Laurence Dutton

Dear Readers/Followers,

AES Corporation (NYSE:AES) isn’t your typical utility play. Instead, it’s a Fortune 500 energy company that focuses on accelerating the future of energy, with a focus on renewables. I haven’t written about this company before, because whenever I looked at it, the valuation honestly wasn’t that great.

And the fact is, it still isn’t great today. I’m going in with a “HOLD” into AES for a number of reasons, all of which I’m going to go through here today. Still, there’s a lot to be said for investing in utilities, and if this one declines back down to normal levels, it could become an interesting investment.

So let’s see what we have going for us here!

AES Corporation – What is the company and what does it do?

AES is headquartered in Arlington, VA, and has its background in the consulting space. That’s actually how AES started. It was initially a consulting business that was started by two Energy Administration appointees from the Nixon era. It went public in -91.

AES IR (AES IR)

AES was heavily impacted by the Enron scandal, due to the liquidity crisis that followed the collapse. The company went from consulting to building power plants across 20+ different countries. Over the past few years, AES has switched its focus from legacy to the construction and provision of solar and wind-based energy and storage systems. The company does M&As, not just organic growth, and has revenues over $10B, a market cap of over $18B, and carries a company credit rating of BBB- from S&P Global. Not the best, but serviceable and understandable given the company’s somewhat heavier debt (75.32% lt/cap).

The company has a dividend that it’s held since 2012, meaning around a 10-year tradition. The yield on that payout is 2.51% today, which makes it one of the lower-yielding alternatives in the space.

Low yield combined with low credit rating, in turn, combined with high multiples, do not make for a very attractive set of fundamental circumstances – and they are the reason why this company hasn’t been very high on my list for some time.

But let’s continue, because it would be unfair not to mention the company’s absolutely stellar track record in the wake of the recent years of energy investment.

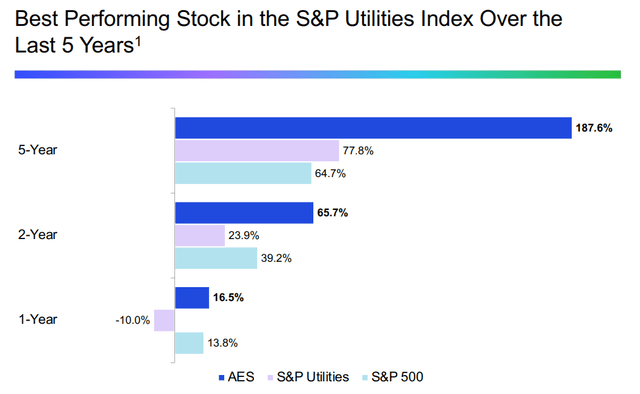

AES IR (AES IR)

AES investors have done very well for themselves historically – but this is mostly due to the fact that the company was severely undervalued for several years between 2010-2017. I didn’t have my eyes opened for me for AES until later, so the opportunity that existed was investing during COVID-19 – which I didn’t, and instead elected to invest in other dividend potentials. Clearly, an investment into AES would have been a good choice as well, though my initial argument is that the company is actually excessively overvalued here, with the market unsure of how to value it in its current form.

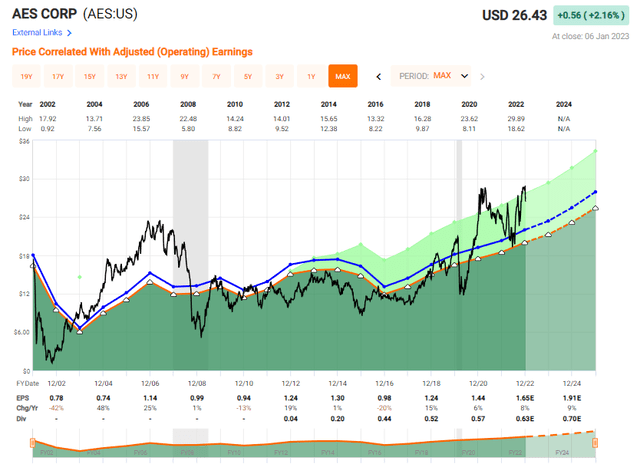

The company has a good track record of delivering sound growth – at least for the 5 past years. There’s a reason the company focuses on that 5-year period because EPS for the past 20 has been a lot choppier.

