By Jeff Prestridge, Financial Mail on Sunday

21:50 20 May 2023, updated 21:50 20 May 2023

Fund management group Pictet is one of the world’s leading thematic investors. Over the past 28 years, the Swiss-based group has built a range of funds around themes that it believes will drive forward world economic growth – everything from biotech, clean energy, health through to robotics.

One of the first themes that Pictet latched on to was premium brands – investing in companies that own best-in-class brands which consumers like, are loyal to, and are prepared to pay a premium price for. It says 120 companies worldwide currently qualify for premium brands status, although it doesn’t invest in all of them.

Its identification of this investible theme has proved a shrewd move. The asset manager now runs £3.5 billion of portfolios around it, £2 billion of which is invested in Pictet Premium Brands, a fund available to UK investors.

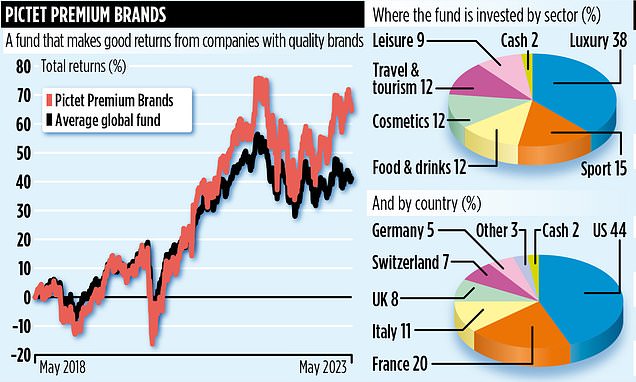

Managed by long-standing investment managers Caroline Reyl and Laurent Belloni, the fund has a strong performance record. Over the past one, three and five years, it has generated respective returns of 16, 71 and 70 per cent – superior to its global growth peer group.

The fund comprises 39 stocks, most of which are listed in the United States and Europe. Many of the names of the companies in its portfolio are associated with luxury goods: the likes of Italian car manufacturer Ferrari and LVMH which owns a portfolio of die-for consumer brands such as Dior, Hennessy, Louis Vuitton and Moet.

‘Luxury is the DNA of the fund,’ says Belloni, ‘but premium brands can be found in many areas. What we are looking for are companies that have pricing power, benefit from consumer loyalty, are enjoying sustainable business growth and operate in markets where high barriers to entry exist.’

He adds: ‘It’s why we hold the likes of cosmetics giant L’Oreal, have stakes in key financial brands such as Visa and American Express, as well as hotel groups such as Marriott International and Hilton Worldwide.’

Related Articles

HOW THIS IS MONEY CAN HELP

Although the portfolio, in terms of holdings, is skewed towards the West, it is very much a play on economic growth across Asia, especially China. Many of the companies are selling their goods to the growing middle classes in Asia who have money to spend and an eye for premium western goods. Indeed, with the reopening of the Chinese economy, the fund has also bought stakes in US luggage specialist Samsonite and Chinese company Anta Sports, owner of sportswear brand Fila. ‘Both companies should benefit from China opening its economy and borders,’ adds Belloni.

By their very nature, premium brands tend to have long lives. As a result, the fund’s portfolio remains relatively stable. But when the shares of specific holdings surge in price, the managers often take the opportunity to take some profits by trimming the stakes. In recent months, positions in electric car manufacturer Tesla and French luxury brands company Hermes have been among those to take a haircut.

Although Reyl and Belloni pick the fund’s stocks, they draw upon the expertise of an advisory board for themes within the premium brands space that could play out in the future and prove profitable. ‘Members have specific knowledge in areas such as fashion, sports goods, leisure and the Chinese economy,’ says Belloni. ‘We meet them twice a year and it’s extremely useful for us as fund managers. It gives us a window into the future and some of the sub-themes we should be exploring.’

The fund has ongoing annual charges of just over one per cent and is available via major platforms such as AJ Bell, Hargreaves Lansdown and Interactive Investor.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.