XH4D/iStock via Getty Images

By Jay Jacobs

COFFEE & EVs

Jay Jacobs, U.S. Head of Thematics and Active Equity ETFs at BlackRock, and Armando Senra, Head of Americas ETFs and Index Business at BlackRock, discuss the latest trends in electric vehicles (EV) and how iShares ETFs are designed to help investors capture opportunities across the EV value chain.

KEY TAKEAWAYS

- The Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) allocated billions to the development of the electric vehicle (EV) industry.

- Major auto industry players are committing billions for mining, battery production, EV charging infrastructure, and car assembly.

- This enhanced investment may help accelerate the adoption of EVs, spurring greater demand by reducing costs for consumers, while supporting more production capacity.

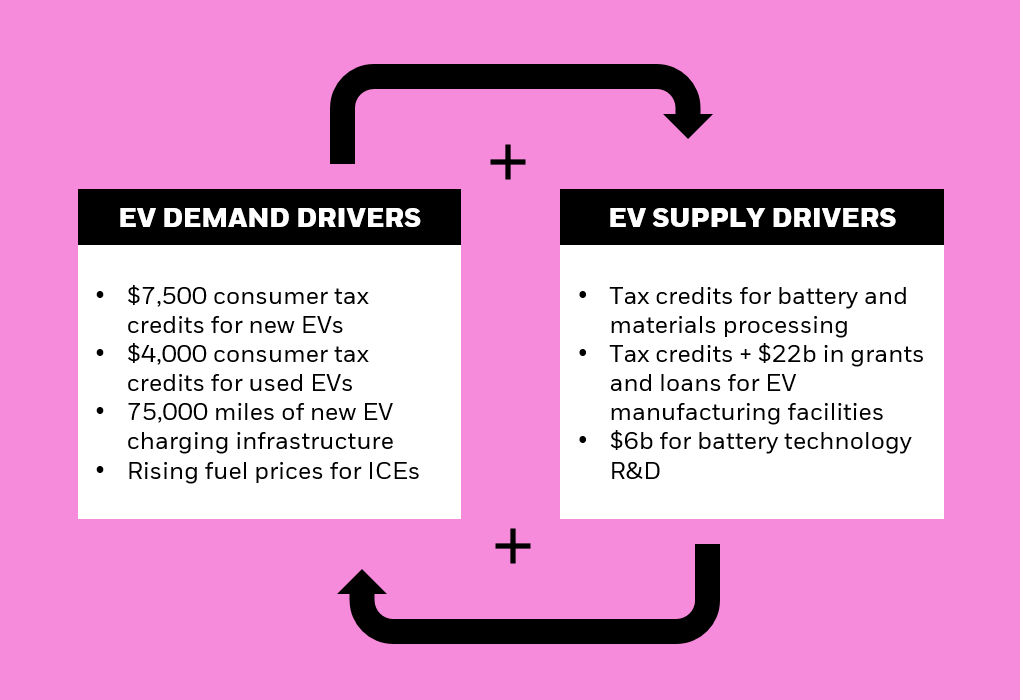

FISCAL POLICY IS HELPING TO CATALYZE A VIRTUOUS CYCLE OF EV SUPPLY AND DEMAND

The recently passed IRA and IIJA will direct billions of dollars toward EVs and EV infrastructure over the next decade. The two laws reinforce one another, creating a virtuous cycle which could spur greater adoption of EVs, by stimulating both demand and supply.

Virtuous cycle of EV supply and demand drivers

Source: Senate Democrats, “Summary of the Energy Security and Climate Change Investments in the Inflation Reduction Act of 2022,” accessed on November 4, 2022. U.S. Department of Transportation, “Historic Step: All Fifty States Plus D.C. and Puerto Rico Greenlit to Move EV Charging Networks Forward, Covering 75,000 Miles of Highway,” as of September 27, 2022. U.S. Senator Ben Cardin, “Bipartisan Infrastructure Investment and Jobs Act Summary,” as of September 2022.

