(Bloomberg) — European Union ambitions to dramatically increase nuclear power are in need of an economic-reality check, according to financial-watchdog data which shows that a yawning investment gap will put climate goals increasingly at risk.

As rising temperatures blow past records, more nations are lining up behind climate-friendly atomic energy to mitigate global warming. Nuclear advocates estimate some $5 trillion of investment should be directed toward the technology globally, with more than $250 billion likely needed in the EU.

Those eye-watering levels of investment are poised to face financing hurdles that capital markets are unable to resolve, researchers at Brussels-based think tank Finance Watch wrote this week. High EU debt, fiscal constraints and doubts about future electricity-market structure are combining to create a gulf in funding, according to report author Thierry Philipponnat.

“Radical uncertainty is at the heart of the question for the nuclear industry,” Philipponnat said late Tuesday in an interview. “So many unknowns make it difficult to discount future cash flows.”

Even as taxpayers across western countries warm to nuclear energy as an around-the-clock power source to complement intermittent solar and wind generation, investors have balked at the scale of funding. Neither banks nor private equity say they’re willing to assume the full scale of construction risk of plants that have tended in recent decades to come in billions of dollars over budget and years late.

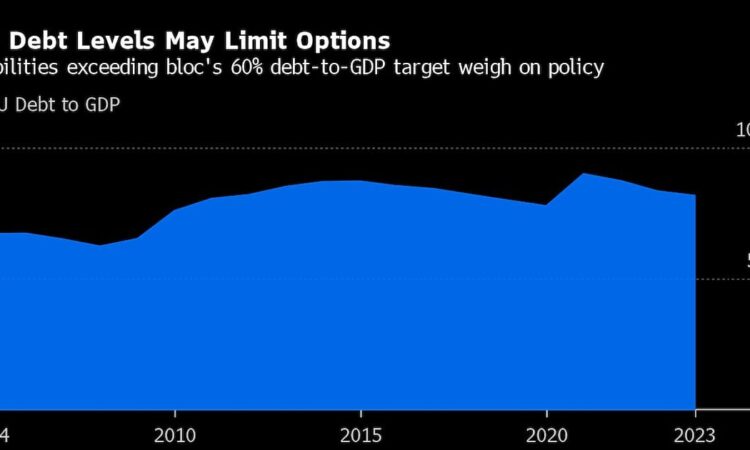

China and Russia, the two countries building the most new reactors worldwide, rely on state financing to support those projects. But that subsidy model is unlikely to work in the EU, where nations have already blown past fiscal constraints set out by the Maastricht Treaty, designed to limit national debt at 60% of gross domestic product.

“At these levels of investment, you risk exploding all the tolerable limits on budget deficits,” Philipponnat said. ”The magnitude of what we are talking about defies all the traditional rules.”

The funding gap means the EU nuclear industry will struggle to meet a target of increasing capacity 50% without reforming fiscal rules. The Finance Watch report recommends as a first step that the European Commission recognize the risk of significant underinvestment and quantify the shortfall. Policymakers also need to make European capital markets more efficient.

“Public money will never be enough if the rules currently governing it are not reformed,” the report’s authors wrote.

©2024 Bloomberg L.P.