(Bloomberg) — Saudi Aramco’s top executives are set to hold a series of events in London and the US to drum up demand for the oil giant’s $12 billion share sale, five years after it scrapped an international roadshow for its initial public offering.

Most Read from Bloomberg

Aramco Chief Executive Officer Amin Nasser will be among officials attending at least one of the events in London this week, according to people familiar with the matter. Chief Financial Officer Ziad Al Murshed is also slated to be at a roadshow in the city over the next few days, they said.

The firm is planning a separate event in the US, the people said, declining to be identified as the information is private. Institutional investors can submit orders until June 6 for the share sale that kicked off Sunday.

The $1.8 trillion oil giant’s offer was covered in just a few hours after the deal opened. It wasn’t immediately clear how much demand came from overseas, though the order book reflected a mix of local and foreign investors, Bloomberg News reported.

Read More: Saudi Aramco’s $12 Billion Stock Offer Sells Out in Hours

The extent of foreign participation will be closely watched. During Aramco’s 2019 initial public offering, overseas investors had largely balked at valuation expectations and left the government reliant on local buyers.

The kingdom had planned a series of international events for that $29.4 billion deal, including one in London, which it later scrapped. The company also decided not to market the sale in the US, Canada or Japan, and instead held a roadshow in front of a home audience that had already made their minds up about investing.

The IPO eventually drew orders worth $106 billion, and about 23% of shares were allocated to foreign buyers.

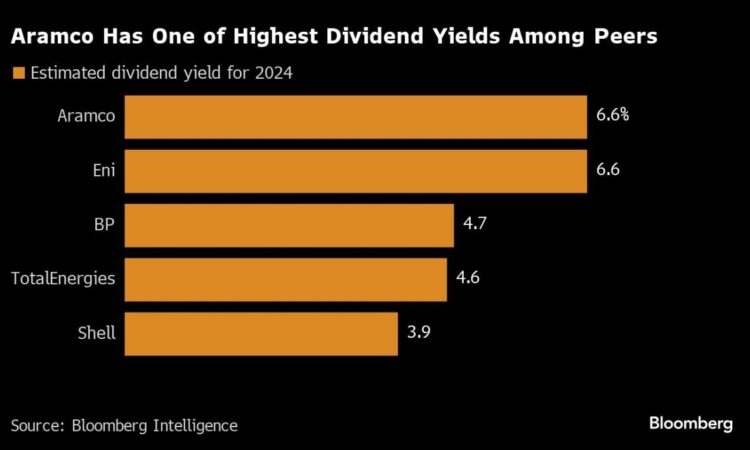

A top selling point this time around is the chance to reap one of the world’s biggest dividends. Investors willing to look past a steep valuation and the lack of buybacks would cash in on a $124 billion annual payout that Bloomberg Intelligence estimates will give the company a dividend yield of 6.6%.

Read More: Investors Pile Into Saudi IPOs With $176 Billion in Orders

The Saudi government owns about 82% of Aramco, while the Public Investment Fund holds a further 16% stake. The kingdom will continue to be the main shareholder after the offering, which adds to Riyadh’s efforts to raise cash and fill a budget deficit.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.