The United States and the European Union (EU) are aligned on the security risks of an unstable semiconductor supply chain—and yet they risk fighting over how to repair it.

Both Washington and Brussels fear that Chinese chips in Western electronics could be used for surveillance and intelligence gathering. Both have launched expensive public-funded programs to build up their own industries. At the transatlantic Trade and Technology Council (TTC), a key focus is to ensure these semiconductor support programs are complimentary, not competitive. The TTC is also developing “an early warning system to address and mitigate semiconductor supply chain disruptions.”

While it is hard to justify state intervention in most areas of a free market economy, the desire to mitigate security risks justifies extraordinary government intervention. Semiconductors drive the essential tools of contemporary life, from smartphones to automobiles. They are crucial to military prowess, guiding missiles, controlling jets, and running secure communications systems. While the industry is cyclical, demand is expected to boom in the coming decade. The global semiconductor market exceeded $500bn in sales in 2022 and is expected to expand into a trillion-dollar industry by 2030, according to a recent McKinsey & Company report.

During the COVID-19 pandemic, a shortage of chips wreaked havoc on entire industries, causing deep economic pain and generating geopolitical tensions. In response, the United States, the EU, and China have unveiled ambitious public-funded programs to strengthen their chip industries.

Even so, the EU and US projects entail big risks. The European and US timelines differ: The United States already has approved its chips plan, while the EU continues to debate its legislative proposal. Despite their avowed aim of avoiding duplication, critics fear an inevitable overlap. The giant European and US state-funded subsidy programs could end up spent on white elephant chip-manufacturing facilities, producing a global glut. Signs of a short-term chips glut are already becoming evident.

It would be preferable to use public funds to build up capabilities on “choke points” in the chip development and manufacturing process. The EU should concentrate on its competitive advantage in optics and chemicals. The United States should emphasize its unparalleled design and software capabilities.

Security Risks

The COVID-19 pandemic has highlighted the semiconductor supply chain’s bottleneck-prone nature. With demand soaring for physical goods and foundries shut, global shortages spread, causing economic havoc. Automaking, which depends on advanced electronics, is estimated to have lost the production of almost eight million cars in 2021. Popular products, including the latest Sony PlayStation, became scarce. Beyond generating gaps in consumer products, chip shortages produced security fears, which became accentuated after the Ukraine war depleted Western arsenals.

The Javelin anti-tank weapon, for example, which has proved crucial in Ukraine’s resistance to the Russian invasion, requires at least 250 chips. Ukraine requested hundreds of Javelin systems per day at the outset of the war, but US companies struggled to procure the semiconductors needed to meet the demand.

Modern militaries must replace their stockpiles of semiconductor-intensive munitions. To prepare for a potential conflict with China, experts have called for the US military to build up its stockpiles and help countries like Taiwan do the same. These recommendations require a smoothly functioning, resilient semiconductor supply chain.

While many of the most advanced chips are designed in the United States, the EU is strong in the imaging technologies required to miniaturize silicon, and Asia dominates manufacturing. Taiwan produces 65% of the world’s semiconductors, while smaller percentages are produced in South Korea, Japan, the United States, and the Netherlands. China produced 5.5% of the world’s semiconductors in 2021.

