Building on a long-standing collaboration between Rhodium Group and MERICS, this report summarizes China’s investment footprint in the EU-27 and the UK in 2023, analyzing the shifting patterns in China’s FDI, as well as policy developments in Europe and China. Key findings and a link to the full report are below:

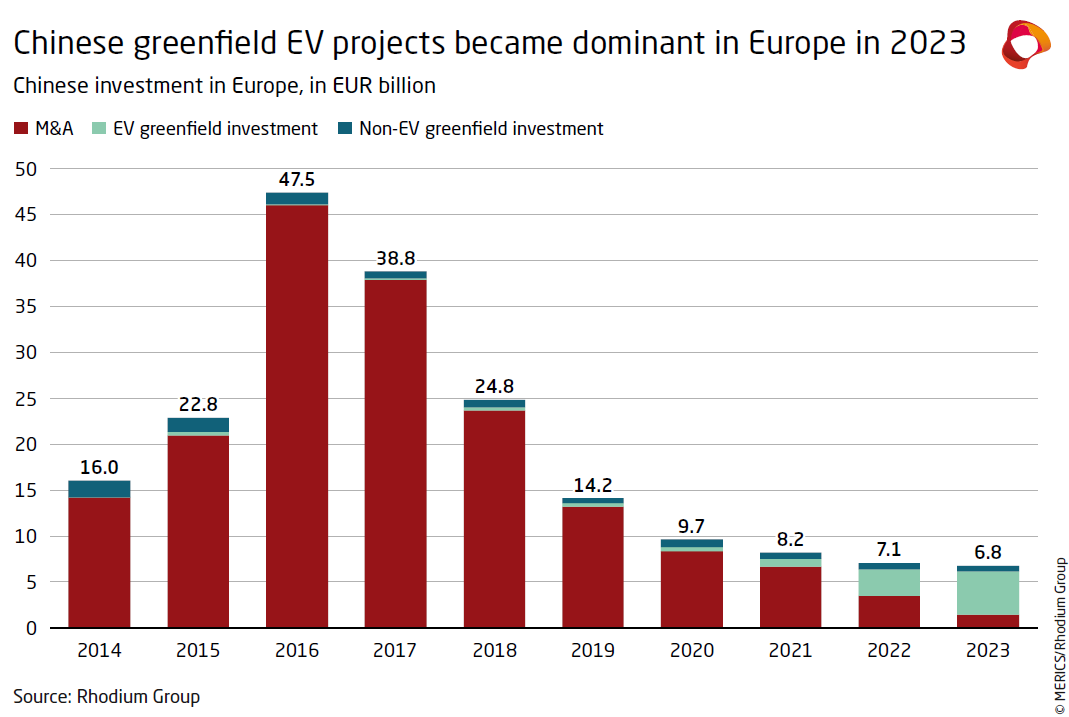

Chinese investment in Europe drops to lowest level since 2010: Chinese investment in Europe (defined here as the EU-27+UK) slipped again to EUR 6.8 billion in 2023, from EUR 7.1 billion in 2022. This was the lowest level since 2010.

Mergers and acquisitions (M&A) keep tumbling: The value of mergers and acquisitions (M&A) fell by 58 percent to just EUR 1.5 billion. China’s economic difficulties and strict capital controls, alongside increased scrutiny of foreign investment into Europe, contributed to the fall in M&A deals.

Greenfield investment keeps FDI levels from falling off a cliff: The share of greenfield investment shot up to 78 percent in 2023, a further increase from 51 percent in 2022. Top greenfield projects in 2023 came from private firms CATL, AESC and Huayou Cobalt, who invested in battery plants in Hungary, Germany and France.