AES Valuation (F.A.S.T Graphs)

Yes, it has 10 years’ worth of DGR at 16%, but that’s only because it started at 0%. The company calls its balance sheet strong and insulated – I’ll allow that it’s investment-grade, but in the context of utility and energy plays, I won’t agree with the assertion that BBB- is “strong”.

It’s acceptable.

The company has 4 market-oriented business units and it’s the owner/holding company of 6 separate utility companies that serve 2.6M customers with a total of $33B worth of assets on the books. These assets have the capacity of output 31,500 MW, with another 3,500MW currently under construction. The company employs over 8,400 worldwide.

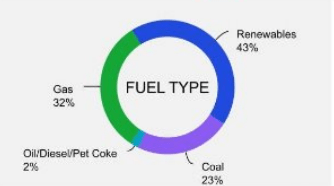

Its stated goal is the enabling of transition to low-carbon sources of energy and achievement of the Paris Agreement’s goal of net-zero emissions by 2050. By that logic, it should be viewed more as a renewable play than anything else, though the company’s feedstock/energy exposure does not yet fully reflect this ambition.

AES IR (AES IR)

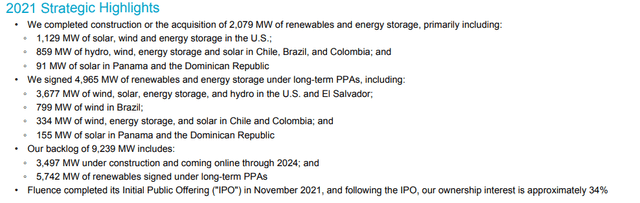

AES is a play on the opportunity presented by the transformation of the electricity sector, and its ambition is to grow its portfolio with low-carbon products and solutions, as well as working to grow these further. In 2021 alone, the company signed long-term contracts for about 5GW of renewables, bringing its 2021FY backlog to 9.2GW.

The company works with its customer with co-creation ventures – including examples like 24/7 carbon-free energy to Google (GOOG). The company also works on its input side, collaborating with mining companies to reduce their emissions and enable the transition to renewables.

So, the company is massively expanding its pipeline into renewables, diluting the legacy of its overall fuel mix with a heavy future tilt to renewables. In 2021 alone, take a look at the company’s renewable highlights.

AES IR (AES IR)

Most of the company’s generated electricity is sold through contracts – medium or long term, with 2-5 or above 5 years in terms of the timing. The company’s utility businesses are found in AES Indiana and Ohio in the USA, and four Utilities in El Salvador. AES Indiana is a fully integrated utility, and AES Ohio is transmitted and distributed, regulated, and has contracts in their respective geographies. AES Indiana owns and operates all of the facilities necessary to generate, transmit and distribute electricity – the same is true for AES Ohio.

In El Salvador, there is limited competition for the company’s capacities – so there’s some more volatility here. Other than that, the company’s utilities work the same as any other utility does – it’s allowed to earn a regulated rate of return on assets, determined by the regulator based on the utility’s allowed regulatory asset base, capital structure, and cost of capital. That’s how regulated utilities work – across most of the world.

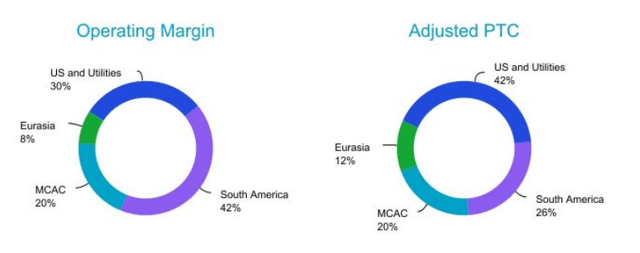

Here’s the split and margin in terms of geographies.

AES IR (AES IR)

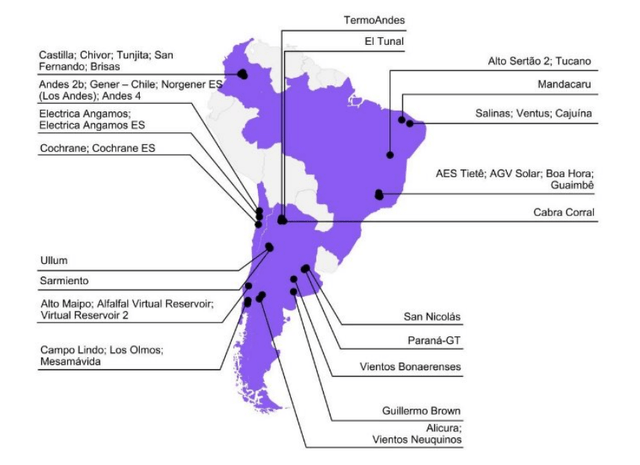

The company further owns capacities in Puerto Rico, Chile, Colombia, Brazil and Argentina – a massive set of assets across the entire continent…

AES IR (AES IR)

…and also owns generation across the Dominican Republic, Mexico, Panama, India, Bulgaria, Jordan, Netherlands, and Vietnam. Aside from this legacy and renewable generation, the company also invests in Fluence (FLNC) and other investments.