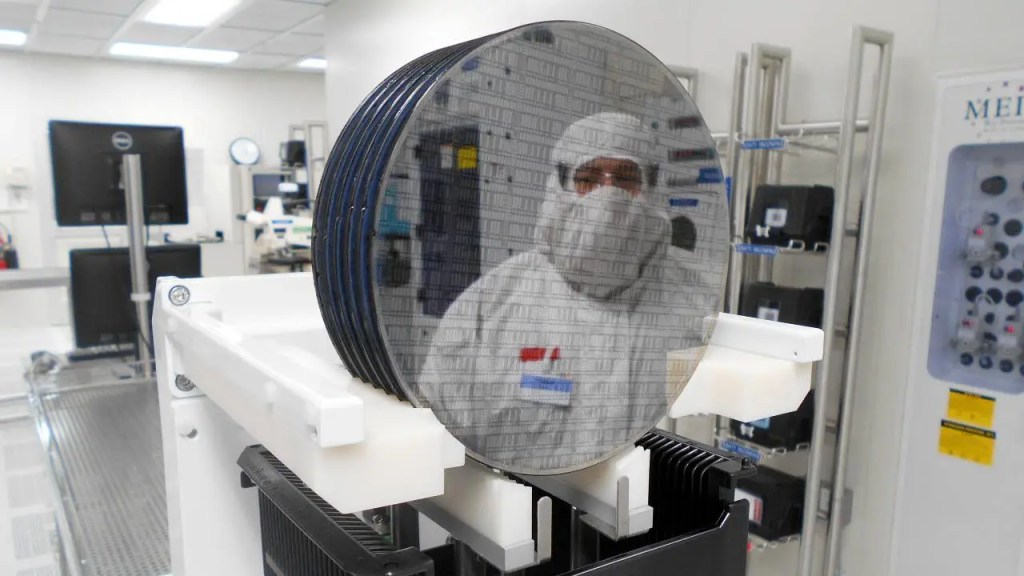

Taiwan’s undisputed leadership in advanced chipmaking provokes particular concern. In semiconductors below 10 nanometers—the leading-edge versions of the technology—Taiwan holds more than 90% of the global market share. This dominance introduces several supply chains risks: The island is located just off the coast of China, which claims sovereignty. A Chinese naval blockade of the island, or an outright invasion, would immediately cut off supply of nearly all current production SoCs (System on Chips) designed by the likes of Qualcomm, Broadcom, and Nvidia and supplied by them to Apple, Samsung, Dell, HP, etc. Beyond geopolitics, recent droughts in Taiwan have impacted manufacturing (chip fabrication requires significant amounts of water) and the island is subject to destructive earthquakes. Both the United States and the EU have “zero fabrication capacity for leading-edge logic chips (5 nanometers and below).”

The chip industry is capital intensive. It costs billions of dollars or euros to build a modern foundry. Since the start of the century, the number of firms able to offer the most modern technology has fallen from nearly 30 at the turn of the century to just two, Taiwan’s TSMC and South Korea’s Samsung.

Beyond these risks, both the United States and the EU have identified China’s growing semiconductor capabilities as a strategic threat. China is building a competitive semiconductor industry, using extensive state subsidies, intellectual property (IP) theft, and forced labor, they say. US and EU law enforcement and intelligence agencies have voiced concern about the ability of Chinese electronics companies to surveil and gather sensitive data.

Chinese electronics companies, including some which are state-owned, have also sought to purchase or invest in several microelectronic companies, including in the EU and United Kingdom. In late 2022, the German government halted the sale of a semiconductor factory to a Swedish subsidiary of a Chinese electronics company. In the UK, the government mandated the unwinding of the sale of a Welsh company to a Chinese one. Yet Chinese companies remain present in the EU technology space—Huawei, the large Chinese telecommunications firm, has continually pushed for more “partnerships” with EU technology companies.

US and EU Chip Proposals

Both the United States and the EU are gearing up to spend large amounts of public funds to boost domestic semiconductor production. Success is far from certain. The Western efforts are late. China, Taiwan, and South Korea all have provided significant subsidies for years to their semiconductor industries.

The US CHIPS and Science Act

US President Joe Biden signed the Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS and Science Act) into law on August 9, 2022. The act ensures $280bn in spending over the coming decade. Of that amount, $200bn is slated for research and development (R&D) and commercialization. Another $52.7bn is targeted at semiconductor manufacturing, with $24bn worth of tax credits for chip production. A final $3bn is slated for programs aimed at leading-edge technology and wireless supply chains.

A considerable amount of the funding will give tax incentives to build new chip-manufacturing facilities in the United States, which are planned to be built or expanded in Ohio, New York, and Texas. Additional resources are allocated to boost research, with smaller grants going to improve supply chain security abroad. The legislation subsidizes developers of telecommunications technology with an important condition—recipients of the federal money must not use advanced Chinese chips.

