Nomi2626/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on November 10th, 2022

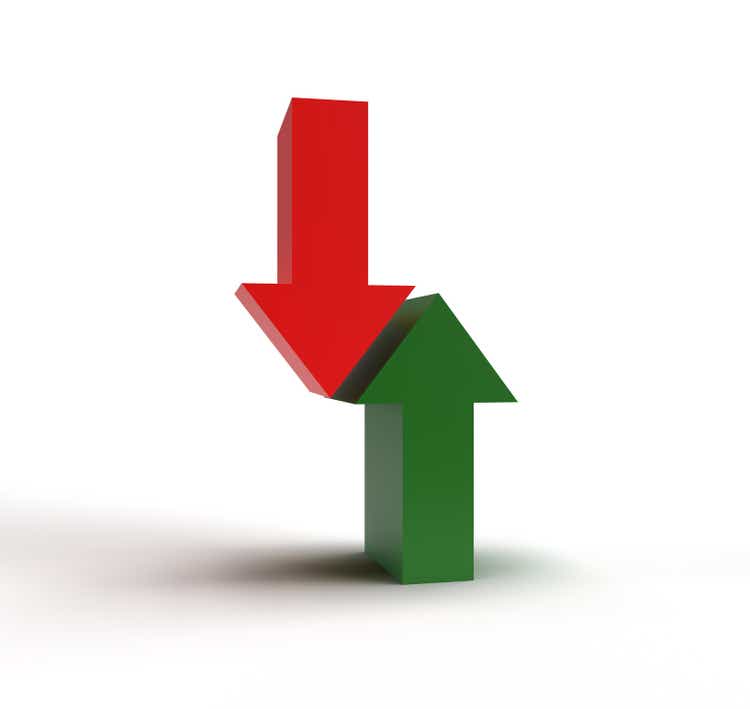

Earlier this year, I suggested that The Gabelli Equity Trust (NYSE:GAB) was trading at too high of a premium and that Liberty All-Star Equity Fund (USA) could be a possible replacement. This was based solely on the valuation difference between these two closed-end funds. Since that post, here is the results on a total share price and total NAV return basis.

Ycharts

What we can see is that GAB’s total NAV return had actually performed much more strongly than USA during this time. Since markets rose rapidly in October, I believe that GAB had some help. The primary help was that they are a leveraged fund and USA operates with no leverage. Despite these results, the premium of GAB had come down, offsetting any of those positive gains on a total share price basis. Albeit, both produced negative total share price returns.

Additionally, the suggested swap played out swiftly over the following months. Then it narrowed again in terms of total return performance before widening out once again in the last month or so. This actually is another example of letting valuation guide your CEF investing and why a swap strategy can generate superior results.

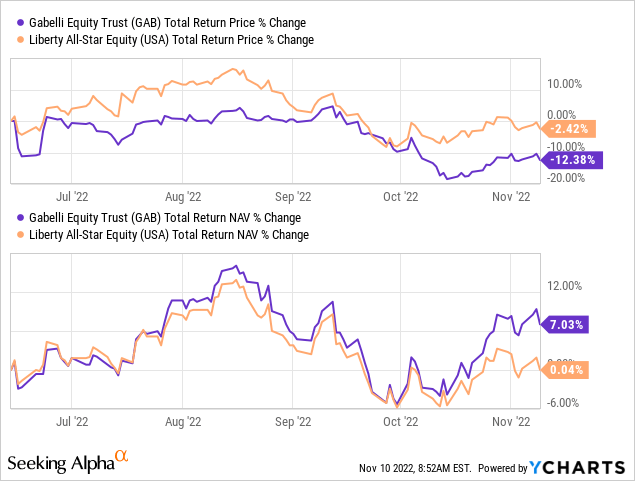

Now that GAB’s premium has come down, this trade has played out and holding either is okay at this point. That being said, both are still trading at slight premiums, which doesn’t necessarily seem warranted when you are getting some pretty plain equity exposure. So, I still can’t apply a “Buy” rating outright.

Ycharts

Of course, the higher distribution rates these funds pay based on their managed distribution plans work much better than something such as the S&P 500 ETF (SPY) for income investors. The overall market declines have also provided more attractive levels for dipping into equities for the long-term too.

As of writing this, the latest inflation data was given, and it showed that inflation was cooling. It is yet to be determined if this is truly a peak and heading lower. Despite that, the markets are rallying strongly, so those light total share price return losses since the prior update could easily turn into gains very soon.

