Europe is still running behind in the global scramble to secure the green supply chains of the future. China’s decades’ long planning and investment, and the US’s more recent surge of support, risk leaving our continent in the dust.

Chris Heron is Communication and Public Affairs Director at Eurometaux; Julia Poliscanova is Senior Director at Transport & Environment; Kinga Timaru-Kast is Public Affairs and Communication Director at Recharge

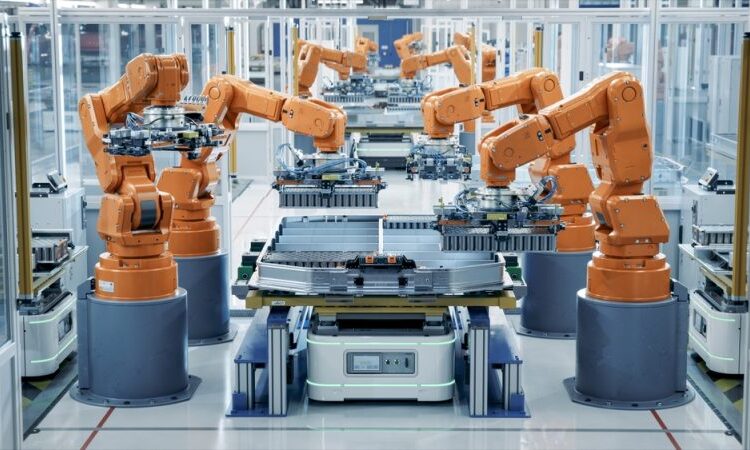

The European Commission’s new Battery Fund is a critical first step to catch up by bridging the finance gap to scale up production of EU batteries, their components and the whole supply chain. It must be designed well from the start to really deliver the push that Europe’s investing companies need to compete.

Today’s €3 billion funding pot needs to be used wisely to bring an exponential effect on EU battery value chain investment.

Let’s also be clear that this mechanism must be the first step of many. It will need expanding substantially during the next legislature to secure final investment decisions across the battery value chain, and to really compete with the US Inflation Reduction Act and the overcapacities built up in China.

We’re calling for the European Commission to design a smart and future-proof mechanism that delivers on four keys for success: simplicity, speed, supply chain vision, and sustainability.

As the Commission is putting in place the detailed framework for the new fund, the fund’s speed in becoming operational and the simplicity of its design are the first two keys to success.

Europe will not win the battery race by overwhelming its companies with complex templates and questions that require input from whole teams of experts – as required for some of the grants under the Innovation Fund today.

Instead, the first call should come no later than late 2024. Support could be based on the actual output that will be produced in Europe, i.e. the volume of cells or battery materials.

The fund should partially cover the operational costs as well, such as energy and labour which in Europe are amongst the highest globally.

Our third key for success is a supply chain focus. We’re calling for the EU’s new battery fund to also address materials manufacturing as a major bottleneck to Europe’s resilience.

Today, Europe’s supply chain investment simply isn’t keeping pace with its battery needs, particularly for cathode and anode active materials, and battery material refining and recycling.

While potential exists, turning it into commercial projects won’t be easy. The EU Battery Fund could be one of the enablers. According to T&E’s forecast, by the end of this decade, the region could in fact fulfil all its processed lithium needs and secure between 8% and 27% of battery minerals from recycling in Europe.

The EU has the potential to manufacture 56% of its demand for cathodes by 2030, but only two plants have started commercial operations so far. No commercial operations have started in Europe for anodes.

But these promising ambitions need to be turned into final investment decisions.

Here the Commission’s initial support to battery cell manufacturers should already reward local supply chains. Priority should be given to companies that demonstrate a commitment to sourcing from EU-based midstream and upstream suppliers.

So, the new fund should also plan to directly support strategic EU cathode and anode manufacturing, refining, and recycling projects; at the same time as keeping a focus on cell manufacturing especially in initial funding rounds.

Our final key for success is sustainability.

Europe’s project choice should be guided by simple selection criteria, rewarding best-in-class projects with the lowest carbon footprint in their supply chain. This is Europe’s unique selling point, with our companies across the battery supply chain basing their business case on manufacturing with a much lower footprint than global competition.

Member States should ensure the right investments are made locally and that access to renewables is facilitated to build on this competitive advantage. Since batteries and their components are already regulated under the EU Battery Regulation, no additional sustainability criteria is necessary.

The new EU Battery Fund is not a holy grail solution, but its financial support is critical to build the green blocks of the EU energy transition. If designed simply, with the entire local supply chain in mind, and with a focus on sustainability, it can put Europe on the global battery map.