Chart description: Illustration depicting the virtuous cycle between the EV demand and supply drivers. The arrows indicate that the bulleted lists of EV demand drivers and EV supply drivers impact one another, and the plus symbols indicate where the impact could be positive. Taken together, this could be a positive reinforcing loop — a virtuous cycle.

Demand: The IIJA includes $7.5 billion to install 500,000 EV chargers, ~4x the total number of chargers currently in the U.S., and extends EV charging infrastructure across 75,000 miles of highway.1,2,3 This can spur greater demand by reducing “range anxiety” among EV consumers and could lower prices by reducing the need for larger batteries since smaller batteries could mean that batteries cost less to produce. Additionally, the IRA extends $7,500 consumer tax credits for purchasing new EVs that meet certain qualifications and introduces a $4,000 tax credit for used EVs,4 bringing EVs closer towards price parity with internal combustion engines.

Supply: The two laws include billions in tax credits, loans, and grants for new facilities and production along the full EV value chain, from raw materials refining to battery production to final EV assembly. With the potential for increased consumer demand, we believe there could be a significant manufacturer uptake in these opportunities. (See The Inflation Reduction Act’s impact on clean energy and EVs and 2023 thematic outlook for more analysis).

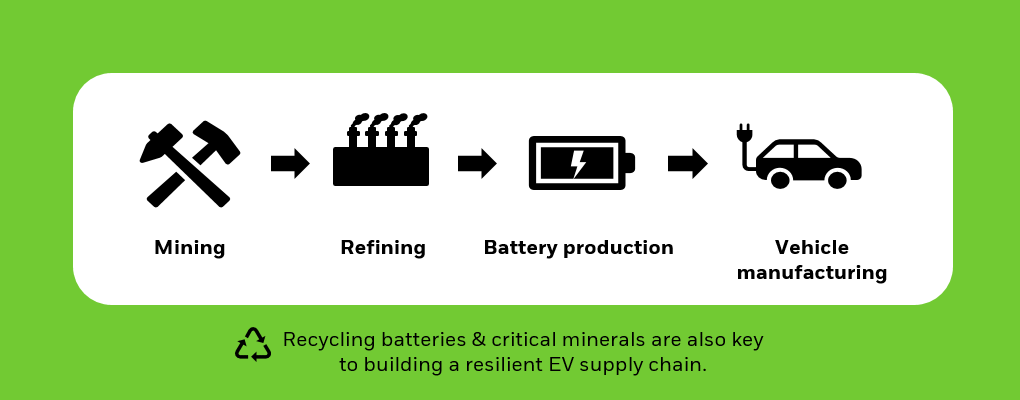

EXPANDING THE EV VALUE CHAIN

The IRA and IIJA are already combining to materially impact the capacity of domestic EV supply chains with new commitments across vehicle manufacturers, mining, and battery production. Many EV car models are backordered for several months, slowing the technology’s adoption despite strong consumer demand.

Efforts to accelerate the buildout of new EV manufacturing capacity in North America are critical to both meeting high demand and securing the supply chain domestically. Currently, the U.S. relies heavily on other countries for many aspects of its supply chain – only 4% of lithium processing, 1% of battery cathode and anode production, and 7% of battery cell manufacturing currently occur in the United States currently.5 Expanding the domestic EV supply chain, illustrated below, is one area where new commitments are taking shape.

Electric vehicle (EV) supply chain

Source: BlackRock (as of December 2022). For Illustrative Purposes only.

Chart description: Illustration depicting the electric vehicle (EV) supply chain. This graphic shows the steps of the EV supply chain from mining to refining to battery production to vehicle manufacturing. It also highlights the importance of recycling batteries and critical minerals as key to building a resilient EV supply chain.