GAB Basics

- 1-Year Z-score: -2.01

- Premium: 5.74%

- Distribution Yield: 11.24%

- Expense Ratio: 1.55%

- Leverage: 22.44%

- Managed Assets: $1.92 billion

- Structure: Perpetual

GAB’s investment objective is “long-term growth of capital, with income as a secondary objective.” That’s the reverse of what we see in a lot of CEFs. Especially considering that the 10% managed distribution plan means that appreciation could be limited. The fund really isn’t constrained on what they can invest in. Though they can invest in high yield and other fixed-income investments, they most heavily invest in equity positions.

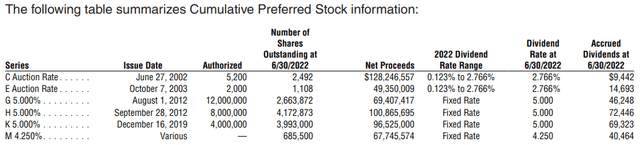

GAB is leveraged but is less sensitive to interest rate increases because they have a considerable amount through fixed-rate preferreds. These fixed rates are more expensive than the auction rate preferred had been. However, with these fixed costs, it also means that higher rates don’t impact the costs of the borrowings. Here is the list of their preferred as of June 30th, 2022.

GAB Preferred Leverage (Gabelli)

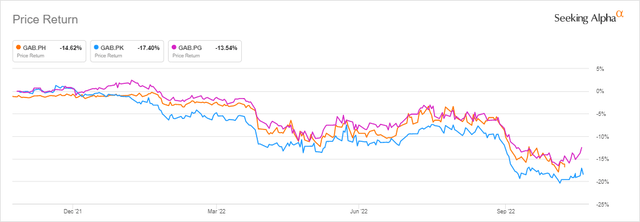

At least for GAB, that isn’t a bad thing. Investors holding these fixed-rate preferreds see lower share prices for these publicly traded preferreds. This can be a negative for them, but if they were happy to buy them at lower yields, then they should presumably be happy to average down at these now higher yields. Below is the one-year price return of these preferreds, showing how they’ve declined as interest rates have risen.

GAB Preferred Price Performance (Seeking Alpha)

Interest rates might not impact them that negatively, relatively speaking. However, any leverage is going to make an investment riskier due to the amplified moves to the downside when the markets slide.

Performance – Long-Term Suggests Discount Possible

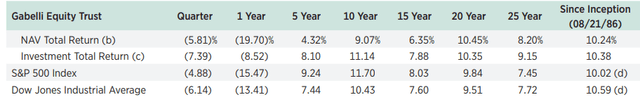

Similar to any equity investment, GAB has put up some really great results over the last decade. They’ve put up results that are similar to the S&P 500 and the Dow Jones Industrial Average over the longer term. Results have been a bit less stellar in the more recent annualized periods.

GAB Annualized Returns (Gabelli)

However, one investing in GAB is likely looking at the distributions the fund can pay out rather than always beating the S&P 500. The fund is also weighted quite differently compared to the S&P 500. That can make it a more diversifier for one’s portfolio if they are overweight tech.

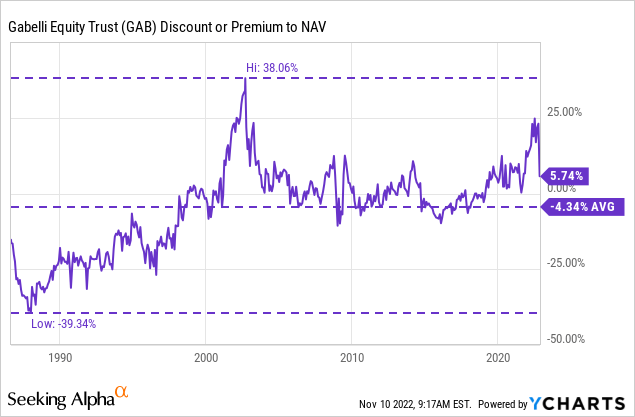

GAB is quite an old closed-end fund, with its inception in 1986. In fact, it is even older than the SPY. If we go back as far as we can, the fund has averaged trading at a discount. Interestingly, the fund from about 2000 to now has traded more often at a premium.

Ycharts

Interest rates in the 90s were higher than they were through most of this period. Perhaps an indication that GAB should be trading at a discount once again. Only time will tell, but it’s why I don’t really feel comfortable buying GAB at a premium.

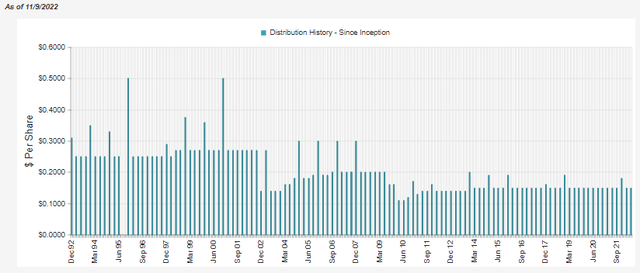

Distribution – Managed Payout

GAB has a managed 10% distribution plan. Essentially, they’ll pay out at least 10% annually, but it isn’t adjusted on a fixed basis (i.e., USA has a 10% managed distribution, but it gets adjusted every quarter to 2.5% of NAV.) Instead, GAB maintains a rate and tops off if it is shy at year-end. Given the rapid decline of the overall market this year, no year-end should be expected.

