Ursula Von der Leyen, and Emmanuel Macron obtained very different results from their Beijing visits, while the UK joined the CPTPP. Which perspective, political or trade, will ultimately prevail in Europe’s handling of China?

By Chris Devonshire-Ellis

Recent events in and around Asia have underscored just how politically diminished Europe has become in Asia – with the visit of EU Commissioner to China and the UK joining of the CPTPP, coupled with the French Presidents visit to Beijing following Xi Jinping’s trip to meet Vladimir Putin. A carousel of geopolitics as high-powered leaders try to influence a new world. Clearly, life pre-Covid is not going to be as it was before. Times have changed.

Xi’s trip to Moscow underscored both China and Russia’s belief that the emergence of a new world order is both necessary and in process, with both nations emphasizing this as a much-needed force for good. The West, they argue, has become selfish and arrogant, wanting to impose its own will upon the rest of the world, largely for their own gain. ‘We have a system in place that has served us well since the end of WWII’ appears to be the rhetoric. That may be, however this hinges on who exactly the system has served and the true meaning of “us”.

It certainly doesn’t appear to be the world’s climate, polluted regions, the record numbers of the poor and displaced, the vast global economic disparity, where the CEO of Exxon ‘earns more money than God’ (a Joe Biden quote) while the World Bank estimates 719 million people live in extreme poverty while species are going extinct in record numbers and sea levels both heating up and rising at levels humans have never before experienced. In 2023, there are currently 20 armed conflicts all going on at the same time ranging from Ukraine, to Myanmar, Somalia, Syria, and Yemen being just five of them. All 20 have death tolls above 1,000 and some in the 100,000’s.

Choosing this moment in time to discuss the makeup of a new world order when the current one is clearly failing it turn out is of global paramount importance. Instead its often dressed up as either a fight between democracy and autocracy or as China and Russia wanting to take over the world.

The success or otherwise of these calls for change are lead, in part, by Europe, with the United States and what Russia has dubbed ‘the Anglo-Saxon world’ – Australia, Canada, New Zealand and the United Kingdom all in tow. That doesn’t quite mean that all Europe is on board; outliers such as Serbia and Hungary are also advocates for change. But for the most part, it’s the EU and UK.

The past week of course saw Ursula Von der Leyen, the EU Commissioner, visit China’s President, Xi Jinping in Beijing to discuss China’s ‘involvement’ in the Ukraine conflict. With Xi having returned a week earlier from meeting the Western-ostracized Vladimir Putin in Moscow, Von der Leyen was apparent keen to ‘lay down the ground rules’ to China in terms of what the EU expected. No weapons sales to Russia being a paramount request, ‘or there will be consequences’.

Ursula Von der Leyen in China

It isn’t the best of times for an EU politician to be making demands of China (some would call them threats). The EU indefinitely froze the EU-China Trade Agreement it had spent years negotiating in May 2021, has labelled the country guilty of genocide in Xinjiang, been highly pro-Taiwan and subjected it, in part, to sanctions and tariff impositions on a variety of products, justified mainly on the fundamental values of human rights, democracy and a fear of Chinese infiltration of communications and other strategic equipment. (it does seem strange though that no smoking gun in terms of justifying these claims has ever been produced, suggesting the real reason lies elsewhere. It also calls in question the capabilities of the West’s own security services if they can’t detect Chinese spyware). The result is that asking Xi Jinping – or even attempting to tell him – that China must back off from Russia and any assistance as concerns Ukraine was largely doomed to fail. And so it seems to have proved. Von der Leyen had her 15 minutes with Xi, but wasn’t visibly present at any of the major events or subjected to any detailed media coverage in China. It has appeared so low-key as to be almost invisible.

Xi and China’s politicians in general regard the situation in Ukraine as being a European-manufactured problem, and one for the Europeans to resolve, and that means discussions with Russia, as Beijing has pointed out on numerous occasions. Von der Leyen’s approach appears to be that the EU doesn’t want to talk to Russia. Given that they have sanctioned most of the Russian government, including the widely expected Foreign Minister Sergey Lavrov, even being seen to now creates its own political gordian knot.

