Mild winter weather in the first quarter adds another obstacle to the challenging macro environment facing US utilities from coast to coast, analysts tracking the sector said as earnings season began.

“Weather is going to be a big issue for all utilities this quarter,” Morningstar analyst Travis Miller told S&P Global Commodity Insights. “It was a relatively warm winter. That means utilities are going to have … a little more pressure to work to minimize costs over the rest of the year to make up for some of those lost earnings on weather during the first quarter.”

Nationwide heating degree days in the first quarter decreased 5% from normal and fell 8% from the same period in 2022.

Guggenheim Securities analyst Shahriar Pourreza said the year “continues to be a litmus test for our coverage as higher interest costs, labor and materials inflation, and now weather push [management] teams to flex their cost savings muscles.”

Pourreza, however, noted in an April 20 report that many companies have already embedded higher rates into their earnings guidance.

“So, despite investor concerns around the effects of interest rates on the sector and the concurrent underperformance of the group, we note that guidance for most if not all utilities appears to us to already embed this exposure, while the reality [year to date] has actually been an improvement in rates in utilities’ favor,” Pourreza wrote.

Scotia Capital analyst Andrew Weisel said it should be “widely understood” by now that first-quarter results will be challenged.

“While many utilities under our coverage guide to 6% [to] 8% [year-over-year] growth in 2023, achieving that may be harder than management teams expected just two to three months ago,” Weisel wrote in an April 21 earnings preview.

The analyst also pointed out that weather will add to “expected earnings pressures from higher interest expenses and general inflationary trends.”

“Cold-weather utilities in particular will feel the pain of the mild winter, plus, in several cases, elevated storm activity,” Weisel wrote. “Still, unlike for most of the broader economy, we have confidence in companies’ abilities to deliver this year thanks to [operations and maintenance] expense cuts … and financing and tax strategies — at least for most utilities — though it won’t be easy.”

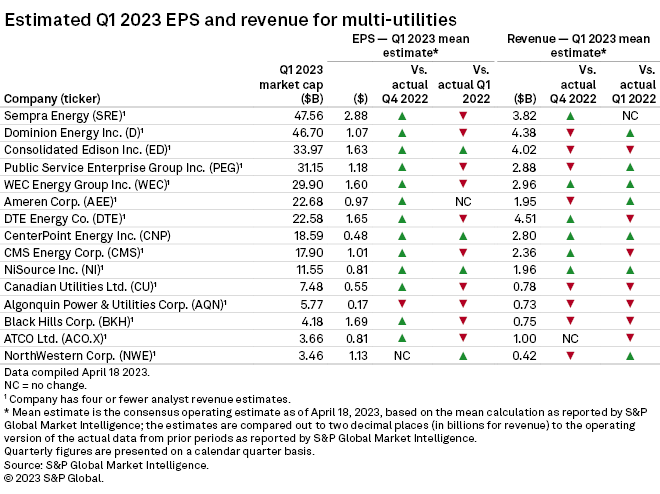

CMS Energy Corp., DTE Energy Co. and WEC Energy Group Inc. are the multi-utilities expected to experience the most pressure from mild weather.

Guggenheim also believes Alliant Energy Corp., Duke Energy Corp., American Electric Power Co. Inc., Southern Co., Dominion Energy Inc. and Entergy Corp. will experience big impacts from weather.

