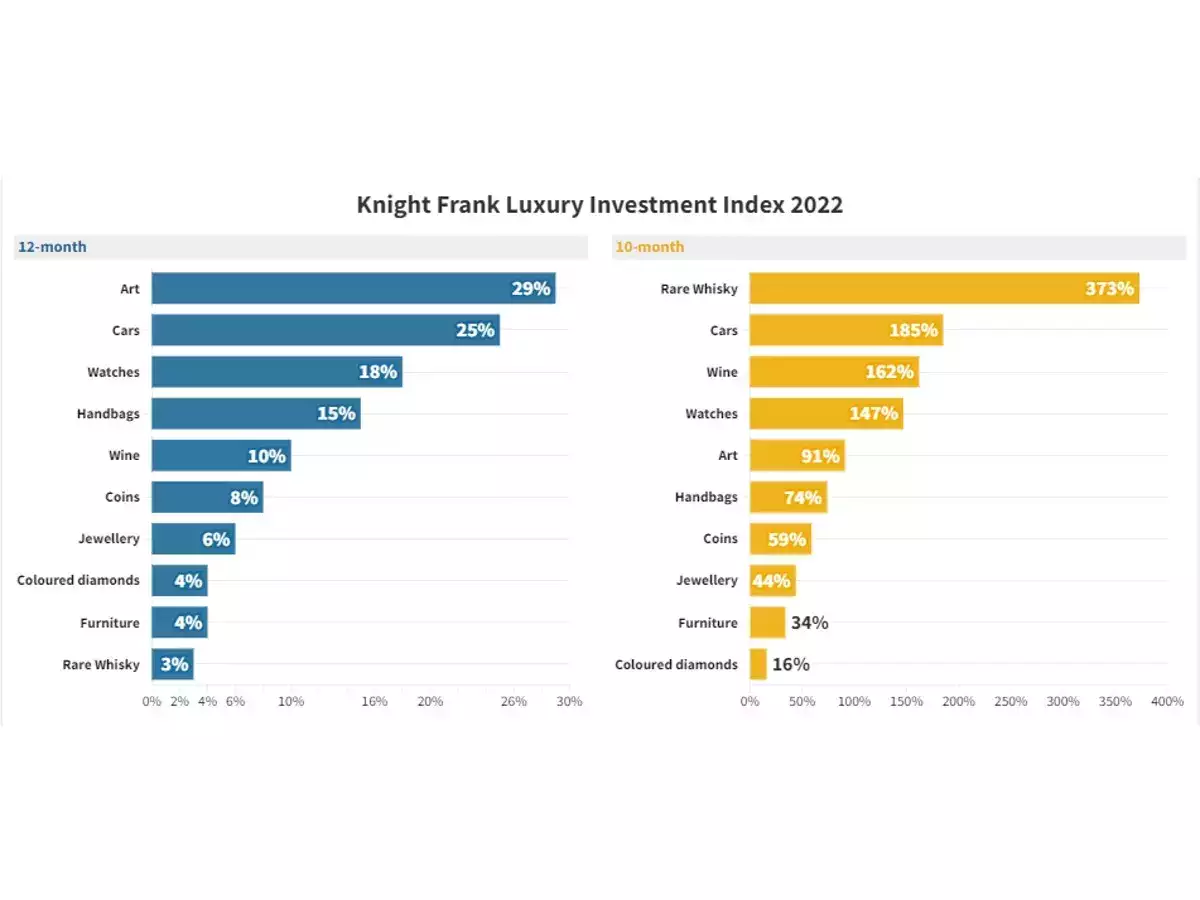

- The 10 investments tracked by Knight Frank Luxury Investment Index 2022 shows that art was the top performer.

- Watches, classic cars and even collectible handbags provided double digit returns during the period.

- In 2023, ultra wealthy Indians are likely to invest highly in art, watches and luxury handbags, followed by jewellery.

The art of investing lies in art itself. As per the latest KnightFrank report, the annual returns that the super rich received from their art investments in 2022 were at 29%.

According to The Wealth Report 2023 by Knight Frank, even as ultra high networth individuals (UHNIs) follow their passions with their wealth, they are barely losing any money. As per the report, the top item purchased by UHNIs in 2022 was an Andy Warhol painting named Shot Sage Blue Marilyn, for $195 million in a Christie’s auction.

As per the 10 investments tracked by Knight Frank Luxury Investment Index 2022, art was the top performer in the 12-month period ending December 2022. In a ten-month comparison, the returns were even better at 91%.

“The proprietary Knight Frank Luxury Investment Index (KFLII), which tracks the value of ten investments of passion, has increased by a healthy 16% during 2022, comfortably outpacing global inflation rate whilst outperforming the majority of mainstream investment classes, including equities and gold,” said the report.

To put that in perspective, Indian benchmark Sensex gave just 2.8% return in 2022 while the US was even worse as Nasdaq Composite tumbled 33% and S&P down 19%.

Classic car value revs up

Another offbeat investment was classic cars that revved up its performance, delivering 25% return — the highest in the last nine years. The most expensive car sold last year was the Mercedes-Benz Uhlenhaut Coupé for $143 million.

Another interesting collectable by ultra rich are watches that delivered an annual return of 18%. Collectable handbags and wine also witnessed strong growth, while rare whisky was at the bottom of the list.

“The results of our index and some of the staggering sums paid for investments of passion over the past 12 months highlight just how important their collections are to UHNWIs and how resilient many of these asset classes are to economic and geo-political events. Gen Z and Millennial wealth is also having a profound impact with new collectable markets emerging all the time,” said Andrew Shirley, author of the Knight Frank Luxury Investment Index.

Luxury investments in 2023 by ultra rich

In 2023, ultra wealthy Indians are likely to invest highly in art, watches and luxury handbags, followed by jewellery. The report states that globally, art (59%), watches (46%) and wine (39%) make up the top three categories of passion led investments.

| Rank | Investment of passion | India | Global |

| 1 | Art | 53% | 59% |

| 2 | Watches | 53% | 46% |

| 3 | Luxury handbags | 53% | 20% |

| 4 | Jewellery | 41% | 33% |

| 5 | Classic cars | 29% | 34% |

| 6 | Wine | 29% | 39% |

| 7 | Furniture | 29% | 14% |

| 8 | Rare whisky | 12% | 18% |

| 9 | Coloured diamonds | 6% | 9% |

| 10 | Coins | 6% | 8% |

“India’s wealthy have always had a penchant for collectibles across categories, however traditionally these were mostly for conservation, rather than investments,” said Shishir Baijal, chairman and MD at Knight Frank India. As these markets offer attractive returns, Indians are rushing to buy them as well.

“With the domestic and global market offering significantly higher returns for such articles, Indian ultra-wealthy are actively seeking investment opportunities in passion led investments. The demand for rare articles has been rising across different generations in India and with the rise in wealth in India, we can expect more investments in these asset categories,” said Baijal.

SEE ALSO: Axis Bank completes acquisition of Citibank’s consumer business for ₹11,603 crore – here’s everything to know

Indian super-rich bracing for a better year ahead: Knight Frank