Burberry Group PLC (LON:), a name synonymous with British luxury fashion, has had an eventful year in 2024. Known for its iconic trench coats and distinctive tartan patterns, Burberry has long been a major player in the global fashion industry. This year, the company has navigated both challenges and opportunities, providing investors with a lot to consider.

Stock Performance and Financial Health

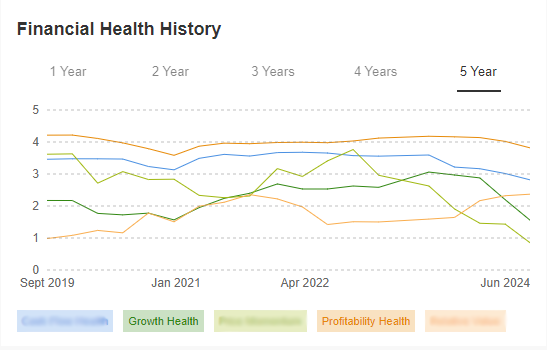

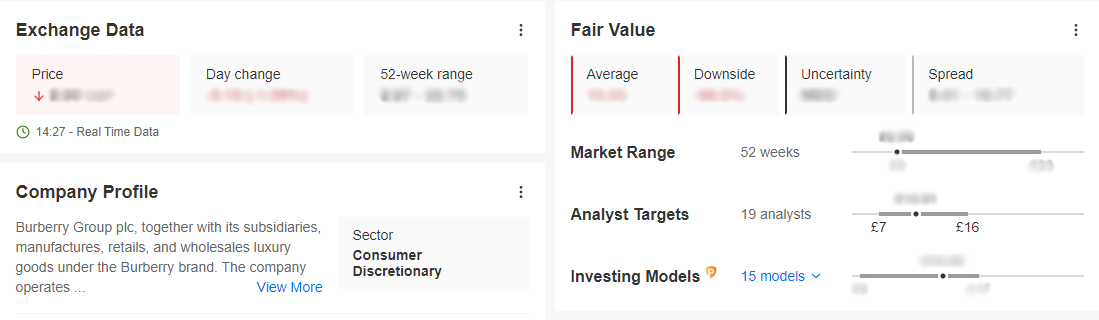

Burberry’s stock, listed under the ticker BRBY, has seen a rollercoaster ride throughout 2024. At the start of the year, the stock was performing steadily, but several factors have influenced its movement since then. As of the latest updates, BRBY is trading around 1,900 GBP, reflecting a moderate increase from its price at the beginning of the year.The company’s financial performance has been robust despite global economic uncertainties. In its most recent earnings report on 1st May 2024, Burberry announced a revenue increase of 5% year-over-year, reaching £2.8 billion. This growth was primarily driven by strong sales in the Asia-Pacific region and a successful digital transformation strategy that has enhanced online sales. According to the CEO Jonathan Akeroyd, “Our strategic focus on digital and the Asia-Pacific market has paid off handsomely this year” (1st May 2024).

Key Developments and Strategies

One of the significant developments for Burberry in 2024 has been its commitment to sustainability. The company has launched several initiatives aimed at reducing its carbon footprint and promoting ethical fashion. This move has not only enhanced its brand image but also attracted environmentally-conscious consumers.Moreover, Burberry has continued to innovate in the digital space. The company’s digital sales platform has been a crucial driver of growth, especially as consumer shopping habits shift increasingly online. According to Fashion Network (LON:) on 15th March 2024, “Burberry’s digital strategy has been a game-changer, setting a new standard in luxury retail.

“Market Challenges

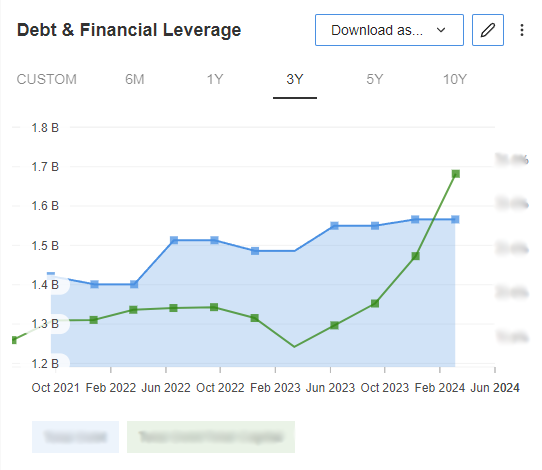

However, Burberry has not been without its challenges. The global economic slowdown and inflationary pressures have affected consumer spending in some key markets. Additionally, fluctuations in the foreign exchange market have impacted earnings, given Burberry’s international presence. Despite these hurdles, the company has maintained a strong financial position, with a healthy balance sheet and substantial cash reserves.

Analyst Opinions

Analysts have varied opinions on Burberry’s prospects. On 20th April 2024, Morgan Stanley (NYSE:) upgraded its rating on BRBY, citing strong growth potential in emerging markets and the company’s successful adaptation to digital retail. On the other hand, some analysts remain cautious. According to a report from The Guardian on 30th May 2024, “While Burberry’s performance has been commendable, the luxury market remains volatile, and cautious optimism is advisable.”

Looking Ahead

As we move forward, Burberry’s strategic focus will likely continue to revolve around sustainability, digital innovation, and expansion in growth markets. The company’s ability to adapt to changing market conditions and consumer preferences will be critical to its long-term success. Investors should keep an eye on the upcoming quarterly reports and any strategic announcements from the company.In conclusion, Burberry Group PLC has shown resilience and adaptability in a challenging year. While there are hurdles to overcome, the company’s strong brand, innovative strategies, and commitment to sustainability position it well for future growth. For investors, Burberry remains a compelling option, balancing a storied legacy with forward-thinking initiatives.

Feel ready to dive into details and start finding interesting stocks to invest? Try our AI supported solution InvestingPro today!

Get an extra 10% discount by applying the code UK10 on our 1&2 year plans. Don’t wait any longer!

How to buy pro

InvestingPro