In 2024, the fuel that drove economic activity in 2023 will start running low. In the US, excess savings will soon be spent, and business investment will wane. Europe is more vulnerable to recession risk and faces stagflation, while China struggles to resolve its property crisis.

Tighter financial conditions will weigh on economic growth and corporate profits. Fiscal support may reverse as governments focus on debt reduction. The key risk is that growth slows by more than markets expect.

You can also

Macroeconomics

Written by

The recessions that seemed so certain to arrive in 2023 may simply have been delayed. At the beginning of the year, US 10-year Treasury yields were 3.9% and the US fed funds rate was forecast to peak at 5%. While Treasury yields are significantly higher at the time of writing, expectations for the fed funds rate were not far off.

The reason the GDP growth forecast was further off the mark is primarily the lingering impact of the massive fiscal stimulus at the beginning of the Biden administration, followed by the ‘green New Deal’ Inflation Reduction Act. This stimulus has spurred growth and investment as intended, though at the cost of Treasury yields at times above 5%.

The cash that drove the US economy in 2023 will, we fear, run out in 2024. Excess consumer savings are waning, and higher interest rates are having the inevitable effect on demand, both for goods and services, and particularly housing.

We nonetheless do not believe the slowdown will end in recession. We expect US quarterly GDP growth to weaken at the beginning of 2024, but only briefly.

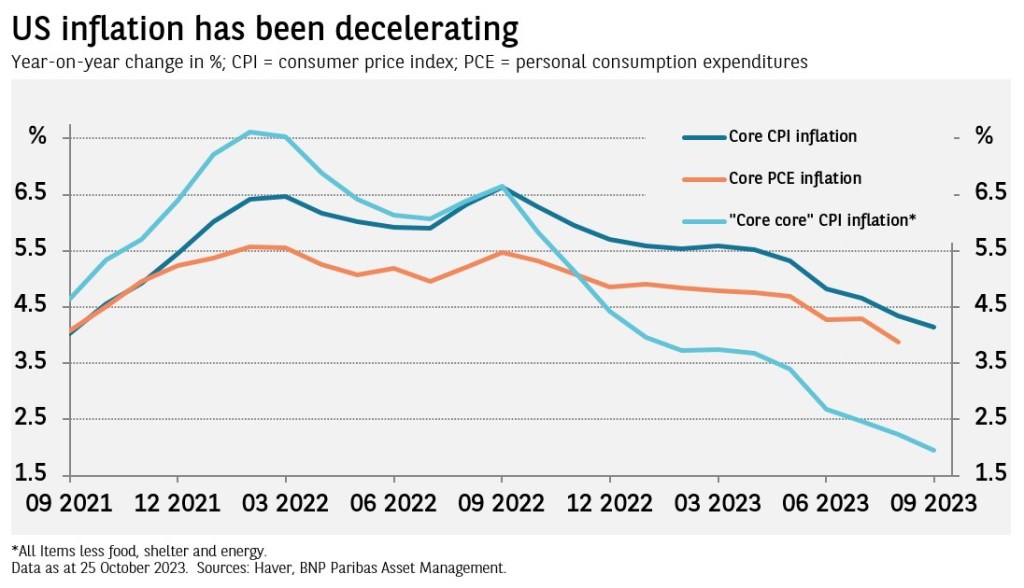

We expect core inflation to moderate further based on the view that several quarters of below-trend GDP growth will be enough to return core personal consumption expenditures (PCE) inflation to the US Federal Reserve’s 2% target, albeit not until 2026 (see Exhibit).

The Fed’s patience in allowing inflation to exceed its target for so long is one of the main reasons why the inverted yield curve, which seemed to signal a recession so clearly at the beginning of 2023, will likely turn out this time to have been a false alarm.

Another region where many investors failed to predict the trajectory of growth was China. The belief had been that China would experience a reopening like those seen in the US and Europe, with significant pent-up demand after three years of zero Covid policies poised to spur strong growth.

This seemed to be the case initially, but the rebound faded much sooner than expected. Chinese households had not accumulated as much savings as those in the US and Europe as government support was far more modest, and worries about the property market dampened consumer and business confidence.

Until China’s authorities take more forceful measures to address insolvencies among property developers, and indebtedness among local governments who depend on property sales for revenue, economic growth will likely continue to disappoint. Trade relations with the US will probably also remain difficult, regardless of who is elected the next president.

US growth to weaken briefly; China awaits more stimulus

Europe is the region where pessimistic forecasts were largely realised, and where pessimism is potentially still merited. Europe has faced a similar increase in policy rates as the US, and a bigger jump in energy prices, but without much fiscal stimulus.

