Investing in stocks priced under $10 can offer investors an exciting opportunity to diversify their portfolio and potentially capitalize on undervalued assets.

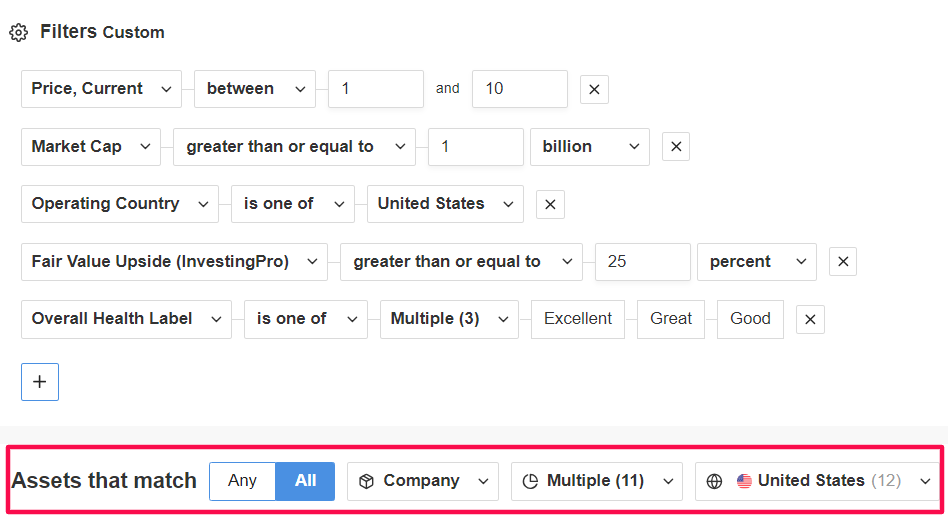

As such, I used the InvestingPro Stock Screener to search for cheap, high-quality stocks that could be excellent buying opportunities for frugal investors.

I first scanned for stocks of U.S.-based companies priced between $1 to $10, with a market cap greater than or equal to $1 billion and that have InvestingPro ‘Fair Value’ upside greater than 25%.

Finally, those companies that also possess an Overall Health Label of ‘Excellent’, ‘Great’, or ‘Good’ made the list.

Source: InvestingPro

The InvestingPro stock screener empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters, saving you substantial time and effort.

If you’re looking for more actionable trade ideas, I’ll be hosting a free webinar on Monday, April 8 at 8:00AM ET/1200GMT in which we will explore the transformative power of Investing Pro’s Fair Value analysis and decode how to identify optimal buying opportunities in the market.

Enroll here: https://www.investing.com/education/webinars/know-the-best-timing-to-buy:-how-to-avoid-overpriced-stocks-13421

Here are ten stocks priced under $10 that investors may consider adding to their portfolios, sorted by their market value.

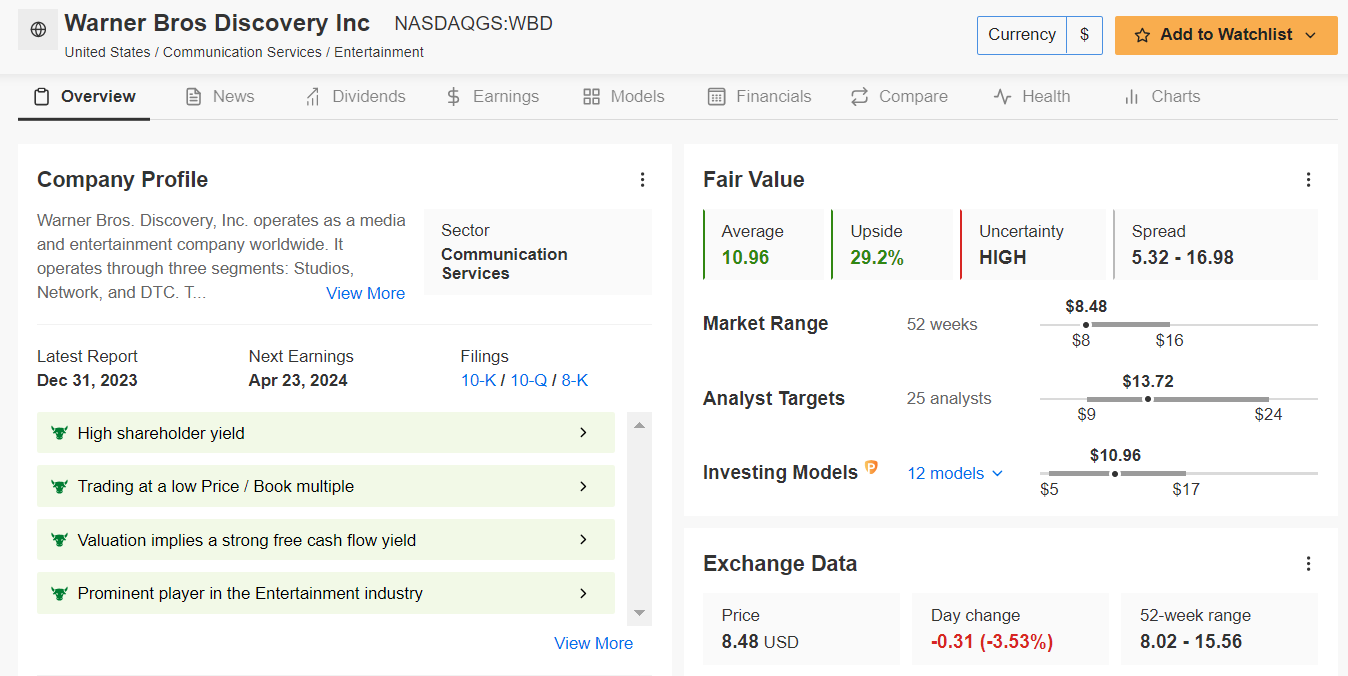

1. Warner Bros Discovery – Media & Entertainment

- Tuesday’s Closing Price: $8.48

- Fair Value Estimate: $10.96 (+29.2% Upside)

