I’m an investment expert – this is my forecast for savings rates, the stock market and crypto in 2024

On the cards: Laith Khalaf looks at what could happen for savers and investors in 2024

With inflation on the wane, the Bank of England is now tipped by markets to cut interest rates multiple times in 2024.

But ratesetters are keen to push back on these assumptions and three members of the Bank’s monetary committee voted for a rise last week, although they were outvoted 6 – 3 and base rate was held at 5.25 per cent.

Yesterday, the ONS revealed that inflation had fallen to 3.9 per cent, adding to those rate cut hopes.

But what does this all mean for savers and investors?

Laith Khalaf, head of investment analysis at AJ Bell, outlines what he sees on the cards for cash savings, equities, gilts, gold and cryptocurrency in 2024.

Cash savings

Just as we may well have seen peak interest rates, we might have passed peak cash in terms of the returns on offer.

We may not have hit the summit in terms of flows into the asset class, as yield-starved savers revel in the forgotten delight of getting a reasonable return while taking negligible risk.

Markets are now pricing in several interest rate cuts in the UK next year, though these expectations can be easily blown off course by recalcitrant data points that buck the prevailing narrative.

If inflation is truly licked and looser monetary policy starts to materialise, instant access cash rates will fall back.

Fixed term cash rates will fall first though as they anticipate future interest rate changes to a greater degree.

Indeed we have already seen fixed term rates coming off the boil, with the average one year bond now offering 5.2 per cent, down from a high of 5.5 per cent in October, according to Bank of England data.

It looks likely that in 2024 we’ll reach an inflection point where the best rate on fixed term bonds falls below that on instant access accounts. Indeed the two have already started converging.

It looks likely that in 2024 we’ll reach an inflection point where the best rate on fixed term bonds falls below that on instant access accounts

Without being paid a premium to lock their money away, savers will probably turn away from fixed term bonds in favour of instant access accounts.

In 2021 the Financial Conduct Authority set a goal to reduce the number of people with sizeable assets in cash and get them investing instead.

Their goal was to reduce the number of consumers with a higher risk tolerance holding more than £10,000 in cash by 20 per cent, taking this figure from 8.6million in 2020 to 6.9million by 2025.

The regulator couldn’t really have picked a worse time to launch this effort, seeing as the return on cash has gone up fifty fold in the last two years.

Data from Barclays stemming back to 1899 shows that over a 10 year time period, there is a nine in 10 chance that shares will beat cash.

This statistic underlines the reason for holding equities for the long term, but higher interest rates have naturally made that case harder to win than when cash returns began with a zero.

> Check the best easy access savings rates in our tables

> Check the best fixed savings rates in our tables

Cash matters: Just as we may well have seen peak interest rates, we might have passed peak cash in terms of the returns on offer

Equities

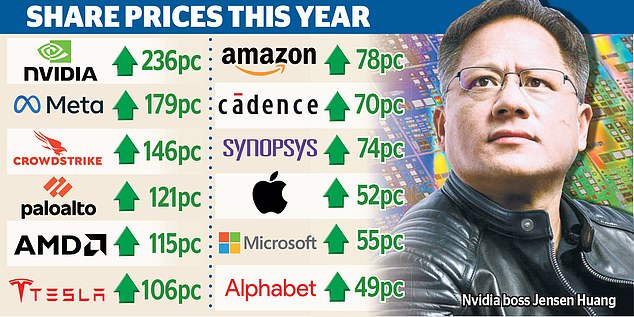

2023 was a positive year for global equity markets, driven in large part by excitement over the potential for artificial intelligence to drive another leg in the tech boom.

Concerns over the valuations of the US stock market and in particular a small cabal of big tech companies are gradually being rendered moot or seemingly foolish by continued strong performance.

They say if you can’t beat them join them, and there must be plenty of value investors out there who would quite happily change their spots if they could do so without losing face.

The potential for the Fed to cut interest rates in 2024 should be positive for growth stocks, but probably of equal significance is for the tech titans to keep pumping out earnings growth to keep the punters happy.

Perhaps a concerning sign was NVIDIA’s third quarter results, in which the chip company hugely outstripped analyst expectations and lifted its fourth quarter guidance, only to see its share price slide.

It feels like the market might be wanting ever more miraculous acrobatics in order to elicit a round of applause. Certainly the rich valuations placed on the tech sector leave little room for error in operational performance, and any slip ups could consequently be harshly punished.

> Magnificent Seven vs the S&P 500: Why the US market rocketed 22% this year

The UK stock market by contrast remains sluggish and out of favour. Sentiment amongst domestic retail investors is at an extremely low ebb, if fund flows are anything to go by.

Part of the explanation for the torpor is the sectoral make-up of the Footsie, with its banks, mining and insurance companies making it look pedestrian and downright Victorian compared to the fast-moving tech revolutionaries of the NASDAQ.

There is nothing in the runes for 2024 which suggests the long-running antipathy towards the UK stock market is going to go into reverse, and the UK now makes up such a small part of the MSCI World Index that global investors can sidestep it entirely without taking too much risk against their benchmark.

That doesn’t mean the UK market can’t make progress, as it did in the last year with a 6 per cent return.

But it might not set the world alight compared to other regions, most notably the US, with even Japan trying to break in on the action.

The UK is still a good place for dividends which means investors are at least paid to wait for a turnaround in fortunes, and those payments also set a floor under valuations as a cash income stream always carries currency.

The UK’s medium and smaller companies have also performed very well in the longer term, though they are currently laid low by the same malaise that infects their large cap cousins.

