FTSE 100 Live: Gains fade with US stocks seen mixed

Proactive Investors –

- up 3 points at 7,638

- BP (LON:) and Shell PLC (LON:) gain as oil price rises

- Superdry mulls more cost cuts

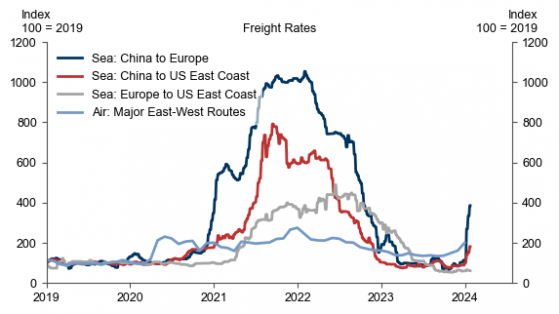

Rising sea freight costs not a threat to inflation – Goldman

Goldman Sachs (NYSE:) has played down the impact on inflation of rising sea freight costs amid disruption to Red Sea shipping.

The investment bank pointed out costs from Asia to Europe have risen by 350% and by 100% from Asia to the US, noting some commentators and investors worry that these cost increases could meaningfully raise global goods inflation.

Source: Bloomberg, Freightos, Goldman Sachs Global Investment Research

Goldman is less concerned for for two reasons.

First, the current increase in shipping costs does not coincide with the widespread factory shutdowns and transfer-driven demand surges that helped send goods inflation soaring in the aftermath of the pandemic, suggesting less scope for amplification of cost pressures today.

Second, international transport costs account for a small share of the price of final consumption goods (around 1.5% on average), with sea freight accounting for an even smaller share (around 0.7%).

Under reasonable pass-through assumptions, a 100% increase in the cost of sea freight therefore only raises core goods inflation by around 0.4pp and overall core inflation by around 0.1pp, it estimated.

The bank estimates higher shipping costs will raise global core inflation by roughly 0.1pp in 2024, with somewhat larger effects in Europe and somewhat smaller effects in the US.

“We therefore see only modest upside inflation pressure from Red Sea shipping disruptions barring a more significant increase in transport costs going forward,”Goldman concluded.

Inchcape explores UK retail sale – Sky

Inchcape PLC (LON:), the London-listed car dealer, is exploring a sale of its UK retail business, according to reports.

Sky News said Inchcape has begun sounding out prospective buyers of its domestic operations in recent weeks.

Bankers at Rothschild have been hired to oversee talks with bidders, in a deal Sky suggested could be worth several hundred million pounds, citing City analysts.

The division consists of 70 sites, employing 3,700 people, and works with car manufacturers including Audi, BMW, Jaguar, Toyota and Volkswagen (ETR:).

Shares are up 1.6%.

Lloyds to scrap mobile bank branches

Lloyds Banking Group PLC (LON:) is shutting down its mobile banking service this year, after it last week revealed plans to shed 1,600 jobs across its branch network.

The banking company has been informing staff and customers of plans to scrap the Lloyds Bank and Bank of Scotland mobile branches in May.

Lloyds runs the service as an alternative to high street branches, with vans visiting towns and cities across the UK.

But the lender said it has decided to end the service because it is being used less by customers.

A spokeswoman said: “Customers have used our mobile branches much less over time and some locations now have as little as two customers using the service.

Nasdaq seen higher ahead of big week of tech earnings

Stocks in New York are expected to post modest gains at the open on Monday ahead of a key week.

In pre-market trading, futures for the were flat, while those for the were up 0.1% and contracts for the rose 0.3%.

Joshua Mahony at Scope Markets said today is “the quiet before the storm, with central banks and corporate earnings expected to make this perhaps the most important week in the first quarter.”

“The ever-reliable tech sector has helped drive much of the upside that took all three US indices into record territory last week, but the time has come to justify those lofty valuations.”

“Between Tuesday and Thursday, we see 22% of the S&P 500 report across just five tech names.”

On Wednesday, the will conclude a two-day meeting and announce its latest decision on monetary policy.

The US central bank is widely expected to but the focus will be on the accompanying language for any hints on the timing of future cuts.

Meanwhile, on Friday, non-farm payrolls data is due while a busy week of earnings sees numbers from tech heavyweights, Microsoft (NASDAQ:), Amazon (NASDAQ:), Alphabet (NASDAQ:), and Meta.