The eurozone may well experience a mild recession in 2023 and, will hardly grow by our estimates in 2024. Another external shock could easily tip the region into a deeper recession. For all that, we do not see inflation decelerating much more quickly than in the US, meaning our outlook on Europe is essentially one of stagflation.

A US recession could still be needed to get inflation back to the Fed’s target if inflation stabilises at a higher level; the ‘easy’ gains from normalising supply chains and the end of ‘revenge’ travel may already be behind us. Deglobalisation, constrained labour markets, and energy transition investments are all inflationary factors.

Moreover, as wages catch up with inflation, the increase in real wages and incomes could lead to a reacceleration in consumption. The unprecedented disruptions of the last four years have made economic forecasting particularly difficult. Investors and central banks have thus had to simply await the next batch of economic data to see how growth and inflation were evolving. Forecasting has hardly become any easier and data dependency has not ended.

Finally, we note that the geopolitical landscape is becoming increasingly complex and challenging, with tensions evident from Ukraine to Taiwan and now Israel. Although geopolitics and the electoral landscape are likely to have a significant impact on markets in 2024, it is not currently possible to assign meaningful probabilities to potential outcomes.

Asset allocation

Written by

2023 witnessed extreme volatility in the macroeconomic narrative – or ‘narrative volatility’ – in addition to heightened volatility in financial assets, especially fixed income. What are our asset allocation views for 2024?

Market expectations moved skittishly from recession to ‘soft landing’ to overheating and back again (and again). The narrative at the time of writing is one of a ‘soft landing’ – that inflation can return to the main central banks’ 2% target without materially weaker growth.

We are less optimistic: risks are easily skewed towards weaker growth. This scenario would likely result in lower bond yields and lower equity prices as expected earnings fail to materialise.

Market valuations are strikingly disconnected, with elevated bond premia and comparatively low equity risk premia.

As a result, combining our assessment of fundamentals and market valuations or risk premia, our highest conviction asset allocation view for 2024 is being long duration alongside caution on developed market equities.

High conviction on long duration

Fundamentals and valuations are the two chief drivers of asset allocation views. Looking at our 12-month investment horizon, both support a long duration stance.

Consensus US growth expectations for 2023 ratcheted steeply higher over the year as government spending and the rundown of Covid-era excess savings offset the impact of meaningfully tighter monetary policy. We are sceptical of the more optimistic forecasts for 2024 growth where caution was quickly replaced by a doubling of real growth expectations from last summer’s low point.

Instead, we believe that 525bp of rate hikes will work their way through the US economy in 2024, absent the two chief drivers that propelled 2023 growth. Namely,

- The doubling of the US fiscal deficit that was unprecedented outside wartime and is unlikely to be repeated in 2024

- Surplus savings, which our analysis suggests have been broadly depleted, particularly by lower income groups.

US consumption should slow as savings levels normalise, correcting for the sizeable overshoot to real incomes and other indicators of consumption. Business investment meanwhile could be considerably weaker: to be sure, leading indicators suggest investment should be falling, not growing, by 10%.

We also see downside risks to an already struggling Europe, with leading indicators continuing to deteriorate and with meaningfully tighter financial and credit conditions to boot.

Investing in bonds means locking in attractive yields

Dislocated valuations

Every risk has attached to it a price, and asset valuations appear strikingly dislocated to us. Notably, fixed income risk premia are at levels seen only a handful of times over the last century; they are markedly more attractive than equity risk premia for the first time since 2009. One appeal of bonds is that investors know what they will be paid – and current levels lock in attractive annualised returns.

This gap exists whether we use a simple comparison (for example, looking at 30-year yields with some spread risk on top versus forward earnings yields) or more complex analysis (using discount models along the US Treasury yield curve). The gap also exists regionally, notably the US and Europe.

The abruptness of the 2023 sell-off in bond yields also brings negative externalities, or a feedback loop, deepening the downside growth risk by creating a rapid tightening in financial conditions and a greater risk of an accident in the financial system.

Positioning

We express our long duration views chiefly through long-dated real yields, where the risk/reward looks particularly attractive. We are long of European investment-grade bonds unhedged, emerging market local currency bonds and, modestly, US nominal bonds.

EM local bonds are our most recent position, seeking to take advantage of the sharp sell-off in rates over the autumn of 2023. EM local bonds are an alternative, diversified way to gain long duration exposure. EM central banks tightened policies well ahead of their developed market peers, locking in high prospective returns for investors – especially given the improved fundamentals, notably emerging markets’ external funding needs.

EM local debt is also more attractive than EM equities given the increasingly opaque outlook for China, particularly on macroeconomic policy, which has an outsized impact on equity indices.