Xi, you can imagine, when confronted with this particular dilemma, probably shrugged his shoulders. It’s a European problem, not a Chinese one, and the EU needs to resolve it.

What will happen? Barring any unforeseen political upheaval in Moscow, the EU has tied itself into so many knots over Russia it has blocked itself in. That will likely take a change in the European political landscape to resolve. With an upcoming winter 2024 just 9 months away, energy prices at record highs, inflationary problems and reports of thousands of EU businesses going bust, pressure is going to be on. Most EU countries have elections in 2023 and 2024, and Von der Leyen herself will be gone by early 2025.

This is why many analysts suggest the Ukraine conflict will drag on. By all accounts, because of the manner in which this has been achieved, Von der Leyen will be seen, in Beijing’s eyes, to be partially responsible for this. Turning to Beijing to request assistance / threaten (depending on your perspective) China will be seen as a sign of weakness in Zhongnanhai, and a hallmark of an unreliable politician who was involved in starting a conflict but proved equally unable to get out of it.

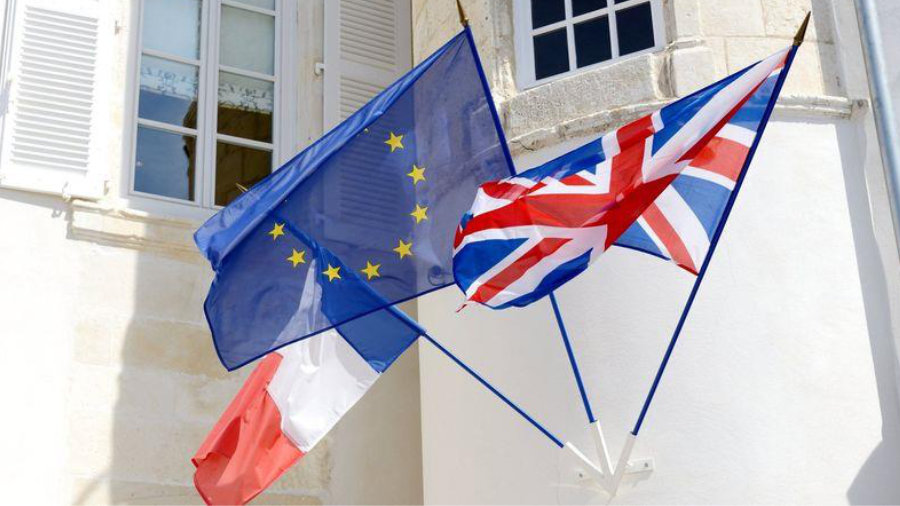

Emmanuel Macron in China

Macron’s visit to China was almost the polar opposite. With Von der Leyen handily by his side to deal with the EU political issues with China, the French President turned up with an aircraft full of French businessmen and investors. As a result, he was feted by Xi and given the honor of a military parade – Macron’s visit was an Official French State visit after all. Business was very much on the agenda, and French companies were duly rewarded – deals in nuclear technology, renewables, aviation (Airbus won a huge contract), automotive, desalination and agriculture among many others were signed. The Airbus deal involves creating a new assembly line in Airbus’ Tianjin factory so the company can double its production capacity of A320 models. The new line is scheduled to be fully operational in 2025. Given that Airbus received 516 orders for A320’s in 2022 this is a significant deal, and can be valued at about US$100 million an aircraft – or a production deal worth some US$51 billion in revenues.

L’Oréal, the world’s leading cosmetics company, struck a three-year partnership deal with China’s Alibaba to promote sustainable consumption. On the cultural side, China’s Forbidden City Museum and France’s Versailles Palace are to arrange a joint exhibition “Exchanges between France and China in the 18th Century”, sure to be a huge attraction in both countries.