- Market Cap: $20.7 Billion

Despite its recent merger and subsequent fluctuations in stock price, Warner Bros Discovery (NASDAQ:) presents an intriguing investment opportunity. The newly formed media giant boasts a vast content library and diverse revenue streams, positioning it for long-term growth in the streaming and entertainment industry.

WBD stock is currently trading at a bargain valuation, according to the InvestingPro models. Shares could see an increase of about 29% from Tuesday’s closing price, bringing it closer to its ‘Fair Value’ of $10.96 per share.

Source: InvestingPro

Wall Street analysts surveyed by Investing.com are even more optimistic and see the stock at $13.72 per share, implying upside potential of 61.8%. The percentage of buy ratings stands at 60%, hold 36% and sell 4%.

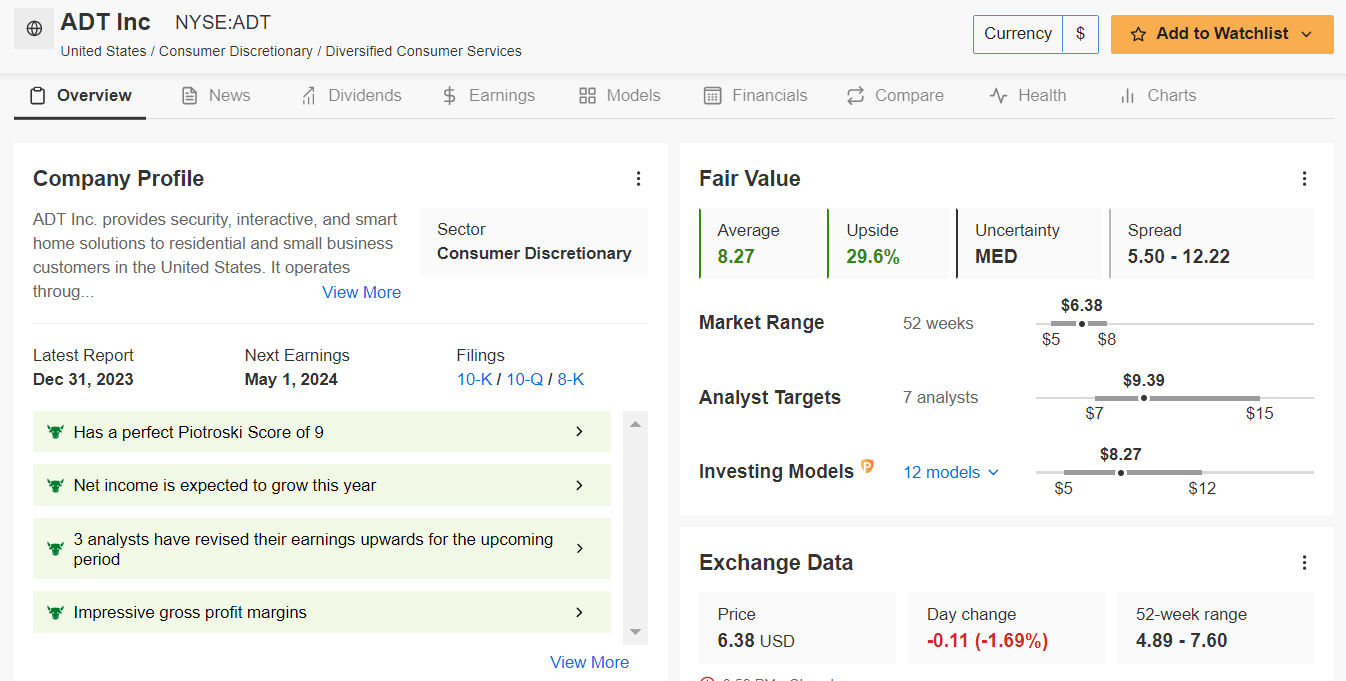

2. ADT – Security & Automation Solutions

- Tuesday’s Closing Price: $6.38

- Fair Value Estimate: $8.27 (+29.6% Upside)

- Market Cap: $5.7 Billion

ADT (NYSE:), a leading provider of security and automation solutions, offers investors exposure to the growing home security market. With increasing demand for smart home technology and surveillance systems, ADT’s innovative products and services position it for expansion and revenue growth.

The present valuation of ADT stock suggests it’s a bargain, as per the InvestingPro model. There’s potential for a gain of almost 30% from yesterday’s close, aligning it with its ‘Fair Value’ price target estimated at $8.27 per share.