Emerging local bonds are an alternative way to gain long duration exposure

Cautious on equities, chiefly in Europe

The same fundamental risks and valuation concerns that lead us to favour bonds also drive our caution on equities for 2024. Unlike at the start of 2023, our concerns are now concentrated mostly in Europe.

While the US experienced a small earnings recession, European earnings grew steadily through the post-Covid period. European companies are forecast to continue to generate positive earnings growth (in the mid to high single digits) for the near future. However, in weaker growth periods such as the one we see ahead, earnings have tended to fall by a similar magnitude, that is, by up to 15%.

Analyst forecasts have remained optimistic, even though the guidance provided by companies during the latest earnings season was markedly more cautious. Put differently, a recession may not be needed for the optimistic expectations to be called into question.

Adjusting for this weaker earnings outlook, European equity valuations appear unattractive, in our view – not only relative to the region’s own history, but also compared to European high-grade, high-yield and government bonds.

Sustainability

Written by

As sustainability-related investing matures, the regulatory environment continues to develop and a wider range of environmental, social and governance (ESG) issues are coming into focus.

In the second quarter of 2024, the European Commission will publish the outcome of its consultation on the future of its Sustainable Finance Disclosure Regulation (SFDR). Among the concerns the consultation seeks to address is the use of Articles 8 and 9 as de facto product labels, which was not the intention of the original regulation. One proposal is to replace the current approach with a fund categorisation scheme like that established by the UK’s Sustainability Disclosure Requirements (SDR).

Market participants have invested significant time and money in reflecting the precepts of the existing regulation, so a wholesale reinvention at this stage would be challenging, and in our experience, SFDR is already succeeding in directing capital to the sustainable economy.1 Sustainability-related investing is still a relatively young discipline, so it is inevitable that regulation will continue to develop at pace – but depending on the outcome of the consultation, it remains to be seen if SFDR 2.0 will be more revolution or evolution.

The global picture adds a layer of complication, with rulemaking on sustainability-related investing underway in both the US and Asia. In the years ahead, the challenge for global asset managers will be to reconcile the differing requirements of regulatory regimes around the world while ensuring their efforts bring investors clarity, not confusion.

Double materiality in ESG analysis

The backlash against sustainability-related investing over the past year or so has sparked a conversation about the lens through which the sustainability of companies and other security issuers is evaluated.

ESG ratings that apply a lens of single materiality – focusing on environmental, social and governance issues as financial risks – can sometimes produce outcomes which onlookers may perceive as counterintuitive, undermining the credibility of sustainability-related investing as an approach. For example, some companies from heavily polluting industries have been able to achieve high ratings thanks to their management of ESG risks.

As a consequence, 2024 should bring a continuation of the shift towards double materiality – looking not only at the impact of ESG issues on companies, but also the impact of the company’s activities on the environment and society. Among regulators and market participants, recognition is growing that incorporation of both perspectives is vital to understanding a company’s overall sustainability profile. This is particularly true in the EU where double materiality considerations cut across the regulatory framework and the EU Taxonomy details a company’s activities contributing to environmental objectives.

Climate adaptation and the just transition

As well as expanding the criteria against which companies are evaluated, investors are increasingly seeking to reflect a wider range of ESG issues in portfolios. To date, the bulk of climate change investment has been directed towards mitigation – efforts to address the causes of climate change through emissions reduction, as well as technologies such as carbon capture and storage. However, as the risks presented by the physical effects of climate change become increasingly evident in our daily lives, the need for an additional focus on adaptation has become clear.

Investing in climate adaptation can be challenging.

For mitigation, the investment proposition is often simple: invest to build a renewable energy power plant, then receive the cash flows the plant produces, for example.

Climate adaptation needs more attention

Compare this with a resilience-oriented investment such as a seawall in a coastal town: the investment mechanism is the same, but the source of return for investors is less clear since the primary benefit of the investment is reduced future risk, which is difficult to monetise.

Creative solutions to this challenge are beginning to emerge, opening opportunities for investors and mobilising private capital towards this urgent theme, which is central to efforts to achieve a just transition that acknowledges the disproportionate impact of climate change on the Global South.

Inequality and the S in ESG

The last few years have seen more investors prioritise climate and biodiversity loss as key concerns. Awareness is also growing of the systemic risks linked to inequality, in a period where we have seen income and wealth inequality grow significantly in some jurisdictions and globally.

Whereas the causes of climate change (another important systemic risk) can be identified easily (GHG emissions), the causes of inequality can be harder to diagnose and encapsulate a wide range of corporate practices and policy choices.