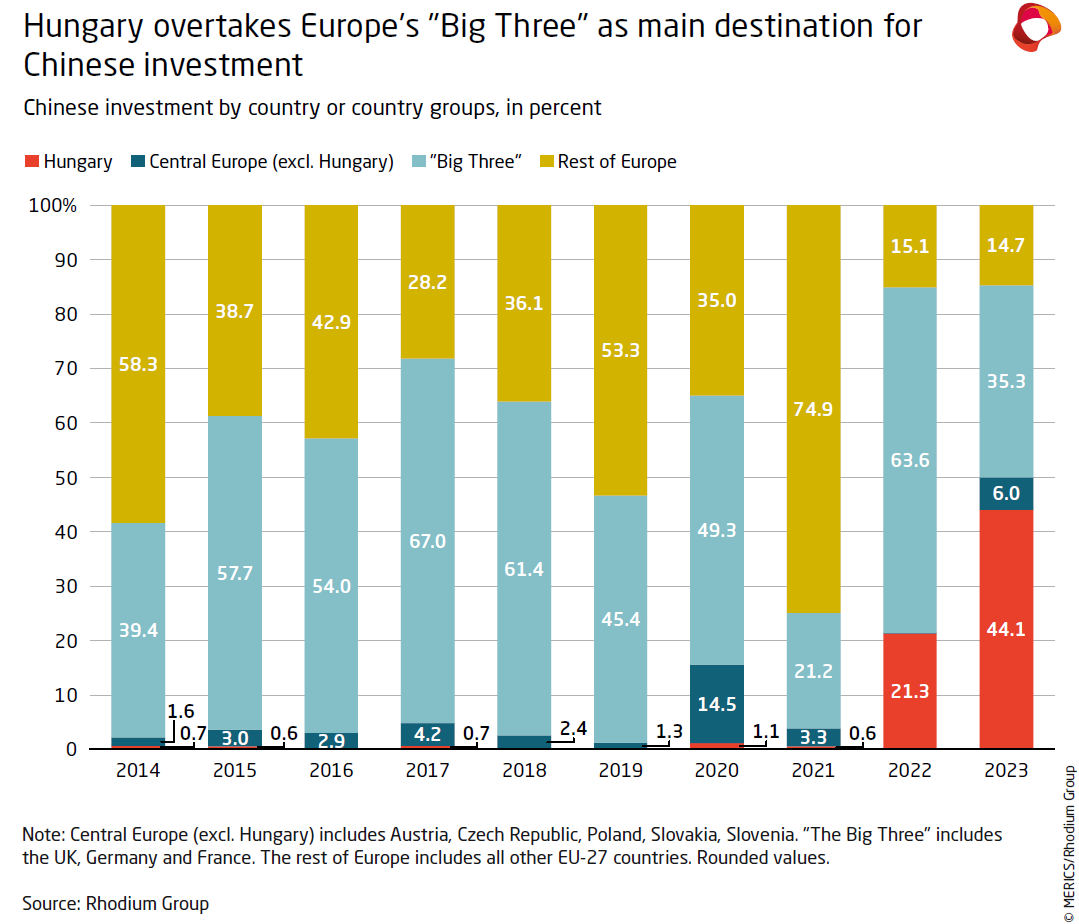

EV driven investments propel Hungary as the top destination: In 2023, Hungary received 44 percent of all Chinese FDI in Europe, benefitting from the surge in electric vehicle (EV) investments. Over two thirds (69 percent) of Chinese FDI were made in the EV sector in 2023, up from 41 percent in 2022.

Investment is spreading along the EV supply chain: Chinese FDI is increasingly moving both up- and downstream along the EV value chain. Chinese suppliers of battery inputs like cathodes and anodes have announced two greenfield projects worth over a billion euros each, and which are expected to break ground in 2024. BYD has announced plans to produce EVs in Hungary by 2026.

