2024 outlook for UK & EU equities – Hidden investment opportunities, Elections & Year of strong reforms

By Frédérique Carrier, Head of Investment Strategy for RBC Wealth Management in the British Isles and Asia

UNITED KINGDOM

- Stagflation risks and a likely general election suggest a volatile environment in 2024.

Subdued economic growth and troublingly persistent inflation suggest the UK may well fall victim to stagflation in 2024 if the labour market deteriorates further. The Bank of England is unlikely to be willing to cut interest rates before the second half of the year, in our view. Despite the unpalatable macroeconomic backdrop, we see opportunities for patient investors. UK equities are attractively valued, largely unloved, and offer defensive characteristics.

The UK’s challenges continue but its unloved equities offer opportunities.

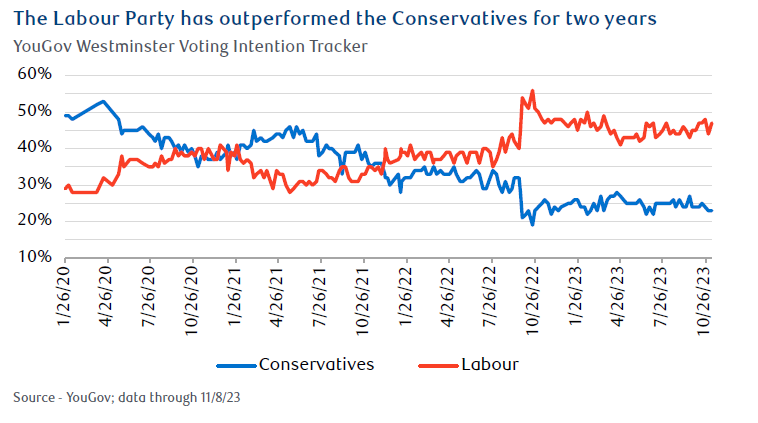

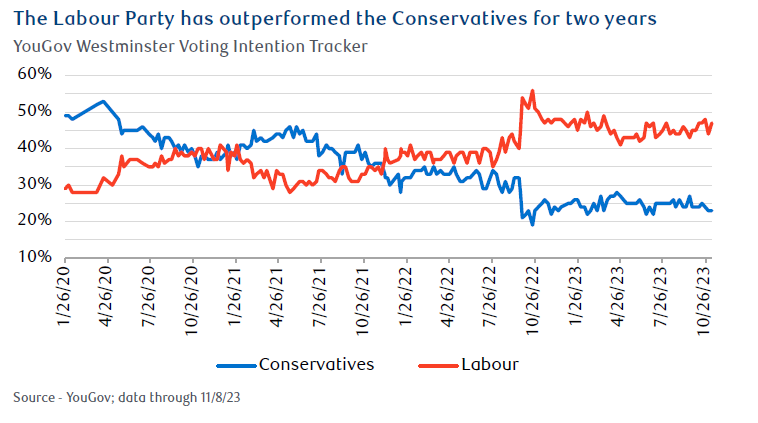

A changing of the guard? The next UK general election is likely to be held in 2024. Given that the traditionally left-wing Labour Party has consistently held a large lead in the polls for more than a year, it is worth considering how the party would govern once in power.

Under its leader Sir Keir Starmer, Labour has changed its spots. The policies of its radical left-wing faction, such as imposing higher taxes on high earners and nationalizing utilities, have been abandoned. The party seems to have transitioned towards the center and has markedly improved ties with the corporate sector. Overall, we do not think a Labour win would incite a strong negative reaction in financial markets.

Labour also aims for a closer relationship with the EU, including a regulatory alignment of “certain sectors” and accepting some oversight by the European Court of Justice. Labour is also looking to deregulate the planning rules for new homebuilding, strengthen employment rights, and forge ahead with the transition to a low-carbon economy.

Some of these aims may be difficult to achieve, in our view. The EU is unlikely to accept this “cherry picking” approach, and reforms to national planning policy may well continue to meet fierce domestic opposition as they threaten to change the landscape. Importantly, Labour would inherit governorship of a country with deep scars—not only from Brexit but also from the fastest spree of monetary policy tightening by the Bank of England (BoE) in three decades—and one that is heavily indebted with gross debt to GDP approaching 100%. All of this may limit a new government’s ability to reboot the economy.

