(Bloomberg) — France’s next government will need to find more than €15 billion ($16.2 billion) in extra revenue or savings a year to meet European Union demands, according to people with knowledge of the assessment.

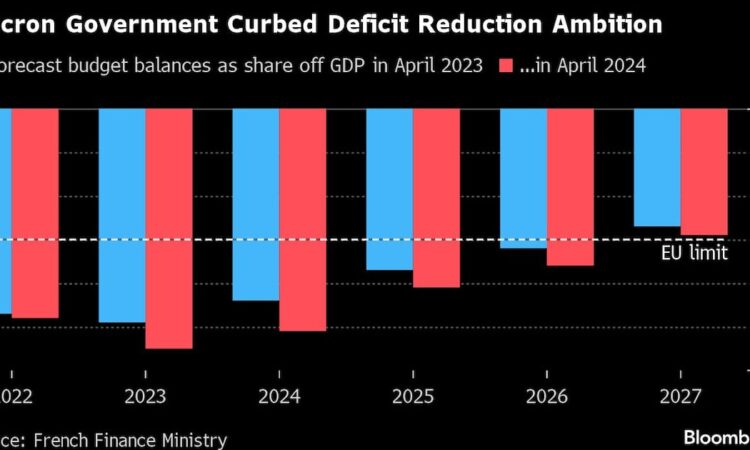

With current Finance Minister Bruno Le Maire vowing to leave the public finances on a steady course when he leaves office, the tally provides a glimpse of the challenge faced by President Emmanuel Macron in getting a coalition government together whose likely constituent parties all want higher spending.

The total was included in a proposal that the European Commission sent to Paris last month, said the people, who declined to be identified because discussions on the matter are confidential. The adjustment equates to around 0.55% of annual gross domestic product over seven years.

The opening gambit from Brussels will form the basis of tough negotiations with a prospective French government that has yet to be formed. The country was one of several EU members rebuked in June for breaching the bloc’s fiscal rules, and is now subject to a monitoring regime that could lead to potential sanctions.

Agreeing any spending cuts in France will be a tall order after Macron’s snap elections. A left-wing alliance won the vote but didn’t clinch a majority of lawmakers, and the result is a hung parliament riven by divisions on budget policy.

The outgoing government in Paris has committed to an emergency steps to pare spending this year, and Le Maire outlined details of a further €10 billion in savings on Thursday.

Parties in position to form the next administration have pledged huge increases in expenditure and could cancel any of those measures. Even the hastily assembled manifesto of Macron’s own group would add around €21 billion a year to the deficit, according to analysis from think tank Institut Montaigne.

Speaking on Thursday, Le Maire said the next government must abide by the EU’s new fiscal rules to ensure its international credibility. That means sticking “rigorously” to an existing long-term plan that foresees adjustments of 0.8% of GDP this year, 1.2% in 2025 and 0.5% and 0.7% in the following two years.

“Either we continue with savings and repairing public finances, or we massively increase taxes on French people,” Le Maire said. “It’s the only alternative, failing which we would expose ourselves to a very strong market reaction.”

The minister will be in Brussels next week, when the EU’s Excessive Deficit Procedure will be examined, a finance ministry official said.

Le Maire said France is requesting a longer horizon to get its budget deficit under control, seeking an extension from four years to seven — though that doesn’t change the current plan to reach the 3% ceiling by 2027.

The €15 billion tally for the required so-called primary structural adjustment is part of negotiations for France to get more time, the people said. France’s gridlock is complicating discussions on reforms and investments that would accompany that longer outlook, the people added.

Measures that could reduce spending include a reform of the unemployment insurance system that was due to be implemented. However, on the night of the first round of the legislative elections, the prime minister suspended the implementation of the changes. Le Maire acknowledged that the jobless benefit change was a condition for leniency from Brussels.

Without an extension of the time horizon, the country would have to pare back plans more drastically. The adjustment needed should be 0.94% of GDP in a four-year scenario, and 0.54% over seven years, according to estimates by Bruegel, a Brussels think-tank.

PIMCO Europe Sovereign Credit Analyst Nicola Mai told Bloomberg Television on Wednesday that he reckoned any administration that gets formed in Paris will ultimately play ball.

“We’re going to have a weak government — a minority government,” he said. “Whoever is in government is probably going to broadly meet the commission’s demands when it comes to the deficits.”

The recommendations to countries made last month are intended to guide them as they prepare to send medium-term fiscal plans to Brussels by Sept. 20 under the EU’s newly revamped fiscal rules.

Those plans then get scrutinized by officials and the bloc’s finance ministers, serving as a basis for annual budgets that countries must then submit by mid-October.

France’s Timetable

A member state and the commission may agree to extend the September submission deadline by a reasonable period, a commission spokesperson said. But failing to deliver on that would prompt the bloc’s finance ministers, on a proposal from the commission, to recommend that the submission sent by Brussels in June should fully apply, the spokesperson added.

For bond investors, France’s fiscal trajectory is crucial at a time when its debt already exceeds 110% of GDP and keeps rising.

The extra yield investors demand to buy French bonds compared to safer German equivalents has already shot up as the market balks at that prospect. The spread is now hovering at 65 basis points, well above an average of around 40 basis points over the past five years.

While financial markets have granted France a “summer lull,” pressure from investors may mount before scheduled reports by ratings companies later this year, Barclays Bank Head of Economics Research Christian Keller told Bloomberg TV.

“France needs to do something, and they need to do the opposite of what most of the parties seem to be suggesting right now,” he said. “Over time there will be pressure on French spreads, further from where we are now.”

–With assistance from Kriti Gupta, Tom Mackenzie, Lizzy Burden, Francine Lacqua, William Horobin and Constantine Courcoulas.

(Updates with Le Maire starting in second paragraph)

©2024 Bloomberg L.P.