By Ambar Warrick

Investing.com — Most Asian stock markets sank on Friday as uncertainty over U.S. monetary policy triggered sharp losses in technology stocks, while Japan’s Nikkei index rallied as the incoming head of the Bank of Japan vowed to maintain ultra-loose policy.

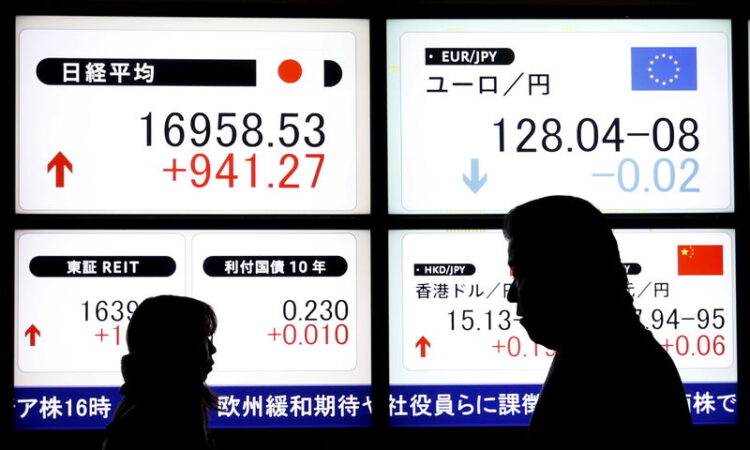

The Nikkei 225 jumped 1.1% after economist Kazuo Ueda, who is set to take over as the BOJ governor in April, said that he largely intends to hold interest rates at ultra-low levels in the near-term.

Speaking during a parliamentary session, Ueda said that while the bank will eventually tighten policy, the BOJ will keep conditions accommodative to support economic growth in the near-term.

Still, data showed on Friday that Japanese consumer inflation rose to an over 41-year high in January. Rising inflation may eventually force the bank’s hand, and is expected to crimp economic growth.

Most other Asian stocks fell on Friday, with technology-heavy bourses retreating the most. Hong Kong’s Hang Seng index slumped 1.4%, driven by an over 4% loss in Alibaba Group Holding Ltd (HK:9988).

While Alibaba logged a stronger-than-expected quarterly revenue, growth was still at its worst level since 2013, as it grapples with a slowdown in its key Chinese market.

Losses in Alibaba also rattled other regional tech majors, with South Korea’s KOSPI losing 0.6%, while the Taiwan Weighted index fell 0.4%.

But gains in Taiwan Semiconductor Manufacturing Corp (TW:2330) helped the country’s benchmark rise 0.6% this week, following a positive outlook on chip demand from Nvidia (NASDAQ:NVDA).

China’s Shanghai Shenzhen CSI 300 index fell 1%, while the Shanghai Composite index shed 0.7% on Friday, but both were set to rise for the week. India’s Nifty 50 and BSE Sensex 30 indexes rose 0.3% each in early trade, and were set to lose 2.1% and 1.6%, respectively, this week.

Broader Asian stocks were battered by uncertainty over U.S. monetary policy, ahead of a reading on the Personal Consumption Expenditures index – the Fed’s preferred inflation gauge. The index is expected to reiterate that U.S. inflation remained elevated in January.

Fears of more interest rate hikes by the Fed increased in recent weeks following stronger-than-expected inflation readings, as well as signs of resilience in the U.S. economy. Rising interest rates bode poorly for Asian stocks, given that they limit foreign capital flows into the region.

Get The App

Join the millions of people who stay on top of global financial markets with Investing.com.

Download Now