> FTSE 100: Check the UK stock market’s performance

Central bank: The Bank of England is selling down the gilt holdings in its quantitative easing programme

Gilts

It’s been a funny old year for the UK government bonds after a calamitous 2022.

Recent expectations that interest rates will fall have actually put the gilt market into positive territory for the year.

The current 10 year gilt yield currently sits at around 3.7 per cent, roughly where it started 2023, though over the course of 12 months there has been a round trip up to 4.7 per cent.

Short-dated gilts have proved popular with retail investors and are still yielding more than some of their longer-dated cousins. The current two year gilt yield stands at 4.3 per cent.

Assuming inflation continues to fall away, the yield curve can be expected to move towards a more normal shape which rewards investors for taking on duration risk.

How quickly and how far this trend goes will largely depend on the path of UK interest rates.

In the meantime gilts are now offering a much more appealing return than they did for almost all of the noughties, but for retail investors the yields on offer are probably less alluring than cash.

Except that is for low coupon short-dated gilts, which offer a tax wheeze for the initiated, and which have proved popular with DIY investors in 2023.

The yield on gilts should be tempered with some acknowledgement of supply risks, especially in an election year when markets might get spooked by uncosted spending promises.

As things stand it looks like both main parties will stand on a platform of fiscal prudence, but funny things can happen on the campaign trail.

There is already a plentiful supply of gilts coming from continued government borrowing, and the Bank of England is also selling down the gilt holdings in its quantitative easing programme, again increasing supply which could put pressure on prices.

Insurance companies and pension funds can normally be relied upon to hoover up a lot of issuance, but the government is actually trying to get pension funds to invest in UK companies, which would entail investing less in their preferred hunting ground of government bonds.

Go gold: It’s ended up being a positive year for gold with double digit dollar returns

Gold

It’s ended up being a positive year for gold with double digit dollar returns.

However the weakness of the dollar has helped propel the price upwards, and as a result returns for UK investors in sterling terms are running at about half that of dollar returns, at 6 per cent or so for the year before charges.

Again, interest rate policy has been a key factor in gold pricing. The prospect of falling interest rates, especially in the US, are a tailwind for gold as they represent a reduction in the opportunity cost of holding the precious metal, which pays no income.

A 10 per cent rally in the gold price in the last quarter of 2023 suggests the market has already woken up to the prospect of interest rate cuts, and so progress in 2024 will depend partly on when those are delivered, and to what extent.

Government debt dynamics may also play a role in the fortunes for gold, as any further credit downgrades for the US would be negative for the US Treasury market, a key competitor for gold.

However the likelihood of a US default is still so slight that the effect of any deterioration in its fiscal position will probably be marginal.

The US was downgraded by the credit ratings agency Fitch in 2023, and its credit outlook was reduced by Moody’s too, but that didn’t stop the US 10 year bond yield falling from a peak of 5 per cent to under 4 per cent today.

Gold bugs are probably better off hanging their hat on a hard landing for the US and global economy, which would spark a flight to safe haven assets, including gold.

While gold is often seen as a safe haven, investors need to be careful not to equate this with price stability.

People do tend to rush to the precious metal in times of financial stress, but it shouldn’t be taken as read that gold isn’t volatile.

It is, and steep losses can be incurred. Between 1980 and 1982, the gold price fell by over 60 per cent, and between 2011 and 2015, it fell by around 45 per cent.

From its peak in 1980, the gold price fell by 33 per cent over the next 20 years, and it took 27 years for gold to reach its former high. That’s a long period in the wilderness.

> Is now a good time to invest in gold… and how do you do it?

Crypto: Crypto has been on the charge this year, despite numerous scandals and ongoing global regulatory pressures

Crypto

Crypto has been on the charge this year, despite numerous scandals and ongoing global regulatory pressures.

In the UK the government is pressing ahead with plans to regulate many crypto activities in line with existing financial services, resisting a call from the Treasury Select Committee to treat crypto activities as gambling.

Actually, increased regulation might be a positive for crypto, potentially opening up fresh pools of capital and fostering greater confidence amongst consumers.

2024 also sees a halving, where the reward for mining Bitcoin falls by half, which will reduce the supply of fresh Bitcoins coming to market.

Bitcoin bulls will point to this as a big positive force for the cryptocurrency’s price, and this is likely behind some of the strong performance we’ve seen this year.

However this isn’t a shock to supply as such, seeing as halvings occur every four years, and in an efficient market this would already be reflected in prices.

However the extreme price volatility in Bitcoin, on occasion prompted by something as extraneous as a tweet from Elon Musk, presents a challenging case study for the hypothesis that markets are rational arbiters of all available information.

In the long run the widespread adoption of crypto as either an asset or a currency is still highly speculative, and as a result prices can be expected to remain incredibly volatile and heavily influenced by sentiment.

The recent price surge, combined with the halving, is likely to generate headlines and draw in punters, and in the past we have seen media frenzies feeding and being fed by higher and higher Bitcoin prices.

The question is how many of those who invest in these periods actually end up making a profit. It remains the case you shouldn’t bet your shirt, unless you’re prepared to lose it.

Do your homework

No one can be certain how the economy and savings and investments will fare in 2024.

As with anything to do with money, make sure you do your research before taking the plunge.

Never invest more than you can afford to lose. Investing in crypto or certain risky equities will not be suitable for everyone.

Check the financial providers you are dealing with are adequately regulated and try to find some reviews online, or by word of mouth, before putting money into savings or investments.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

eToro

eToro

Share investing: 30+ million community

Bestinvest

Bestinvest

Free financial coaching

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.