Earnings beats, misses

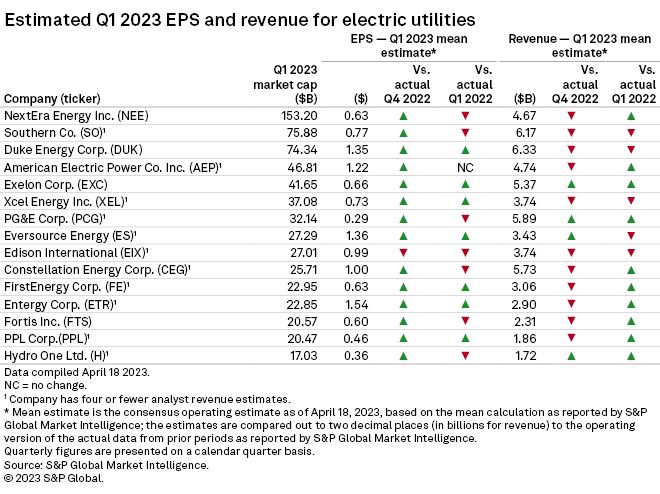

Of the top 15 North American electric companies, Southern, PG&E Corp., Edison International, Constellation Energy Corp. and Canada-based utilities Fortis Inc. and Hydro One Ltd. are all expected to post year-over-year earnings declines, according to an S&P Global Market Intelligence analysis of S&P Capital IQ consensus estimates.

Duke, Exelon Corp., Xcel Energy Inc., Eversource Energy, FirstEnergy Corp., Entergy and PPL Corp. are all expected to beat first-quarter 2022 earnings results, while American Electric Power is expected to have no change in its year-over-year mean estimate, the analysis shows.

On April 25, NextEra Energy Inc. reported first-quarter adjusted earnings of about $1.68 billion, or 84 cents per share, compared to adjusted earnings of $1.46 billion, or 74 cents per share, in the first quarter of 2022. The S&P Capital IQ normalized consensus EPS estimate for the quarter was 76 cents.

NextEra reiterated its 2023 adjusted earnings guidance of $2.98 to $3.13 per share. The company also backed its prior projection of adjusted earnings between $3.23 and $3.43 per share for 2024. For 2025 and 2026, NextEra said it expects to grow earnings 6% to 8% off the 2024 adjusted EPS range, which translates to $3.45 to $3.70 for 2025 and $3.63 to $4.00 for 2026.

Falling gas prices

While earnings could be pressured, CreditSights analysts believe that a drop in natural gas prices will support balance sheets.

Benchmark Henry Hub gas futures prices have languished below $3/MMBtu since January, a sharp decline from a price of more than $9/MMBtu in August 2022, according to Market Intelligence data.

“We expect an improvement in deferred fuel balances when utilities report first-quarter earnings, and this should lead to an improvement in cash flows,” CreditSights analyst Andrew DeVries wrote in an April 21 report. “We already had a strong view these costs would be fully recovered by ratepayers, but we now expect the timelines for these recoveries to be accelerated owing to the sharp pullback in natural gas prices.”

The analyst added that the drop in natural gas prices “should lead to significantly less pressure on customers’ bills.”

In addition, CreditSights believes that utilities will be able to make the “strong argument to regulators” that the billions of dollars they plan to spend on clean energy investments and decarbonization efforts also will reduce customer bill exposure to gas prices.

Morningstar’s Miller, however, said capital growth plans will add pressure to customer bills.

“With rising interest rates and inflation, it will be important to see which utilities can maintain their growth program and maintain support from regulators for the investments that they’re making,” Miller said.

Of the North American multi-utilities, Sempra Energy, Dominion, Public Service Enterprise Group Inc., WEC, DTE, CMS, Canadian Utilities Ltd., Algonquin Power & Utilities Corp., Black Hills Corp. and ATCO Ltd. are forecast to report lower earnings per share compared to the first quarter of 2022.

Consolidated Edison Inc., CenterPoint Energy Inc., NiSource Inc. and NorthWestern Corp. are projected to beat 2022’s earnings results, the analysis shows. Ameren Corp. is forecast to have no change in its year-over-year mean EPS estimate.

Dominion, PSEG, WEC, Ameren, CenterPoint, NiSource and NorthWestern are expected to report an uptick in year-over-year revenue.

M&A slowdown

As weather and rising interest rates add to sector headwinds, the market for asset and business sales could continue to cool.

“It was fairly easy to justify investments in utility assets when interest rates were very low. With interest rates where they are right now, it’s a little more difficult to justify investing in cash flow-producing assets,” Miller said in an April 24 phone interview. “As long as interest rates stay at this level or even continue rising, I think you’ll see less interest in utility assets.”

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.