The United States has made security a focus of its chip plans. Both the 2019 and 2021 National Defense Authorization Acts (NDAAs) included steps to boost US chip manufacturing and secure supply chains of semiconductors designed for military use. Chips used for military applications must be more resilient—able to withstand high altitudes and extreme environments—than ones designed for consumer goods. In the 2019 NDAA, a pilot program was introduced to determine the authenticity and security of microelectronic parts in weapons systems. The 2021 NDAA created new incentive programs to boost domestic manufacturing, as well as a new federal center for research and workforce training.

The US government will still struggle to manage chip inventories. The government can only convene the private sector to distribute timely information on supply chain threats and bottlenecks—and set long-term incentives to ease them. The burden of managing chip inventories largely remains on the private sector.

The European Chips Act

In 2022, the European Commission proposed a significant overhaul of its semiconductor industry. The European Chips Act would pump €43bn ($46.58 bn) into research and manufacturing for European chip designers and manufacturers. It aims to double the EU’s share of the global semiconductor market from less than 10% today to 20% by 2030.

While most European officials agree on the importance of chips funding, the European Parliament and EU governments still must approve. At the time of writing, the EU had not agreed on how it will raise funds for its Chips Act. European spending looks set to be much lower than US spending. The South Korean government’s predicted spending on chips of $400bn through 2030 will dwarf planned European investments of between €20bn and €30bn ($21.67-$32.5 bn) by 2030.

Additional disagreements exist on how the European funds should be spent. Most could end up going to Asian and US firms and, indeed, Intel is slated to receive large dollops of German and EU funding to build a foundry outside Berlin. The plan could increase tensions between EU members. Since funding for these subsidies comes from national budgets, the richest member, Germany, could outspend others, as evidenced by the first large, planned investment linked to the Chips Act — Intel’s Magdeburg foundry. Poorer or smaller EU members could be left behind.

Unlike the US focus on national security, the EU’s legislation focuses on the “security of supply,” the ability of the EU to overcome the gap in its chip supply chain. The European Chips Act would give the EU latitude to direct manufacturers to manufacture critical chip components and to use its bulk buying power as a lever to incentivize manufacturers.

One criticism of the European plan is its focus on the most advanced chips. Since the demise of Nokia as a smartphone supplier, European industry requires few of the most modern chips. It would make more sense to concentrate on the more specialized power semiconductors and micro-controllers required by the continent’s strong car and manufacturing industries.

The goal of increasing the EU’s share of the global chip market from 10% to 20% by 2030 is arbitrary. Europe does not boast a world-class chipmaker on which to build market share. From being mainstream consumer chip suppliers with top 10 global rankings in the 1990s, Germany’s Infineon and French-Italian STM Manufacturers have retreated into niche areas. The European Chips Act will not bring them back into the mainstream, nor create the start-ups required for semiconductor innovation and renewed growth in the European ecosystem.

Instead, the focus should be on reinforcing European preeminence in key “choke” areas. Europe enjoys impressive chipmaking strengths. Dutch company ASML dominates manufacturing of the lithography machines required to produce the most modern miniature chips. Germany’s Zeiss leads in optics. Belgium’s Solvay and Germany’s BASF provide critical chemicals.

Export Controls

The United States has taken drastic steps to curb China’s efforts to expand its semiconductor industry. In late 2022, the Department of Commerce imposed export restrictions that effectively ban US nationals from working in Chinese businesses associated with chip manufacturing. New licensing requirements make it difficult to export chips from China to the United States, and to ship US equipment to China. Both US and foreign-made products that contain advanced chips with US inputs must now receive US government approval before being sent to China. The new regulations have shaken the Chinese chip-making industry—experts have noted that the new rules will likely set China back “years.”

China consumes more than a third of the world’s semiconductors, the vast majority of which are manufactured abroad. Reducing the ability of companies to export to China could have significant consequences for global industry. China may have to invest up to a trillion dollars to make up for the shortfall.

While the United States has taken action to reduce the presence of Chinese microelectronics, the EU has not followed suit, partly hamstrung by its own consensus-based foreign policy and trade system. EU semiconductor manufacturers, notably ASML in the Netherlands, complain of US protectionism. Chinese-manufactured security cameras, which have been restricted in the United States, are still common in the EU. Chinese telecommunications firms, notably Huawei, are enmeshed in EU telecommunications—in Berlin, Huawei controls a higher market share of telecom equipment than it does in Beijing.

