Cathie Wood’s Ark Invest Scoops Up This Crypto-Linked Stock Undeterred By 24% Plunge This Week By Benzinga

© Reuters. Cathie Wood’s Ark Invest Scoops Up This Crypto-Linked Stock Undeterred By 24% Plunge This Week

Benzinga – Cathie Wood’s Ark Invest is a backer of cryptocurrencies, especially Bitcoin (CRYPTO: BTC), and crypto-linked stocks. On Friday, the firm lapped up beaten-down shares of cryptocurrency exchange Coinbase Global, Inc. (NYSE: COIN).

Ark Invest, through its Ark Innovation ETF (NYSE: ARKK) and Ark Next-Generation Internet ETF (NYSE: ARKW), bought 162,325 Coinbase shares, valued at $9.27 million.

Also Read: EXCLUSIVE: ‘We Knew It Would Be A Bumpy Ride,’ Why Ark Invest Is Bullish Long Term On Elon Musk And Twitter

The stock shed about 24% this week after the SEC cracked down on crypto staking. Rival exchange Kraken paid $30 million to settle charges brought by the regulator, alleging that the exchange offered unregistered securities through its staking program.

Incidentally, ahead of the development, Coinbase CEO Brian Armstrong acknowledged in a tweet, rumors of a potential staking ban for retail customers in the U.S. and also expressed hopes it does not come to pass.

Notwithstanding the week’s drop, Coinbase shares are still 61% higher for the year-to-date period.

Coinbase closed Friday’s session down 4.26% at $57.09, according to Benzinga Pro data.

See also: EXCLUSIVE: Why DraftKings Is A Key Holding Of Ark Invest, Stands Out Ahead Of The Sports Betting Competition

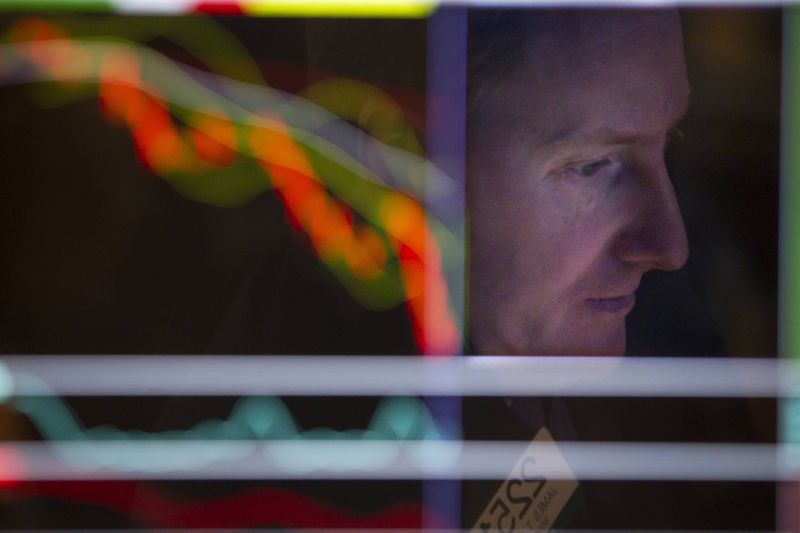

Photo: Shutterstock

Latest Ratings for COIN

DateFirmActionFromTo| Mar 2022 | Goldman Sachs | Maintains | Buy | |

| Feb 2022 | Compass Point | Maintains | Neutral | |

| Feb 2022 | Canaccord Genuity | Maintains | Buy |

View More Analyst Ratings for COIN

View the Latest Analyst Ratings

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.