That French businesses should take notice of the opportunities in China should be no surprise – the Chinese President Xi Jinping spelled this out loud and clear in last October’s Communist Party Congress. For those who listened, Xi stated that “maintaining China’s strategic trade and investment links with the rest of the world and economic opening will only be wider.” The CPC plan also included details on raising the disposable income of Chinese nationals, and specifics of upgrading another 300-400 million Chinese to middle class consumer status within the coming decade. China’s ‘Dual Circulation Strategy’ which grows the economy by both increasing exports, and crucially, domestic consumption. That is very good news for European export manufacturers wanting to sell to China – a middle class expected to double in a decade. That is what the French businesses and Macron were in Beijing for – and it worked.

The UK & The CPTPP

Also announced last week, although with somewhat less fanfare than the Von der Leyen and Macron EU trips to Beijing, was that the United Kingdom has joined the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). This bloc includes Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam, and in terms of the UK is somewhat of a curates egg in that the UK already has trade agreements with several of these nations. It is expected to add about 0.8% of growth to UK GDP over a decade – fairly small beer, although at least Britain can point to one positive result, albeit small, in the years since Brexit. However, there has been criticism that the real reason the UK joined the CPTPP is a political one, and is aimed at keeping China, which has expressed interest in joining the bloc – out. Apparently having UK negotiators on board is aimed at frustrating Beijing aims so much – they never join. It seems somewhat perverse to join a trade bloc and then state the actual intent is not to allow trade with certain members who wish to join. In this respect, the UK seems part of the Von der Leyen mindset that China must be put in its place. The UK’s trade with China was down 6.7% in 2022. The CPTPP addition doesn’t cover that decline, let alone that of Brexit. Curiously the British media didn’t mention France’s Airbus deal, – 20% of Airbus is owned by the UK’s BAE Systems. Given the extent of the Airbus Tianjin deal, that one contract alone in terms of what it means for BAE dwarfs any CPTPP benefits.

Political Trends

It is hard to point to political trends – as the famous quote by Joseph Chamberlain is recorded in 1886 as having said: ‘In politics, there is no use in looking beyond the next fortnight’. Anything could happen, and especially in these uncertain times. However, given the current course, it would appear that without Russia’s cheap energy and any resolution to the Ukraine conflict, Europe is set for a tough time the next few years. It remains to be seen how that will play out in the political field and how long the Western position in terms of media and current political support can be maintained. Inflation however is expected to remain higher than GDP growth meaning price increases and a decline in the standard of living. The current political thought-leadership in power will need to protect their voter base against that to retain any chance of maintaining the current course. If not, a change in dynamics can be expected by 2025. For now, the EU appears positioned to want to stay that hard line course. However as Ursula Von der Leyen and the United Kingdom appear to be finding out, when it comes to China this may be subject to the law of diminishing returns.

Trade Trends

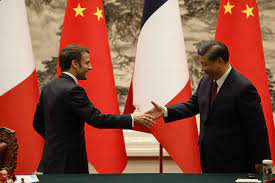

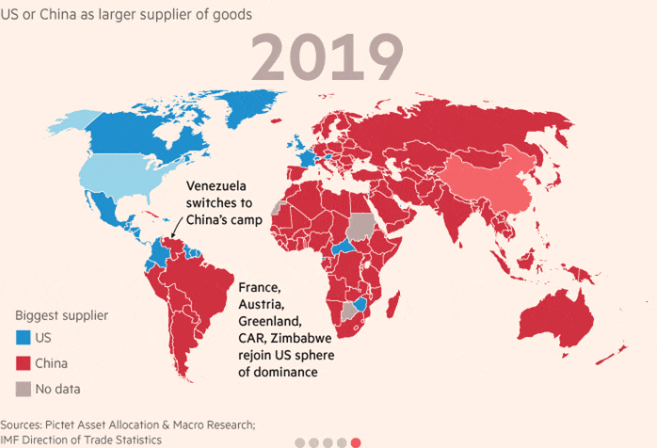

China is generally regarded as having surpassed the United States in global trade influence in 2019. These two graphics, based on data compiled by the IMF, show how fast China’s trade of global trade has pushed back against the United States dominance in just 20 years.