Set up to help address this in 2021, the Business Commission to Tackle Inequality (BCTI is a multi-stakeholder coalition including some of the largest companies. Its report Tackling inequality: An agenda for business action (2023) makes 10 recommendations on how to mobilise the private sector to tackle inequality; they cover

- What companies produce (#2: Make essential products and services more accessible and affordable)

- How companies behave as employers (#3: Create a diverse, equitable and inclusive workplace; #6: Pay and promote living wages; #7: Support and respect worker representation)

- Their role in markets and society (#8: Support effective public policy; #9: Adopt responsible tax practices).

We believe the investment community has an opportunity to increase its scrutiny of corporate performance against these recommendations, as well as to engage in related policy dialogue.

References

[1] We track our aggregate capital allocation to companies classified as sustainable under our implementation of SFDR in open-ended funds, and identified a 15% overweight versus the market in sustainable companies (equivalent to EUR 35 billion, as of May 2023).

Investment themes

Jump to: AI trends | AI investing | Private assets | China

AI trends

Written by

Matthijs Leendertse, Digital innovation consultant and lecturer, Amsterdam

The launch of ChatGPT has pushed artificial intelligence (AI) into the mainstream spotlight: the technology’s impressively broad applicability looks set drive innovation and creative destruction in the years ahead.

Artificial intelligence is a technological advance in its own right. More importantly, it is an enabler that a whole spectrum of players can harness to build new products and services. The technology’s ‘generativity’ – its capacity to produce unanticipated changes – is already bringing both rapid advances and significant disruption across industries.

As a result, we are on the verge of series of technological revolutions in various sectors – and as we know from previous such revolutions, that means a period of creative destruction, with change happening quickly, existing players being outpaced by new challengers, and new solutions to old problems emerging at pace.

This effect was seen in a microcosm with the launch of OpenAI’s ChatGPT, which apparently came from nowhere to become one of the fastest-growing consumer technologies of all time, leaving previously unassailable tech giants scrambling to keep up. However, while ChatGPT has grabbed the headlines, the big leaps forward are likely to come from specific applications within individual sectors. Three appear to offer particularly rich potential.

Healthcare

From drug development to patient treatment, AI technology is already influencing almost every aspect of the medical sector. As the advances continue, we can expect personalised medicine to be used at scale, improving overall health and alleviating the strain of ageing populations on healthcare systems in the developed world.

In diagnostic tools, the technology is now accelerating quickly – for example, in breast cancer screening, AI can rapidly screen millions of images and detect anomalies with significantly higher accuracy than a human doctor.

In drug discovery and development, AI has already been used to discover new types of antibiotics to combat resistance, and can be used to predict the efficacy of drugs and speed up testing. Pharmaceutical companies are buying up specialist AI firms, but the winners will be those with the ability to nurture AI capabilities and combine them with manufacturing and implementation expertise.

Education

AI has the potential to be the great equaliser in education, erasing distinctions across countries and between state and private education systems. There are widespread applications personalised learning approaches – from helping children who are falling behind to supporting the integration of those arriving in new countries without language skills.

One particular source of business opportunity is in lifelong learning. Governments around the world recognise that populations will need to reskill as a result of technological change. In the European Union, for example, the goal is for 60% of the adult population to participate in training each year by 2030. As a result, training provision is becoming a vast market in which AI technologies could play a significant role.

AI: it’s how we choose to use it that will determine its impact

Logistics and mobility

AI’s ability to map, monitor and manage supply chains means it can drive marked improvements in productivity and efficiency. Firms can use AI technologies for demand forecasting, predictive planning and transport route optimisation.

This has implications both for vehicle production and for how those vehicles are used. In the future, we could see dramatic changes to the transport system, with autonomous vehicles driven on optimised routes that reduce congestion, allowing people and goods to move around much more quickly and reducing the impact of transport on the environment.

Risks and questions for the future

AI has the potential to power economic growth and drive huge productivity gains, but it also brings risks and uncertainties.

Technological revolutions both destroy and create jobs – hence the term ‘creative destruction’. However, the short-term impact on people’s livelihoods can be profound, and can result in social unrest. The same could be true if the equalising potential of AI is not realised and instead the technology benefits only the wealthy.

It is clear from the example of ChatGPT that questions of data ownership and privacy will be pivotal in how the AI revolution plays out.

- Who owns the data that AI uses to learn?

- How do we safeguard the privacy of the people whose medical records it employs?

- Beyond that, who will own the technologies themselves?

- Will power and wealth be concentrated in a few companies, as we’ve seen with smartphones and social media, or will a more fragmented marketplace of specialist AIs emerge?

Finally, AI is already exacerbating existing geopolitical tensions, notably the rivalry between the US and China. Both countries are pouring resources into AI, but China’s lack of privacy laws may mean it has an edge in the form of huge data sets. Increased protectionism and the desire for digital sovereignty may prevent AI firms from achieving global scale.

