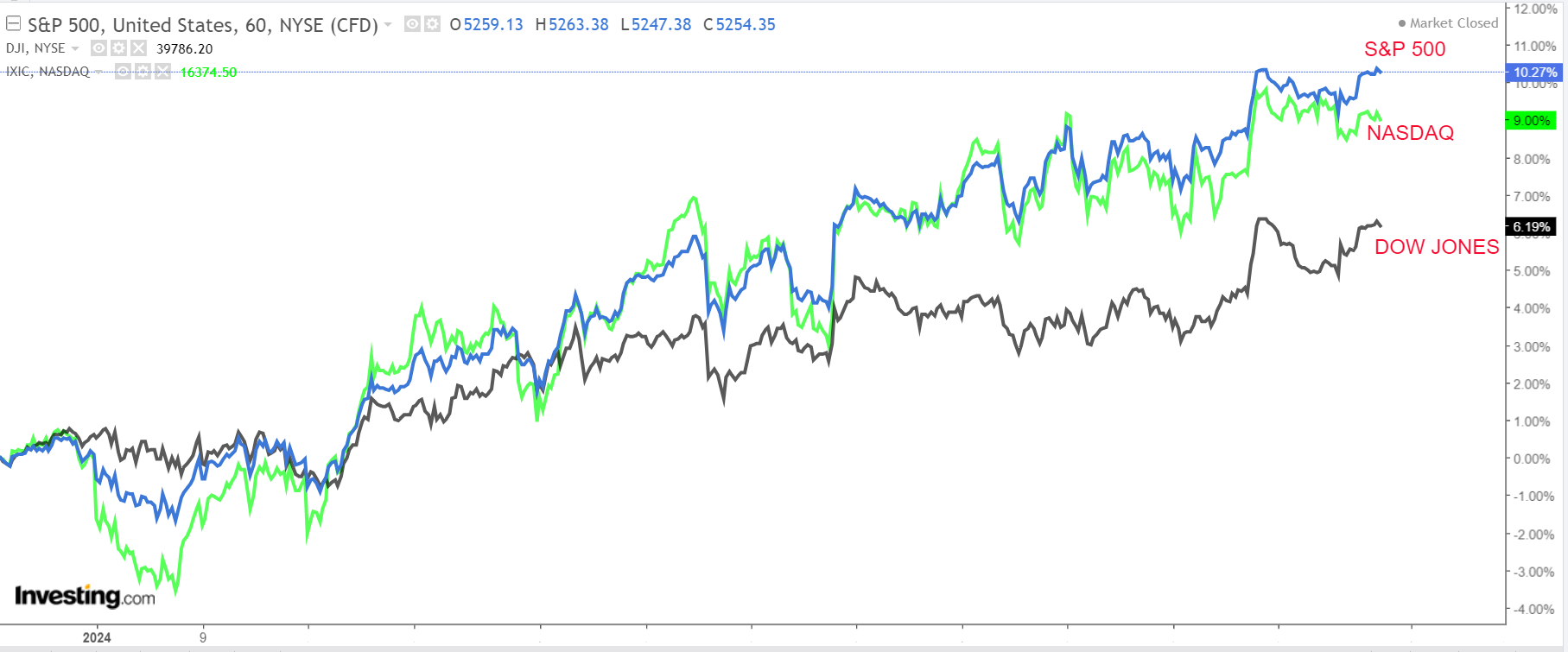

The ended at a new record high to close out the month of March, with the benchmark index registering its best first quarter performance in five years.

Each of the three main U.S. indices recorded solid gains for both the month and quarter thanks to ongoing excitement over artificial intelligence (AI) related stocks and expectations the Federal Reserve will begin to cut interest rates at some point this year.

In March, the S&P gained 3.1%, the blue-chip added 2.1%, and the tech-heavy climbed 1.8%.

It was the fifth straight winning month for all three major averages.

Source: Investing.com

For the quarter, the S&P 500 shot up roughly 10.2% for its best first-quarter gain since 2019, while the Nasdaq and Dow rallied 9.1% and 5.6% respectively.

