Where is US gross domestic product (GDP, a government measure of economic output) at now? In the past, any answer was a guess—or would have to wait until a full month after quarter end, when the initial estimate is released. But now, helpfully, the intuitively named GDPNow gives an answer—the US Federal Reserve’s Atlanta branch (amongst others) developed a model that takes incoming economic data and uses past historical relationships to provide a nowcast estimate of the quarter’s growth.[i] It evolves with releases throughout the quarter, a way to see how data are shaping up in summary form.[ii] But we don’t think investors should assume this is a perfect reflection: Fed models—and economists’ forecasts generally—are imperfect. In our view, they also reflect available data markets have already weighed, making them a fun digest for investors—but little more than that.

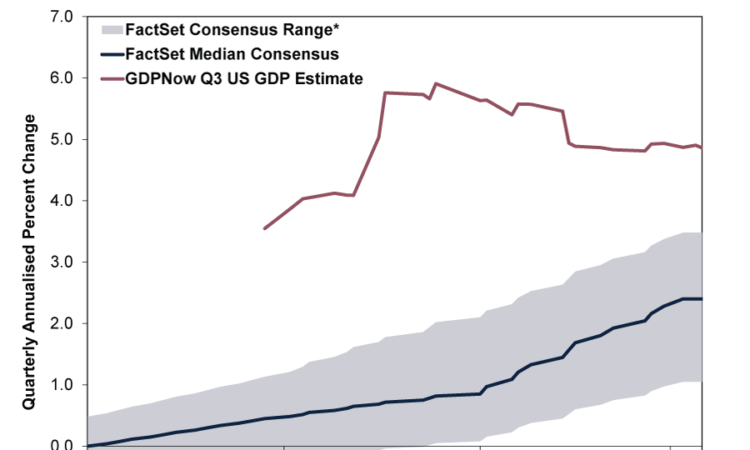

Over the last few months, GDPNow has raised eyebrows across the pond, projecting America’s Q3 GDP growth well above economists’ estimates. (Exhibit 1) With September data releases still outstanding, GDPNow currently suggests 4.9% annualised Q3 GDP growth in the US (maroon line; annualised refers to the rate at which GDP would grow or contract over a full year if the reported quarter’s growth rate persisted for four quarters). This comes alongside many economists dialling up their Q3 growth forecasts (blue line), from zero at the quarter’s start to around 2.4% annualised at quarter end. Notably, their sunnier disposition apparently extends to the Federal Reserve’s staff economists, who dropped their recession (prolonged economic contraction) forecast at July’s end after calling for a “mild” one in March.[iii]

Exhibit 1: Evolution of GDPNow’s Q3 US GDP Estimate

Source: US Federal Reserve Bank of Atlanta and FactSet, as of 5/10/2023. *Range of top 10 and bottom 10 average forecasts.

American GDP growing consistently above 2% annualised since Q3 2022 also cuts against The US Conference Board’s Leading Economic Index (LEI) readings over the last year. The LEI is a longstanding and, in our view, mostly forward-looking indicator of economic conditions ahead. Through August, it fell 17 straight months (since April 2022), whereas it is supposed to lead “turning points in the business cycle by around 7 months.”[iv] This speaks to the fact GDP better captures the services industry than LEI, which is manufacturing-heavy—LEI’s biggest weak spot, in our view.

What to make of all these competing growth projections? First, GDP itself is a backward-looking indicator. The US Bureau of Economic Analysis’s (BEA) preliminary “advance estimate” comes out almost a month after quarter end.[v] Q3’s release is 26 October, quite a late lag—and still a moving target long after the fact.[vi] It is subject to at least two more revisions (through 21 December’s third estimate) before all is said and done.[vii]

GDPNow appears to improve on this by extrapolating much of the same incoming data that go into US GDP into a real-time gauge.[viii] But we would caution: These models—whilst seemingly impartial—aren’t any more prescient than economists’ forecasts; they too, in our view, are only ever opinions, with biases hidden in models’ assumptions.

