(Bloomberg) — Monetary policy, inflation and labor remain the top worries for finance chiefs for the coming 12 months, with nearly one-third of executives in a survey saying they are delaying, scaling down or permanently canceling investments due to uncertainty surrounding the US presidential election.

Most Read from Bloomberg

That percentage, at 28%, is lower than the reading in June 2016, when about half of chief financial officers said they planned to pull back on investing or hiring due to political uncertainty, according to Duke’s Fuqua School of Business. About 32% of respondents said they see this year’s election impacting investment decisions.

Fuqua – together with the Federal Reserve Banks of Richmond and Atlanta – polls CFOs on a quarterly basis, asking about their spending plans, the economic outlook, key concerns and other topics, for example technology and its impact on business. Fuqua didn’t ask about the impact of political uncertainty during the 2020 presidential campaign.

Heading into the second half of the year, US finance executives continue to battle a similar set of challenges as they did in previous quarters. Executives are watching for the Federal Reserve’s next steps, signs of further economic slowdown and the presidential campaign as they weigh spending decisions for the remainder of 2024 and for 2025.

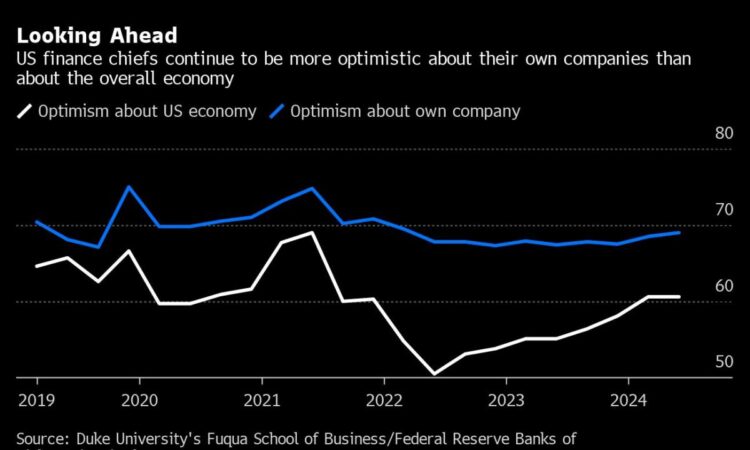

Optimism among CFOs remains moderate, unchanged from the first quarter of the year — when they gave an average rating of 60.6 on a scale from 1 to 100 — but higher compared to the prior-year period. The 447 respondents to the survey that closed June 3 said they expect an average growth rate of 1.8% for US gross domestic product for the coming 12 months, slightly lower than in previous quarters.

Executives continue to be more positive about the outlook for their own business than for the overall economy. “In a world where consumer confidence went down, CFO optimism didn’t,” said John Graham, a finance professor at Duke University and the survey’s academic director. “It is not super optimistic, but also not super low. The CFOs never got close to predicting a recession, and they are continuing in the same vein,” Graham said in an interview.

Despite that, finance chiefs see cost pressures continuing, with 57% of respondents saying they expect the prices of their products to increase at a higher rate than prior to the pandemic.

“While growth in unit costs, wages, and prices has moderated from their peaks in 2021 and 2022, price expectations among surveyed financial leaders are not back to their pre-pandemic levels, suggesting that pricing pressures may be more persistent than initially thought,” Daniel Weitz, survey director at the Atlanta Fed, said in a release.

Finance executives also said they plan to automate tasks that are currently performed by employees, with a majority expecting artificial intelligence to play a key role. Automation is boosting product quality and output, reducing labor costs and can help with substituting workers, the respondents said.

“CFOs say their firms are tapping AI to automate a host of tasks, from paying suppliers, invoicing, procurement, financial reporting, and optimizing facilities utilization,” Graham said.

(Updates chart.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.