Driving the gains on the month and quarter has been Nvidia (NASDAQ:), which is now the third most valuable company listed on the U.S. stock exchange. NVDA stock gained 14.2% in March and soared 82.5% for the quarter as the AI boom shows no signs of slowing.

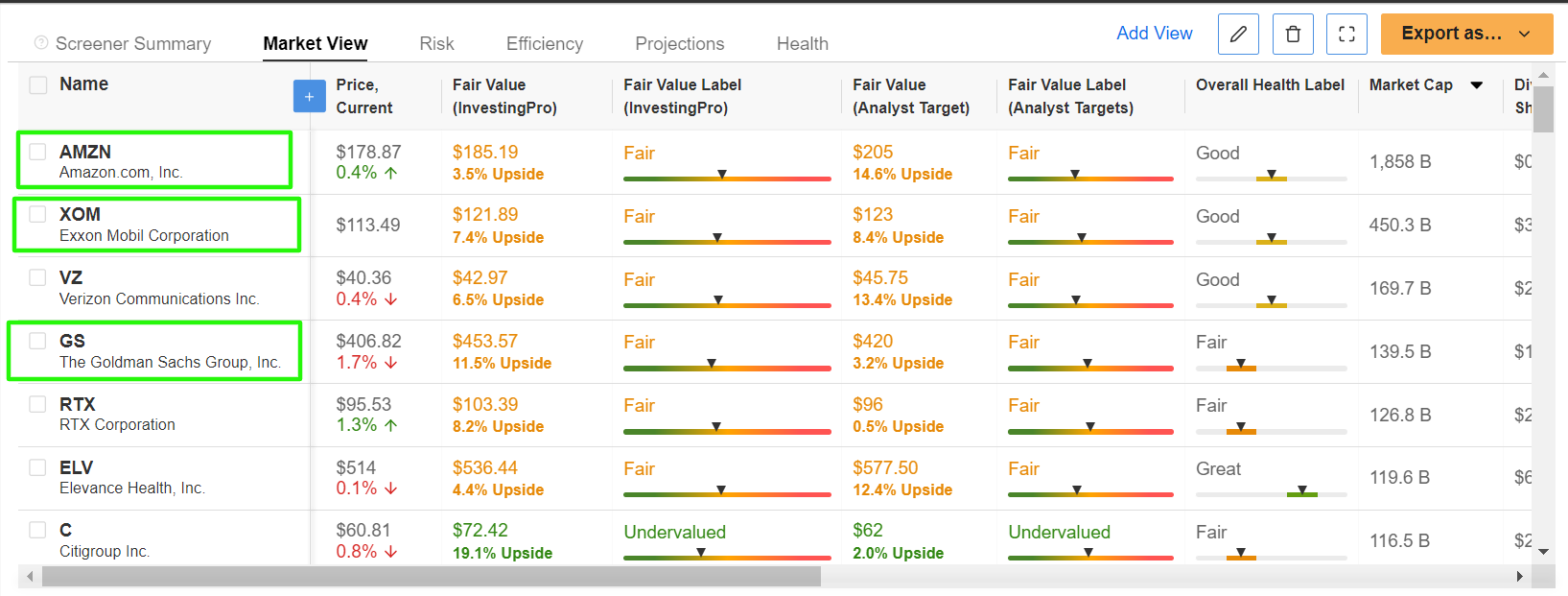

Amid the current backdrop, I used the InvestingPro Stock Screener to search for the best undervalued stocks that have demonstrated strong performance year-to-date and are poised to deliver further gains in the month ahead.

InvestingPro’s stock screener is a powerful tool that can assist investors in identifying cheap bargain stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters, saving you substantial time and effort.

Source: InvestingPro

With upcoming quarterly earnings reports expected to serve as near-term catalysts, Amazon (NASDAQ:), ExxonMobil (NYSE:), and Goldman Sachs (NYSE:) present compelling opportunities for investors heading into April.