Source: InvestingPro

Additionally, Wall Street has a long-term bullish view on ADT, with six out of the seven analysts surveyed by Investing.com rating the stock as either a ‘buy’ or a ‘hold’. They have a price target of $9.39, implying that shares could climb 47.2% from their current market value.

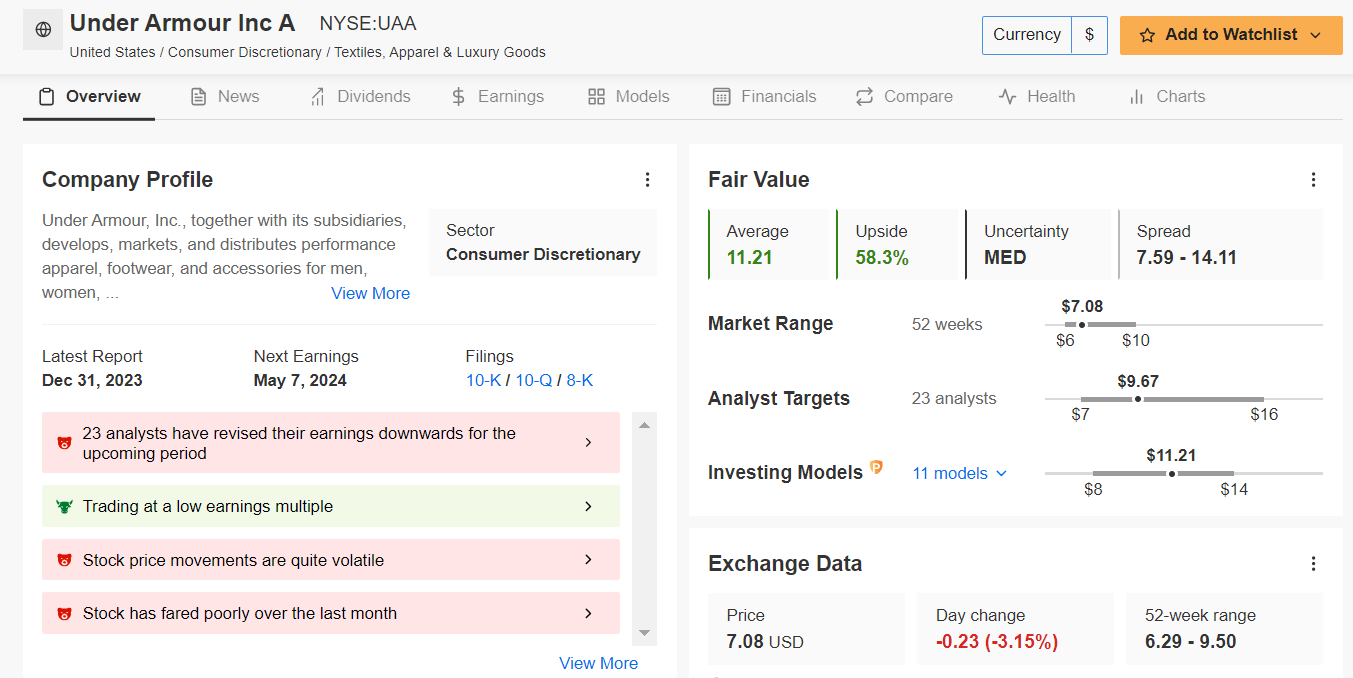

3. Under Armour – Athletic Apparel & Footwear

- Tuesday’s Closing Price: $7.08

- Fair Value Estimate: $11.21 (+58.3% Upside)

- Market Cap: $3 Billion

Under Armour (NYSE:), a global athletic apparel and footwear company, has faced challenges in recent years but remains a dominant player in the sports apparel industry. With a focus on innovation and brand revitalization efforts, Under Armour has the potential to regain market share and deliver value to investors.

According to the InvestingPro model, UAA stock is presently priced well below its ‘Fair Value’ estimate. Anticipated growth of 58.3% from Tuesday’s closing price could bridge the gap to $11.21 per share.

Source: InvestingPro

In addition, the sentiment among 29 analysts surveyed by Investing.com for Under Armour’s future remains upbeat, with 27 advocating either a ‘buy’ or ‘hold’ position for the stock.

