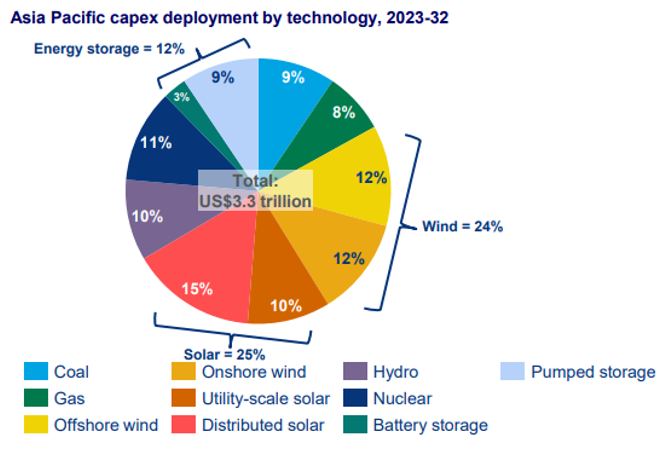

The Asia Pacific region is forecast to invest US$3.3 trillion in power generation over the next 10 years, with 49% earmarked for wind and solar, and 12% for energy storage, according to latest Wood Mackenzie analysis.

“The Asia Pacific region is critical to the power sector’s energy transition as it grows to over half of global electricity demand this year. The two largest markets in the region, India and China, are at the forefront of renewables growth, but are also leading the world in coal power deployments,” says Alex Whitworth, Head of Asia Pacific Power & Renewables Research at Wood Mackenzie, during his keynote speech at Renewable Energy India Expo 2023.

Whitworth adds: “The region is forecast to add 1,840 gigawatts (GW) of new capacity in the next five years, more than the rest of the world combined. As leaders India and China face rapidly growing power demand, each country continues to invest in a mixture of technologies, with emphasis on the cheaper options of coal and renewables.”

Source: Wood Mackenzie Asia Pacific Power & Renewables Service

A spotlight on India

Speaking at the sidelines of the Expo, Whitworth talks about India’s power market and its role in the energy transition: “India is one of the most dynamic and important growing power markets in the Asia Pacific region and the world. As the second largest regional market after China, since it overtook Japan a decade ago, India’s growth potential is still vast. Power demand doubled in the last 12 years, an achievement we could very well see again as strong economic growth continues over the next 12.”

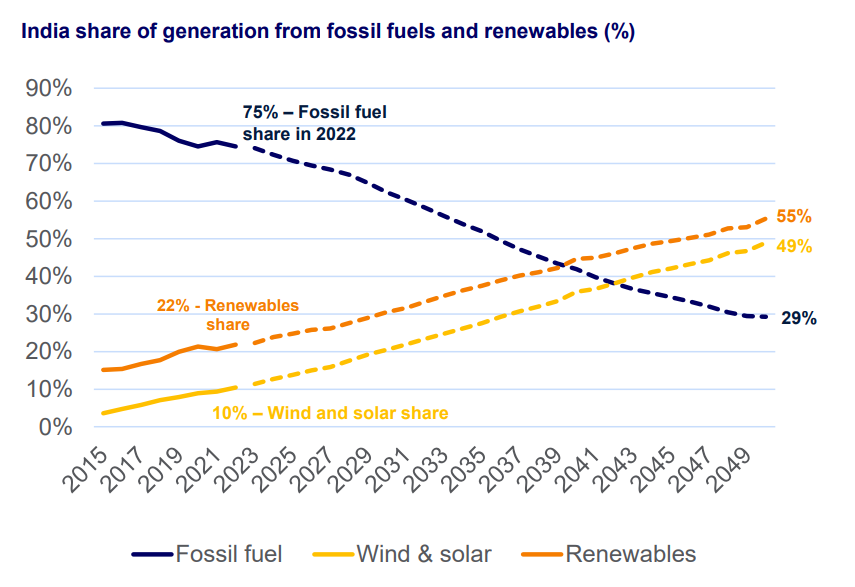

India has some of the lowest cost renewables in the world which has driven rapid deployment of large-scale wind and solar. This has pushed up the country’s renewables share of power generation to 22% in 2022, with wind and solar making up nearly half of the total.

But despite an aspirational 2070 carbon neutral target, India is still investing heavily in new coal power to support growth, with a pipeline of over 50 GW of projects planned and under construction. India’s power demand is expected to rank third globally by 2050, after China and the US, and the future of its coal fleet will have a major impact on global carbon emissions.

Whitworth adds: “Currently, fossil fuels (mainly coal) still provide 75% of India’s power supply but that share is declining steadily. Impressively, India’s per capita power sector emissions are expected to peak in the next decade at a level less than half of where most western markets were at a similar level of development. But is it enough? In the next decade alone, India will need US$350 billion in power generation investment to meet growing power demand.”

“There are huge opportunities for renewables development for utility solar, onshore and offshore wind, as well as hybrid renewables and storage projects. In addition, grid investments could require a similar amount of investment to support the capacity buildout and deliver power to consumers,” says Whitworth.

India’s power sector carbon emissions have grown from 850 million tonnes (Mt) in 2015 to hit an estimated 1200 Mt in 2023, and this figure is expected to rise further to 1400 Mt by 2030. Although not all of India’s power demand growth can be met by renewables today, this is a key goal for the country to meet in the next decade to transition to a low carbon power system.

Source: Wood Mackenzie Asia Pacific Power & Renewables Service

Whitworth concludes: “While cheap renewables and technology advances support continued expansion of renewables in India, the speed of growth of wind and solar is not a given. There are key uncertainties around grid investments and reform of pricing mechanisms to support such investment, growth of energy storage, as well as policy support for all of the above. Despite such uncertainties, India’s key role in the overall global energy transition is certain.”

Source: Wood Mackenzie