AI as a technology is neutral; it’s how we choose to use it that will determine its impact on our future. Governments around the world are aware of the need to shape the direction of travel, but do not want to lose their competitive edge by being the first to act. When it does come, regulation will need to find a balance between creating investment environments attractive enough to encourage research and development while mitigating some of the risks.

AI investing

Written by

As artificial intelligence continues to proliferate into new applications, we expect 2024 to be a crucial year in the development of the investment opportunity that AI offers.

The launch of ChatGPT marked an inflection point. It took the use of so-called large language models – a branch of generative AI, which extends the capability of deep learning algorithms to generating new content – to a new level.

In addition, ChatGTP developers democratised access to AI models through cloud services and mobile apps, making it much easier for other developers, companies and individuals to use the technology.

The release of ChatGPT set off a race among cloud service providers and other technology companies to extend their datacentre infrastructure, software stacks, foundation models and applications. Several leaders in the field published outsized positive earnings revisions and saw remarkable stock returns in 2023.

Nine developments in 2024

We expect:

1. Continued growth of the infrastructure for training AI models. Capital spending by cloud service providers and large businesses stands to benefit semiconductor companies and the providers of servers, storage and networking gear

2. The emergence of a credible competitor to the leading provider of graphics processing units (GPUs). A potential industry shift towards software that can fit with different hardware could begin to work in its favour as it continues to collaborate with the open-source software ecosystem

3. A wide range of leading tech companies looks set to continue to use application-specific integrated circuits (ASICs) in select high volume applications. However, we expect GPUs to power most AI workloads

4. Developers will likely deploy GPUs, field programmable gate arrays (FPGAs) and ASICs. AI will likely be a major driver of semiconductor demand for the remainder of the decade, and logic and memory chip companies, foundries and semiconductor capital equipment and materials providers should benefit

5. On the networking side, there is an emerging opportunity for the back-end networking of AI supercomputers, with Ethernet adoption outpacing InfiniBand growth, due to its ability to support multi-tenant cloud infrastructure

6. Providers of servers, data storage equipment, optical networking gear and cyber security platforms will likely see incremental revenue opportunities

7. Cloud service providers could develop larger, more powerful AI systems. Software companies will likely continue to embed AI functionality to improve their products. Investors are sure to monitor the ability of technology providers to monetise the new capabilities.

8. Use cases for AI will likely proliferate. UK newspaper The Economist has pointed out several interesting scientific applications, including:

- Pattern recognition (for drug discovery and materials science)

- Predictive engines (folding proteins)

- Complex computer simulations (weather models and simulating processes)

- The use of generative AI to design new chemicals.

Companies are using generative AI for a broad range of activities including

- Software development

- Chat bots for customer service

- Writing contracts

- Automating the production of marketing content.

In the industrial sector, manufacturers and equipment providers are implementing AI systems to enhance process controls and virtual digital twin models.

9. Bottom-up fundamental research will be critical to identifying the best stocks to play this theme, while avoiding companies that are unable to adapt.

Types of artificial intelligence

AI as a key growth driver

As AI adoption proliferates, there are several risk factors to monitor with respect to fundamental analysis, environmental, social and governance (ESG) factors and investor sentiment.

From a growth perspective, the speed and duration of infrastructure development are uncertain, and there could be pauses for ‘digestion’ during the process. AI expenditure could crowd out budgets for other information technology projects.

We are optimistic about the pervasive adoption of AI

On the ESG front, irresponsible users could abuse AI for surveillance, hacking and the creation of deep fake news. Biased data sets may result in incorrect output from AI models. Other issues include the significant energy requirements for powering the datacentres that run AI models.

We may see investor sentiment and valuations fluctuate as the technology moves through the adoption cycle.

On balance, we are optimistic about the pervasive adoption of artificial intelligence and its positive impact on cloud service providers, software companies, owners of large databases, the semiconductor supply chain, and companies that are using AI to improve business processes.

We see AI as a key enabler of recommendation engines, automated customer service systems, manufacturing automation, document production, and many other systems. With such diverse potential, we believe AI will be a key growth driver in 2024 and beyond.

Private assets

Written by

In 2023, infrastructure debt showed it could deliver a resilient performance even in a challenging economic environment. In the year ahead, the asset class offers investors a rich pipeline of opportunities aligned with their return and income goals and with the increasing focus on supporting the transition to a sustainable economy.

A resilient asset class with a strong pipeline

In a macroeconomic environment characterised by volatility, rising interest rates, high inflation and geopolitical tensions, infrastructure debt has demonstrated its ability to serve as a resilient solution for investors looking for long-term income, stable cash flows and diversification versus other asset classes. Performance was strong across sectors in 2023, with some exceptions in markets that have seen particularly steep increases in capital expenditure (capex) costs.