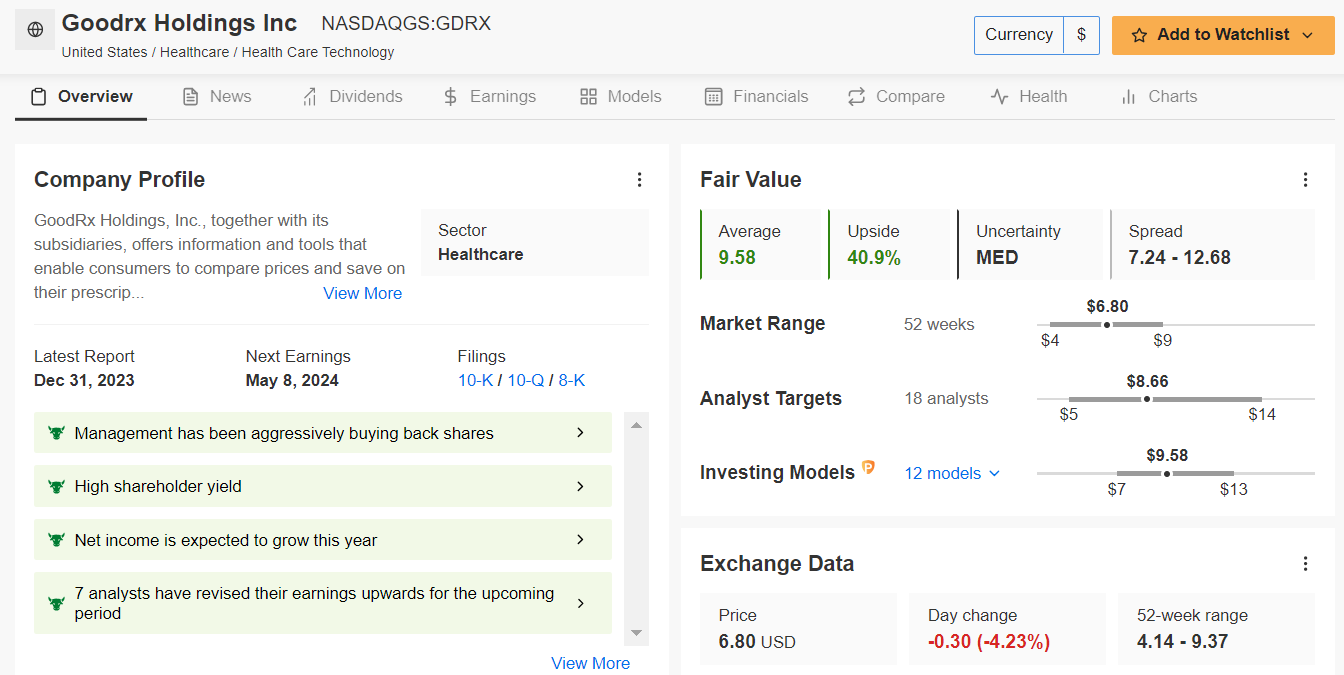

4. GoodRx – Digital Healthcare Platform

- Tuesday’s Closing Price: $6.80

- Fair Value Estimate: $9.58 (+40.9% Upside)

- Market Cap: $2.7 Billion

Goodrx (NASDAQ:), a leading digital healthcare platform, provides consumers with access to affordable prescription medications and healthcare services. As healthcare costs continue to rise, GoodRx’s user-friendly platform and cost-saving solutions position it for sustained growth and market expansion.

GDRX stock is trading at a bargain valuation, as indicated by the InvestingPro model. There’s a possibility of a 40.9% increase from last night’s closing price, moving it closer to its ‘Fair Value’ set at $9.58 per share.

Source: InvestingPro

Furthermore, 19 out the 20 analysts surveyed by Investing.com rate GoodRX’s stock either as ‘buy’ or ‘hold’, reflecting a bullish recommendation.

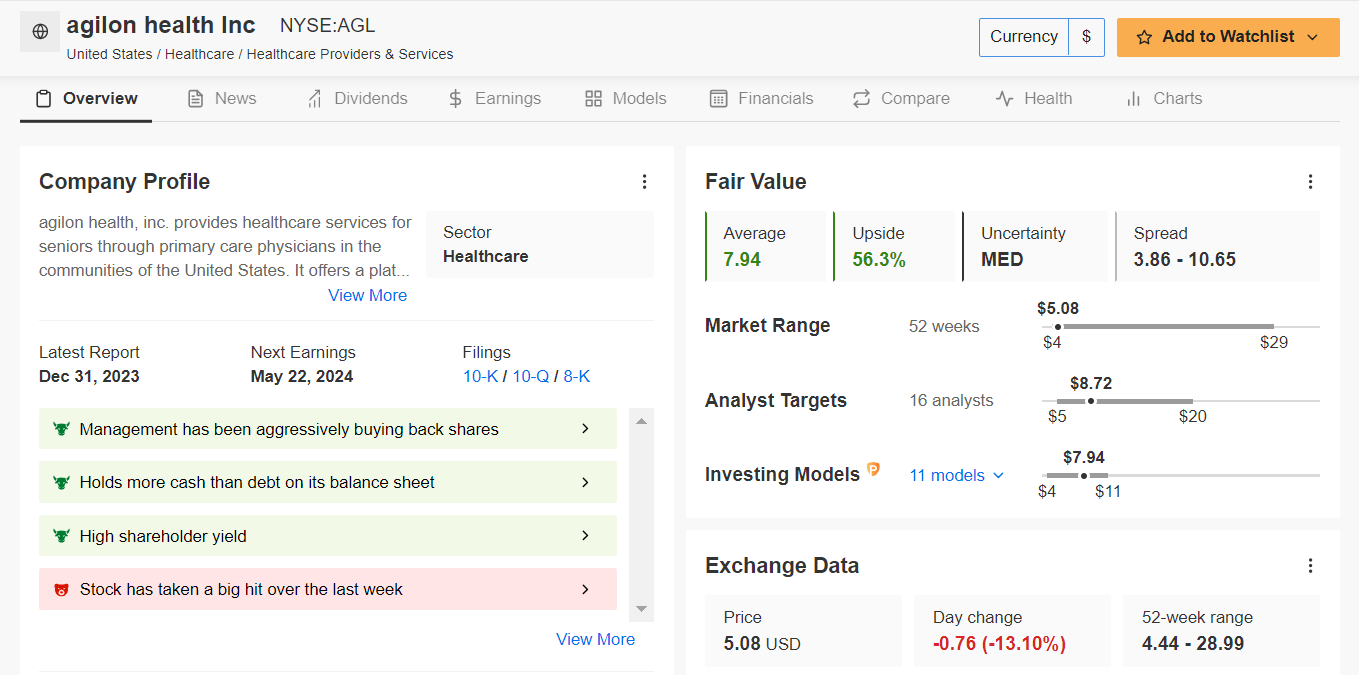

5. Agilon Health – Healthcare Services (NASDAQ:) & Solutions

- Tuesday’s Closing Price: $5.08

- Fair Value Estimate: $7.94 (+56.3% Upside)