As noted above, the IRA and IIJA include billions to support new materials processing, battery production, and EV manufacturing facilities. In addition, tax credits in the IRA seek to incentivize building out this domestic EV supply chain as well. Only EVs with final assembly in North America are eligible for a $7,500 consumer tax credit, with an estimated 30% of total EVs qualifying,6 and, moving forward, this tax credit is also tied to the sourcing of critical minerals and battery components. A certain percentage of the raw materials used in EV batteries must come from North America or other qualifying countries – starting at 40% in 2023 and climbing to 80% post-2026. EV’s batteries must be manufactured and assembled in North America – starting at 50% in 2023 and increasing annually to 100% in 2028.7

AUTO COMPANIES ARE RESPONDING TO THE IRA BY DEEPENING AMERICAN SUPPLY CHAIN INVESTMENTS

Since the IRA was announced, several companies have announced commitments that expand the domestic EV value chain, including:

Materials Processing

- Piedmont Lithium (PLL) is investing $580 million to establish a lithium processing, refining, and manufacturing facility in Tennessee.8

- Volkswagen (OTCPK:VWAGY, OTCPK:VLKAF, OTCPK:VWAPY), (VW) and Mercedes-Benz (OTCPK:MBGAF, OTCPK:MBGYY) struck a battery materials agreement with Canada, securing access to lithium, cobalt, and nickel.9

Battery manufacturing

- Toyota (TM, OTCPK:TOYOF) boosted its investment in its North Carolina battery manufacturing facility by an additional $2.5 billion.10

- Honda (HMC, OTCPK:HNDAF) and LG Energy Solution announced a joint $4.4 billion venture to produce lithium-ion batteries in the U.S.11

EV manufacturing & assembly

- Ford (F) broke ground on its new $5.6 billion EV assembly plant in Tennessee, its first all-new assembly plant in 53 years.12

- BMW (OTCPK:BMWYY) announced that it will invest $1.7 billion to ramp up EV production in South Carolina, with the goal of producing six fully-electric EV models in the US by 2030.13

EV charging

- ABB Charging (ABB) is investing in a new U.S. EV charging facility in South Carolina, capable of producing 10,000 chargers a year.14

- Lincoln Electric (LECO) announced a new line of fast EV chargers to be produced in Ohio.15

FULL SPEED AHEAD

As policy provides a strong tailwind heading into 2023 and beyond, EVs could be a likely key beneficiary. We believe the IRA and IIJA could serve as a powerful accelerant for EV adoption, which we have long viewed as a compelling megatrend poised for long-term structural growth.

In our view, investors looking to capitalize on a potential period of acceleration in the EV space may want to consider ETFs that invest holistically across the EV value chain.

VIDEO TRANSCRIPT

Jay Jacobs:

Armando, are you in?

Armando Senra:

I’m in.

Jay Jacobs:

Let’s talk EVs.

Armando Senra:

Let’s do it.

Armando Senra:

Okay, Jay, before you talk about EVs, just to level set, I love cars, but normally, they have an engine, they make sound, they have three pedals, and here we are. So tell me more about why you love EVs.

Jay Jacobs:

EVs are the future, and it’s for several good reasons. First of all, these cars are more efficient, they get so much out of the electricity that goes into them, creating a more efficient type of drive. Second, they’re simple, they have less moving parts, which means they can be easier to maintain, and actually a lot of estimates show that electric vehicles are already cheaper on a total lifetime ownership basis than internal combustion engines. And finally, I think something you can appreciate, they’re fast.

Armando Senra:

So I get it, that is the future, but do you see that it’s mostly for early adopters right now?

Jay Jacobs:

That’s the biggest misconception about electric vehicles right now. First of all, we’ve seen a lot more models come out. So it’s not just sports cars, there’s trucks, there’s SUVs, there’s lower price sedans, really providing a product for every type of consumer that’s looking for an electric vehicle. But secondly, we’re seeing a lot more charging infrastructure. So with the Infrastructure Investment and Jobs Act, we expect to see about 10 times more chargers in the United States going forward, which gives people a lot more options when they’re charging up their electric vehicle. And then, finally, we’re seeing prices come down. The Inflation Reduction Act is about to add a $7,500 tax credit for car buyers to reduce the price of the lot. So you combine that together, more models, lower prices, more charging infrastructure, you’re seeing electric vehicles go from kind of that early adopter stage towards going into the mass market.