Let’s delve deeper into what makes these three standout companies solid choices for the month ahead.

1. Amazon

- 2024 Year-To-Date: +18.7%

- Market Cap: $1.87 Trillion

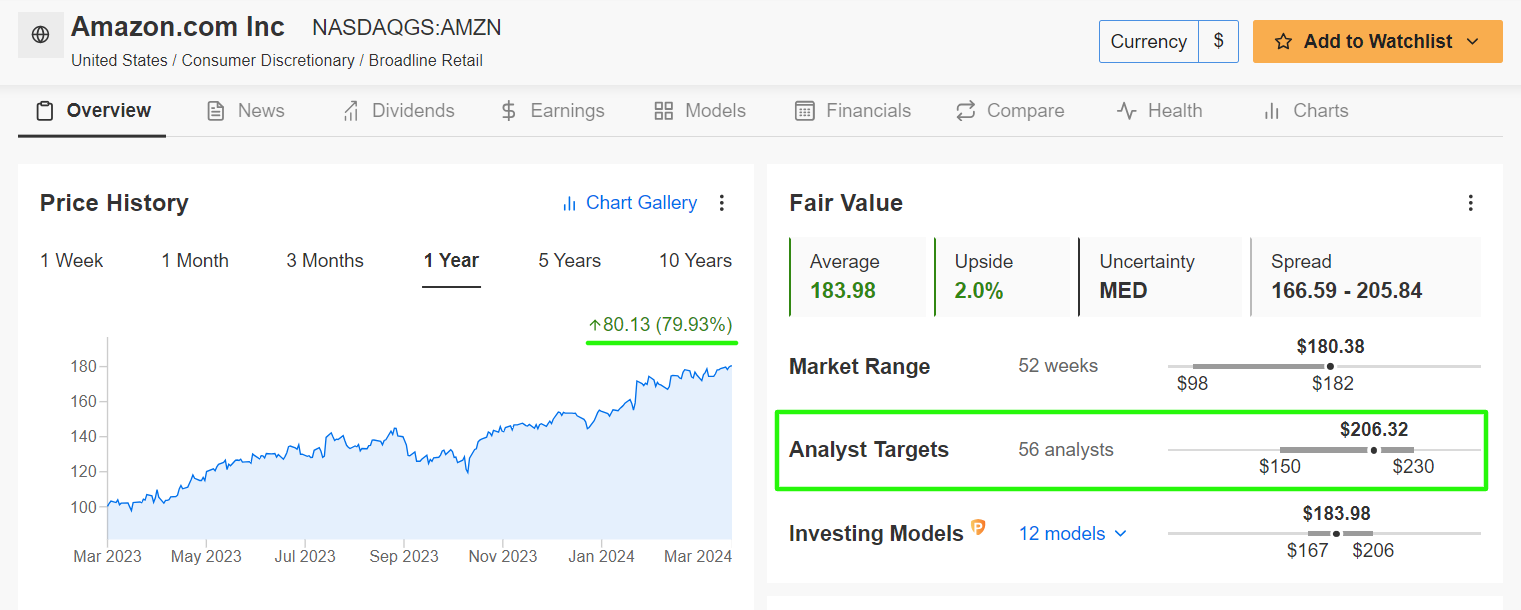

Amazon (NASDAQ:) stock ended Thursday’s session at $180.38, not far from its July 2021 all-time high of $188.65. With a valuation of $1.87 trillion, the Seattle, Washington-based e-commerce and cloud giant is the fifth most valuable company listed on the U.S. stock exchange.

Shares have significantly outperformed the broader market in the past 12 months, surging roughly 80%.

Source: InvestingPro

Despite the impressive rally, current ‘Fair Value’ assessments indicate the stock is undervalued. InvestingPro models predict a 2% potential upside from the current market value, while Wall Street analysts estimate a 14% increase to about $206/share.

