Riding the AI wave

AI is the most powerful trend to emerge from the tech sector in recent years, and Japan has a lot of companies exposed to the AI value chain. These are predominately semiconductor equipment providers, and the initial Generative AI investment wave has made these companies – which provide the building blocks of AI – early beneficiaries, including Advantest (GPU testing), Disco (dicer & grinder) and Tokyo Electron (etching equipment).

As the initial investment phase begins to subside, we predict that we will see companies across the rest of the technology stack reap rewards. Two areas that we think worth keeping an eye on are robotics and video gaming.

AI will power the next generation of robots

AI has the potential to expand the range of problems robots are able to solve – especially if they are able to better understand and adapt to their surroundings. Nvidia calls this ‘physical AI’ and, as AI better understands physics, they predict a significant impact on the industrial sector. Nvidia has a robotics platform and I expect a growing number of collaboration partnerships to be announced with robotics companies as the platform develops.

We robotics this as one of the most exciting areas of the Japanese tech market, driven by structural changes in the labour market.

- Labour shortages and the rising cost of labour are long-term structural drivers for increased automation – labour shortages will be a significant challenge for businesses, especially in the manufacturing and warehouse industries.

- Fewer workers, particularly younger from demographics, are willing to undertake a career in these sectors due to low pay and the nature of the roles.

Technology is part of the solution, and we see the payback period from introducing automation becoming shorter as labour costs rise. As a result more and more areas are being considered for automation.

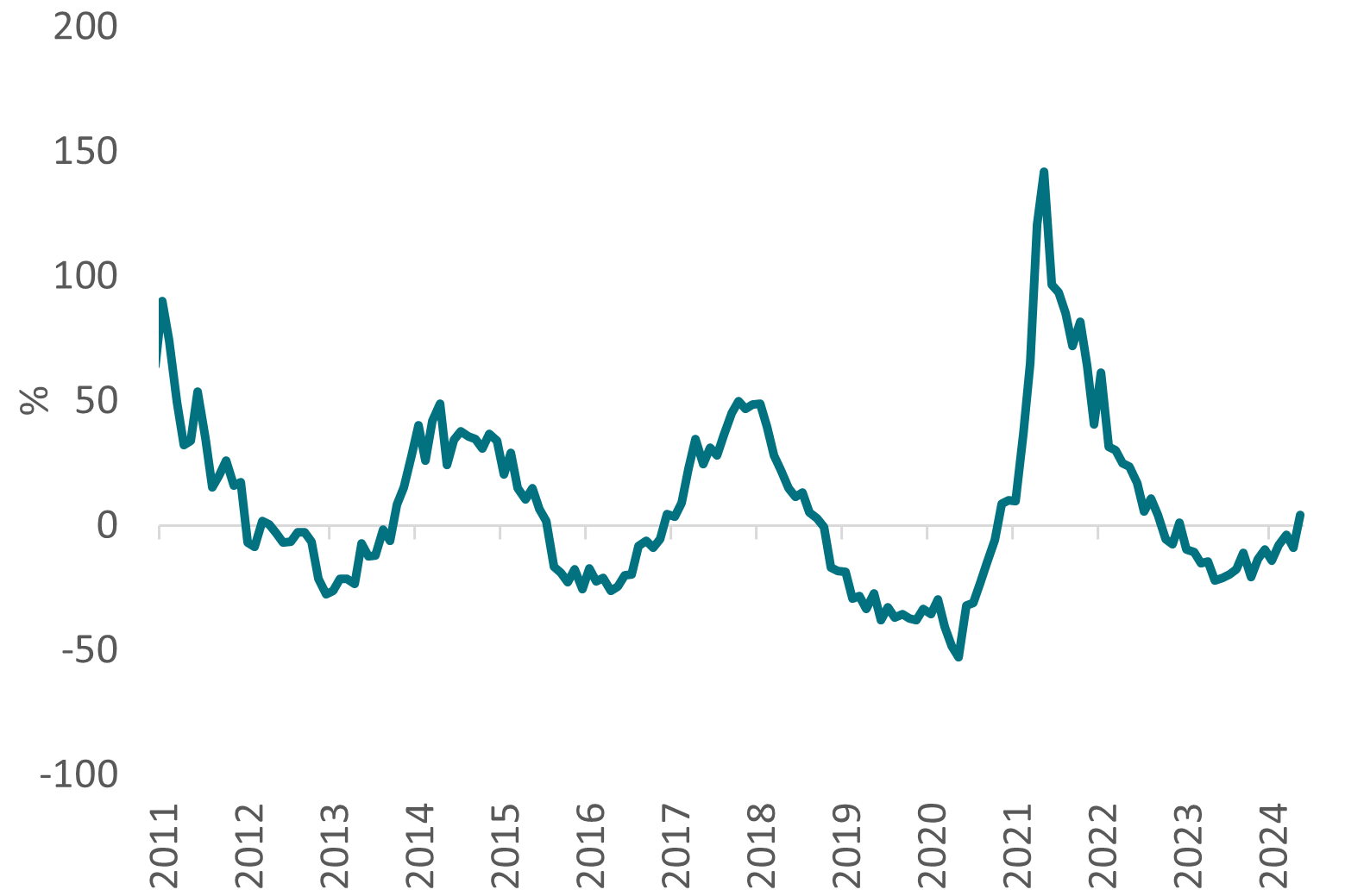

Additionally, we see signs of the start of a new manufacturing cycle on the horizon. The Japan Machine Tool Orders Index, a key leading indicator, troughed in Q4 2023, when orders were close to -20%, year-on-year, but is now improving, with momentum in positive territory. Manufacturing PMIs, new orders, and the US Federal Reserve’s business outlook and forecasts for capital expenditures also indicate that manufacturing activities should improve in the second half of this year.

Japan Machine Tool Orders Index is improving following a 2023 trough

Japan Machine Tool Orders Index, year on year, %

Image

Source: Bloomberg/AXA IM, June 2024.

In this scenario, factory automation and warehouse automation related companies should benefit, such as Keyence, Mitsubishi Electric, Fanuc and Yaskawa Electric.