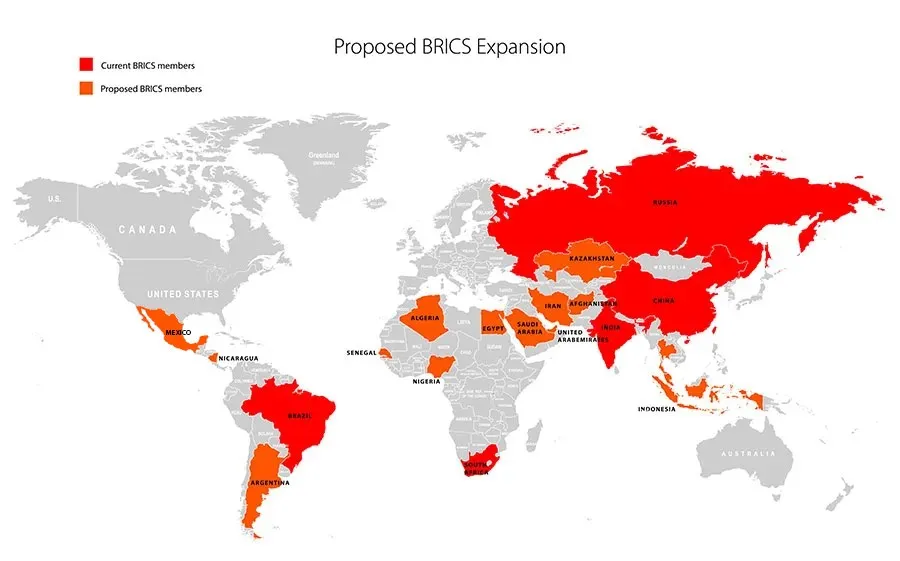

This is not purely down to China’s WTO accession, although that was certainly a springboard. China’s growth in overseas trade has also been fuelled by China’s agreeing to multiple trade deals on a global basis – all designed to reduce tariffs; price competitiveness in sheer numbers of available workers; the Belt & Road Initiative; and intense diplomatic efforts far greater than those of the West. What is interesting is that the 2019 trade figures in terms of global reach is an advance picture of the proposed and expanded BRICS + grouping. Multiple countries have officially expressed an interest in joining this, with discussions also taking place of aligning BRICS with other free trade blocs such as Africa’s AfCFTA and Latin America’s Mercosur.

Potential Outcomes

Given the political caveat that ‘anything could happen’, it certainly appears that the trade grouping outweighs the US and EU political grouping by a significant degree. That matters, and it matters with resolving the Ukraine conflict too. While the West is keen to point to UN resolutions that issued a ‘non-binding’ resolution that Russia must leave Ukraine, voted for by 141 countries, in reality this achieves very little. There is no commitment to actions against Russia, rendering these types of proposals effectively meaningless. But looking at the China and BRICS map, one can see the trade aspect as dominant. Given that Russia is very much part of the BRICS and a major player within it, the data suggests that the West does not have support when it comes to any measures that would involve curtailing trade – even with Russia.

In effect, this lays bare the West’s position – its geopolitical stance is outweighed by the somewhat overwhelming desire for global trade. In this case, Macron’s France, in a position endorsed by its President, appears to be on a course to also accept the reality: that perhaps the beating up of China (and to some degree Russia) is now waning and has run its course. That would mean a return to a more trade and culturally minded attitude towards Beijing is starting to break out. If that happens, then commitment towards the continuing isolation of Russia will also begin to wear off. By the time Parisian queues form to see “Treasures of the Forbidden City” and exhibitions of Sino-French culture celebrated, the political compass as concerns Messrs Xi and Putin may have swung to a more tolerant and Ukraine resolution directed perspective. The green shoots of a more liberal approach to China from Europe may be starting to appear. If so, EU businesses would be wise to consider China opportunities as its consumer market continues its expansion – a doubling within the next decade.

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. He may be reached at [email protected].

Related Reading

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at [email protected].

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.