A struggling economy. Economic data, which softened throughout 2023, is likely to slip further as the full impact of much higher interest rates increasingly filters through the economy. We think this will likely be partly offset by an improvement in real wages as inflation has declined. But much depends on the labour market. The risk is that it could weaken should the impact of higher rates exert pressure on corporate profit margins. Unemployment increased from 3.7% in January to 4.3% of late. Overall, a consensus group of economists expects GDP growth of a mere 0.4% in 2024, on par with the level in 2023.

Despite this weak growth outlook, we think the BoE will likely keep the Bank Rate, currently at 5.25%, elevated for much of 2024. Core inflation has waned but remains sticky, at 5.7%.

We see risk of stagflation in the UK, a state characterized by relatively high inflation together with slow economic growth and rising unemployment.

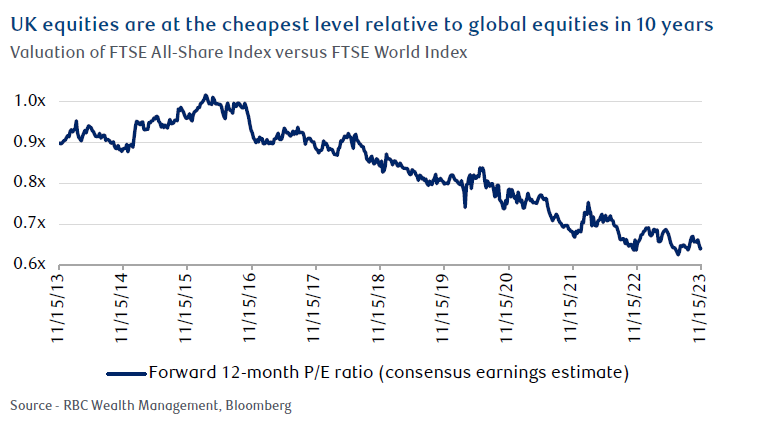

Opportunities in an unloved market. We acknowledge the challenging domestic economic prospects but continue to recommend a Market Weight position in UK equities. We believe the FTSE 100 Index’s defensive qualities should hold it in good stead given the more volatile backdrop we are expecting for the global economy and global equities in 2024. The UK’s blue-chip equity index, the FTSE 100, has relatively large exposure to defensive sectors (e.g., Health Care and Consumer Staples). Moreover, it has a bias to “old economy” industries, including Energy (approximately 14% of the FTSE 100), a sector where the risk-reward is favourable at present, in our view, given the tight supply-side dynamics, inexpensive valuations, and improving earnings momentum. Importantly, UK equity valuations appear undemanding, with almost every sector trading at an abnormally high discount relative to history.

Given the challenging domestic economic prospects, we remain cautious on companies with UK-centric revenues. We continue to recommend maintaining a bias for globally diverse, high-quality businesses. Across the market, the valuation multiples of many leading UK-listed global companies remain at a notable discount to their international peers listed in other markets. We view this as an unwarranted “UK market discount” on these global companies, and think this presents an opportunity for long-term investors in these stocks.

EUROPE

- 2024 may be the year when fiscal and structural reform efforts enjoy the greatest impetus.

With the regional economy struggling, the reforms agenda has been given new impetus. Recommendations to improve the effectiveness of the single market are due in the spring; it will be up to the new European Parliament, which will be elected midyear, to implement them. For equities, weakening macro and earnings momentum remain headwinds. We would become more positive when signs that the region’s relative economic growth momentum is improving become apparent.

Reforms in focus; we remain cautious until the next economic upcycle.

Weak momentum. After the recent sharp weakening in eurozone manufacturing and services activity, stabilization is possible over the next few months. The Industrials sector needs to rebuild depleted inventories, and consumer confidence could improve now that pricing pressures are abating. Nevertheless, we expect elevated interest rates to increasingly force belt tightening on the corporate sector.