This is a global business, with a very complex risk exposure due to its heavy assets in what I would call riskier/emerging markets such as South America, Vietnam, and other geographies. Not necessarily bad, but certainly not as safe as investing in legacy.

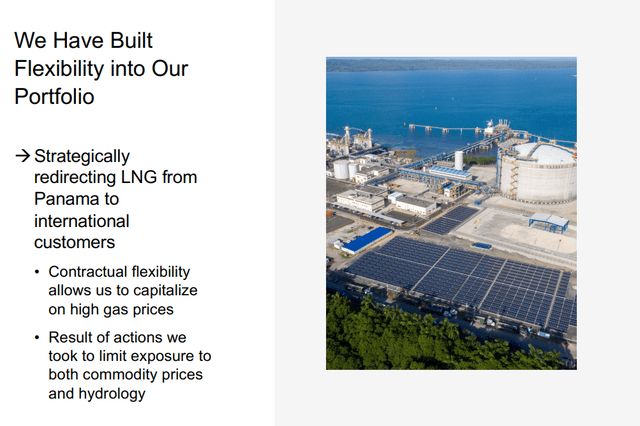

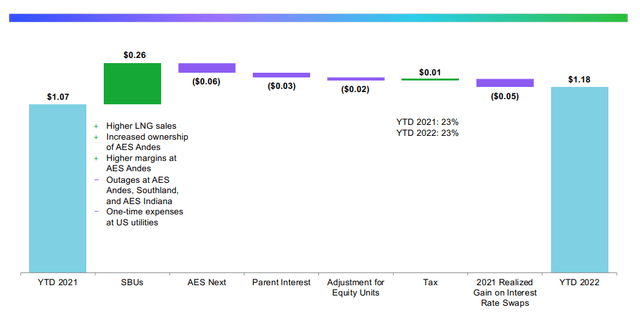

The company has been flying high on the count of global energy trends – and it continues for the latest quarterly report. The company’s EPS growth is in line with a 7-10% annual growth rate, with strong financial results. It’s a global energy empire that has the capacity of using its resources to where they are used most/are the most profitable, such as what they did from Panama in 3Q22.

AES IR (AES IR)

The coming Inflation Reduction Act, or IRA, is also going to be a major boost to renewables growth in the USA, leading to a significant demand increase across the board, which AES is positioned to take advantage of. The majority of the company’s current backlog is expected to come online 2025E at the latest, and its 42% solar, 32% wind, and the rest Energy storage (only 6% gas, 1% hydro). A very attractive overall mix.

So, EPS is up due to both an attractive energy market, and because AES can take advantage of the current situation and sell LNG with higher margins and its operations increasing. There aren’t really any fundamental worries on the horizon with any of its subsidiaries or operations.

However, what we need to remember is that this is an international operation, with some riskier exposures, meaning you should more or less expect that there is some sort of impact in any one of the company’s segments. The company’s international exposure also goes a way to explain the relatively low credit rating, despite what is otherwise well-laddered fundamentals, with no massive debt due until 2026 and beyond, and a weighted average CoC of 2.88%, at 94% of fixed or hedge ratio for the recourse debt, and long maturities (10 years average), with somewhat higher (5.15%) average all-in cost. Again, not the best, but definitely good enough.

An organization like this is bound to have a range of global outages and challenges, while also seeing advantages.

AES IR (AES IR)

Results so far are good, and I don’t really see any sort of headwinds that would result in the company not achieving its currently forecasted guidance and goals. Also, the company’s growth trajectory seems set, in this particular macro with heavy advantages towards renewables. The company has also garnered interest from infrastructure investors like Hannon Armstrong (HASI), who is investing in their business.

Based on these fundamentals, and these results, I move to valuation.

AES Corporation – The valuation

While the company suffers from macro risk due to its exposures to a whole host of geographies that come with geopolitical and climate-related implications, I believe that operations are solid enough that we can assign or allow for some sort of premium on part of AES here.