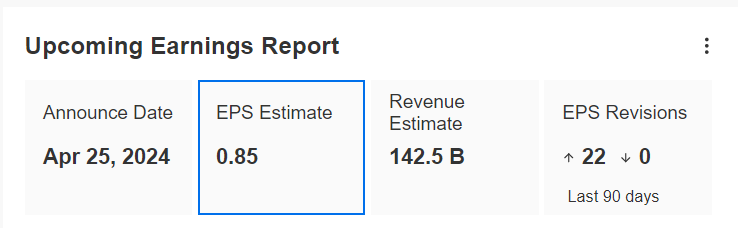

Catalysts for April: Amazon is slated to release its first quarter financial results on Thursday, April 25 at 4:00PM ET and sell-side confidence is brimming.

Earnings estimates have been revised upward 22 times in the 90 days leading up to the print, according to an InvestingPro survey, compared to zero downward revisions, as Wall Street grows increasingly bullish on the tech titan.

Source: InvestingPro

Consensus calls for Amazon to post earnings per share of $0.85, surging over 170% from EPS of $0.31 in Q1 2023, as the company’s focus on innovation, including investments in automation, is expected to drive operational efficiency.

Revenue is expected to climb 11.9% from the year-ago period to $142.5 billion, reflecting ongoing strength in its cloud computing, e-commerce, and advertising businesses.

ProTips Headwinds: InvestingPro’s ProTips underscore Amazon’s promising outlook, emphasizing its favorable positioning in the e-commerce and cloud computing industries, which has allowed it to leverage a resilient business model and strong profit growth.

Source: InvestingPro

Taking that into account, Amazon represents a compelling investment opportunity for April, with its shares likely to break out to new record highs in the new month.

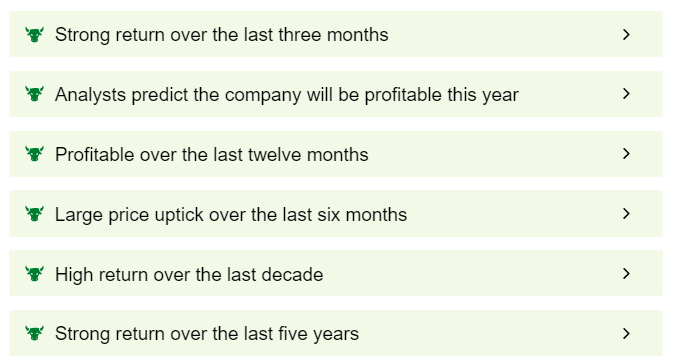

2. ExxonMobil

- 2024 Year-To-Date: +16.3%

- Market Cap: $461.2 Billion

ExxonMobil (NYSE:) stock closed at $116.24 last night, putting it within sight of its record peak of $120.70 reached on September 28. The Irving, Texas-based ‘Big Oil’ company has a market cap of $461.2 billion at its current valuation, making it the largest U.S. oil producer and the 14th most valuable company trading on the NYSE.

Shares have increased 16.3% since the start of 2024, blowing past the gains made by competitors Chevron (NYSE:) (+5.7%), Shell (LON:) (+1.9%), and BP (NYSE:) (+6.4%) over the same timeframe.

Source: InvestingPro

It is worth noting that the quantitative models in InvestingPro point to a gain of 6.7% in XOM stock from Thursday’s closing price. That would bring shares closer to their ‘Fair Value’ price target of $124.08.