The European Central Bank will likely keep interest rates on hold well into 2024. Though inflation has decelerated sharply to 2.9% and bank lending has waned markedly, wages are still growing at 4% year over year, a level inconsistent with the 2% inflation target. Slightly higher unemployment is likely necessary for wage growth to decelerate further.

Only once rates are cut can a sustainable economic recovery take hold. A consensus group of economists expects real GDP growth of 0.7% in 2024, marginally up from 2023’s 0.5% estimate. The potential for a muted recovery is due to the region’s increasing lack of competitiveness and the reining in of fiscal stimulus.

Structural issues need tackling. The pandemic and the war in Ukraine have compounded the bloc’s long-standing structural issues such as its heavy regulatory burden, and the lack of cooperation among EU innovators and companies. These issues conspire to undermine the effectiveness of the EU single market, in theory a seamless amalgamation of 27 national markets with 450 million people.

In her 2023 September State of the Union speech, European Commission President Ursula von der Leyen identified competitiveness as a key priority. Task force recommendations are due in March 2024. The challenge is to preserve the freedoms of movement of capital, goods, and services while competing with the U.S. and China.

Following the June 2024 European Parliamentary elections, it will fall on the next European Commission to implement any recommendations to improve competitiveness and the state of the internal market. The buy-in of national governments will be an important test of their commitment to improve competitiveness.

Fiscal reforms. Moreover, previous EU rules limiting national budget deficits and indebtedness were suspended over the past three years. This was to facilitate financial support for the corporate sector from Brussels and national governments. Financial aid was aimed at supporting the economy reeling from the pandemic and the war, and at accelerating the green transition for domestic reasons and as a response to both the U.S. Inflation Reduction Act subsidies and China’s generous support of its industries.

Discussions to reform the fiscal rules have been ongoing as there is a broad consensus within the EU that more fiscal flexibility is required. Those discussions are likely to drag into 2024. We believe the rules will eventually be watered down though they will likely still require some fiscal tightening for most countries.

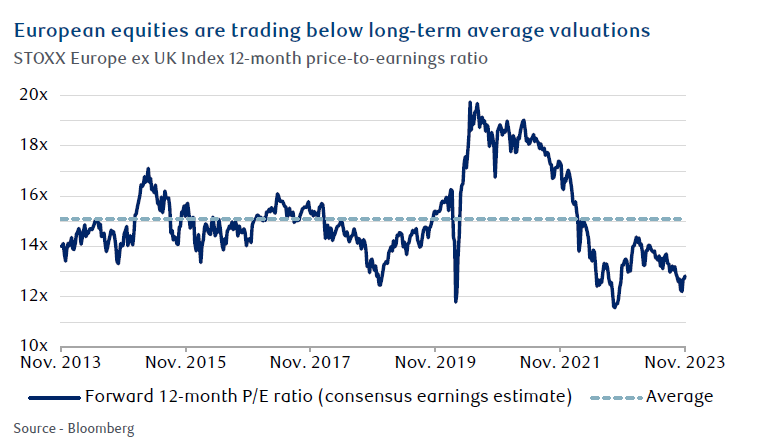

Remaining Underweight, for now. We continue to recommend an Underweight position in European equities as weakening macro and earnings momentum remain headwinds for the region’s ability to outperform.

Consensus earnings forecasts are at risk of being downgraded, particularly among cyclical stocks and sectors.

However, we are watchful for any green shoots and signs that the euro area’s relative economic growth momentum is improving. This would be a key catalyst to increase allocations. The combination of inexpensive valuations and an eventual improving economic backdrop could prove an attractive combination in the months ahead for European equities, especially given their out-of-favour status.

Until then, against the backdrop heading into 2024, we would remain highly selective. For the patient investor, we believe particularly attractive opportunities exist in Industrials supported by structural tailwinds such as decarbonization, semiconductor equipment manufacturer and mission-critical software providers within Technology, and luxury goods stocks that have pulled back in recent months to more attractive valuation levels. Health Care remains our preferred defensive sector, relative to Consumer Staples and Utilities.