Toa55/iStock via Getty Images

The Canadian cannabis space was one of the worse areas to invest since 2018 and Canopy Growth (NASDAQ:CGC) was one of the leaders of the sector. The stock has fallen over 95% from the highs due to the generally weak cannabis space and a fundamental flaw in the business plan. The company appears set to officially push into the U.S. market, possibly causing a delisting from the Nasdaq. My investment thesis remains Bearish on the stock following the latest move that could further destroy shareholder value.

U.S. Push

After all of these years focused on the Canadian and global cannabis opportunity while waiting for U.S. legalization to enter the U.S. market, Canopy Growth decided to create a U.S. division. The company plans to aggressively enter the U.S. market with the formation of Canopy USA, LLC.

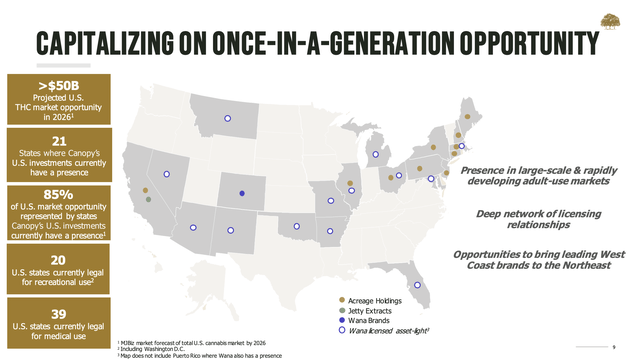

No one can blame Canopy Growth with the U.S. market far and away blowing away the global cannabis market. The company targets the U.S. cannabis market reaching $50 billion by 2026 and the opening of new recreational markets in New York, Connecticut, Virginia and the recent launch in New Jersey will drive this country towards such a large market.

Source: Canopy Growth U.S. presentation

Canopy Growth wants Canopy USA to control the U.S. cannabis investments with existing exercise rights to acquire Acreage Holdings (OTCQX:ACRHF, OTCQX:ACRDF), Wana and Jetty. More importantly, the company wants to consolidate the financial performance in accordance with U.S. accounting regulations in order to highlight the value of the assets while the previous arrangements only provided ownership and financial reporting once a triggering event occurred (federal legalization or de-scheduling of cannabis).

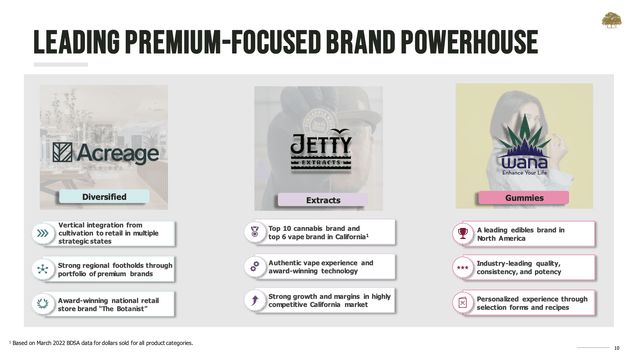

Source: Canopy Growth U.S. presentation

The company already has the option to acquire 100% of both Wana and Jetty with a more complicated arrangement with Acreage. The multi-state operator [MSO] hasn’t exactly generated impressive results over its history, in part due to the ownership position of Canopy Growth.

The move comes with a big hiccup due to SEC regulations preventing companies from listing on the major stock exchanges with businesses illegal at the federal level. As such, Canopy Growth has acknowledged the move could cause the shares to be delisted per the SEC filing:

While we believe that we comply with all applicable laws and regulations, as well as the applicable cannabis related policies of…Nasdaq, our interpretation may differ from those of the stock exchanges now or in the future, and therefore…Nasdaq could allege that, as a result of our non-voting and non-participating interest in Canopy USA, we violate the exchanges cannabis-related policies.

Such a delisting would make Canopy Growth one of the worse companies in the history of the stock markets. The company got a massive $4 billion cash investment from Constellation Brands (STZ) back in 2018 and has already burned the amount prior to making this aggressive move to just report consolidate financial performance of the U.S. investments.