- Market Cap: $2.1 Billion

Agilon Health (NYSE:) operates as a healthcare services company focused on improving the quality and efficiency of care for seniors.

With an aging population and increasing demand for value-based care models, Agilon Health’s innovative approach to healthcare delivery makes it an attractive investment opportunity.

As per the InvestingPro model, AGL stock is currently priced at a substantial discount. There’s potential for a 56.3% climb from Tuesday’s closing price, bringing it towards its ‘Fair Value’ estimate of $7.94 per share.

Source: InvestingPro

In addition, Wall Street remains optimistic on Agilon Health, as per an Investing.com survey, which revealed that analysts have a stock price target of $8.72, which would imply potential upside of roughly 72% from current levels.

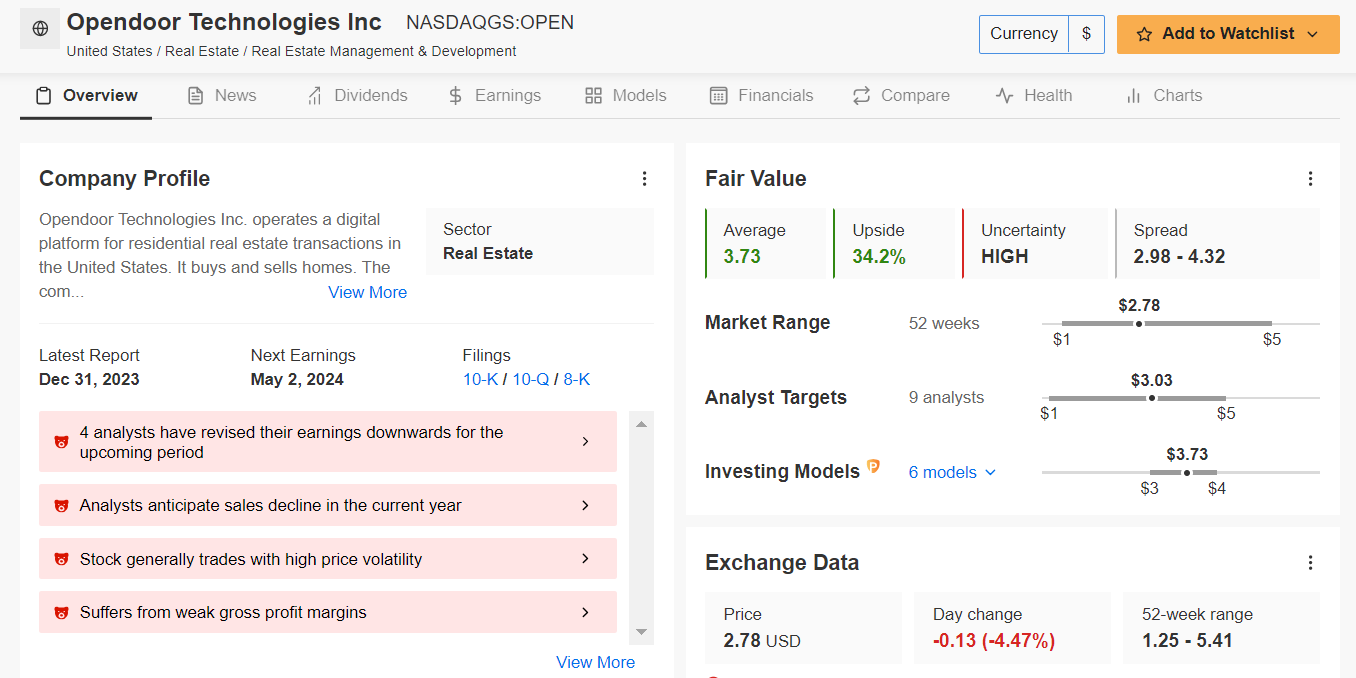

6. Opendoor Technologies – Real Estate Technology

- Tuesday’s Closing Price: $2.78

- Fair Value Estimate: $3.73 (+34.2% Upside)

- Market Cap: $1.9 Billion

Opendoor (NASDAQ:) Technologies operates an online platform for buying and selling homes, offering convenience and transparency to both buyers and sellers. With the real estate market undergoing digital transformation, Opendoor’s technology-driven approach has the potential to disrupt traditional real estate transactions.

Source: InvestingPro

It is worth noting that current ‘Fair Value’ assessments indicate OPEN stock is undervalued. InvestingPro models predict a 34.2% potential upside from the current market value to $3.73 per share, while Wall Street analysts estimate a more conservative 9% increase to $3.03/share.

