(Bloomberg) — The UK defied a decline in foreign direct investment across Europe last year, in a welcome vote of confidence for Prime Minister Rishi Sunak’s economic program.

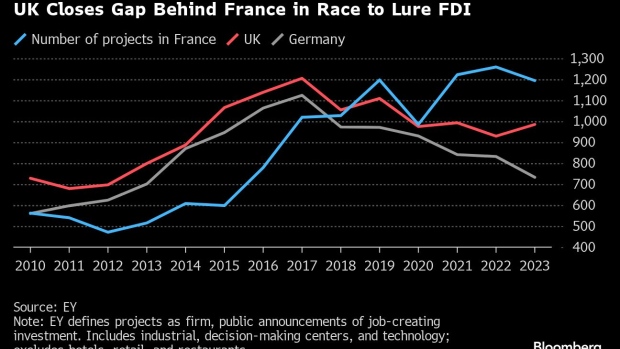

The number of new FDI projects in the UK grew 6% to 985 in 2023, placing the country second in the league table behind France, according to an annual attractiveness survey by consultancy firm EY published Thursday. Investment in both France and Germany dropped.

Across the 44 European countries covered, foreign investment stalled – with 4% fewer projects than in 2022. The figure was down 14% from the 2017 peak and the total jobs created as a result of FDI declined 7% to 319,923.

“Europe is in urgent need of foreign investment and this survey should serve as a wake-up call right across the continent,” said Julie Linn Teigland, EY area managing partner. “Urgent action must be taken now to help ensure Europe remains competitive in the face of increasingly stiff competition from the US and China.”

Money spent by global investors on greenfield projects or expansion plans is seen as a key measure of competitiveness in Europe, where the UK had historically led the way. Since overtaking the UK in 2019, the French government has repeatedly cited EY’s ranking as evidence that President Emmanuel Macron’s sometimes unpopular pro-business reforms are paying dividends

Even as the number of projects in France declined last year, keeping the top spot will give his government a boost at a time when weak economic growth has pushed up unemployment and undermined Macron’s fiscal policy.

“France is the leading economy in Europe,” Finance Minister Bruno Le Maire said. “The stability of our supply side policies is universally saluted by investors — we won’t deviate from it.”

The UK bounced back after a decline in 2022, a year in which it went through three prime ministers and Sunak’s predecessor caused a bond market meltdown by announcing huge tax giveaways at a time of rampant inflation. Now, executives report a cautious sense of optimism as the economy emerges from recession, inflation subsides and living standards improve.

Last year, there was a sharp increase in software and IT investment in London, which overtook Paris as the Europe’s top investment region.

“After a 2022 marked by political uncertainty, high inflation and rising energy prices, investors perceived something of a return to stability to UK markets last year,” EY said.

The verdict will be seized on by Sunak’s Tories, who have trailed the Labour opposition in national opinion polls for months and are braced for losses in local elections on Thursday. How well Sunak does in the council votes could prove critical for his premiership, with some in the party reported to be waiting for a moment to launch a leadership change ahead of a general election expected this year.

“These results are proof that our plan to pursue a relentlessly pro-investment agenda is paying off,” said Dominic Johnson, minister for investment in the Department for Business and Trade. Investments including Jaguar Land Rover owner Tata Group’s £4 billion ($5 billion) commitment to an electric-vehicle battery factory in Somerset are “sending a clear message that the UK is open for business,” he added.

Germany, the worst-performing economy in the Group of Seven, ranked third as it saw a 12% decline in the number of projects. EY said industrial investors have been deterred by the recessionary environment, high energy prices and supply risks.

Together, the UK, France and Germany account for about half of all investment projects into Europe.

The report blamed slow economic growth, spiraling inflation, soaring energy prices and a “febrile geopolitical environment” for causing the first downturn in European FDI since 2020.

Investment in France fell by 5% to 1,194 projects and by 12% in Germany to 733. France saw an improvement in value, though, with the number of jobs created by FDI rising by 4%. EY said the improvement reflected “business-friendly reforms and a comparatively healthy economy relative to other European countries.”

Companies surveyed by EY said they were concerned by regulatory burdens, volatile energy prices and political instability in Europe, warning that new rules on artificial intelligence, sustainability and data protection “could stifle business growth.”

The UK shifted its focus a few years ago from the number of greenfield projects, as captured by EY’s survey, to overall value. Separate figures on value published annually by the Financial Times FDI markets database found that in 2022 the UK attracted £79 billion of greenfield investment compared with £27 billion in Germany and £17 billion in France.

©2024 Bloomberg L.P.