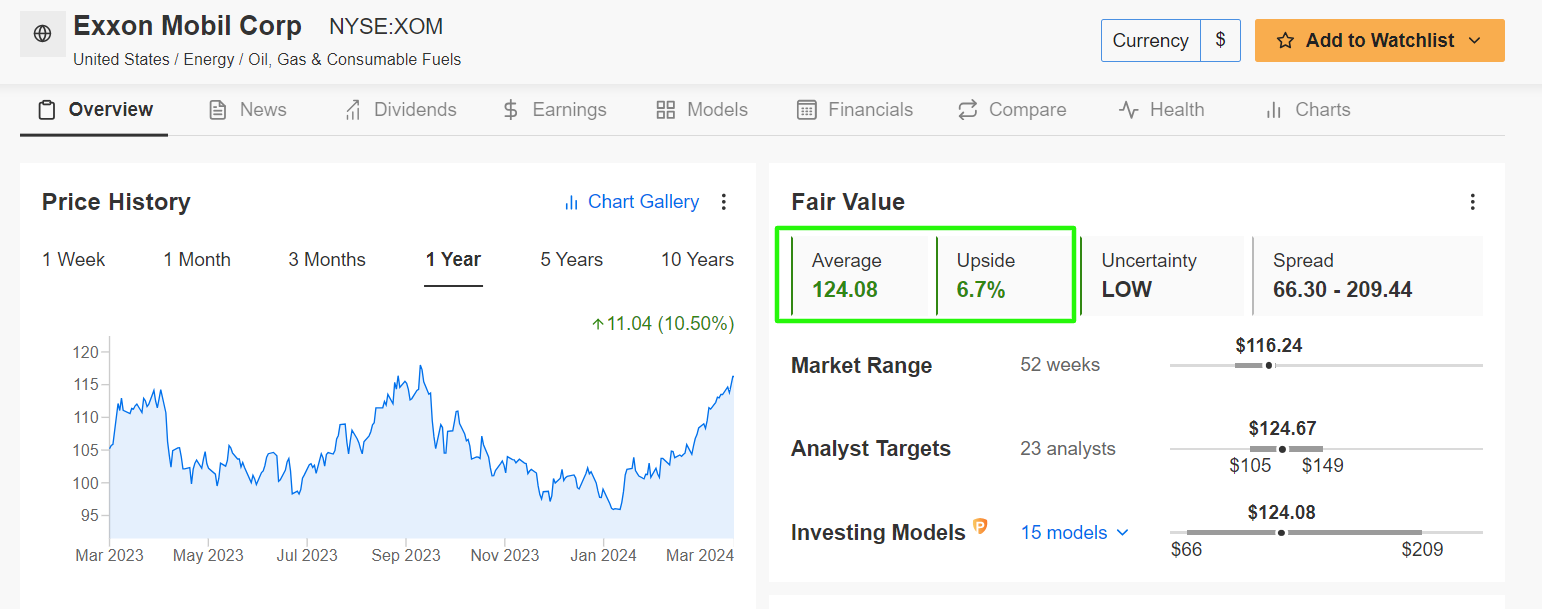

Catalysts for April: In my opinion, XOM remains one of the best stocks to own heading into the new month thanks to its upbeat earnings prospects.

ExxonMobil is forecast to deliver its financial results for the first quarter ahead of the opening bell on Friday, April 26, at 6:30AM ET.

Source: InvestingPro

Consensus estimates call for the Irving, Texas-based energy giant to post a profit of $2.14 per share on revenue of $78.56 billion.