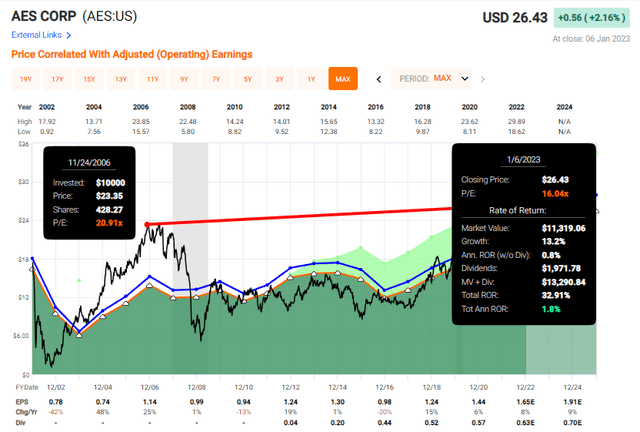

My main issue with the company is that this actually wasn’t that stable, or “good” of a company in the past. If we look at long-term normalized multiples, they don’t line up with the current ones. Not even close.

For a 20-year average, there is a P/E of 13.3x, as the company hasn’t been able to grow its earnings by more than 1.84% over the past 20 years per year. In fact, if you had bought the company during the peak before the recession, your current RoR would have been horrible, regardless of how much the company has grown in the past few years.

AES valuation/ROR (F.A.S.T graphs)

So, the past 5 years have been absolutely stellar. The bullish thesis hinges on that development continuing, and the forecasts call for that to be the case.

Is it likely?

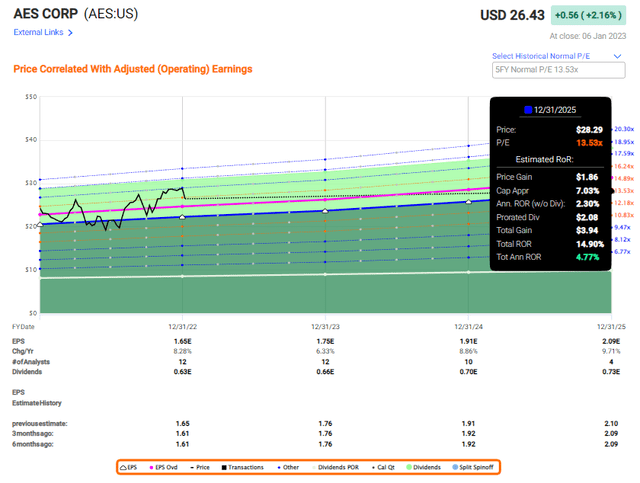

I would say yes, it’s likely. The current situation in the renewables space, in terms of governmental support and global interest, would need to see significant derailment for this company’s earnings to go negative in the short or medium term. However, don’t kid yourself – this company is pretty expensive at this time, especially for the yield it offers. At its 20-year average, the upside is less than 5% per year.

F.A.S.T graphs AES Upside (F.A.S.T graphs)

Even if we assume 15x that upside is only 8.19%, meaning my own minimum of 8.5% annually isn’t even fulfilled. In terms of historical pricing, the company isn’t cheap either.

Analysts do think the company is cheap here – they give it a $30.17/share average, with a low of $22 and a high of $33, with 11 out of 12 analysts either at a “BUY” or an “Outperform”. So my own view on the company is a minority – which is fine.

I do see the potential upside for AES here – I just think we’re paying a bit much for it at this time. Maybe the company will prove to be that absolutely stellar and safe investment, generating above-average returns and maybe normalizing at closer to 15-18x P/E. But that’s some of the best fully integrated utilities on earth, which I happen to invest in. These utilities come at significantly less risky exposures, and mixes that are already as attractive, or equally attractive to AES.

Because of that, I don’t see a massive “BUY” case for the company at this time – and I would like for it to at least get back down to 15x normalized.

That would be around $25/share, and that’s where my initial share price ends up being.

Thesis for the common share

- AES is an attractive global energy play, with utility exposures across all major continents in the world. They have an attractive, renewable-tilted pipeline that could position AES as one of the world-leading businesses in this segment.

- Institutional investors and larger companies are loving this business – but I believe the recent 5 years of valuation show uncertainty as where to this company “should” be traded.

- I personally believe that the company should trade closer to 15x P/E, which leads me to give the business a $25/share PT, making it a “HOLD”.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion

The company has an upside – it’s just not high enough at this time. I say “HOLD”.