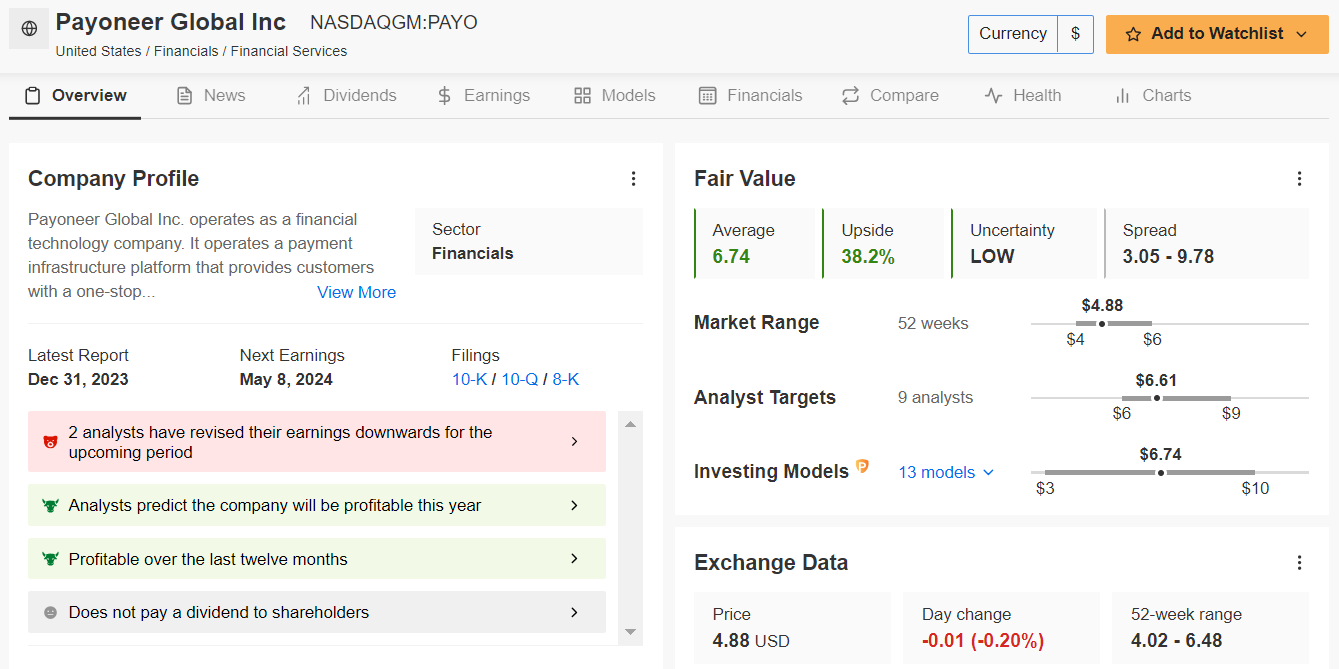

7. Payoneer Global – Financial Technology

- Tuesday’s Closing Price: $4.88

- Fair Value Estimate: $6.74 (+38.2% Upside)

- Market Cap: $1.8 Billion

Payoneer Global (NASDAQ:), a leading provider of cross-border payment solutions, enables businesses and freelancers to send and receive payments globally. With the rise of e-commerce and remote work, Payoneer’s platform facilitates seamless international transactions, positioning the company for continued growth.

The InvestingPro model indicates PAYO stock is currently extremely undervalued. There’s a possibility of a 38.2% increase from the current price, bringing it closer to its ‘Fair Value’ estimation of $6.74 per share.

Source: InvestingPro

Also, Wall Street remains optimistic on Payoneer, as per an Investing.com survey, which revealed that all ten analysts have a Buy-equivalent rating on the stock and a price target of $6.61.