Armando Senra:

I totally agree that EVs are the future. Tell me, what is the investment case ultimately behind EVs beyond just the car manufacturers?

Jay Jacobs:

It’s about looking at the entire ecosystem of companies that puts a car like this on the road. Right now, we’re sitting on about 4,000 battery cells that are produced by battery producers. There’s dozens of pounds of lithium that go into those batteries produced by lithium miners. There’s several engines produced by parts suppliers, there’s even autonomous vehicle technology that allows this car to drive itself. You put that all together, it’s an entire ecosystem of opportunity in the electric and autonomous vehicle theme.

Armando Senra:

I love that, which is why iShares IDRV ETF makes so much sense, you’re investing across the entire value chain as opposed to just buying the car manufacturer.

Jay Jacobs:

Exactly, IDRV is one of our megatrend ETFs that provides exposure to the entire theme, from those lithium miners to battery producers, to car manufacturers, parts suppliers, even those autonomous vehicle companies, all in one ETF.

Armando Senra:

Great, so can we tell the car to drive us to get coffee? I need coffee.

Jay Jacobs:

Absolutely, let’s go get coffee.

Armando Senra:

Let’s do it.

Narrator:

Visit iShares.com to view a prospectus which includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. Investing involves risk, including possible loss of principal.

© 2023 BlackRock, Inc. All rights reserved.

1 U.S. Department of Transportation, “President Biden, Department of Transportation Releases Toolkit to Help Rural Communities Build Out Electric Vehicle Charging Infrastructure,” February 2, 2022.

2 IEA, Trends in charging infrastructure – Global EV Outlook, 2022.

3 U.S. Department of Transportation, “Historic Step: All Fifty States Plus D.C. and Puerto Rico Greenlit to Move EV Charging Networks Forward, Covering 75,000 Miles of Highway,” as of September 27, 2022.

4 U.S. Senate, “Summary of the Energy Security and Climate Change Investments in the Inflation Reduction Act of 2022,” July 2022.

5 Benchmark Mineral Intelligence and The Times, “Who Owns the Earth? The scramble for minerals turns critical,” Jon Yeomans and Fred Harter, 2022.

6 Forbes.com, “Inflation Reduction Act Benefits: Electric Vehicle Tax Incentives for Consumers and U.S. Automakers,” September 7, 2022.

7 H.R. 5376, Inflation Reduction Act of 2022.

8 TN.gov, “Governor Lee Commissioner McWhorter Announce Piedmont Lithium Inc. to Establish Operations in McMinn County,” September 1, 2022.

9 Reuters, “Volkswagen, Mercedes-Benz team up with Canada in battery materials push,” August 23, 2022.

10 Toyota USA Newsroom, “Toyota Announces $2.5 Billion Expansion of North Carolina Plant with 350 Additional Jobs and BEV Battery Capacity,” August 31, 2022.

11 Hondanews.com, “LG Energy Solution and Honda to Form Joint Venture for EV Battery Production in the U.S.,” August 29, 2022.

12 Bloomberg.com, Ford Breaks Ground on $5.6 Billion Complex for Electric Vehicles and Batteries,” September 23, 2022.

13 BMW Group-werke.com, “BMW Group Announces $1.7 Billion (USD) Investment to Build Electric Vehicles in the U.S. and Signs Agreement with Anvision AESC for the Supply of Battery Cells to Plant Spartanburg, October 19, 2022.

14 ABB, ABB Expands US manufacturing footprint with investment in new EV charger facility, September 14, 2022.

15 Lincoln Electric Holdings, Lincoln Electric Launches a DC Fast Charge Electric Vehicle Charger Initiative, August 29, 2022.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Technologies perceived to displace older technologies or create new markets may not in fact do so. Companies that initially develop a novel technology may not be able to capitalize on the technology.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0123U/S-2659759

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.