(Bloomberg) — China is losing its luster as a top country to invest in as firms seek to avoid geopolitical risks and turn to Southeast Asia and Europe, according to a survey by the European Union Chamber of Commerce in China.

Most Read from Bloomberg

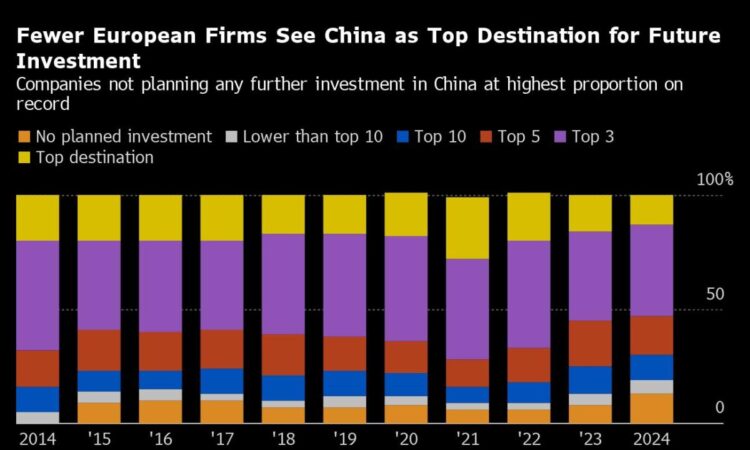

Only 13% of firms surveyed earlier this year saw the country as a top destination for investments, the lowest level since record began in 2010 and down from 27% in 2021. Companies were more optimistic about growth in China then, but now they were shifting investments increasingly to mitigate the impact of “decoupling” between China and other countries as well as to find opportunities elsewhere, according to the survey released Friday.

The gloomy responses highlight China’s fading appeal to foreign firms despite President Xi Jinping’s pledge in November to take more “heart-warming” measures to ease access to the world’s second-largest economy. The worsening sentiment is especially alarming as it reflects a view on the country with the pandemic largely out of the picture, suggesting the challenges are long-term.

“What we see now is that this perception of the issues in the domestic economy are now beginning to take on a more permanent character,” Jens Eskelund, president of the business chamber, said at a press briefing on Thursday. “That means companies are beginning to adjust their expectations.”

Over two thirds of respondents said doing business in China became more difficult in 2023, the highest proportion since the question was first asked in 2014. The construction sector reported particularly challenging conditions, saying the playing field is tilted more in favor of domestic competitors as building activity slowed amid China’s real estate crisis.

A host of foreign leaders from German Chancellor Olaf Scholz to the US Treasury Secretary Janet Yellen have complained in recent weeks to Beijing about the unequal treatment of overseas firms operating in the country.

The EU and the US have ramped up a campaign against China’s trade and economic practices, taking issue in particular with what they say are China’s industrial overcapacity and attempt to revive growth by flooding global markets with cheap products, including electric vehicles and steel.

Read More: EU Says Ready to Use All Trade Tools to Defend Against China

Echoing those concerns, over a third of EU firms in China say they see overcapacity across industries, with the issue most pronounced in construction and automotive sectors. They chalk it up to over-investment in domestic production capacity and a lack of demand inside China, saying the excess is depressing prices and raising competitive pressure in the country.

European leaders have threatened new tariffs on electric cars imported from China, accusing Beijing of providing illegal financial support for the industry. European Commission President Ursula von der Leyen this week said the bloc is prepared to deploy all the tools available to defend its economies after a meeting with Xi in Paris.

China has rejected the claims saying its industry is competitive due to innovation, not government subsidies.

Read More: China’s Factory Glut Alarms the World But There’s No Quick Fix

Ambiguous rules and an unpredictable legal environment remain top regulatory obstacles, according to the survey. Financial services firms saw data-related laws as a top concern, though the survey was conducted in January and February before China walked back new rules governing cross-border data flows.

Concerns over China’s slowdown intensified in 2024, with 55% of respondents ranking it among their top three business challenges compared to just 36% the year before. Over half of the companies surveyed plan to cut costs, with one in four of those firms looking to do so by reducing headcount.

Only 42% said they plan to expand their operations in the country in 2024, the lowest since record began in 2012. These measures risk further compounding the country’s economic woes, the chamber said.

As China’s appeal as an investment destination fades for European firms, the Association of Southeast Asian Nations has emerged as the main beneficiary of the redirected money, followed by Europe, India and North America, according to the survey.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.