The United States and the EU look set to continue sparring over just how hard to crack down. Initially, the Dutch government resisted US pressure to ban ASML from exporting its most modern machines to China. In the end, US pressure won out. This could open a new era of transatlantic cooperation.

Policy Recommendation

Blunt policies designed to prevent China from building an advanced chip-manufacturing industry could backfire. In the short term, they will hurt domestic companies by reducing their sales. In the long term, they will have little effect on China. Instead, democratic countries should pursue sanctions that target China’s violations of international humanitarian and trade rules.

Enforce Intellectual Property Import Restrictions

Chinese IP theft is widespread and damaging to the United States; 80% of all economic espionage prosecutions brought by the US Department of Justice revolve around actions that would benefit the Chinese state. The estimated cost of these stolen trade secrets is between $225bn and $600bn per year.

Recent reports have detailed Chinese theft of trillions of dollars’ worth of IP. In 2019, a California court ordered XTAL, a US subsidiary of Chinese company Dongfang Jingyuan Electron Ltd., to pay ASML $845m to compensate for IP theft. In 2021, ASML voiced concerns that Dongfang Jingyuan Electron Ltd. was using stolen IP to develop competing yield-enhancing products.

The United States and the EU should restrict or tax imports of Chinese technology that depend on stolen Western IP. The United States should reengage with the World Trade Organization to force structural change in China, rather than rely solely on the brute force of sanctions.

Increase Forced Labor Import Restrictions

A March 2020 Australian Strategic Policy Institute report identified 83 foreign and Chinese companies that directly or indirectly benefit from Uyghur forced labor. The industries range from electronics to textiles to automobiles. The list is certainly not comprehensive.

In the electronics industry, Apple and other US companies have been implicated in forced labor in China. Seven Chinese suppliers have been accused of forced labor, ranging across the electronics supply chain. Policymakers and experts especially highlight electric vehicle battery and solar panel manufacturing.

The United States and the EU should shift their focus to restricting imports of Chinese technology that has been sourced or manufactured with the use of forced labor. While recognizing that it is often difficult to identify production from forced labor, suspicious solar panels could be taxed based on existing international trade rules that prohibit unfair trading practices.

Increase Scrutiny of Chinese Acquisitions

Western countries have taken steps to examine acquisitions and investments by Chinese companies in critical industries. In the UK, chip company purchases are closely scrutinized. In the United States, the number of Chinese acquisitions reviewed by government regulators over security concerns has skyrocketed.

At the same time, the EU has continued to allow major deals to move forward, including a deal for a Chinese company to purchase a section of an important German port. Democratic countries, and the EU in particular, should take steps to ensure that adequate security oversight exists for foreign investment in critical industries, particularly from China.

Target Chip Funding

The EU and US chips acts represent important steps to boost domestic production. They should focus on R&D for the next generation of semiconductors. Advanced imaging technology will be needed to develop the next generation of chips. New manufacturing equipment, currently built in only a select few locations, will become a critical part of controlling the next generation of the semiconductor supply chain. Money should not exclusively be poured into foundries, but also invested in finding new ways to improve supply chain security, such as integrating artificial intelligence into the semiconductor supply chain.

Avoid Protectionism and Hypocrisy

Unless rethought, US and European public funding of semiconductors could threaten a new transatlantic crisis. President Biden and von der Leyen are working to diffuse a monthslong spat over the US Inflation Reduction Act’s electric vehicle tax credits. Both the US Congress and the European Parliament could stand in the way of a solution. Under the US “Buy America” provisions, the CHIPS Act threatens a repeat of the Inflation Reduction Act fight.

Europe risks falling into a similar trap.

While much of its public funding could go to US and Taiwanese companies to build foundries in Europe, the threat of imposing local manufacturing restrictions is driving these investments.

US and European funds should not only focus on manufacturing chips. The Chinese army flooding into Taiwan is not the only threat, though it remains real. Instead, the United States and the EU should concentrate on building up their respective competitive advantages and synergies with leading-edge semiconductor process development. Together, that is the most effective way to meet the Chinese challenge and secure the semiconductor supply chain.

Alexander Wirth and Bill Echikson contributed research.