Even if mechanical, we think GDPNow—like all models—is prone to error. In Q2, for example, GDPNow initially estimated 1.7% annualised US GDP growth in April, but it stood at 2.4% in July on the eve of the actual report—which it nailed! (Exhibit 2) The advance estimate for America’s Q2 GDP was 2.4% annualised—however, the BEA subsequently revised this down to 2.1%.

Exhibit 2: GDPNow Guestimates

Source: US Federal Reserve Bank of Atlanta and FactSet, as of 5/10/2023.

Or take Q1 GDP in America. In mid-March, GDPNow was looking at 3.2% annualised growth. But this fell to 1.1% annualised by late-April’s Q1 GDP advance estimate release—which, ta-da, was also 1.1%—only it didn’t stay that way (again). The BEA later revised Q1 GDP all the way up to 2.2% annualised (on 28 September, in Q2 GDP’s third estimate).[ix] Whilst nice that GDPNow tends to converge on the BEA’s advance estimate—as more data become available—it moves a lot during (and after) the quarter and often doesn’t bear much resemblance to the BEA’s subsequent revisions.

So how close will GDPNow’s present 4.9% annualised estimate for Q3 US GDP be to reality (or at least the BEA’s continually updated version of events)? A lot depends on September’s data—forthcoming throughout this month. Then, too, besides the Federal Reserve Atlanta branch’s GDPNow, other branches have their own (wildly varying) nowcasts. The New York branch’s is currently looking at 2.1% annualised, whilst the St. Louis branch’s projects 1.6%.[x] And those are just some of the Federal Reserve’s more widely watched ones. There are more on the private side: Moody’s Analytics High Frequency GDP Model is at 3.7% annualised, and Bloomberg Economics’ US GDP Nowcast is “about” 3%.[xi] Never mind the plethora of private-sector forecasts and surveys incessantly making the rounds. All to put a number on what is now in the rear view!

But here is the thing for investors: Even if gussied up and massaged mathematically, GDPNow and its siblings are based on available data—which we think markets have long since priced, as stocks look further ahead at how economic (and political) factors are likely to affect earnings over the next 3 to 30 months versus what they already anticipate. GDPNow (alongside other nowcasts) may provide a useful signal of what data in total are showing—before the US’s official GDP report. And this can influence people’s sentiment and projections along the way.

But an aggregation of backward-looking data, and an imperfect one at that—no matter how they are sliced and diced or combined and recombined—doesn’t yield much new information to forward-looking markets, which move most on surprise, in our view. As we think all the attention and effort at divining GDP’s path show, stocks relentlessly pre-price all that data and then some (opinions, forecasts and attitudes about them) well ahead of time, to the point that GDP—and estimates thereof—are usually amongst the least shocking econometrics markets encounter.

In that context, don’t get carried away with GDPNow (or nowcasting generally for that matter). Instead, hard as it is, focus on conditions 3 – 30 month out, like stocks do—which, short-term volatility aside, we find are better than any model or forecaster.

[i] “GDPNow Model Description,” Staff, Federal Reserve Bank of Atlanta, 5/10/2023.

[iii] “Fed Staff Drop US Recession Forecast, Powell Says,” Staff, Reuters, 26/7/2023. A recession is a protracted, economy-wide period of contracting economic activity.

[iv] “LEI for the US Fell Again in August,” Staff, The Conference Board, 21/9/2023.

[v] Source: BEA, as of 5/10/2023. Statement based on the BEA’s “Release Schedule.”

[vi] “Quick Guide: GDP Releases,” Staff, BEA, 5/10/2023.

[ix] Source: BEA, as of 28/9/2023.

[x] Source: Federal Reserve Banks of New York and St. Louis, as of 5/10/2023.

[xi] “US High Frequency GDP Model,” Matt Colyar, Moody’s Analytics Economic View, 2/10/2023. “Fed Can’t Disregard Another Inflation Head Fake,” Jonathan Levin, Bloomberg, 6/9/2023.