Canopy Growth believes the issuance of exchangeable shares with non-voting rights or control over Canopy USA helps meet the legal regulations of the major stock exchanges. The shares will be converted into common shares once federally legal.

Due to these listing risks, Constellation Brands apparently agreed to convert their shares into exchangeable shares while surrendering outstanding warrants (not sure they had any value anyway) and Board members will resign from the Board of Canopy Growth. Under this plan, Constellation will no longer have any control over Canopy Growth in order for that company to not have any issues with remaining listed on a major U.S. stock exchange.

Not Worth the Risk

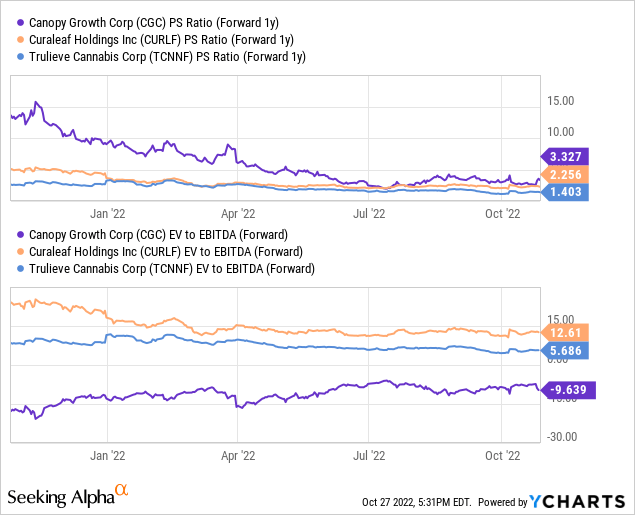

The stock has always traded at a premium multiple to the multi-state operators (MSOs) in the U.S. unable to trade on the major stock exchanges. Any delisting from the Nasdaq would pressure Canopy Growth below the valuation multiples of the MSOs already generating strong EBITDA margins with dominant market positions in multiple states.

Compared to the top MSOs of Curaleaf (OTCPK:CURLF) and Trulieve Cannabis (OTCQX:TCNNF), Canopy Growth still trades at up to double the forward P/S ratio of the actual cannabis market leaders. On top of that, the MSOs trade at cheap EBITDA multiples while Canopy Growth isn’t even forecast to generate a positive adjusted EBITDA until after these deals all close at the end of 2024.

The new U.S. companies have ~$300 million in annual revenues now, so the Canopy Growth financials will be vastly improved highlighting the desire to report these consolidated results. In the June quarter, Acreage reported revenues of $61 million and adjusted EBITDA of $10 million for a 16.9% margin leaving the small MSO with one of the lowest margins in the space.

Canopy Growth has 480 million shares outstanding and these deals will increase the share count by ~110 million shares based on the current plans to acquire the U.S. companies and the conversion of debt by Constellation.

At $3, the stock has a market cap of $1.44 billion and the value will jump to $1.77 billion with the additional shares. At a rough guess considering Canopy growth is divesting the Canadian retail operations and the C3 business, the stock trades at ~3x sales targets with the exclusion of divested businesses and the inclusion of the U.S. units.

If this plan works, the MSOs might be able to work out similar arrangements with exchangeable shares with non-voting rights allowing those stocks to uplist. The MSOs would have far more upside on uplisting to the major stock exchanges based vastly better EBITDA margins.

Takeaway

The key investor takeaway is that Canopy Growth is making an aggressive move to consolidate U.S. operations at the risk of being delisted from the Nasdaq. If the move works, the Canadian cannabis company will become a U.S. focused cannabis stock in one swift move. If the move fails, the stock will fall from being delisted.

The U.S. MSOs would remain more attractive due to lower valuations and the opportunity to make a similar move allowing those stocks to be uplisted. Not to mention, Canopy Growth doesn’t except to close the key Acreage deal until the 2H’24 limiting any conclusion to the plan for nearly a year.