GAB Distribution History (CEFConnect)

This is because the NAV distribution rate is already sitting at 11.88%. Meaning their obligation of meeting a 10% payout should be met. Due to the slight premium of the fund, the distribution yield for shareholders currently sits at 11.24% if you bought shares at the last closing price.

Since the fund will continue to payout based on its target, the distribution coverage isn’t really important. However, it does dictate if NAV is rising or declining. As an equity fund, the distribution would be expected to be covered via capital gains rather than net investment income only.

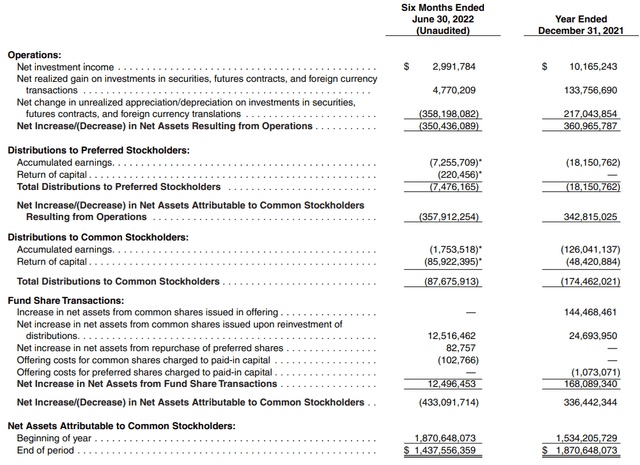

GAB Semi-Annual Report (Gabelli)

GAB doesn’t have any NII left over for common shareholders after the preferred shareholders are paid. This is also fairly common with equity funds that utilize preferred as leverage, so there is nothing shocking to see here. Though interestingly, the fund doesn’t even earn enough NII to cover the preferred. Therefore, they are also dependent on capital gains to cover their payouts too.

As long as markets continue lower, the fund will be forced into paying out its assets. The longer the market downturn, the more damage that can be done. This means that when things do rebound, there become fewer and fewer assets to rebound with.

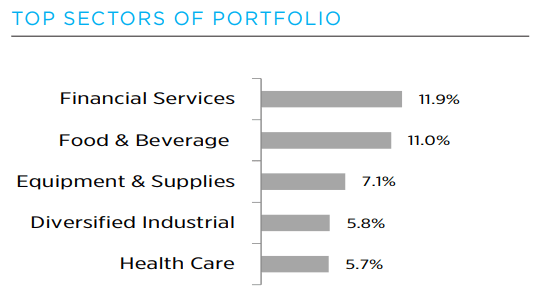

GAB’s Portfolio

One of the strengths of this fund, I believe, is the sector allocation that doesn’t match what the broader markets have. It means less exposure to tech, which can balance out one’s portfolio if one adds GAB. SPY remains ~24% in tech. Of course, I only would if the fund was at a discount. Still, I think this is another strong selling point of the fund besides being attractive for income investors. This was the weighting as of September 30th, 2022.

GAB Sector Exposure (Gabelli)

Here’s a look at the top ten allocations as of the same date above.

GAB Top Ten (Gabelli)

Swedish Match (OTCPK:SWMAY), an OTC trading position in the U.S., remains the largest position of this fund. OTC stocks can potentially mean greater risks for an investor. However, they are a large Swedish (who would have guessed?) tobacco operation.

Gabelli really has a thing for SWMAY, as it is even included as the largest position in the manager’s utility fund, Gabelli Global Utility & Income Fund (GLU). That being said, it looks like this bet paid off, as Philip Morris (PM) is working to acquire the company. We earlier touched on that in our last Gabelli Dividend & Income Trust (GDV) update. Since then, PM has been pressured to raise the bid for the company. This is exactly what happened last month.

On a side note, GDV remains a viable alternative to GAB for those looking for a discount Gabelli fund. However, the fund’s distribution isn’t a managed 10% plan that GAB utilizes.

Conclusion

GAB’s premium has come down, and the trade between GAB and USA has essentially played out. Investors who sidestepped this elevated premium could feel more comfortable stepping back into GAB shares. That being said, over the longer term, it has been known to trade at a discount. Since we continue to see a premium, I still couldn’t see it as a “Buy,” but we are seeing a much more comfortable level relative to where it was just a month ago.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.