Looking ahead, the contracted revenues, strong regulation and inflation pass-through characteristics of infrastructure debt mean that, in our view, the asset class is well-placed to weather continued uncertainty in 2024.

While a slowdown in merger and acquisition activity has impacted equity projects, the debt pipeline remains strong. We are seeing significant refinancing activity as companies seek to fund capex plans, as well as greenfield opportunities. Demand is driven by the megatrends of energy transition, clean transportation and digitalisation. These will require vast infrastructure needs in Europe and around the world. As a result, the market looks set to continue to expand in the coming months and years, offering investors a wealth of potential projects to finance.

As the asset class grows, a broader spectrum – from senior secured to more junior debt – is becoming available, creating variety for investors. Higher interest rates mean infrastructure debt can now provide attractive absolute returns. In the junior debt segment, returns are at core infra equity-like levels, suggesting reallocation into the asset class may be a persistent trend. Meanwhile, the positive illiquidity premium offered by senior debt means it continues to serve as an effective diversifier to traditional fixed income.

Sustainability in focus

We believe the infrastructure debt market is at a turning point, with investors in Europe and, increasingly, around the world, transitioning to low-carbon assets as recognition grows of the need for private capital to support net-zero goals. The sustainability and climate change mitigation characteristics of these assets look set to remain key investment criteria in 2024.

Renewable energy is a vital part of the puzzle, but decarbonisation of all infrastructure assets is needed, from transportation to the phase-out of coal in the utility mix. The first carbon capture and storage projects are beginning to come to the market for financing, and we are identifying interesting early opportunities throughout the battery storage technology and green hydrogen value chains.

Beyond climate change, new sustainability themes are emerging. The preservation of biodiversity and natural capital is becoming increasingly important in the analysis of new projects. Emphasis is also growing on the circular economy and recycling, both in project design, which seeks to minimise the use of raw materials and optimise reuse of materials at the end of the asset’s life, and as a source of investment opportunity.

Digitalisation drives infrastructure development

Challenges and risks

Although the environment for infrastructure debt is favourable, there are some challenges. The backdrop of higher capex costs means greater caution is required on the profitability of projects – for example, in renewable energy, the cost of producing a wind turbine or a solar photovoltaic (PV) array has risen steeply.

Lenders need to be highly selective and ensure projects can generate sufficient income and stable cash flows to mitigate the higher costs. The rich project pipeline makes such selectivity possible.

Given that so many of the current opportunities are in new technologies, lenders also need the resources and specialist expertise to evaluate complex projects while maintaining an adequate risk profile.

Lenders with the ability to analyse the full value chain, from technology to market research to income generation, and to offer bespoke financing solutions that align with emerging business models, will have greater capacity to invest proactively and take advantage of early-stage opportunities to capture the best risk/return ratios.

Rapid market innovation

As well as the new assets and investment ecosystems emerging in the transition to a low-carbon economy, there is rapid product innovation occurring in the infrastructure debt market. Managers are increasingly developing thematic funds focused on specific sectors and investment themes, while the increased availability of debt in the sub-investment grade segment creates an opportunity to finance assets with some development risk, as opposed to only projects that are ready-to-build.

In Europe, the latest iteration of the European Long-Term Investment Funds regulation (ELTIF 2.0) will enable retail investors to access the asset class for the first time. This emerging trend will mean product structures need to evolve to offer additional liquidity, while reflecting the traditional buy-and-hold characteristics of infrastructure debt.

Another area of innovation is artificial intelligence (AI). Digitisation has long been a driver of the development of infrastructure assets, and AI represents a big step forward given its ability to act an enabler for new solutions, optimising the design and use of infrastructure assets and the management of data.

The applications are widespread. In power supply, for example, AI technology can optimise energy consumption to realise economies of scale, as well as identifying efficiencies in the management of the electricity production grid. In 2024 and beyond, we expect AI to support the building of better, more efficient and greener assets across the whole asset class.

China

Written by

Global investors were bearish on China during most of 2023 as worsening debt and property market woes compounded disappointment over Beijing’s response to issues around the post-pandemic recovery. The outlook for Chinese assets in 2024 hinges upon further initiatives to boost lacklustre growth. Meanwhile, the country’s structural transformation looks to be on track and can be seen as a long-term theme for investors.

Cyclical weakness

The consensus view on China’s growth outlook darkened from the third quarter of 2023 after waves of disappointing economic data and news of financial woes. The prevailing forecast at the time of writing was that GDP growth would range between 4.5% and 5.0% in both 2023 and 2024. Stock markets fell in response despite valuations already looking cheap.