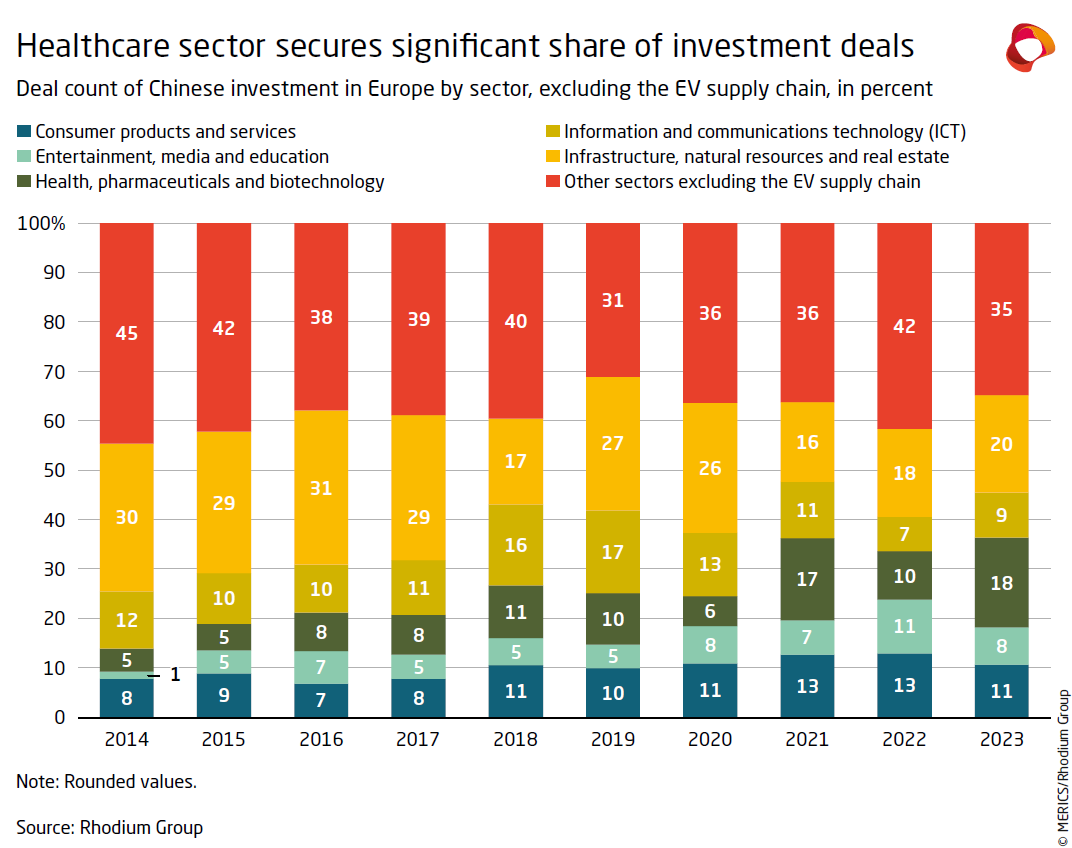

The healthcare, consumer and ICT sectors remain relatively resilient: Europe’s healthcare, consumer products, entertainment, and information and communication technology (ICT) sectors continue to appeal to Chinese investors. They attracted EUR 3 billion in annual Chinese FDI on average during 2021 – 2023. Medical devices are a key area of interest, accounting for two thirds of investment in the healthcare sector between 2021 – 2023.

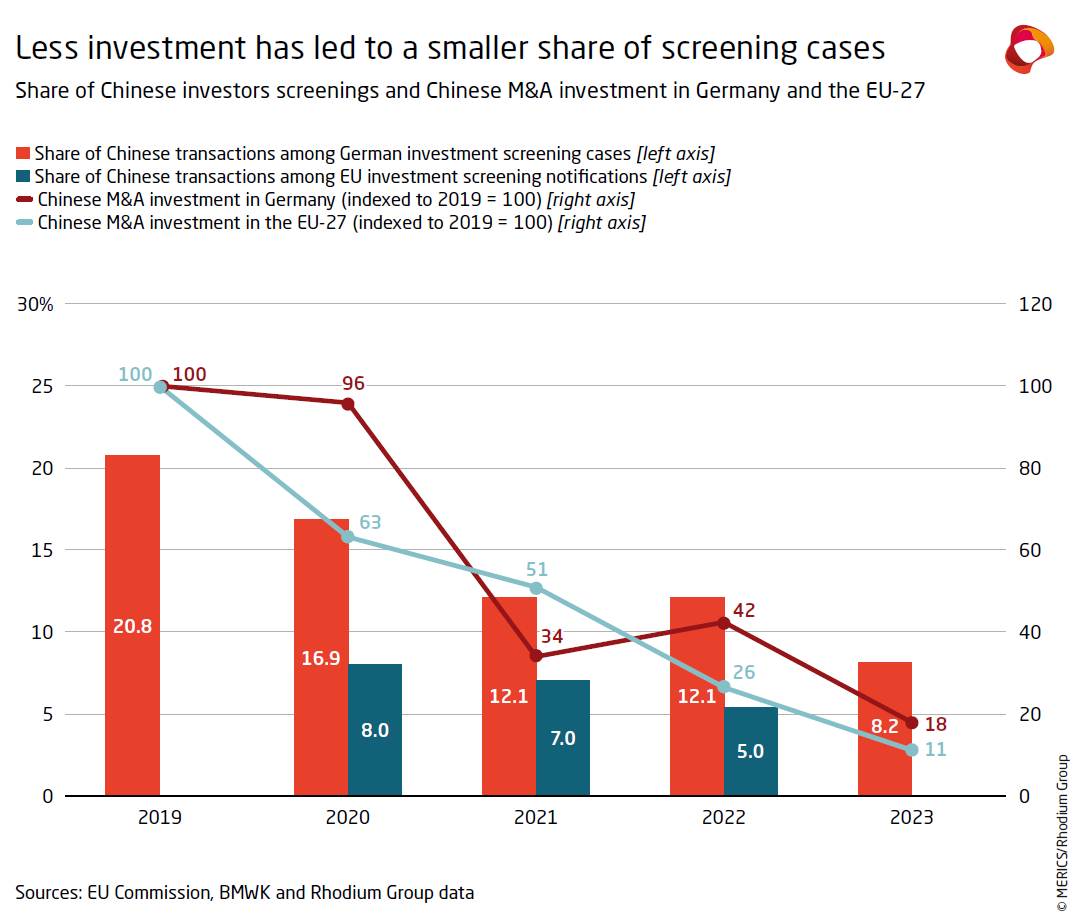

The EU proposes updated screening regulations: The geographical and sectoral scope of investment screening regimes in Europe keeps expanding. The EU is working on greater consistency and a wider remit for screening regulations. Chinese firms looking to invest in strategic sectors in Europe can expect to be the target of more regulatory scrutiny.

No significant recovery in sight: The drop in Chinese investment in Europe will continue to be cushioned by ongoing investment in the EV sector. But a substantial uptick is not expected. Instead, investment is likely to remain at low levels due to the weak financial positions of Chinese firms and increased government oversight in Europe. Chinese firms must also weigh up market opportunities in Europe against the backdrop of growing EU-China trade tensions.