Bank of America is doubling down on plans to expand in European fixed-income trading, with executives ploughing significant resources into doing more business with corporate clients and financial institutions in the region.

BofA has roughly doubled the size of its currency and commodity salesforce catering to European corporate clients over the past two years, according to sources familiar with the matter. The US lender has also hired 50% more staff across EMEA sales and trading to focus on offering financing to European banks and institutional investors, as higher interest rates have prompted a dash for cash among many of these firms.

“We have identified Europe as an area to grow with our clients and we have invested heavily to build a diversified business in terms of both client and product mix,” said Jim DeMare, president of global markets at BofA. “We have invested in people, financial resources and geographical footprint to close the gaps to our main rivals and have now all the ingredients to become a top-tier franchise in the region.”

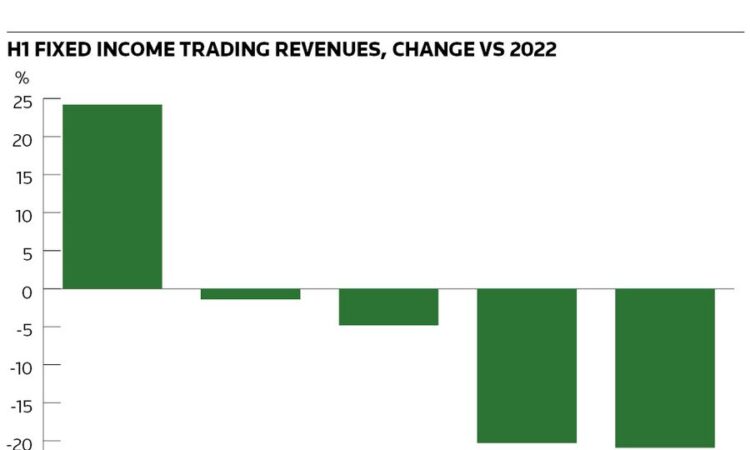

The investments are the latest sign of BofA’s ambitions in Europe after materially increasing its presence in these markets in recent years. That is part of a broader sales and trading push that fuelled a 24% rise in fixed-income revenues in the first half of 2023 from the previous year, making BofA the only one of the five large US banks to grow these activities during that period.

BofA said expenses in its global markets group rose 8% in the April to June period from a year ago, primarily driven by investments in the business, as it comfortably outperformed rivals in fixed income for a second straight quarter. The bank has now increased the amount of assets in global markets by almost a third since mid-2020 to a record US$878bn, while the capital it deploys to the unit has also grown by more than a quarter.

“Investments are ongoing in terms of people, the platform and our regional footprint,” said Snigdha Singh, co-head of EMEA FICC trading and head of EMEA markets initiatives at Bank of America. “The diversification of our business has certainly helped us this year. Consistency is a big differentiator – clients want a full end-to-end service.”

Buy Europe

Many of BofA’s added resources have been aimed at Europe – a region where senior management believes the bank has punched below its weight in the past and can now make up ground against rivals. BofA has increased its headcount in EMEA fixed income by 15% in the past three years, including a significant expansion of its Paris office in the wake of Brexit. The bank now has 180 fixed-income sales and trading staff in Continental Europe compared with just 20 before the Brexit vote.

BofA’s European push has coincided with the most interesting investment backdrop in the region for years. Inflationary pressures have forced the European Central Bank to raise interest rates, dragging government bond yields out of negative territory and making European fixed income look appealing again for overseas investors and locals alike.

Surging volatility has also spurred more activity from local companies needing to manage exposures across rates, FX and commodity markets. Othman Kabbaj, BofA’s head of EMEA FICC sales, said the industry revenue pool had increased “significantly” in the corporate business over the past 24 months as a result.

Lending relationships are often crucial in helping secure higher margin trading opportunities like selling derivatives that corporate treasurers use to hedge. Europe’s fragmented markets can make it hard to compete with local lenders, but Kabbaj said BofA had increased its market share with corporate clients in FX and commodities by 20% since 2021.

“We’re working closely with our banking colleagues to deliver tailored hedging solutions to our corporate clients and we’re making great strides,” he said.

Central banks dialling back the unprecedented monetary stimulus of the previous decade has made financing another crucial area of focus within global markets. The ECB withdrawing its emergency bank funding programmes has forced many banks to look for cash elsewhere. Institutional investors and corporates have also faced new financing needs as rising interest rates have triggered margin calls on derivatives positions, with last year’s so-called liability-driven investment crisis among UK pension funds providing the most extreme example.

“Funding is a really important theme and it will continue to remain so given the end of the decade of low rates and ample liquidity,” said Singh. “It’s a big change in our markets. This is where our clients need us right now.”

Evolving business

Secured financing was one of the areas of strength BofA highlighted in its second-quarter results. Flow credit has been another growth area, said Singh, with the bank building up its sterling and index businesses and continuing to invest in portfolio and algorithmic trading.

The split in BofA’s revenues underlines how much its fixed-income division has evolved in recent years. So-called macro trading has become more prominent, rising from 40% of revenues in 2019 to 64% last year amid a surge in demand for products linked to interest rates and currencies. The amount of markets revenues BofA generated outside North America increased from 35% in 2019 to 40% last year, showing the growing importance of Europe and Asia as well.

“Our results are good because we’ve managed to be profitable in places where, a couple of years ago, we wouldn’t have done as well,” said Jan Smorczewski, co-head of EMEA FICC trading. “A few years ago, we were a bit less focused on macro, which hadn’t performed for many years. Now the balance is far more level.”

BofA’s value-at-risk – a gauge of how much the bank could lose from trading positions – has also grown as its markets activities have ramped up. Average VaR has been US$93m this year, well over double 2019’s level of US$35m. While high, that is still below 2022’s average of US$108m as the bank has pared back somewhat following some volatile market moves.

“We’re incredibly disciplined about the risk that we carry,” said Smorczewski. “This year, market dynamics are very different to last year and this is taken into account when assessing risk.”

![]()