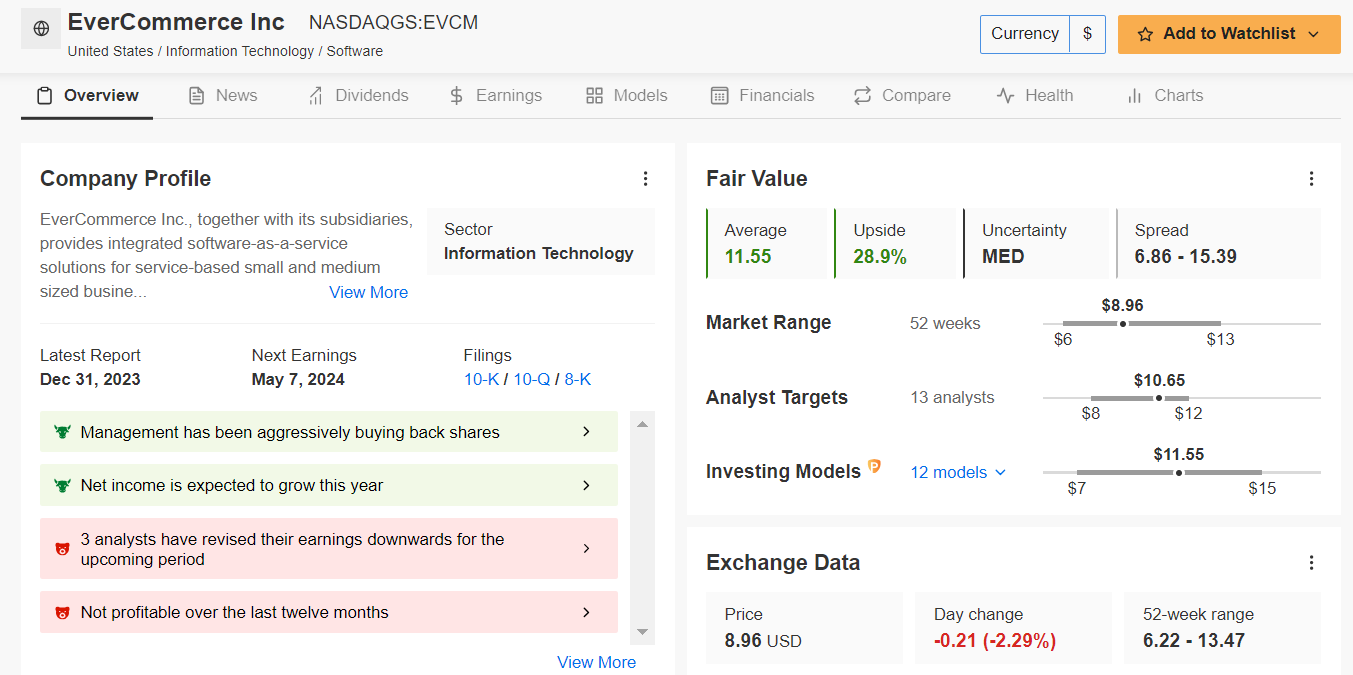

8. EverCommerce – Software for Service-based Businesses

- Tuesday’s Closing Price: $8.96

- Fair Value Estimate: $11.55 (+28.9% Upside)

- Market Cap: $1.7 Billion

EverCommerce (NASDAQ:) operates as a software platform for service-based businesses, offering a suite of tools to streamline operations and enhance customer engagement. With a diverse portfolio of software solutions and a focus on industry-specific verticals, EverCommerce is well-positioned for growth in the digital services sector.

EVCM’s current stock valuation, as per the InvestingPro model, denotes it is trading at bargain levels. There’s a projected increase of 28.9% from last night’s close, moving shares closer to their ‘Fair Value’ benchmark of $11.55 per share.

Source: InvestingPro

Moreover, Wall Street still has a bullish view on EverCommerce, with seven out of 12 analysts surveyed by Investing.com rating the stock as a ‘buy’, compared to three ‘hold’ ratings, and two ‘sell’ ratings.

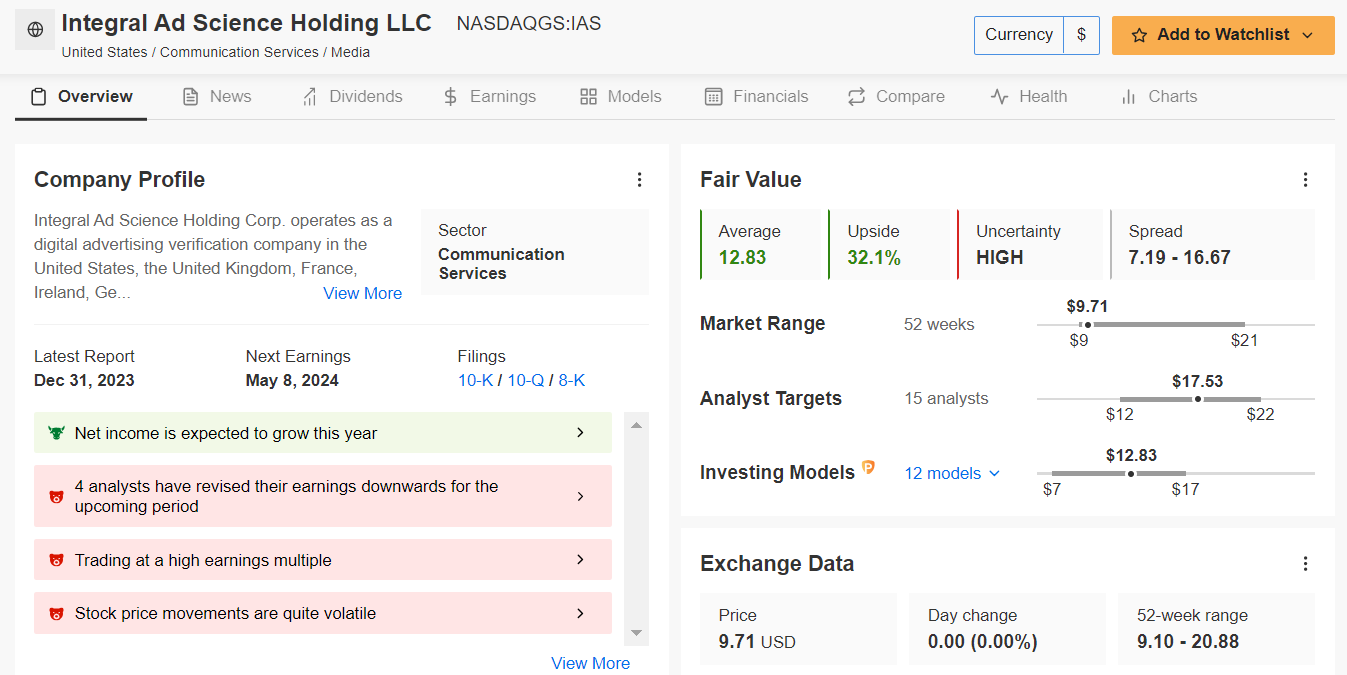

9. Integral Ad Science – Digital Advertising Technology

- Tuesday’s Closing Price: $9.71

- Fair Value Estimate: $12.83 (+32.1% Upside)

- Market Cap: $1.6 Billion

Integral Ad Science Holding LLC (NASDAQ:) provides digital ad verification and analytics solutions, helping advertisers maximize the effectiveness of their online advertising campaigns. With increasing emphasis on digital advertising transparency and brand safety, Integral Ad Science’s services are in high demand, driving revenue growth.