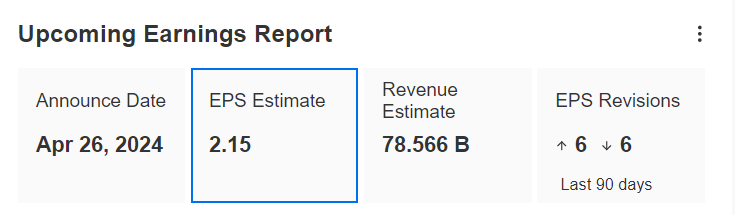

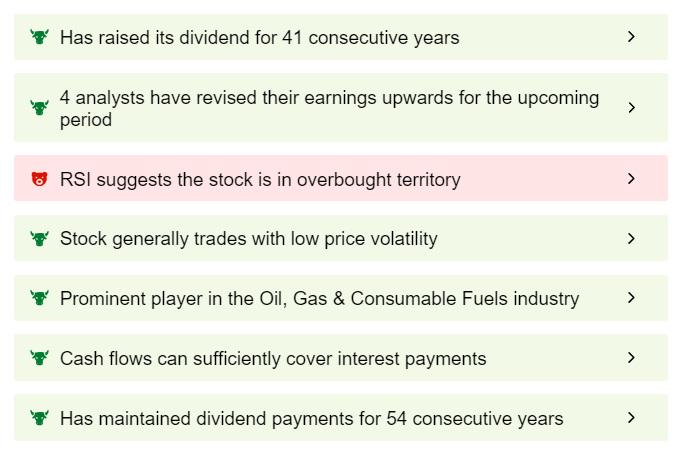

ProTips Headwinds: ProTips paints a mostly bullish picture of Exxon’s financial health, highlighting its strong balance sheet and high free cash flow levels. It also boasts a relatively cheap valuation.

Source: InvestingPro

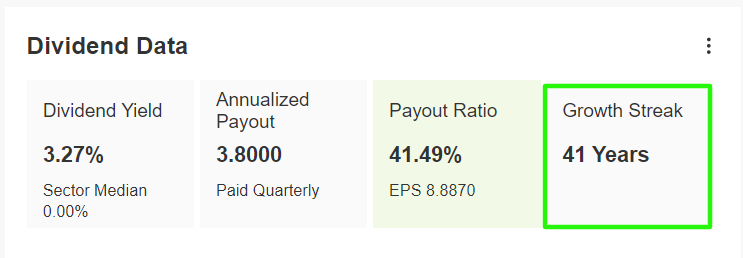

ProTips also mentions that the company has raised its annual dividend payout for 41 consecutive years, a testament to its ongoing efforts to return capital to shareholders.

Source: InvestingPro

The oil-and-gas behemoth currently offers a quarterly payout of $0.95 per share, which implies an annualized dividend of $3.80 at a yield of 3.27%.

ExxonMobil returned $32.4 billion to shareholders in 2023 through $14.9 billion in dividends and $17.4 billion in share buybacks.

