen to 117p early this morning after a senior manager bought £20,000 of shares at 111p last Friday. It may be one example where yes, valuations got too low, yet business prospects are sound.

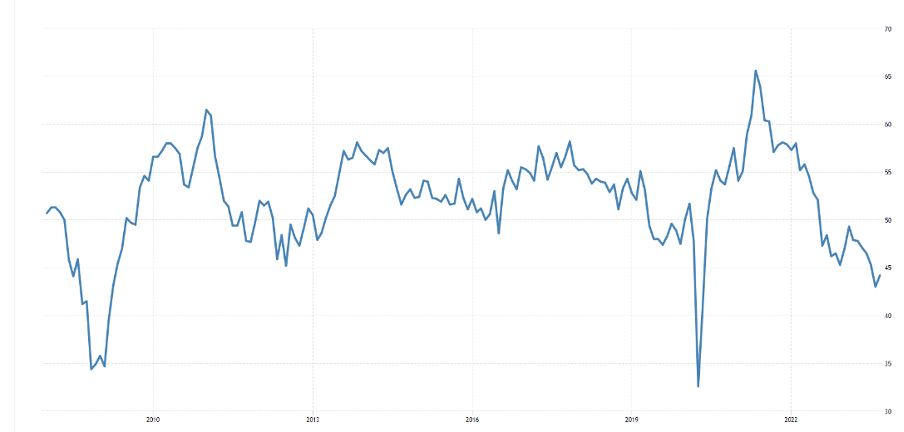

Falls in UK purchasing manager indices are more perturbing

PMI’s represent activity in supply chains: the extent of new orders, inventory levels, production, deliveries and employment. A headline number above 50 represents expansion over the previous month; below indicates contraction. While it’s not a flawless indicator, it can affect decision-making in firms.

Based on the S&P Global/CipsUK methodology, the overall UK PMI fell from 48.6 in August to 46.8 in September – the lowest in 32 months and where consensus had expected a marginal improvement to 48.7.

Besides a reminder of unreliability with near-term forecasts, it meant a negative surprise – also because the eurozone PMI had shown a rise from 46.7 to 47.1 in August.

It is the steepest decline since the wake of the global financial crisis in early 2009, barring Covid lockdowns. Services dropped from 49.5 to 47.2 while the manufacturing index edged up from 44.1 to 44.6, albeit in negative territory. Despite a sense that people in work are doing well as wages peg inflation, the services read implies enough are buckling down.

UK Services PMI 25-year chart

Source: Trading Economic.

UK Manufacturing PMI 25-year chart

Source: Trading Economic.

The UK economy is thus shrinking at a quarterly rate around 0.4%, hence a greater risk of at least one quarter of slowdown. I rather doubt KPMG’s assessment – that we avoid recession – includes these PMIs as its survey has followed swiftly after.

They certainly would have contributed to the Bank of England’s decision to keep interest rates level at 5.25% last week, in the hope of mitigating inflation towards its 2% target.

Equity bulls say household finances are now “strong” after lower expenditure conflated with furlough payments during the Covid lockdowns. In which case, what “cost-of-living crisis”?

Possibly a muddling through scenario will evolve. Retail sales edged up 0.4% in August and the respected GfK consumer confidence index of around 2,000 people has risen this month to the highest level since January 2022 – albeit low in historical context.

What are corporate ‘canaries in the coal mine’ saying?

Updates from H&T Group (LSE:HAT) pawnbrokers and insolvency services firm Begbies Traynor Group (LSE:BEG) show both doing brisk business as enough consumers and firms get squeezed. Yet these are smaller companies so need only a marginal rise in “stress” to prosper.

Yes, a portion of UK citizens has become financially challenged, hence resorting to pawn, yet most are coping. Similarly, steps towards normalising interest rates are killing off “zombie” firms – those that lost their marketing way years ago and carry too much debt – after being propped up by abnormally low rates since the 2008 crisis.

White-collar recruiters such as Robert Walters (LSE:RWA) and PageGroup (LSE:PAGE) have cited tough trading in the UK, albeit relatively better performance in other global regions.

A company that does alert me is S4 Capital (LSE:SFOR), a £400 million digital marketing group put together by Sir Martin Sorrell (founder of WPP). On 18 September it “shocked” the market with interim results that guided for like-for-like net revenue down on 2022 after the first half to 30 June achieved 5% growth.

S4 is relevant given advertising is a classic forward indicator and in classic Sorrell “world domination” style, informs us of the big picture. Recent consensus – for £53 million normalised net profit this year and £72 million in 2024 – sounds over-optimistic and debt will increase due to deferred considerations for acquisitions. At 65p I am not surprised its stock continues to fall as reality sets in.

S4 Capital – financial summary

Year-end 30 Dec

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| Turnover (£ million) | 54.8 | 215 | 343 | 687 | 1,069 |

| Operating margin (%) | -15.4 | -1.8 | 2.4 | -6.3 | -12.5 |

| Operating profit (£m) | -8.5 | -3.8 | 8.1 | -43.4 | -134 |

| Net profit (£m) | -8.1 | -10.0 | -3.9 | -56.7 | -160 |

| EPS – reported (p) | -3.3 | -2.7 | -0.8 | -10.3 | -27.0 |

| EPS – normalised (p) | -2.0 | -0.5 | 2.4 | 4.8 | 2.7 |

| Operating cashflow/share (p) | 1.3 | 6.7 | 12.5 | 9.9 | 13.2 |

| Capital expenditure/share (p) | 0.6 | 2.8 | 1.5 | 2.7 | 3.0 |

| Free cashflow/share (p) | 0.7 | 3.9 | 11.0 | 7.2 | 10.2 |

| Dividends per share (p) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Cash (£m) | 25.0 | 65.4 | 142 | 301 | 224 |

| Net debt (£m) | 20.6 | 3.7 | -22.6 | 52.0 | 162 |

| Net assets (£m) | 342 | 466 | 716 | 801 | 850 |

| Net assets per share (p) | 94.2 | 99.4 | 132 | 144 | 150 |

Source: company accounts.

Renewed concerns over financial contagion from China

KPMG notes China as an additional risk factor as global trade shrinks.

Yesterday, Chinese property stocks fell sharply, with China Evergrande Group (SEHK:3333) down 22% after a debt restructuring. There is renewed talk of financial contagion, hence iron ore prices are also down – over 4% yesterday.

Obviously, we have heard this story countless times before – and a lot shriller – about how China’s property expansion juiced its GDP numbers and was built on dubious “shadow banks”.

But mind a past assumption about how the Communist Party has a strong hand in all aspects of the economy and will resolve matters. This time around, Beijing says no direct bailout is coming.

Not to over-emphasise China, but such news at the start of this week hardly helps in context of what I see as more pertinent indicators – negative surprises by way of PMIs on the UK economy, coming after what S4 Capital said last week about global demand for advertising.

It looks touch-and-go as regards dodging a UK recession.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company’s or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.