Welcome to the investing.com UK weekly update, designed to keep investors informed on the latest market movements and key developments. In this concise report, you’ll find a summary of the last week’s significant news, and trends affecting the index, helping you stay ahead with timely insights for your investment decisions.

We update every Friday as soon as the London Stock Exchange (LSE) market closes at 4:30pm UK local time (GMT+1).

FTSE 100 Share Price Opening 28th May 2024

The opening share price for this week (opening after the Monday Bank Holiday), Tuesday 28th May, was 8,317.59, which sat 0.26% lower than at open on Friday 24th May, indicating that the FTSE has some ground to try and make up for the week ahead.

Investor Sentiment This Week For The FTSE 100

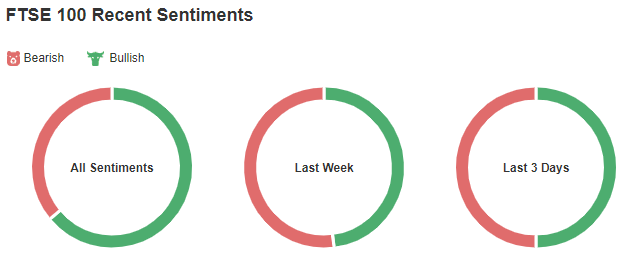

Investor sentiment for this week has proved overall bearish as news of the UK general election looms. Polls, however, have been consistently unanimous with little volatility to suggest sudden swings of sentiment change. Recently, the British Retail Consortium also found that shop price annual inflation softened to 0.6% in May, down from 0.8% in April and the lowest since November 2021. So why the caution?

Investors may be feeling the pinch thanks to seeing the equities retreat in the U.S. stock market, coupled with heavy headline news for a number of FTSE 100 darlings. Of course, this week’s drops put the FTSE 100 back into May-start territory and it’s important to remember that the index is still 6.671% up so far this year. Long-term investors are keeping an eye on the index and snapping up the value arbitrage wherever they can.

Want to know whether specific FTSE 100 stocks fit your investment strategy? Use InvestingPro and win on your decisions. Sign up TODAY for less than £9 per month and get up to 40% off your 1-year plan!

We can see that the investing.com UK community’s sentiment towards the FTSE 100 index has also become more bearish over the last week compared to May as a whole. Could this indicate the start of summer pessimism, or simply a short-term loss of hope for a reversal of recent drops?

Notable Movements & News

Severn Trent (SVT)

The Severn Trent PLC (LON:) water utility company is still being rocked by multiple sewerage scandals, continuing its rapid downward trend which started back on May 22nd. Analysts are now considering this once-dividend-darling (still sitting at a hefty 4.9% despite its large debt burden) stock a Strong Sell.

Royal Mail (International Distribution Services) (IDSI)

The £3.5 billion Royal Mail (International Distributions Services PLC (LON:))) takeover bid from Czech billionaire Daniel Kretinsky has sparked various reactions. IDS has indicated it is “minded” to accept the offer, describing it as fair and reflective of the company’s value. However, the proposal is subject to political and public scrutiny. Chancellor Jeremy Hunt and other officials have expressed concerns, emphasizing the need for safeguards to protect Royal Mail’s role as a critical part of the UK’s national infrastructure.

National Grid (NG)

After the National Grid PLC (LON:) ex-rights announcement this time last week, NG have continued to topple, with some analysts (including Mark Freshney from UBS) suggesting the key is the dividend cut and dividend preference theory, “as the shareholder base has refocused on SOTP/growth rather than yield.”

Ocado (OCDO) and St James’s Place (STJ)

Both Ocado Group PLC (LON:) and St. James’s Place PLC (BS:) look to be losing their place in the FTSE 100 during the quarterly rebalancing that takes place next week. Index organiser FTSE Russell said Darktrace PLC (LON:) and Vistry Group PLC (LON:) will replace them in the blue-chip index. Any confirmed changes as a result of the rebalance will be announced after market close on Wednesday 5th June 2024.

Today’s FTSE 100 Close

The above investor sentiment and factors driving this week’s Footsie volatility meant that today the FTSE 100 closed at 8,271.88, which sits lower than the weekly opening price of 8,317.59.

Best FTSE 100 Shares To Buy

In 2024 alone, ProPicks’ AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That’s an impressive track record.

Explore various wealth-building strategies and use our comprehensive stock screener to see the top FTSE 100 companies to add to your watchlist today.