Aamulya/iStock via Getty Images

Although Japan boasts the third largest economy in the world and the 11th largest population globally, its culinary arts are not all that widespread outside of the homeland. One company trying to change that is Kura Sushi USA (NASDAQ:KRUS). With an emphasis on providing customers with Japanese cuisine in restaurants that utilize a revolving sushi concept where the food is placed on a conveyor belt in order to get to customers’ tables, the business is certainly carving out for itself a rather nice niche in the restaurant space. But just because the company is doing well and growing nicely does not mean that it makes for a compelling investment opportunity at this time. Based on all the data available, shares look drastically overpriced. So because of that, I’ve decided to keep the ‘sell’ rating I had on the company previously.

Distasteful returns

Back in September of this year, I wrote an article that took a rather bearish stance on Kura Sushi USA. In that article, I talked about how impressed I was regarding the company’s strong sales growth. Bottom line results provided by management were also showing impressive performance over time. My ultimate conclusion was that growth would probably continue for the foreseeable future. But as impressed as I was by the company, I was also significantly turned off by how expensive shares were. This led me to rate the company a ‘sell’ to reflect my view that shares should meaningfully underperform the market for the foreseeable future. So far, that has played out nicely. Since my September article, shares are down 13.4% compared to the 9% increase experienced by the S&P 500.

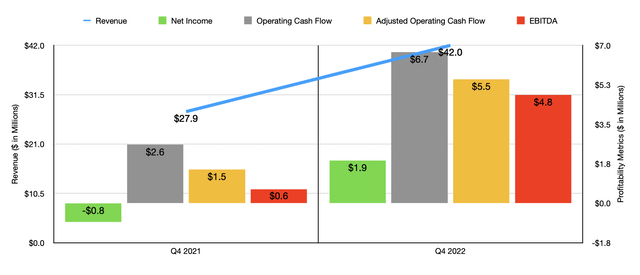

Author – SEC EDGAR Data

If you were to judge the company based solely on its revenue trajectory, you would be perplexed at how shares have performed. When I last wrote about the company, we only had data covering through the third quarter of 2022. Fast forward to today, and we now have data covering through the final quarter of that year. According to management, revenue in that quarter came in at $42 million. That’s 50.5% higher than the $27.9 million the business reported in the fourth quarter of 2021. This sales increase was really driven by two key factors. First and foremost, the company saw the number of restaurants it had in operation climb from 32 to 40. And second, comparable restaurant sales for the company jumped by 27.6%.

Likewise, profitability for the company has also improved. Net income in the final quarter last year came in at $1.9 million. That compares to the $0.8 million loss experienced the same time a year earlier. Of course, we should pay attention to other profitability metrics. Operating cash flow, for instance, jumped from $2.6 million to $6.7 million. If we adjust for changes in working capital, the increase was even larger, with the metric climbing from $1.5 million to $5.5 million. And over that same window of time, EBITDA shot up from $0.6 million to $4.8 million.

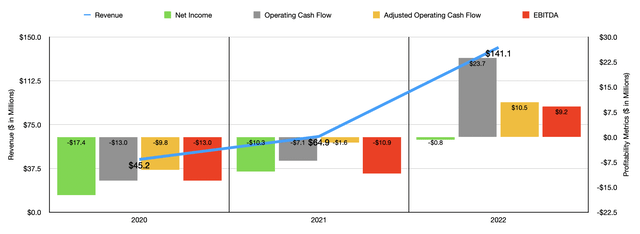

Author – SEC EDGAR Data

The results the company experienced in the final quarter of last year were not a blip on the radar. Instead, they were a continuation of robust year-over-year improvements compared to what the company experienced during its 2021 fiscal year. In 2022, for instance, sales of $141.1 million dwarfed the $64.9 million reported the same time one year earlier. An increase in restaurant count helped, as did an 81.9% jump in comparable restaurant sales which was driven in large part by traffic growth. The company went from a $10.3 million loss in 2021 to a loss of only $0.8 million in 2022. Operating cash flow went from negative $7.1 million to $23.7 million, while the adjusted figure went from negative $1.6 million to $10.5 million. Similarly, EBITDA for the company improved nicely, turning from a negative $10.9 million to a positive $9.2 million.

It should come as no surprise to investors that some in the market might be enthusiastic about the company and its prospects. What’s more is the fact that management is forecasting further growth for the current fiscal year. Aided in part by between nine and 11 additional location openings, the company should see revenue for 2023 coming in between $183 million and $188 million. Unfortunately, management has not really provided much guidance when it came to profits. What they did say is that general and administrative costs will be roughly 16% of sales compared to the 16.5% experienced in 2022. If we take this to mean that margins should be roughly flat across the board, then the company would generate adjusted operating cash flow of $13.8 million and EBITDA of $12 million during 2023.

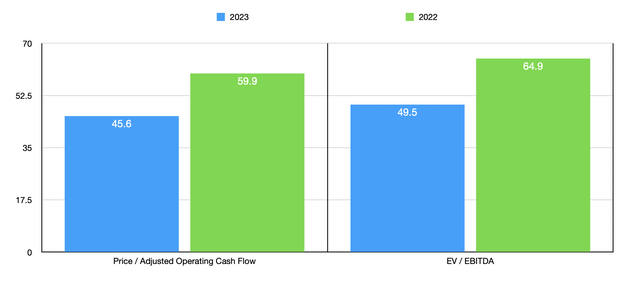

Author – SEC EDGAR Data

If we use these assumptions, we can find that the company is trading at a forward price to adjusted operating cash flow multiple of 45.6. The forward EV to EBITDA multiple would be slightly higher at 49.5. By comparison, if we were to rely on the data from 2022, these multiples would be 59.9 and 64.9, respectively. To put this in perspective, I decided to compare the company to five similar businesses. Or at least businesses that are as close to similar as you could expect. On a price to operating cash flow basis, these companies ranged from a low of 4.4 to a high of 49. And when it comes to the EV to EBITDA approach, the range was from 5.2 to 14.5. In both scenarios, Kura Sushi USA was easily the most expensive of the group.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Kura Sushi USA | 59.9 | 64.9 |

| Denny’s (DENN) | 16.3 | 14.3 |

| Arcos Dorados Holdings (ARCO) | 4.4 | 5.2 |

| Texas Roadhouse (TXRH) | 13.1 | 14.5 |

| Darden Restaurants (DRI) | 12.1 | 12.1 |

| Potbelly Corp (PBPB) | 49.0 | 11.7 |

Takeaway

Although I consider myself a huge fan of all things Japanese, I, unfortunately, cannot be a fan of this investment prospect. Yes, the company is growing nicely. Long term, I suspect that growth will continue. And at some point, that could allow shares to appreciate nicely. But given where shares are priced today, even this rapid growth is not enough to justify an investment in the company in my opinion. Because of this, I feel comfortable keeping my ‘sell’ rating for now, but I do think that downside from here is less significant than when I wrote about the company previously and it wouldn’t take too much for a slight upgrade to a ‘hold’ rating to be warranted.