Record Heat, U.S.-China Meetings Highlight Growth, Investment Case For Renewable Energy: Impax CIO

Associated Press

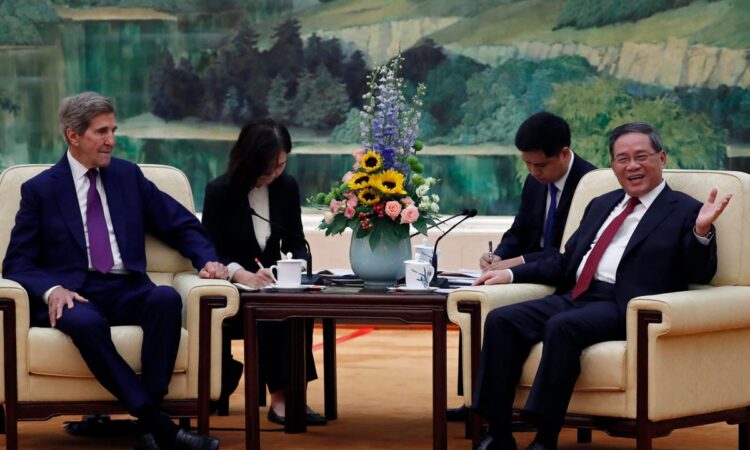

Oppressive heat from Beijing to Phoenix this month is putting a focus on climate change worldwide. High-profile meetings between U.S. Special Presidential Envoy for Climate John Kerry and political leaders in Beijing this week are further spotlighting growth and investment potential in renewable energy and sustainability, the chief investment officer of one of the world’s largest fund management companies focused on renewable energy told Forbes in an interview.

“Overall, the economies of scale will continue to drive down costs and improve the economics of renewables,” Bruce Jenkyn-Jones, CIO for listed investments at London-headquartered Impax Asset Management told Forbes in an interview. Founded in 1998, London-traded Impax opened a New York office in 2022 and has currently more than $50 billion of assets under management.

Sustainability-related areas such as water are worth attention because they generate business for makers of efficient pumps, stormwater management, water treatment systems, he said. “Water has been and, we expect, will continue to be a very compelling investment area,” Jenkyn-Jones said by Zoom from London on Friday.

Before joining Impax in 1999, Jenkyn-Jones worked as analyst following utilities at Bankers Trust and as an environmental consultant for Environmental Resources Management. The Oxford graduate holds a bachelor’s degree in chemistry, a master’s in environmental engineering technology, and an MBA from IESE Business School in Barcelona. Edited excerpts follow.

Flannery: Broadly speaking, what are some of the big trends we’re seeing in renewable energy?

Jenkyn-Jones: It’s a huge range of trends that will be affecting the prospects for renewable energy in the next three to five years. One that is arguably at the top of the list with John Kerry’s visit to China is decarbonization of the electricity network. And with the global focus historically on fossil fuels, the real route to decarbonization is through solar and wind, which can have a zero-emission profile. This continues to be a priority for governments. They recognize the global challenges around decarbonization. That will continue to be one of the driving forces.

The second one is the economics of these technologies. Since I’ve been working in this sector, the cost of wind and solar have come down by extraordinary levels: solar — something like 95% in the last 20 years or so, and wind — by not quite that level but certainly dramatic falls.

Looking forward, we can expect to see more of that. Certainly, there will be commodity price volatility that will have some impact, but overall the economies of scale will continue to drive down costs and improve the economics of renewables.

Alongside that, government support is another component. You’re seeing more and more policies coming out. They are less subsidy-related, but create a clear framework for encouraging further investment in renewables. You’ve seen the Inflation Reduction Act in the U.S. — the IRA; the 45-year plan in China is also interested in that. It’s tending to devolve the responsibility for renewables investments to the regions and the provinces, but it’s still absolutely supportive.

Copyright 2021 The Associated Press. All rights reserved

Linked to that is a bit of emergence of tariffs, protection and reshoring. The IRA has a component of that in tariffs — encouraging investment in production within the U.S., and that’s really quite changed the dynamic and had implications for Europe as well.

And then, if you’re going to invest in new capacity in wind and solar, there are great challenges and significant implications for grids. China had that issue few years ago. Curtailment was a major challenge where electricity was being generated, but the grid couldn’t cope.

That has gotten much better — China’s really got on top of that. You’re starting to see some of these issues now emerging in the U.S, so getting your grid fit for purpose in a renewable energy world is another key challenge. That’s linked to investment in storage, making renewable energy more of a baseload capacity rather than just when the wind blows and the sunshine.

And then the final point around wind in particular is offshore capacity, as the economics there become more compelling. You’ve asked for a list of important trends, and there’s really a huge amount going on in this space, but generally all positive and signaling further investment in renewables over the next three to five years globally.

Flannery: Thinking about particular companies that investors might want pay attention to, what comes to mind?

