National Grid, the British multinational electricity and gas utility company, announced on Monday its strategy to bolster its operational and financial performance through significant investments. The company is set to pour approximately £3.6bn to £3.9bn into its businesses during the 2013/14 period, aiming to expand its regulated assets by around 6.0% annually over the coming years. This move is designed to ensure a secure and well-financed balance sheet, critical for the long-term funding of its UK and US operations.

Strategic Investments for Future Growth

At the heart of National Grid’s investment strategy is the commitment to maintain and improve infrastructure in both the UK and the US. In the UK, the focus will be on the London Power Tunnels project and the advancement of the western high voltage direct current (HVDC) link with Scotland. These efforts are expected to align with the capital investment levels of the 2012/13 period. Across the pond, the US investments will continue at a steady pace, with an anticipated annual spend of £1.3bn to £1.4bn. This funding will concentrate on enhancing existing infrastructure, delivering better service, making selective transmission investments, and connecting new customers. A highlight of the US investment plan is the $800m New England East West System transmission project, which is currently about 65% complete.

Strong Start to the Year

“Our businesses have started the year well,” remarked Steve Holliday, Chief Executive of National Grid. He emphasized the company’s robust balance sheet, which is fundamental for securing the necessary long-term funding for its operations on both sides of the Atlantic. Holliday’s confidence in National Grid’s strategy is evident as he maintains the group’s outlook for the 2013/14 period, expecting “another year of solid operating and financial performance.” This optimistic projection is underpinned by the company’s strategic investments and its focus on expanding its regulated assets.

Implications for the Energy Sector

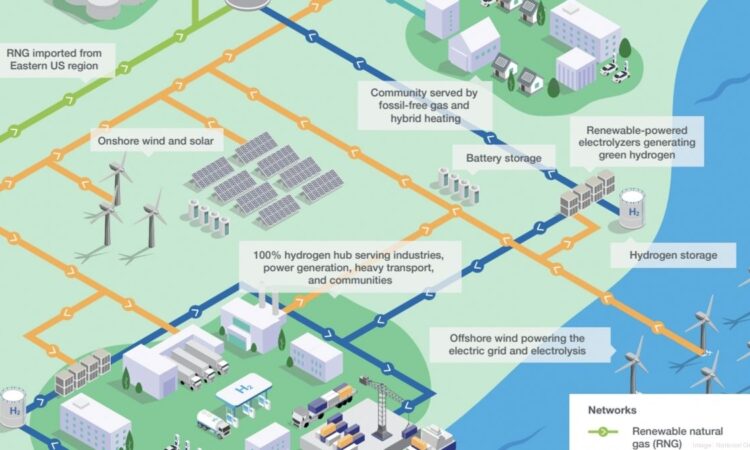

National Grid’s ambitious investment plan is not only crucial for the company’s growth but also signifies a significant development in the energy sector’s transition towards more sustainable and reliable energy systems. This initiative comes at a time when the energy sector is undergoing transformative changes, as highlighted by recent developments like the provisional results of the T-4 Capacity Market auction for the 2027/28 delivery year and the UK government’s commitment to increasing the supply of clean hydrogen fuel. National Grid’s efforts to strengthen infrastructure and expand its regulated assets are in line with global moves towards securing a net-zero electricity system by 2035, a goal further supported by the National Infrastructure Commission’s (NIC) full review of the electricity distribution network.

As National Grid embarks on this substantial investment journey, its actions resonate beyond immediate financial and operational enhancements. The company’s commitment to reinforcing and expanding its infrastructure underscores the broader industry’s shift towards sustainability and reliability. With these strategic investments, National Grid not only positions itself for future growth but also contributes significantly to the global energy transition, setting a precedent for others in the sector to follow.