Source: InvestingPro

IAS stock is extremely undervalued, according to the quantitative models in InvestingPro, making it an enticing option for investors. Shares could see an upswing of 32.1% from Tuesday’s closing price of $9.71.

Furthermore, the sentiment among analysts polled by Investing.com is overwhelmingly positive, forecasting the stock to climb to $17.53 per share, projecting a significant upside of a whopping 80.5%.

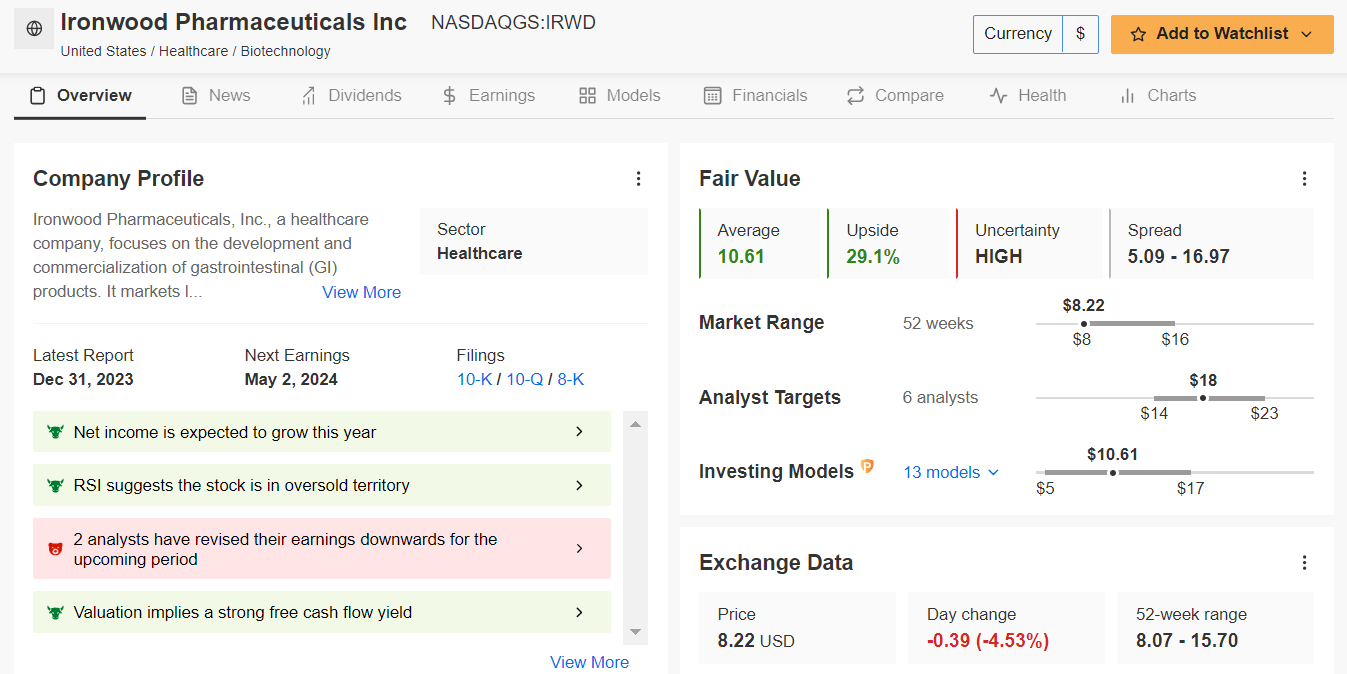

10. Ironwood Pharmaceuticals – Pharmaceuticals

- Tuesday’s Closing Price: $8.22

- Fair Value Estimate: $10.61 (+29.1% Upside)

- Market Cap: $1.3 Billion

Ironwood Pharmaceuticals (NASDAQ:) develops and commercializes therapies for gastrointestinal disorders, addressing unmet medical needs in the healthcare market.

With a robust pipeline of innovative treatments and strategic partnerships, Ironwood Pharmaceuticals has the potential to deliver value to patients and investors alike.

It should be noted that the InvestingPro ‘Fair Value’ price projection for IRWD is $10.61 per share, suggesting a prospective gain of 29.1% from yesterday’s price.

Source: InvestingPro

Meanwhile, Wall Street analysts are even more optimistic and see it at $18, which would imply a gain of 118% from last night’s closing price.

Before investing in any stock, especially those priced under $10, thorough research and consideration of your investment goals are highly recommended. It’s crucial to consider the company’s financial health, industry trends, and your own risk tolerance before making any investment decisions.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Subscribe here and never miss a bull market again!

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY (NYSE:)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.