By Jeff Prestridge, Financial Mail on Sunday

21:51 13 May 2023, updated 21:51 13 May 2023

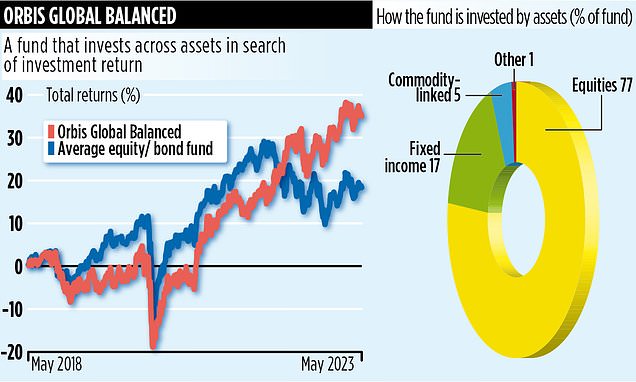

Investment fund Orbis Global Balanced scours the world in search of investment opportunities. Be it bonds, equities or commodities, the £146 million fund will hold them if investment manager Alec Cutler is convinced he can generate a positive return.

Cutler’s willingness to be flexible stands the fund out from the raft of similar mixed asset vehicles that invest a majority of their portfolios in equities – and the rest in bonds, typically on a strict 60:40 basis.

It also works in terms of overall performance numbers. Over the past one, three and five years, the fund has delivered positive returns for investors, generating respective gains of 7, 51 and 34 per cent. These numbers are all superior to the average returns recorded by its peer group over the same time periods.

‘I don’t want to run a fund that operates successfully in one environment, but not in another,’ says Cutler. ‘It needs to survive and succeed across different market conditions and time periods. That means the ability to hold no fixed income bonds when needs must. It also means holding a lot of them when the time is right. Flexibility is the name of the game. Every stock, every security we hold, must compete for space in the portfolio.’

The fund has 114 holdings with equities comprising the biggest component by asset class. Cutler’s view on markets is simple – he thinks US equities remain too expensive while the UK, Japanese, European, Korean and Australian markets all look attractive. China and Taiwan are cheap, but risky because of geopolitical issues.

‘Many UK stocks are crazy cheap,’ says Carter. ‘You Brits seem to hate British companies. Take Balfour. It’s one of the best construction companies in the world. If it was listed in the US, it would be worth twice its current stock market value.’

Other key UK stakes include professional services company Burford Capital (the fund’s biggest UK holding); power generator Drax; engineering giant Rolls-Royce; and floor covering specialist Headlam.

Related Articles

HOW THIS IS MONEY CAN HELP

The fund has exposure to financial stocks, but Cutler does not hold any US banks. He believes there are far too many, all vulnerable to sudden cash outflows, potentially destabilising their businesses.

He also argues that the widespread shorting of US banks by hedge funds – buying shares in the hope of them falling – should be curbed. ‘It can cause a death spiral for those banks targeted,’ he says.

The fund’s exposure to banks includes holdings in Bank of Ireland and South Korean bank KB Financial. ‘The hiatus caused by the fall of Silicon Valley Bank in the United States meant some bank shares elsewhere in the world got sold off,’ says Cutler. ‘We managed to buy them on the cheap.’

Among the fund’s top holdings are a stake in gold mining company Barrick and an investment fund whose performance is linked to the price of gold. The fund’s ballast is provided by exposure to US Treasury Inflation-Protected Securities (TIPS). ‘These provide a real return above inflation and set a good bar for the rest of the fund,’ he says.

Cutler works out of Bermuda, but Orbis – founded in 1989 – has offices across the world, including London, and runs assets totalling £27 billion. The investment strategy employed on the fund is also used to manage portfolios for institutional clients. Sister funds, Orbis Global Equity and Global Cautious, are respectively higher and lower risk, but have so far recorded inferior returns.

Orbis is one of the few investment houses to still charge performance fees. If it underperforms, it refunds a slice of them to investors.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.