(Bloomberg) — The prospect of far-right parties impeding European Union efforts to fill an annual €500 billion ($538 billion) investment gap makes the pooling of capital markets even more imperative, according to Scope Ratings.

In the wake of political upheaval sparked by the bloc’s elections earlier this week, the credit-assessment company said that the region’s ambitions to bolster security while improving its competitiveness now face additional hurdles.

“The growing influence of far-right parties in the European Parliament and in national parliaments of member states will pose a challenge to fulfilling the investment task confronting the European Commission over the next five years,” analysts Eiko Sievert and Tom Giudice wrote in a report released on Wednesday.

With snap parliamentary elections looming in France after the victory of Marine Le Pen’s National Rally on Sunday, investors are refocusing on fiscal risk in the region. The Scope study however looks at the less immediate consequences at a time when the bloc’s officials are starting to confront wider longer-term challenges.

“Additional public funds are needed to narrow the EU’s large investment gap of around €500 billion a year,” the analysts wrote. “Closing the gap will require both public and private investment, including large-scale public-private partnerships, future common EU debt issuance, and direct private capital mobilization.”

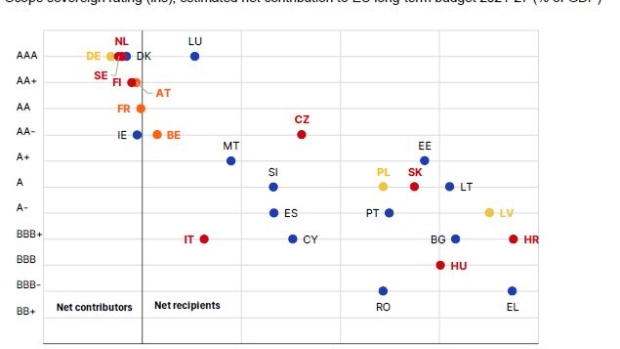

With five members of the bloc — Greece, Italy, France, Belgium and Spain — still nursing piles of borrowings exceeding 100% of gross domestic product, Scope warns that the need for fiscal repair may lead to lower public investment.

“Faster progress of the capital markets union will therefore be a key priority,” the analysts wrote. “Given the fiscal and political constraints for additional EU-wide and domestic public investments, we anticipate accelerated efforts to enhance the CMU. This is needed to narrow the EU’s investment gap, as most financing will need to come from the private sector.”

©2024 Bloomberg L.P.