A flat Q4 doesn’t preclude recession, although that outcome would hardly surprise stocks.

UK GDP was flat in Q4, defying economists’ consensus expectations for a -0.3% q/q dip—which would have been its second straight quarterly decline.[i] Therefore, most coverage suggested the UK just narrowly avoided recession, as many see two consecutive quarterly contractions as defining one. Many nevertheless say recession is still likely, including the Bank of England (BoE) and IMF. Perhaps. But given the widespread belief—and forecasts—it would hardly surprise, likely sapping its effect on stocks.

After UK GDP fell -0.2% q/q in Q3—due partly to the national mourning period for Queen Elizabeth and bank holiday for her funeral—the economic consensus expected a Q4 contraction would confirm the long-projected recession is underway. The Office for National Statistics’ (ONS) initial estimate for no growth, while better than expected and not quite matching doomsayers’ script, didn’t really counter the pessimism strongly. Several outlets were quick to note the UK economy “flatlined” last quarter, pausing the downturn, as the BoE forecasts a -0.5% GDP decline in 2023.[ii] The IMF predicts the UK will be the only major economy to contract this year.

True enough, Q4’s zero-growth doesn’t preclude a UK recession. If Q4 stays flat through the ONS’s later revisions, a Q1 contraction could confirm a lengthier slide in output. Although conventional wisdom commonly considers two consecutive quarterly GDP declines as recessionary, the UK doesn’t officially have a definition. In the US, though, the National Bureau of Economic Research declared a recession in 2001 without a two-straight-quarter GDP dip, for example. Meanwhile, the ONS also notes UK GDP, while close, remains below its pre-pandemic peak level.

UK monthly GDP data hint further at this. Under Q4’s flat headline reading, there was a lot of month-to-month volatility, much of it tied to the Queen’s death. The bank holiday and business closures during the mourning period seemingly pushed September demand into October, inflating early Q4 output and setting up a late Q3 drop. In numbers: September monthly GDP fell -0.7% m/m, tied primarily to the lost working time, setting an easy base for October’s output to rise 0.5%—basically just catch-up growth from September.[iii] After November ticked up 0.1% m/m, December’s -0.5% dip gave back the prior two months’ growth.

To many, December’s contraction confirmed a recession is forming, as the dominant services sector weighed. However, there were some external factors worth noting. Major contributors included rail and postal worker strikes (which continued into Q1), while health services saw a broad-based decline in activity (also partly due to strikes). Further detracting: A big decline in sports activities, as the World Cup postponed Premier League games, although they have since resumed. Of course, the temporary factors weren’t all bad. The ONS said December GDP would have been worse except for colder weather boosting heating demand. Still, it seems fair to say Q4 UK GDP, while mixed—and rather backward looking in the middle of February—appeared to be weakening heading into 2023.

No doubt the UK economy is under stress. The cost of living, in particular, is weighing on consumer spending. As the ONS noted in its December GDP report, “there was continued feedback from retailers suggesting that consumers are cutting back on spending because of increased prices and affordability concerns.”[iv] Not only does the “cost of living crisis” have its own Wikipedia entry, but UK households have been well aware their real disposable incomes haven’t stretched very far for over a year—with three prime ministers to show for it. Stealth tax hikes caused by static brackets ensnaring more as nominal wages have grown are another drag. Former Prime Minister Liz Truss attempted to ameliorate the latter while briefly in office—and was criticized up and down for it—but popular opinion is viewing relief more favorably now as higher tax prospects increasingly focus attention.

Which, for markets, is primarily the thing: None of this is exactly a secret. Last summer, economists were 50/50 on UK recession.[v] Then a downturn became the overwhelming consensus in August with the BoE projecting contraction would start in Q4 and last through 2023.[vi] The Office for Budget Responsibility more or less agreed in its forecast last year.[vii] In September, S&P Global and the British Chambers of Commerce announced the UK was already in recession and had been since Q2 2022 (although neither are official business cycle arbiters).[viii]

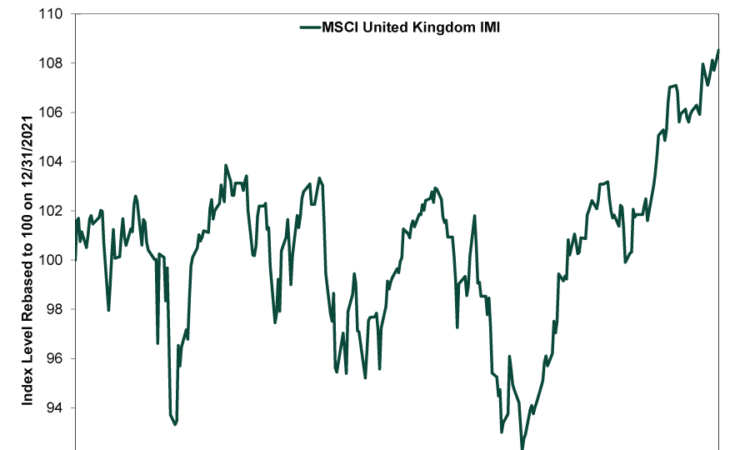

But we think how UK stocks have taken the news is instructive. Exhibit 1 shows the MSCI United Kingdom Investable Market Index in pounds (to eliminate skew from the dollar’s 2022 strength) beginning last year. Since October, it is up strongly, making new highs in early January (although not yet in dollars due to currency skew). After pre-pricing escalating recession fears last fall—and then rising—it seems to us that UK stocks have taken the measure of the downturn and moved on.

Exhibit 1: UK Stocks Appear to Be Moving Ahead of Data

Source: FactSet, as of 2/14/2023. MSCI UK IMI returns with net dividends in pounds, 12/31/2021 – 2/13/2023.

While the jury is still out, almost everyone expects a shallow UK recession. So if we get one—or something less—that probably wouldn’t faze markets much at this point.

[i] Source: FactSet, as of 2/14/2023. UK GDP consensus estimate, Q4 2022.

[ii] “UK Avoided Recession Last Year by Narrowest of Margins. It Might Not Be so Lucky in 2023,” Olesya Dmitracova and Rob North, CNN, 2/10/2023.

[iii] Source: FactSet, as of 2/14/2023. UK GDP, September 2022 – December 2022.

[iv] “GDP Monthly Estimate, UK: December 2022,” Ben Graham, ONS, 2/10/2023.

[v] “UK Recession Threat Is Now Almost 50-50 for Economists,” David Goodman and Harumi Ichikura, Bloomberg, 7/12/2022.

[vi] “The Bank of England Predicts a Lengthy Recession at the End of the Year,” Staff, Associated Press, 8/5/2022.

[vii] “Deeper Recession Now Forecast for 2023,” David Thorpe, Financial Times, 11/17/2022.

[viii] “UK Already in a Full-Year Recession as Europe Faces Tough Winter, S&P Global Says,” Elliot Smith, CNBC, 9/28/2022. “BCC Economic Forecast: New PM Must Act as UK Economy Set for Recession Before Year End,” Staff, British Chambers of Commerce, 9/1/2022.