Some market observers have argued that China’s huge debt burden has limited Beijing’s options to deal with the problems, hence the impact of the dire data on financial markets. We beg to disagree. There is evidence that China’s debt load is manageable and does not constrain Beijing’s economic policy options. The same evidence suggests the weak growth since the pandemic is due to Beijing quitting its previous debt-fuelled supply-expansion growth model and refusing to resort to massive reflation, while being willing to tolerate slower growth rates.

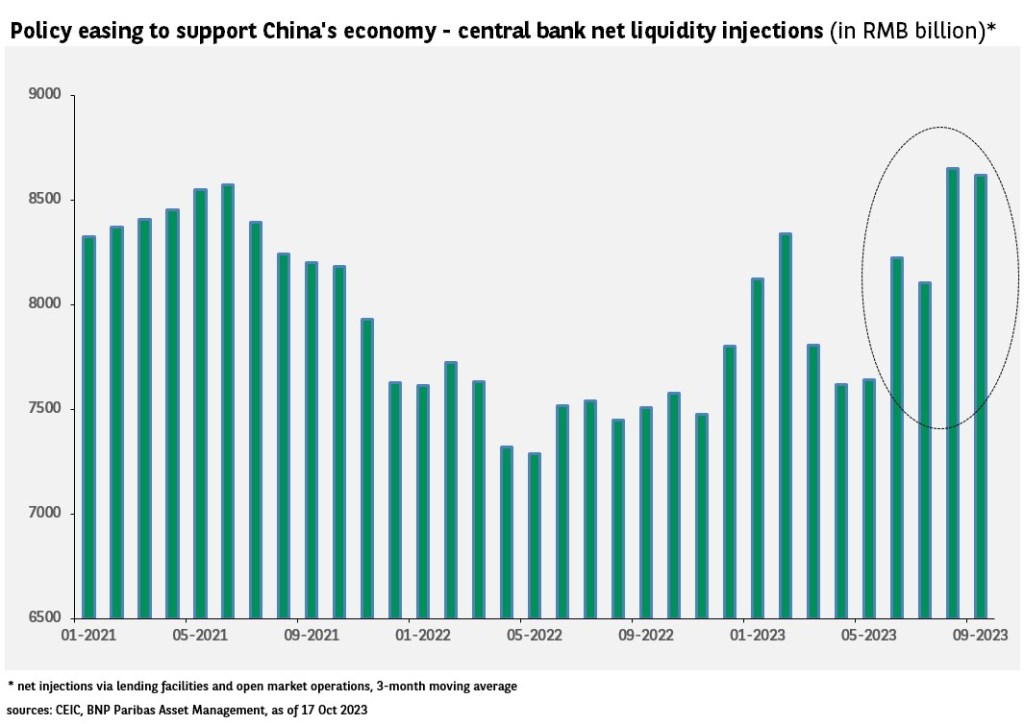

If that is the case, stimulus can resolve China’s economic problems. If the authorities continue with their recent assertive policy easing (see exhibit), market sentiment should improve, and we believe there is a reasonable chance for a sustained rebound in Chinese stocks in 2024.

Structural transformation

It is generally believed that the level of savings in China is too high, and that Beijing needs to put more money in the hands of consumers, so that consumption can take over from investment as the main driver of long-term growth.

However, in our view, the saying ‘invest less, consume more’ makes no sense at this stage since many under-developed parts of the country still need investment to create income and stimulate consumption growth.

Consumption is not the panacea that many assume it to be. Does China need more televisions and furniture with too few flats and houses to put them in? Should the Chinese own more cars, but suffer worse roads and insufficient petrol stations, trains and other means of transport?

China’s problems are mainly cyclical

The Chinese can save so much because they have incomes from jobs created by investment. Basic economics tells us that, on balance, savings should equal investment – that high savings should lead to high investment. Hence, blindly following the ‘invest less, consume more’ mantra makes no sense for a country that still has many regions that need to be developed.

Furthermore, because financial intermediation involves using savings for investment and lending, a high level of debt can be acceptable as long as there are assets backing it. We believe this is the case in China’s debt-financed growth model.

What’s new?