3. Goldman Sachs

- 2024 Year-To-Date: +8.3%

- Market Cap: $143.2 Billion

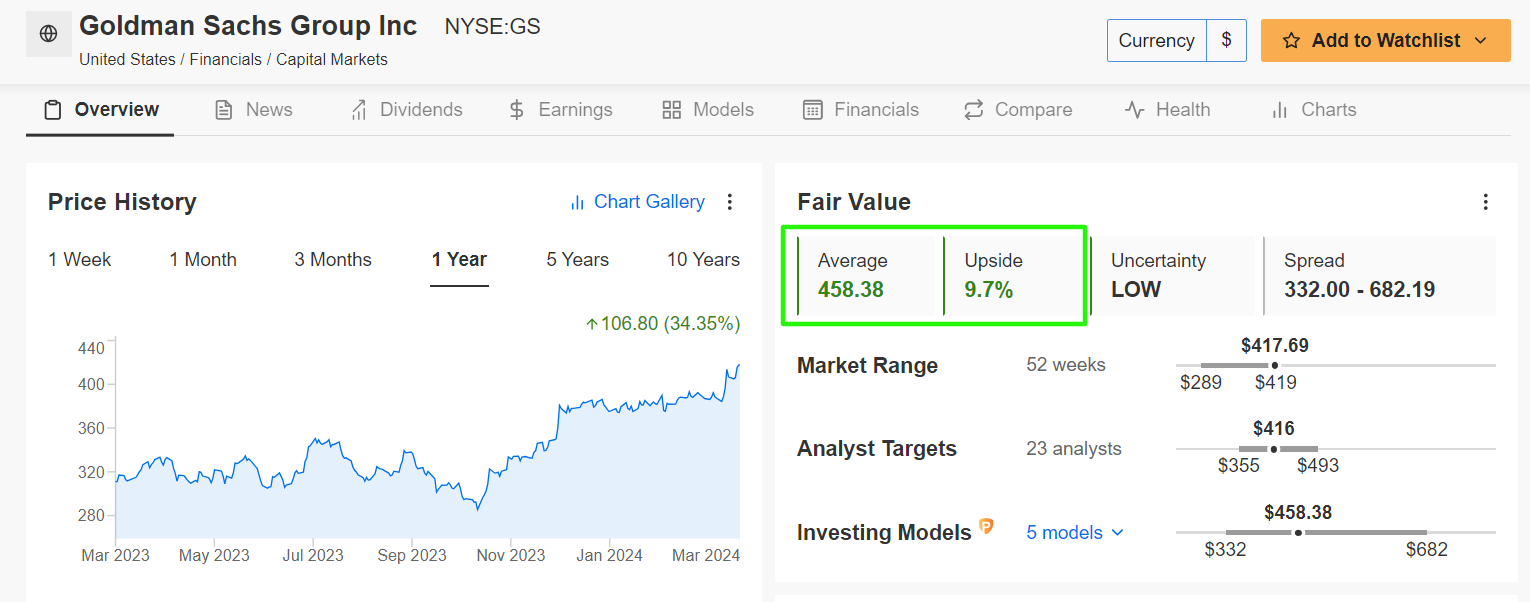

Goldman Sachs (NYSE:) shares ended at a fresh 52-week high of $417.69 on Thursday, a tad below its November 2021 record high of $426.16. At current levels, the New York-based investment banking behemoth has a valuation of $143.2 billion.

Shares are up 8.3% so far in 2024 after scoring an annual gain of 12.3% in 2023.

Source: InvestingPro

It its worth mentioning that Goldman Sachs appears to be undervalued heading into April as per a number of valuation models on InvestingPro, which point to potential upside of 9.7% from the current market value to around $458 per share.

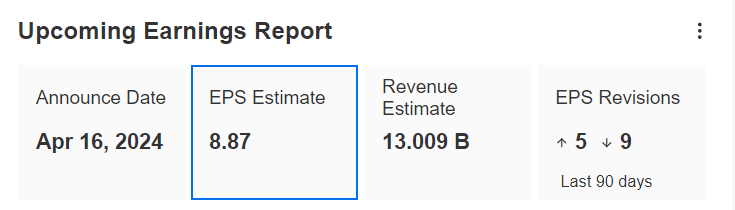

Catalysts for April: Goldman Sachs is scheduled to release its first quarter update ahead of the opening bell on Tuesday, April 16 at 7:30AM ET.

Results are likely to have been boosted by a solid performance in its key investment banking unit and wealth management services business as well as a resurgence in deal-making and IPO activity.

Source: InvestingPro

As seen above, Wall Street sees Goldman Sachs earning $8.87 per share in the first three months of 2024, increasing about 1% from EPS of $8.79 in the year-ago period.

Meanwhile, revenue is anticipated to rise 6.4% year-over-year to $13 billion, reflecting solid growth in investment banking and fixed income trading revenue.

It should be noted that Goldman is seen as the most reliant on investment banking and trading revenue among its big bank peers on Wall Street.

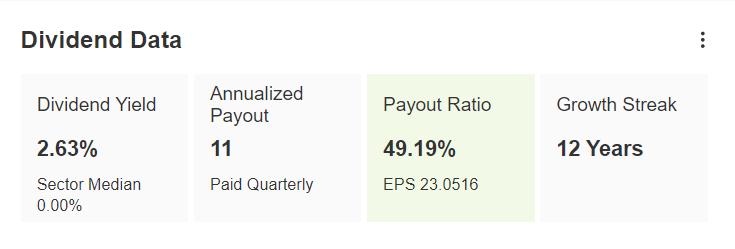

ProTips Headwinds: As ProTips points out, Goldman Sachs is in solid financial health condition, thanks to its pristine balance sheet and a robust profitability outlook.

Source: InvestingPro

ProTips also mentions that Goldman has maintained its annual dividend payout for 26 consecutive years – and it has raised it in the last 12 years – thanks to increasing free cash flow levels.

The company offers an annualized payout of $11.00 per share at a yield of 2.63%.

Source: InvestingPro

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY (NYSE:)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.