The UK economy has been anything but steady and predictable over the past seven decades. Since 1966, there have been numerous recessions, the fallout of a global financial crisis, a pandemic, Brexit and more. And yet through it all, year in year out, the City of London Investment Trust has increased the annual dividend payment it makes to its shareholders.

Throughout the decades, the trust has invested in largely UK-listed companies that tend to pay a good income to shareholders. It then passes on that income to its own investors in the form of dividends.

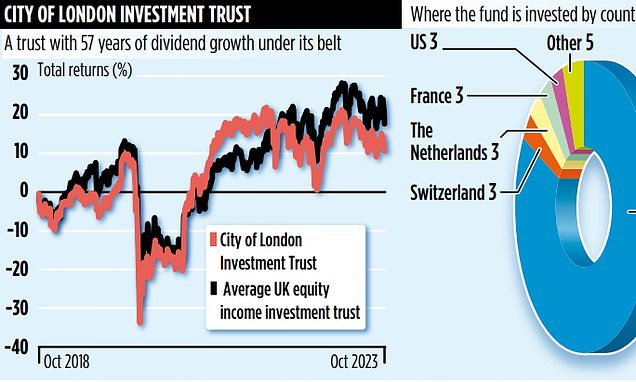

It means the trust has an unbroken run of 57 consecutive increases to its dividend – the longest record of any investment trust. Steady and predictable amid turbulence. And will it manage 58 yearly consecutive rises? Manager Job Curtis has been at the helm for 32 of those years. He says: ‘We cannot ever promise that we will raise the dividend again, but we have every intention to.’

Curtis explains that the structure of the fund is key to its success. City of London is an investment trust, which means it can set aside as much as 15 per cent of its income every year. That way, the trust can dip into its savings to sustain its dividend payment record even in the tougher years. ‘We also invest in companies that are profitable and we are confident can continue to pay out to shareholders,’ he adds.

The majority of the trust’s holdings are UK companies – currently around 83 per cent. Stalwarts of the FTSE 100 feature heavily; the likes of Diageo, Unilever and Shell. So you might expect the fortunes of the trust to be closely aligned with the UK economy. However, Curtis explains that 69 per cent of revenues from the companies in which it invests come from outside the UK.

The obvious benefit of this is that the trust is diversified and not overly reliant on the fortunes of the UK economy. But another advantage has revealed itself in recent months as UK companies battle against sustained high inflation.

‘Because the companies we invest in have a global outlook, many have been operating for years in countries that tend to experience high inflation and are used to dealing with it,’ says Curtis. ‘Unilever has a big market in India, while British American Tobacco has a big operation in Brazil. Both of these countries have not experienced the long phase of low inflation enjoyed until recently in the UK, US and Europe.’

Related Articles

HOW THIS IS MONEY CAN HELP

Once Curtis and his team buy a new stock, they generally hold it for the long term – and often for more than a decade. However, they are not shy of making a change – even if it goes against the grain. ‘We sold out of Microsoft in June, after holding it since 2011,’ says Curtis.

‘I know there is interest in it now because of the growth of AI as it is seen as one of the main players. But it is up over ten times since we bought it and has a market capitalisation almost equal to the whole of the FTSE 100 index. I was happy to take the profit and move on.’

Curtis works in a team of 15, all looking for new investing opportunities. Sometimes, though, the best ideas just land in his lap. In June, Curtis and the team bought Round Hill Royalties, which buys up the rights to songs. At the time it was trading on a 40 per cent discount to the value of its assets.

‘I really like Spotify,’ says Curtis. ‘I enjoy listening to music on the train. I particularly like music from the late 70s – such as Saturday Night Fever. And I thought that although a lot of young people are already streaming, there are a large number of older fans like me who are still discovering it.

‘Round Hill gets royalties from a huge portfolio of music from pre- 2000 and so is set to benefit.’

The value of the trust’s holding in Round Hill has already risen by 65 per cent since he bought it, due to a takeover approach.

City of London has an ongoing annual charge of 0.45 per cent. Its stock market ID code is XLON.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.