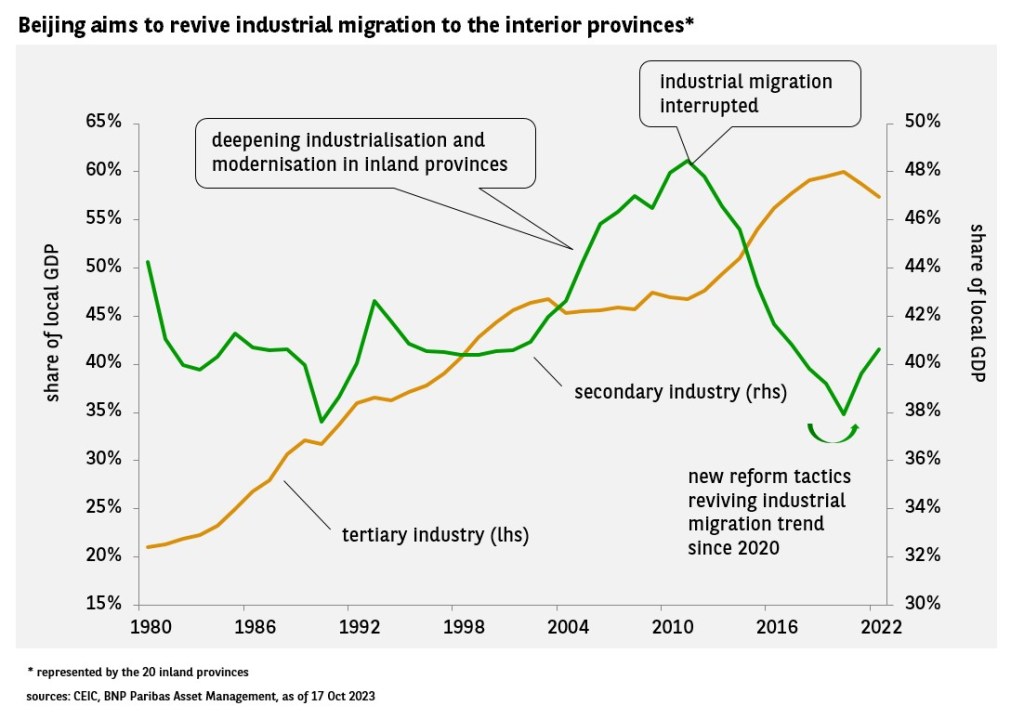

Recognising this investment-consumption cycle and past reform errors, Beijing made a tactical shift in its structural reforms under its broad ’dual circulation’ strategy in the second half of 2020. This approach now favours the development of ‘hard tech’ – the production of hardware and components for strategic and high-tech industries – over ‘soft tech’ – e-commerce development catering for non-strategic consumer demand – and uses the private sector as a driver for innovation.

Beijing expects this approach to revive industrial migration to the interior provinces. Data shows that shift is already happening (see Exhibit 2). Tapping cheaper resources inland should revive GDP growth and raise productivity in the longer term.

Is China investible?

China’s post-Covid economic recovery has been fragile, but the problems are mainly cyclical. In our view, aggressive fiscal expansion facilitated by monetary easing can help resolve them. These measures could boost growth and help asset prices recover in 2024. The risk is premature policy tightening (this is not our base case). That would hurt China’s markets further.

Meanwhile, the structural transformation is renewing investment growth in high-value manufacturing and high-tech industries. Beijing has many crucial tasks: Improving education and healthcare; reforming the labour market structure so that jobs and skills match; providing for the elderly; curbing pollution and limiting the effects of climate change; and, last but not least, simultaneously cutting the debt ratio.

These are tall orders, but they are on China’s policy agenda, and we see them as the long-term investment themes.

Please note that articles may contain technical language. For this reason, they may not be suitable for readers without professional investment experience. Any views expressed here are those of the author as of the date of publication, are based on available information, and are subject to change without notice. Individual portfolio management teams may hold different views and may take different investment decisions for different clients. This document does not constitute investment advice. The value of investments and the income they generate may go down as well as up and it is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns. Investing in emerging markets, or specialised or restricted sectors is likely to be subject to a higher-than-average volatility due to a high degree of concentration, greater uncertainty because less information is available, there is less liquidity or due to greater sensitivity to changes in market conditions (social, political and economic conditions). Some emerging markets offer less security than the majority of international developed markets. For this reason, services for portfolio transactions, liquidation and conservation on behalf of funds invested in emerging markets may carry greater risk.

Environmental, social and governance (ESG) investment risk: The lack of common or harmonised definitions and labels integrating ESG and sustainability criteria at EU level may result in different approaches by managers when setting ESG objectives. This also means that it may be difficult to compare strategies integrating ESG and sustainability criteria to the extent that the selection and weightings applied to select investments may be based on metrics that may share the same name but have different underlying meanings. In evaluating a security based on the ESG and sustainability criteria, the Investment Manager may also use data sources provided by external ESG research providers. Given the evolving nature of ESG, these data sources may for the time being be incomplete, inaccurate or unavailable. Applying responsible business conduct standards in the investment process may lead to the exclusion of securities of certain issuers. Consequently, (the Sub-Fund’s) performance may at times be better or worse than the performance of relatable funds that do not apply such standards.