Prime Capital Investment Advisors Reduces Holdings in United States Steel Co.: Stock Analysis, Dividend Announcement, and Implications

Prime Capital Investment Advisors Reduces Holdings in United States Steel Co.: Stock Analysis and Dividend Announcement

Date: August 4, 2023

In a recent disclosure filed with the Securities and Exchange Commission (SEC), Prime Capital Investment Advisors LLC revealed a reduction of its holdings in United States Steel Co. The investment firm sold approximately 16.6% of its shares during the first quarter of this year, leading to a decrease in their stock ownership by around 34,147 shares. This move has generated significant interest among investors and analysts alike.

Stock Ownership Details and Implications:

As of the most recent quarter, Prime Capital Investment Advisors LLC held 171,844 shares in United States Steel Co., which represents around 0.08% of the company’s total outstanding shares. Based on the closing price as of that period, this position was estimated to be worth $4,485,000.

The announcement made by Prime Capital regarding the sale of these shares has created uncertainty among shareholders and stakeholders within the industry. It remains vital for investors to assess what impact this reduction in stake might have on United States Steel’s future prospects and market value.

Dividend Announcement:

Apart from the reduction in shareholdings, United States Steel also declared a quarterly dividend on its common stock. Shareholders registered as of Monday, August 7th, will receive a dividend payment of $0.05 per share on Thursday, September 7th.

Considering that Friday, August 4th is marked as the ex-dividend date for this particular dividend payout cycle, potential investors planning to enter or exit positions should be cautious not to miss this crucial deadline.

Dividend Yield and Payout Ratio:

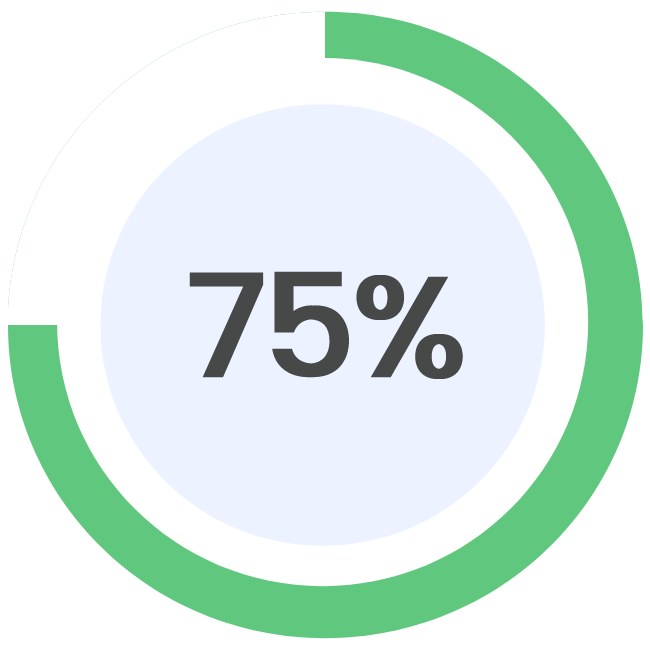

The annualized dividend offered by United States Steel currently stands at $0.20 per share. This figure equates to an enticing yield of approximately 0.82%, attracting dividend-focused investors who seek regular income from their investment portfolios.

Additionally, the company’s dividend payout ratio is at an appealing 3.85%. This signifies that United States Steel allocates a modest percentage of its earnings toward dividends, indicating room for potential growth or reinvestment in future projects.

Conclusion:

Prime Capital Investment Advisors LLC’s recent reduction in holdings of United States Steel Co. has raised intrigue among investors who closely track market movements. As the company prepares for an upcoming dividend payout to its shareholders, it becomes crucial for market participants to analyze their positions and consider the implications of these developments on their investment strategies.

In conclusion, while Prime Capital’s decision to diminish its position may raise questions about United States Steel’s growth potential, the company’s dividend announcement presents a lucrative opportunity for income-oriented investors. Diligent evaluation and careful consideration of these factors will allow investors to make informed decisions aligned with their financial objectives and risk tolerance levels.

United States Steel: Institutional Investor Activity and Mixed Performance Outlook

August 4, 2023 – United States Steel (NYSE:X) has been subject to significant movement in institutional investor activity. Norges Bank is one of several hedge funds and institutional investors that have recently bought and sold shares of the company, acquiring a new position valued at $61,925,000 during the fourth quarter. First Trust Advisors LP also increased its stake by 155.8% in the first quarter, resulting in a value of $124,913,000. Donald Smith & CO. Inc. and Deutsche Bank AG joined the trend by increasing their stakes by 34.8% and 169.3% respectively.

This influx of institutional investment indicates growing confidence in United States Steel’s stock and potential for growth. Furthermore, it suggests that these investors see value and profitability in the basic materials sector despite recent challenges faced by the industry.

Several research firms have provided insight into United States Steel’s performance and prospects as well. Morgan Stanley restated an “equal weight” rating on Tuesday with a target price of $25.00 per share. BNP Paribas adjusted their rating from “outperform” to “neutral” while setting a price objective of $26.00 for the stock.

Despite these mixed reviews from research firms, there seems to be consensus on Wall Street regarding United States Steel’s outlook as an investment opportunity; data from Bloomberg.com reveals that analysts’ consensus rating currently stands at “Hold” with a price target averaging at $26.00.

On Friday, August 4th, United States Steel opened trading at $24.26 per share on NYSE:X, which indicates a relatively stable position for the company given recent market volatility.

Analyzing further details surrounding United States Steel’s financial health offers additional insights into its ongoing appeal to investors: the stock has a fifty-day moving average price of $23.84 and a two-hundred-day moving average price of $25.31.

From a macro perspective, United States Steel possesses a market capitalization of $5.41 billion, and its price-to-earnings ratio currently stands at 4.67 with a beta of 2.15. These figures suggest that the company’s stock may be undervalued in relation to its earnings potential.

United States Steel exhibited strong financial results during its most recent quarterly earnings report on July 28th. The company reported an earnings per share of $1.92 for the quarter, surpassing the consensus estimate by $0.06. Notably, this represents a return on equity of 13.51% and a net margin of 7.05%.

However, it is important to note that United States Steel also experienced a decline in revenue during this period, reaching $5.01 billion compared to the consensus estimate of $5.11 billion—a decrease of 20.4% year-over-year.

Despite these challenges, equities analysts believe United States Steel will post EPS of $4.12 for the current fiscal year.

In conclusion, United States Steel has witnessed considerable institutional investor activity in recent months and received mixed reviews from research firms regarding its investment potential and performance outlook. However, financial indicators such as stable stock prices and strong earnings demonstrate ongoing appeal for investors looking to capitalize on opportunities in basic materials industries.

As the global economy evolves, it will undoubtedly shape future prospects for companies like United States Steel. Savvy investors will continue to monitor market trends and leverage key insights provided by research firms to inform their investment decisions within this ever-changing landscape.