Jenkyn-Jones: There is energy-related, there’s a utility component, and there are also a lot of industrial companies providing the equipment. There are growth stocks, and there are infrastructure stocks. Also, a lot of investors need to manage climate risk within their portfolio. So you really do need to be aware of the opportunities here.

Just thinking about the biggest companies globally in this area, certainly in Europe Vestas is the biggest listed company and makes wind turbines. Then you’ve got another Danish company Orsted, which focuses on the wind farms themselves. It’s a different business model. In the U.S, you’ve got big players like Enphase that make inverters for solar.

And then in China, you’ve got companies like Goldwind and China Longyuan and then a huge number — probably over 250 listed companies of solar companies through the value chain — that are all exposed to these parts of the market. There is a pretty rich universe of renewables companies for investment there.

Impax Asset Management CIO Bruce Jenkyn-Jones

Impax

It’s probably worth saying that not all their business models are that compelling. For a lot of them, the products are quite commoditized. The margins are very volatile, so investors really need to tread quite carefully when investing in the renewable energy sector, even though the growth of the underlying markets is very strong.

Flannery: The investment space becomes even broader when we come to sustainability-related areas such as water and food. How can investors think about those?

Jenkyn-Jones: What unites all of these things is that the world is facing a series of environmental sustainability challenges. We talked about climate change. Equally, you have biodiversity and water shortages, but those align as well with things like healthy living and better nutrition. If you can find companies that can provide solutions to a lot of these global challenges, then often, they’re facing very compelling growth markets.

To dwell on a couple of those examples you gave, in the water side there’s clearly ever-growing demand for water, but there’s a finite supply and things like climate change are creating a finite or even more challenging backdrop for finding reliable supplies of water. And at the same time, pollution challenges of water mean greater investment in water treatment technologies, et cetera.

There really is an interesting dynamic in water. From an investor perspective, the barriers to entry tend to be a lot higher because it’s such a critical commodity. People aren’t typically prepared to take big risks on the technology they use. Companies that are providing more efficient pumps, better infrastructure, stormwater management, water treatment systems are steadily growing and very compelling areas of the market. You can find opportunities right through those value chains. Water has been and, we expect, will continue to be a very compelling investment area.

Flannery: What are some of the interesting investment opportunities in that water area?

Jenkyn-Jones: Again, the water investment area is pretty compelling right through the value chain. Probably one of the largest companies that really covers the bases would be a U.S. company like Xylem, which has pumps, treatment systems and a lot of innovative technology. In Europe, an interesting company that has a pretty broad franchise across the water area is Veolia Environment. In China, and emerging markets, it’s more difficult to find significant big companies that actually have specialized water exposure, but the water investment universe is pretty rich globally.

Flannery: How about sustainable food?

Jenkyn-Jones: Sustainable food is a really interesting area. Probably up until about 15 years ago, there was a focus on looking to produce as much food as possible, as cheaply as possible. The dynamic has really shifted now with growing priorities around healthy nutrition. Animal welfare is becoming more important. Climate change, biodiversity and resilience have also become priorities in that industry, which has really led to a greater focus on sustainability around food supplies. Right through the value chain now you’re seeing more healthy ingredients, and precision agriculture for producing food more sustainably with much lower impact on animal welfare. It’s really become a growth opportunity.

Flannery: What are some of the more interesting companies in that space?

Jenkyn-Jones: Certainly in precision agriculture, one of the leading players is Trimble, a software company that’s involved in a number of other markets in the world of healthy nutrition and natural ingredients. You’ve got companies like Givaudan in Europe, also companies like Kerry in Ireland.

You can also look maybe more in the packaging space and find companies like Westrock, which have some interesting, more sustainable packaging around the sustainable food sector as well.

Qilai Shen

Flannery: If we think about environmental markets more broadly, is there an approach that you have to balancing off renewables and sustainability?

Jenkyn-Jones: That’s a really interesting question. If your central thesis is that companies that are providing solutions to environmental problems are interesting growth markets, then, if you bring together water, sustainable food, renewable energy, you could also include things like transport, the circular economy and the waste recycling sector. And what you actually end up with is an incredibly diverse set of investment opportunities that allows you to put together global equity portfolios that look and feel a little bit like broader global equity portfolios. Maybe they don’t have so much energy, so many financials and probably underweight healthcare, but the performance and risk characteristics are pretty aligned.

Where you tend to find your investments are in industrials, technology and some utilities, but I think the key feature is growth. And the way we really look at this is to find the really high-quality business models with high returns on invested capital in these interesting markets and obviously focus considerably on the valuations of these businesses.

See related posts:

BYD’s Wang Chuanfu Repeats Atop Forbes China’s Best CEOs List

China’s Days As A Sole Overseas Source For U.S. Companies “Are Over” — Stephen Roach

Arab-China Investment, Manufacturing Poised To Grow After High-Profile Event In Riyadh

China’s “Fits And Starts” Economy Needs Private Sector Boost — Matthews Asia’s Andy Rothman

@rflannerychina

Send me a secure tip.